RESOURCES / INVESTMENT MENUS

How to evaluate target date funds

8-minute read

THE TAKEAWAY

Look closely at a TDF’s results, fees and investment approach

Overview

Toni Brown

Head of Retirement Strategy

Senior Retirement Strategist

How to evaluate target date funds

Target date funds are among the most popular default options in retirement plans. As a result, the choice of target date provider is now among the most important decisions for an investment committee.

The beauty of a TDF is its simplicity for participants. However, its underlying complexity can challenge committees tasked with assessing a TDF’s glide path design, risk/return profile and fee structure as part of fiduciary due diligence.

Considerations

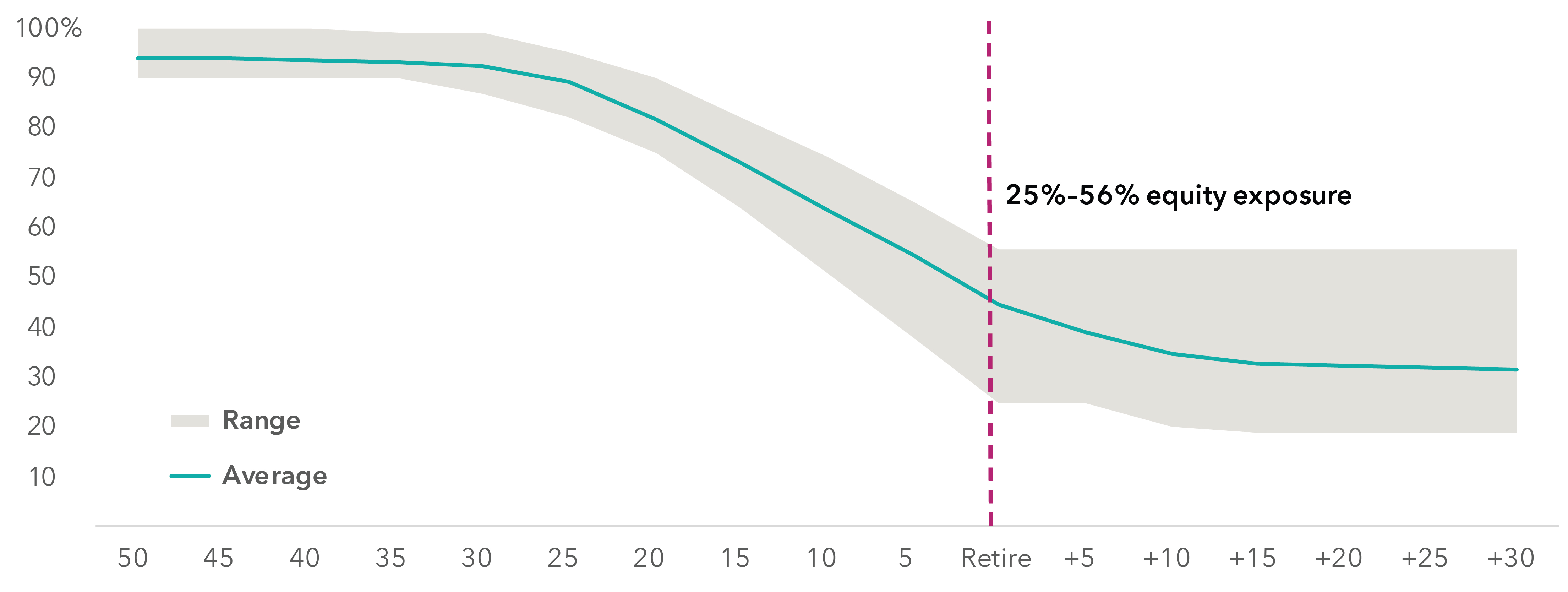

One of the considerations is whether a TDF should be actively or passively managed. Either choice can be appropriate, but it’s important to know that passively managed funds don’t offer inherent fiduciary protection. That’s because no target date fund is completely passively managed. All target date providers make active asset allocation decisions, including deciding the level of equity exposure for both younger and older participants. The amount and types of equities can vary significantly among passive TDFs, as the below chart shows. This can have a big impact on risk and return. Whether a sponsor chooses active or passive, appropriate due diligence should be conducted.

Equity exposure can vary widely in TDFs

Source: Capital Group, based on Morningstar data. Based on the 16 target date series that have a three-year history and no more than 20% of assets actively managed. Percentage of assets in equity (as reported on 8/31/20).

In addition to fees and results, an evaluation of a TDF should consider a target date provider’s investment approach and its potential to balance participants’ need to build and preserve wealth.

When evaluating a target date series, it’s important to look at the asset allocation (the glide path) over time, considering how it addresses the needs of younger and older participants. Ultimately, a target date fund must balance participants’ goals of building and preserving wealth. Early on in a participant’s career, capital appreciation is most important. With many working years ahead, the participant should have sufficient time to recover from any market downturns.

As participants approach retirement, they still need to build wealth. Given lengthening life spans, retirees at age 65 may need to build enough savings to last for what could be a 30-year-long retirement. However, risk becomes more important at this stage. With fewer working years left, participants don’t have as much time to recover from market downturns. During retirement, capital preservation becomes more important.

A fund’s asset allocation is key to balancing the need for growth with the need for downside resilience. However, the amount of equity exposure is only one factor in managing risk. That’s because not all equity is created equal when it comes to volatility. Some equities, like dividend-paying stocks, may hold up better than growth-oriented stocks when markets decline. Security selection can have a great impact on both risk and return potential — making it critical to look carefully at a target date provider’s investment approach.

Questions

Consider these five questions when evaluating target date funds to help facilitate the selection process.

Explore more investment menus resources

-

Investment Menu

Help participants succeed with an investment re-enrollment

-