Retirement Planning

This article is part of our Retirement Plan Trends series, which explores issues affecting the retirement space.

What keeps defined contribution (DC) retirement plan sponsors awake at night? While improving participant outcomes and addressing retirement income needs are among their top priorities, sponsors say potential legislative changes, consolidation in the recordkeeping industry, market uncertainty, inflation, rising interest rates and litigation risk could all disrupt how they manage their plans over the next five years, a new Capital Group survey shows. Several sponsors also mentioned aging participants needing more advice.

Top priorities for 2023

Capital Group surveyed 52 DC and defined benefit (DB) plan sponsors representing a variety of industries, asset levels and geographies (encompassing both public and private DC plans). About half of the sponsors oversee plans with assets of $5 billion or more. We also surveyed a sample of consultants to see how their priorities, recommendations and concerns compared to the plan sponsors we contacted.

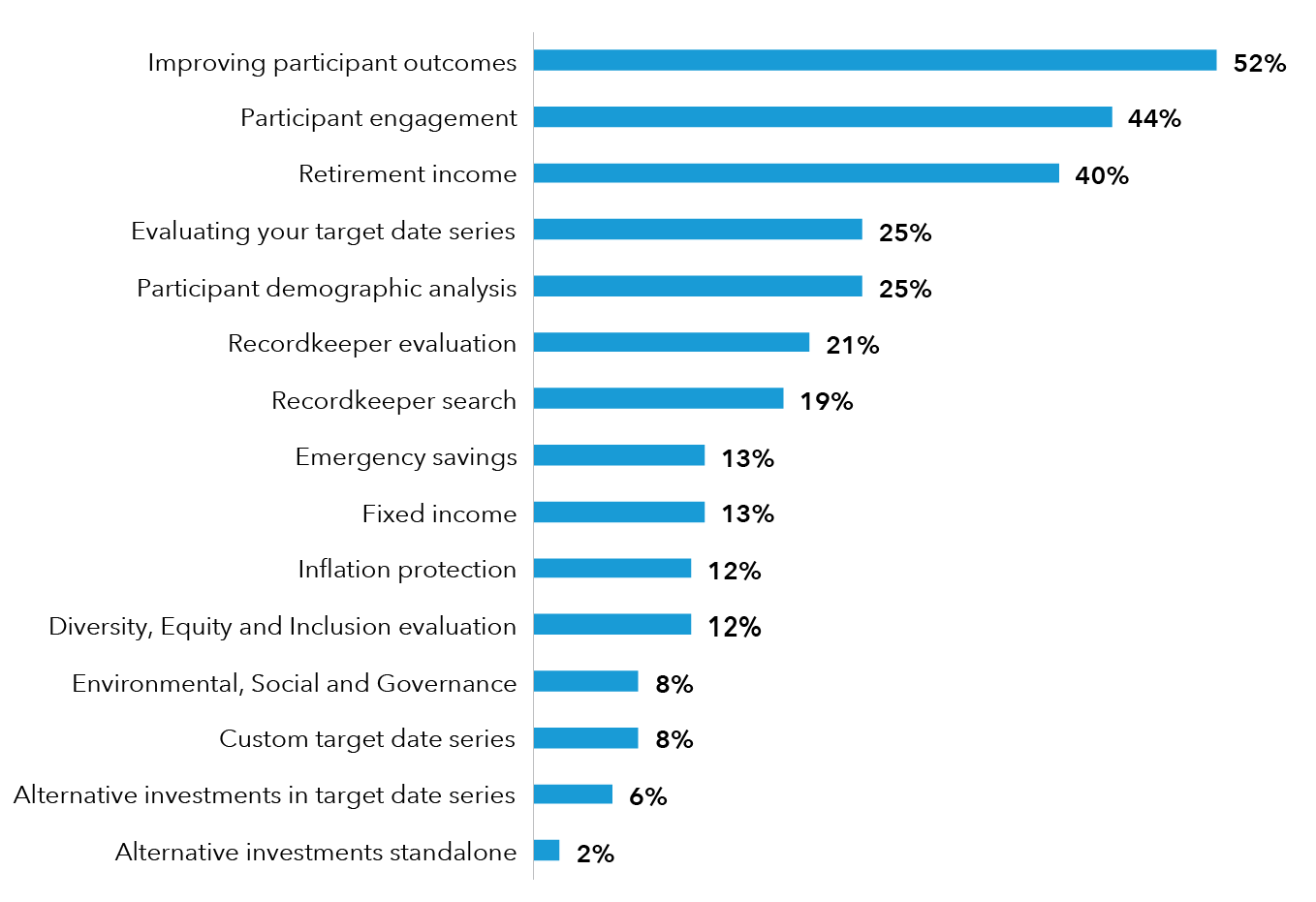

DC plans: Top of the agenda for 2023 for most DC plans in the survey was improving participant outcomes, which for 52% of sponsors was among their top three choices. Participant engagement came next, followed by retirement income. The next-most popular choice was a tie between evaluating a target date series and conducting a participant demographic analysis.

DB plans: For DB plan sponsors, changes in regulatory or accounting requirements and interest rates were among frequently mentioned potential disruptors to their plans over the next five years, while their top priorities are implementing liability-driven investing, achieving fully funded status and addressing the impact of inflation.

DC plans’ top 3 priorities in the next 12 months

Source: Capital Group. Note: DC plan sponsors were asked to name the top three priorities for their plans. Each bar shows the percentage of sponsors who included each topic among their choices. Totals may not reconcile due to rounding. Based on survey responses collected from July 13, 2022, to December 1, 2022.

Consultants and sponsors differ on plan design

Although DC plan sponsors identified improving participant outcomes as their top priority, some still eschew certain auto-savings features that many consultants we contacted recommended. This was evident from our separate survey of 11 consultants.

Among the key contrasts:

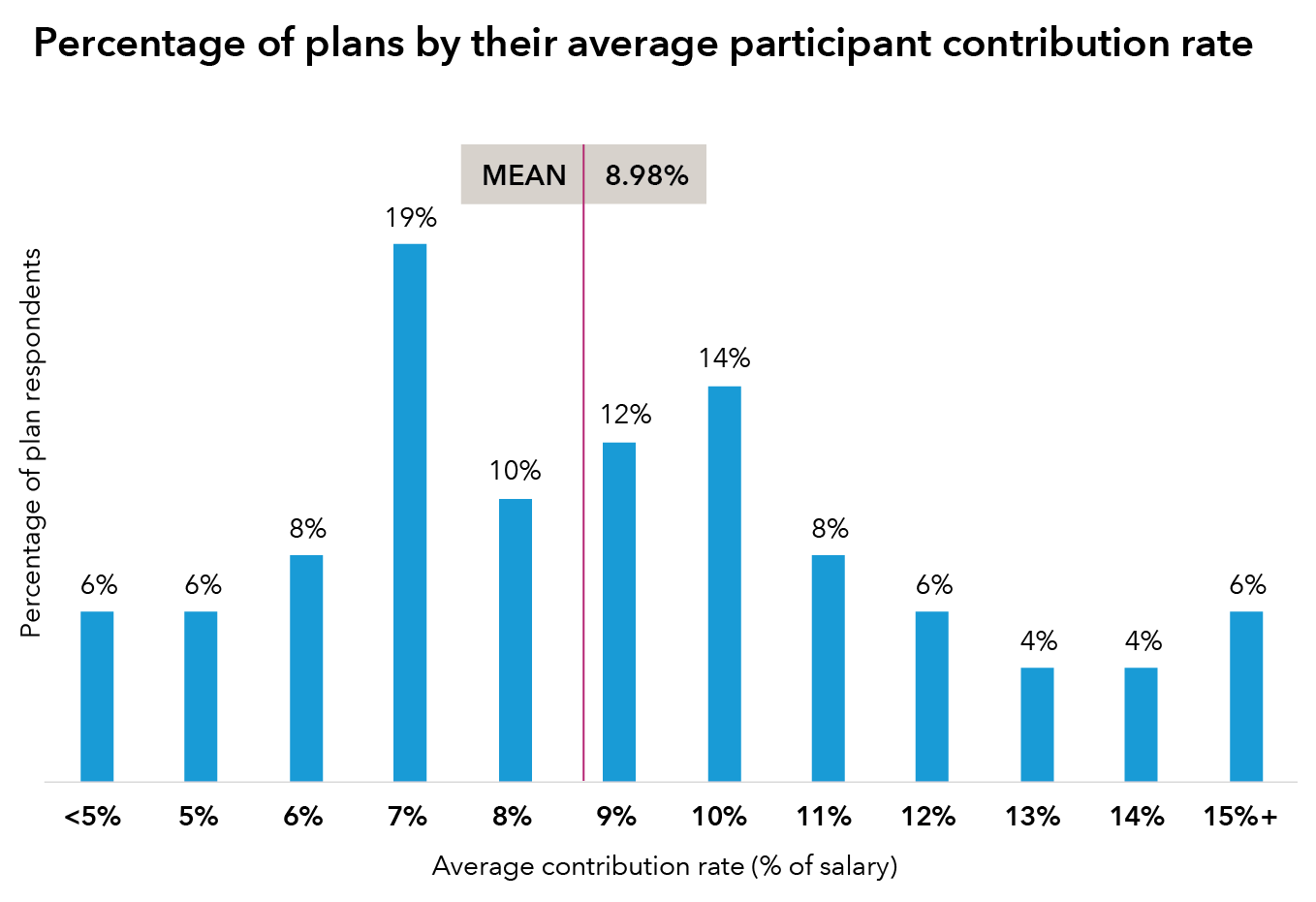

Contribution rates

Source: Capital Group. Totals may not reconcile due to rounding. Based on survey responses collected from July 13, 2022, to December 1, 2022.

With most retirement plan sponsors utilizing consultants and advisors to help them make decisions, the above outlines just some of the contrasts between advice and actual implementation in retirement plans. This was Capital Group’s first survey of the plan sponsor and consultant landscape, and we hope to continue to uncover these trends and strive to help plans better serve participants.

This is the most recent article in our Retirement Plan Trends series, which explores major issues affecting the institutional retirement space.

Don't miss our latest insights.

Our latest insights

-

Portfolio Construction

-

Defined Benefit

-

Liability-Driven Investing

-

Defined Contribution

-

Defined Benefit

Alternative investments are investments other than stocks, bonds and cash. Examples include commodities, real estate, hedge funds and private equity.

A custom target date series is one that a plan sponsor can customize for its participants by creating a glide path (asset allocation) tailored to the participant population and/or hiring particular investment managers to manage the underlying strategies.

A participant contribution rate is the percentage of a participant’s compensation that is invested periodically in a retirement account.

A participant is an individual who is enrolled in a retirement plan.