Retirement Income

- The coming wave of retirees will reduce retirement plan assets.

- Employers may save money by keeping retirees in their plans.

- Keeping retirees “in the family” provides a tangible employee benefit.

Everyone seems to want to help workers save for retirement. Employers encourage participants to use automatic payroll deductions to save as much as they can. Investment managers and the financial media stress the importance of retirement planning. The government has created a whole set of tools – from auto-enrollment to default investments – to increase the nation’s retirement plan savings.

Far less attention is paid to what happens when people actually retire. How do they draw out their funds? What investment changes should they make?

Today, retirees are often on their own to answer these questions – but that could be changing. Both employers and employees are starting to see the value of keeping participants in the plan after they retire.

70 is the new 60

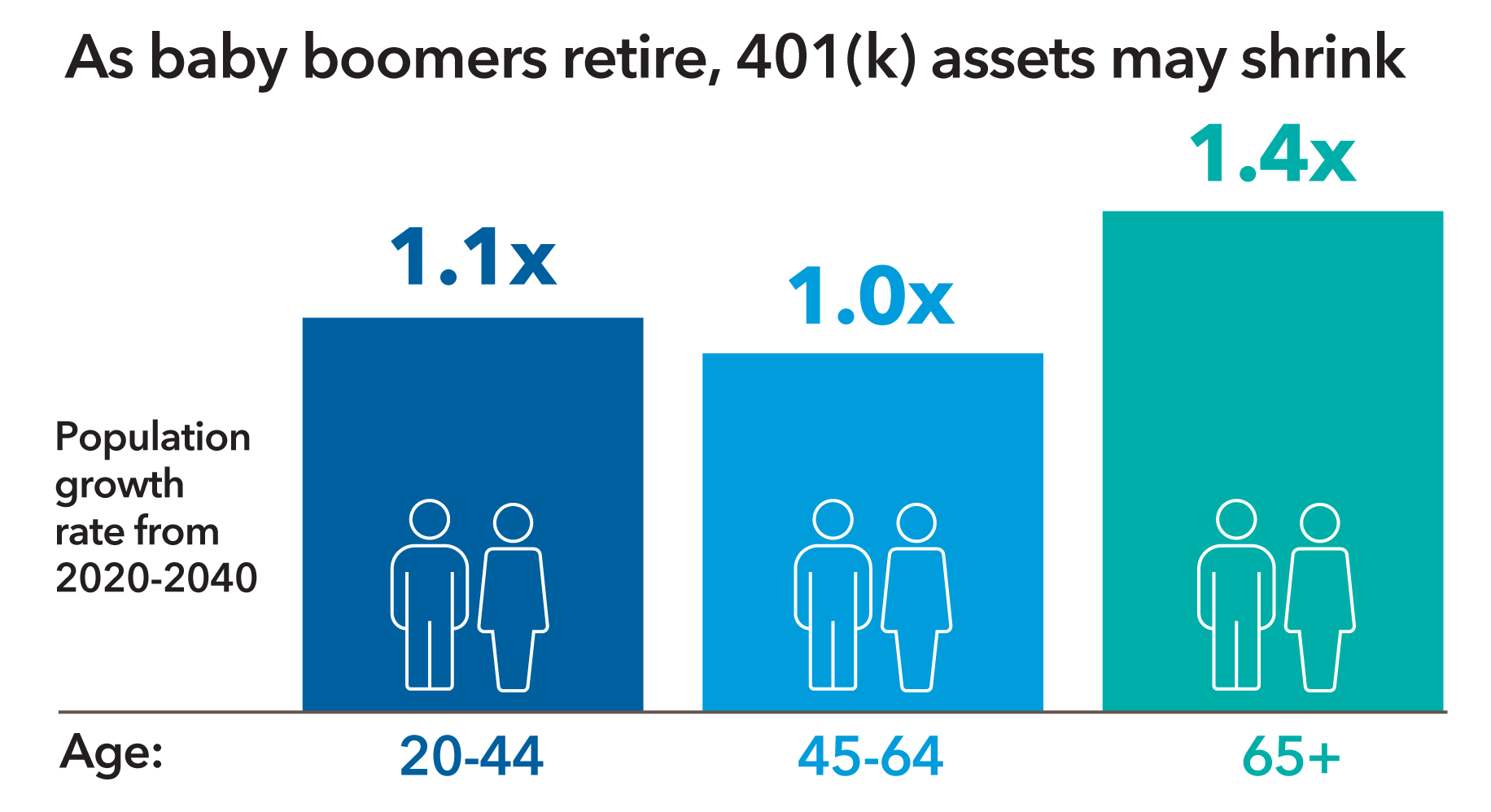

One factor in this change of thinking is the aging of the workforce. The U.S. Census Bureau expects the number of people over age 65 to increase by more than 40% in the next 20 years, with less projected growth in the 20-64 working age group.

As older participants who have accumulated more assets over time retire and withdraw their accounts, younger workers who have saved less will have to bear more of the plan costs.

Source: U.S. Census Bureau data as of 2020.

Keeping retirees in the plan builds goodwill and helps reduce employer costs

The relatively simple step of encouraging participants to stay in the plan after retirement can be a cost-effective way for plan sponsors to address this challenge.

With high-balance accounts remaining in the plan, the costs of running and maintaining it may stay low. In addition, participants start to view the retirement plan – and their employer – as something they hold on to after they’ve accumulated retirement savings. Thus, they may be more likely to make responsible decisions about when to retire.

- Reinforces good investing behaviors. Participants enjoy the continuity of the plan instead of a whole new set of investment decisions at retirement.

- Allows the consolidation of retirement plan assets. Participants may be able to “roll-in” savings scattered across former employer plans.

- Enables participants to stay with investments they know and prefer. The plan may have investments that retirees like, are familiar with and might not be available elsewhere.

- Offers age-appropriate investment options. The plan may offer access to age-specific solutions such as target date funds.

- May result in lower costs. Retirees may benefit from institutionally priced investments.

What can sponsors do to retain retirees?

The following action steps can support defined contribution plan participants in retirement:

- Work with the recordkeeper. Most plans can facilitate lump-sum and systematic withdrawals, but not all recordkeepers support ad hoc (as needed) participant distributions.

- Update employee communications and education materials. A little outreach can help pre-retirees understand the advantages of staying in the plan.

- Evaluate core menu and target date options. Investments with historically stable results can help participants as they move from saving to spending.

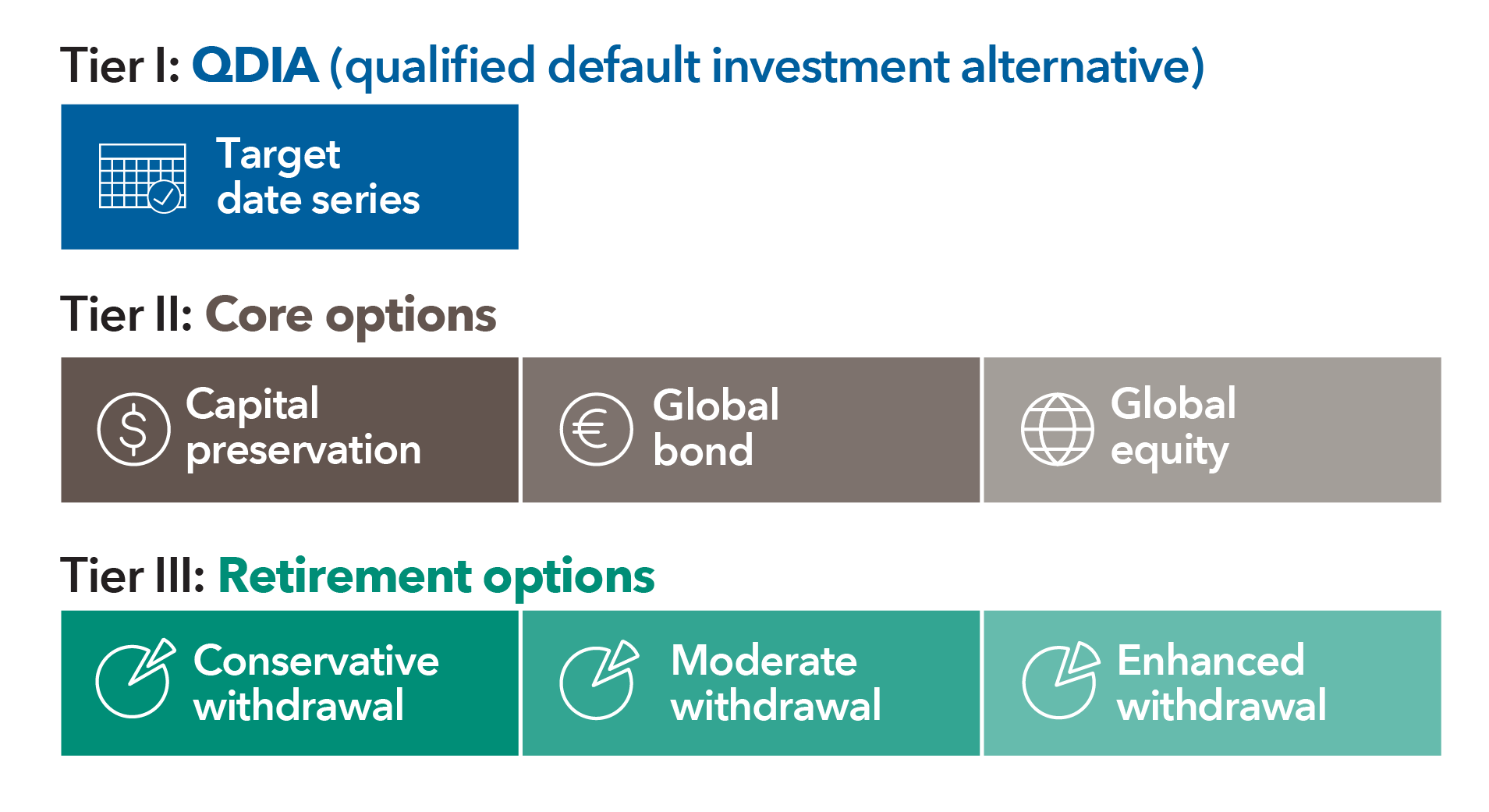

- Consider creating retirement tiers. Plan sponsors may wish to create an additional set of menu choices in their defined contribution plan lineup to address the unique spending requirements of retirees, including options geared toward different rates of withdrawal.

What retirement tiers might look like in a plan

Planning ahead to a post-retirement age

The defined contribution plan was originally designed as a supplemental retirement vehicle – workers’ primary retirement arrangements were defined benefit plans that took care of them through retirement. Now that defined contribution has become established as the predominant retirement plan for American workers, it should transition to a complete retirement system that serves retirees as well as workers.

“As employers think about how to usher employees into retirement,” says Toni Brown, CFA and head of retirement strategy at Capital Group, “they would be well served by looking at retirement not as a finish line but as a transition zone.”

Our latest insights

-

Liability-Driven Investing

-

Defined Contribution

-

Defined Benefit

-

-

Liability-Driven Investing