Defined Contribution

This article is part of our Retirement Plan Trends series, which explores issues affecting the retirement space.

Retirement income, funded status and the SECURE 2.0 Act are among the key areas that plan sponsors are focused on over the next year, according to a Capital Group survey of consultants and institutional defined contribution (DC) and defined benefit (DB) plans. Our second annual survey yielded some interesting insights about institutional plan sponsors’ priorities, investment strategies and the forces disrupting the retirement plan industry. Although DB and DC plans’ priorities differed, they all related to the plan sponsors’ focus on their fiduciary duty to look out for participants’ best interest. In this article, we summarize the survey's major findings.

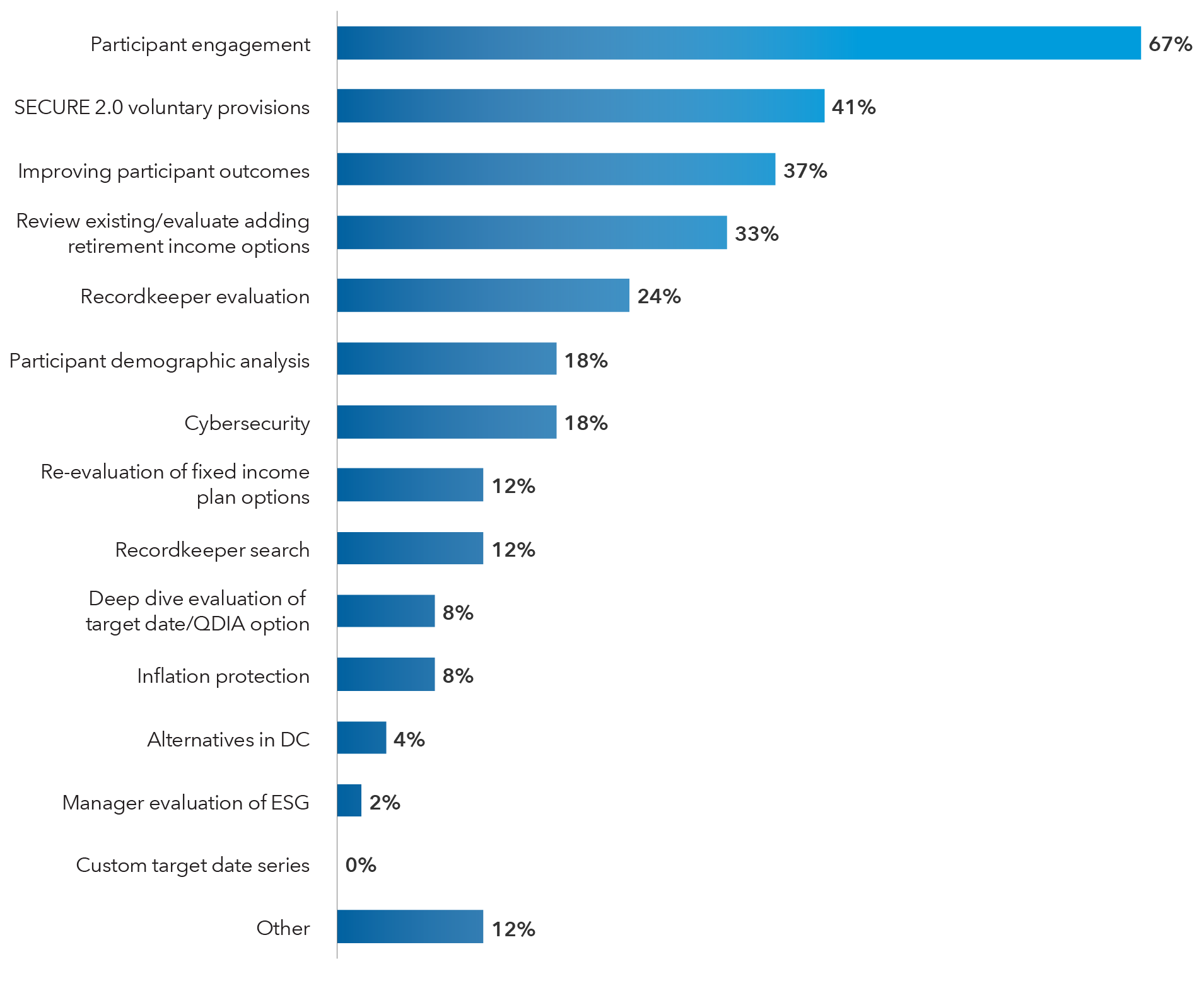

DC plans focused on engagement, SECURE 2.0

Enhancing participant engagement and improving participant outcomes were among the top priorities for DC plan sponsors over the next year, according to the survey. Another big priority: Implementing the voluntary provisions of the SECURE 2.0 Act, such as emergency saving and student loan matching programs. Sponsors believe that these SECURE 2.0 provisions can help participants put more money away, thereby increasing the potential for retirement success.

Our view: The survey results align with our impression that plan sponsors are maintaining a focus on participant engagement and outcomes while exploring ways to improve participant success through plan design and personalization. Plan sponsors seem to be putting less priority on investment governance, perhaps looking to their investment consultants to handle that priority for them.

DC plans’ top priorities over next 12 months

Source: Capital Group. Based on a survey of 49 institutional plan sponsors with a DC plan. Plan sponsors were asked to identify their top three priorities. Survey conducted by Escalent in late 2023. QDIA = Qualified Default Investment Alternative. ESG = Environmental, Social and Governance.

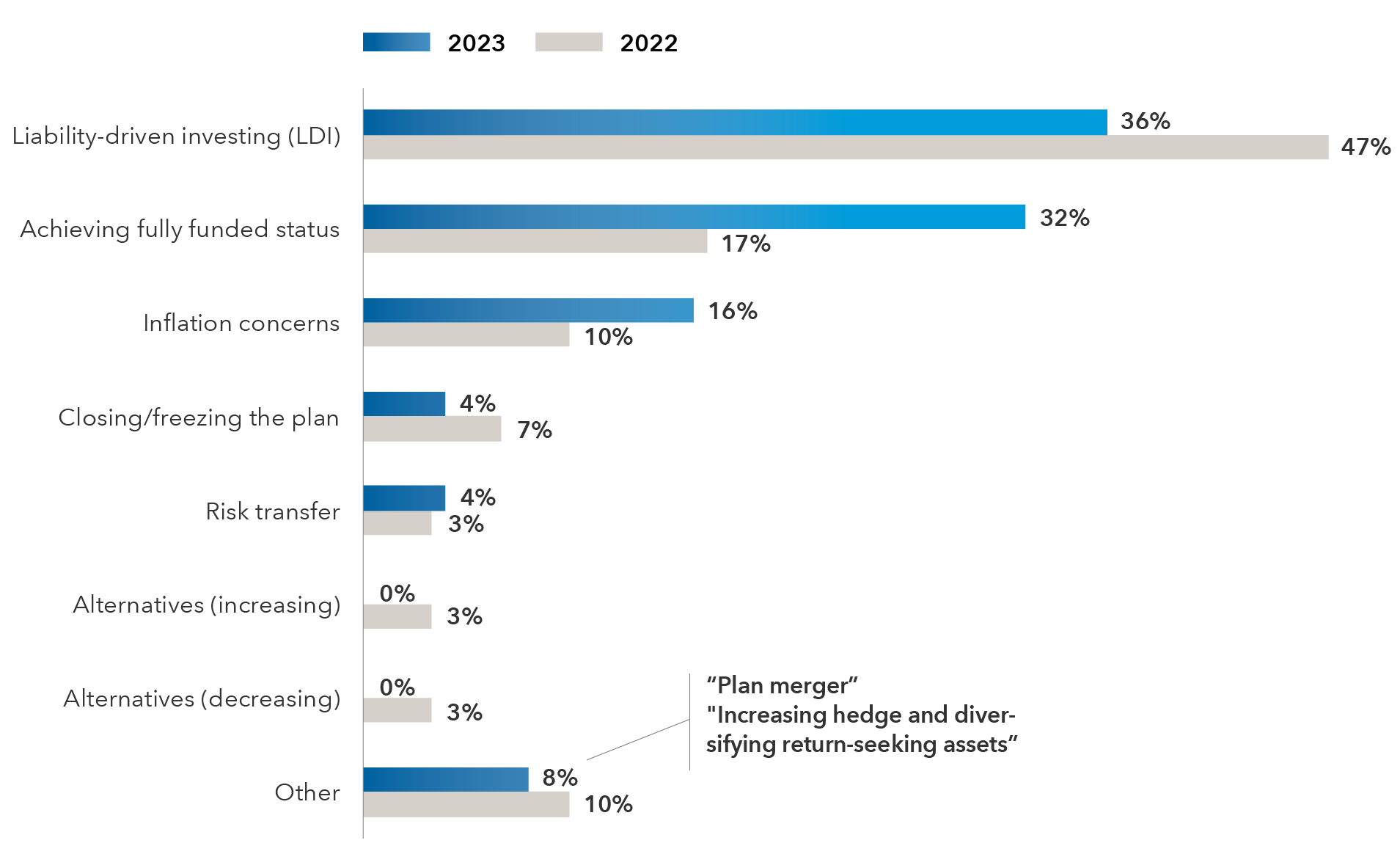

Pensions focused on LDI, funded status

DB plan sponsors reported that their funding has stayed healthy, with a mean funded level of 99%. Given this funding status backdrop, corporate DB sponsors continue to pursue liability-driven investing (LDI) as a top priority to help maintain funded levels and reach fully funded status. Public pensions were more likely to cite “achieving fully funded status” as a top priority. Pension risk transfer was less common to see as a focus over the next 12 months across those plans surveyed.

DB plans’ top priorities over next 12 months

Source: Capital Group, based on surveys conducted by Escalent. 2023 figures based on a survey conducted in late 2023 of 25 institutional plan sponsors with a DB plan. 2022 based on survey conducted in late 2022 of 30 institutional plan sponsors with a DB plan. Plan sponsors were asked to identify their top three priorities. Note: Small sample size.

Consultants’ views of their clients’ top priorities

Consultants said their DC clients’ top two priorities concerned investments: Reviewing or adding retirement income solutions and conducting a deep dive on a plan’s target date/QDIA (Qualified Default Investment Alternative) option. Increasingly, these two topics are seen as related given that many plan sponsors are looking to target date funds as a potential retirement income solution. Another top priority for DC clients was improving participant outcomes, which aligned with plan sponsors’ heavy focus on participants. Meanwhile, consultants stated that their advice to DB clients also emphasized minimizing funded status volatility and navigating potential market volatility.

Many DC plans interested in personalization

Two major areas of interest for DC plan sponsors are portfolio personalization and retirement income. But sponsors aren’t just looking at standard solutions like managed accounts (for personalization) or annuities (for income).

Creating personalized asset allocations for DC participants isn’t a new idea. Personalization solutions can range from off-the-shelf target date series that use both a participant’s birth year and desired retirement year to individual managed accounts that can incorporate additional data supplied by the recordkeeper or participant. Plan sponsors are interested in exploring more personalization in retirement. In fact, 75% of plans that had an opinion about personalized asset allocation said it can improve retirement outcomes, survey data revealed.

At the plan level, one step toward personalization could be to develop a customized target date glide path, which 12% of plan sponsors reported using. However, consultants seem to believe that interest in custom glide paths is leveling off: 64% said they expect the usage of custom target dates will stay the same or decrease over the next five years.

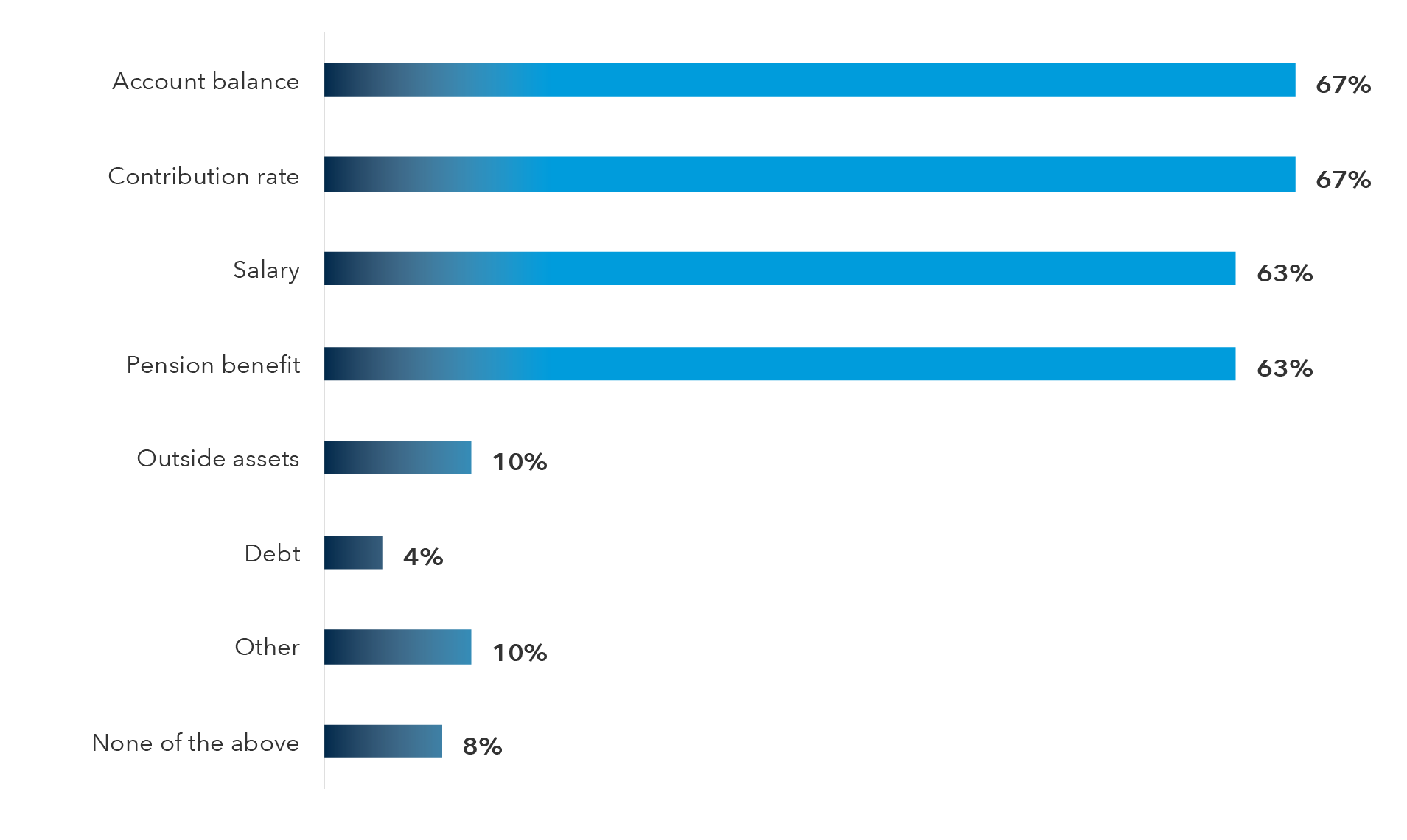

Somewhat newer to the market has been the increase in services that offer a degree of personalization to target date options at the participant level but stop short of being full-blown managed accounts. Unlike managed accounts, these solutions would not require additional personal information from participants and would make use of data collected from the recordkeeper. Personalization comes from blending or off-dating target date vintages to produce an asset allocation for an individual based on data such as salary, contribution level, company match, account balance and age.

Still, many plan sponsors have reservations about personalization, with 25% of those who had an opinion on the topic believing it would not improve outcomes. Many doubted that participants would provide the level of personal financial information needed to make it work effectively. Key information that would be most helpful in personalizing asset allocation was identified as salary, pension benefit, account balance and contribution rate.

Our view: We expect to see increased interest in evaluating how personalized asset allocation services can lead to better outcomes for participants throughout 2024 while ensuring fees are commensurate with the value added.

What participant data would be most helpful in personalizing an asset allocation?

Source: Capital Group. Based on a survey of 49 institutional plan sponsors with a DC plan. Survey conducted by Escalent in late 2023.

Retirement income a priority

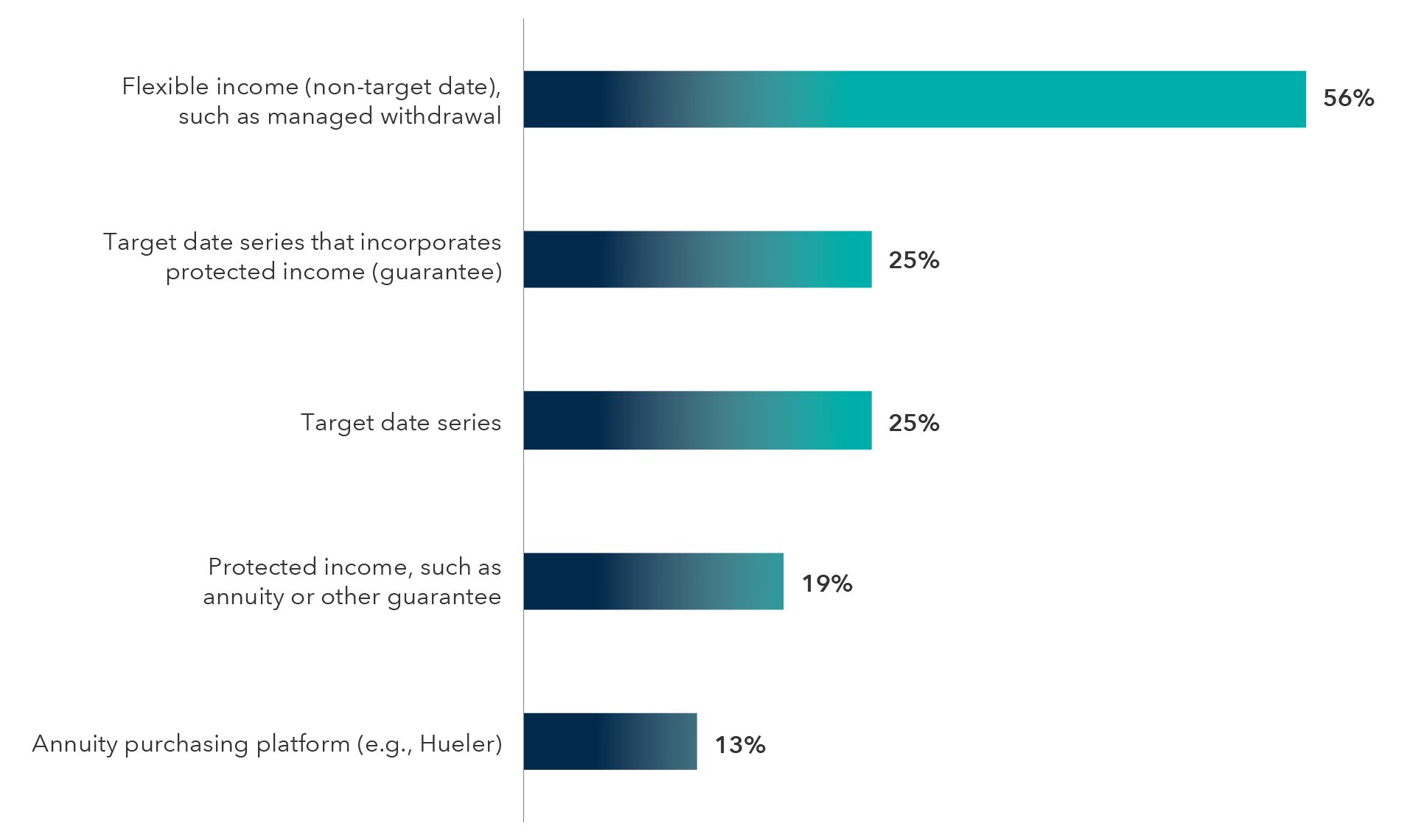

Interestingly, reviewing or adding retirement income options was fourth on plan sponsors’ list of priorities but was the top choice for consultants. Plan sponsors were divided on their approach to retirement income options. One-third already offer a retirement income option, but another 43% said they weren’t even considering adding one to the plan, survey data revealed.

Plans offered a range of retirement income solutions. These tended to be more flexible options such a type of managed withdrawal solution, which was used by 56% of plans offering a retirement income option. A quarter of the plans cited their target date offering as an income option. Target date series that incorporate a guarantee (25%) and stand-alone guaranteed solutions were also mentioned. The consistent message in retirement income has remained that there is likely not a perfect single solution and providing participants with choices between flexibility and guarantees is desirable.

We have seen increasing interest in exploring how the target date series that is already offered in the plan can help to support retirement income. Often target date funds are designed to manage the portfolio through the retirement phase, when participants would be taking income. This trend may cause plan sponsors to do more to ensure participants understand and are able to set up regular withdrawals through recordkeepers. Using target date as a retirement income solution can provide comfort that a flexible income solution is in place while sponsors explore other options, including guarantees.

Our view: Flexibility in retirement income solutions appears to be the preference for plan sponsors. When protected solutions like annuities are offered in defined contribution plans, the uptake is typically low, which could be what is driving the desire for flexible options. Education on annuities has been growing, and we have seen traction in the market on how to better incorporate protected income into retirement plans. We do believe choice will remain key for retirement income.

What best describes your DC plan’s retirement income options?

Source: Capital Group. Based on a survey of 16 institutional plan sponsors with a DC plan that offers at least one retirement income option. Survey conducted by Escalent in late 2023. Note: Small sample size.

DB plans holding steady

After a fairly steady decline in DB plans over the past two decades, the end of 2023 was abuzz with a potential comeback amid reports that some companies were thinking of reopening their traditional DB plans as cash balance plans. While plans that have a significant funding surplus may be evaluating what their future benefit structure might look like, most in our survey were sticking to the status quo. Two-thirds said that the DB plan is neither increasing nor decreasing in importance, and 83% said they are unlikely to wind down their plan.

Pensions are still devoting a significant allocation (49%) to liability-hedging fixed income to protect their healthy funded status, but 47% of plans stated that they held some fixed income for purposes other than hedging liabilities. Alterative investments are still common in pension allocations. Public plans taking more of a total return approach to their portfolios were more likely to hold non-liability-hedging fixed income and alternatives.

Exposure to alternatives has been climbing over the years, but our survey suggests DB plans’ interest in alternatives may be plateauing. About 44% of plans said they were not very or not at all interested in alternatives, with only 8% saying they were somewhat interested. Forty-eight percent of plans were already allocating to alternatives, perhaps demonstrating that anyone interested in alternatives already has an allocation.

Retirement plan disruptors

We also asked plan sponsors and consultants what forces could disrupt how they manage their retirement plans over the next five years. DC plan sponsors highlighted retirement income and SECURE 2.0, followed by market volatility and additional regulatory changes. Only 8% of plans cited litigation, but consultants commonly cited it as one of the biggest fears for their DC clients in their explanatory responses.

DB plans sponsors cited interest rate changes and market volatility as key disruptors. Within the survey’s “Other” category, factors such as political turmoil and corporate benefit changes including freezing or closing the DB plan, were mentioned.

While some may fear these disruptive forces may distract a plan from reaching its goals, we believe there are reasons for optimism. This is especially true in the DC space, where the most frequently cited disruptors like retirement income and SECURE 2.0 could be sources of positive change in our industry. SECURE 2.0 was enacted to help expand access and increase retirement savings for participants. Incorporating SECURE 2.0’s many voluntary provisions should serve to help make participants better off for retirement. Plan sponsors remain focused on helping participants create a paycheck in retirement. This combination of innovation and expanded access could help complete DC’s evolution from a supplemental savings plan to the retirement savings and income vehicle that the industry has long envisioned.

Don't miss our latest insights.

Our latest insights

-

Portfolio Construction

-

Defined Benefit

-

Liability-Driven Investing

-

Defined Contribution

-

Defined Benefit

Alternative investments are financial assets such as private equity, venture capital and hedge funds that do not fall into conventional investment categories such as stocks, bonds and cash.

A defined benefit pension plan is a workplace retirement plan to which the employer makes contributions and promises a defined retirement benefit to the plan participant.

A defined contribution plan is a workplace retirement plan in which the employee and/or the employer contribute to the employee’s individual account under the plan. The value of the account will change based on contributions and the value and performance of the investments.

Funded status is a measure of the difference between the present value of a defined benefit plan’s assets and its future benefit obligations. A funding surplus occurs when the value of a plan’s assets exceeds its benefit obligations; a funding deficit occurs when the plan’s benefit obligations exceed its assets.

Guarantee (annuity): Annuities are insurance contracts that guarantee a certain payment over time, subject to the claims-paying ability of the insurer and specific provisions of the contract. Such contracts often come with surrender charges or penalties for investors who access the money too early. Depending on the type of contract, an annuity may be subject to investment risk and loss of principal.

Liability-driven investing (LDI) is an approach that focuses the investment policy and asset allocation decisions on matching a pension plan’s current and future liabilities.

Managed withdrawal (or managed payout) solution: Managed payout funds are investment strategies designed to offer regular and predictable income (or payouts) to investors. Often, payouts are automatically adjusted based on market conditions — declining during market downturns and rising during periods of market appreciation. Such funds do not offer income guarantees, however, as annuities do.

Pension risk transfer: A pension risk transfer occurs when the plan sponsor of a defined benefit plan seeks to transfer liabilities for some or all participants to a third party, typically via purchase of annuities from insurance companies who agree to assume those liabilities.

Qualified Default Investment Alternative (QDIA): A QDIA is a default investment for participants who do not make an affirmative election. A QDIA limits a plan sponsor’s fiduciary risk if certain requirements are met. Only certain types of investments (such as a target date fund) qualify as a QDIA.

SECURE 2.0 Act: The federal SECURE 2.0 Act, signed into law in 2022, seeks to strengthen the retirement system by implementing reforms to retirement plans like 401(k)s. It builds upon the original federal Setting Every Community Up for Retirement Enhancement (SECURE) Act of 2019.

Target date funds are retirement savings vehicles that shift to a more conservative asset allocation over time. Each fund (or vintage) is managed to a specific targeted retirement year. A custom target date fund provides a custom glide path (or asset allocation) for a specific plan sponsor.

Target date off-dating: This refers to when a participant invests in a target date fund that does not align with his or her desired retirement year. For example, someone who intends to retire in the year 2035 might choose to invest in a 2050 fund because he or she prefers to have a greater equity allocation than a 2035 fund provides. (Funds closer to the target retirement year generally have smaller equity allocations than funds further away.)

Although the target date portfolios are managed for investors on a projected retirement date time frame, the allocation strategy does not guarantee that investors’ retirement goals will be met.