Retirement Planning

- Retirement legislation, referred to as the SECURE 2.0 Act, has finally been signed into law.

- Many of the reforms in the SECURE 2.0 package are focused on new plans, which may provide business-building opportunities for retirement plan professionals.

- Download a printable PDF of what’s going into effect that you can share with clients.

After months of discussions, Congress passed the long-awaited SECURE 2.0 Act of 2022, with President Joe Biden signing it into law in late December.

SECURE 2.0 combines many elements from three separate retirement bills. Expanding on improvements made by the Setting Every Community Up for Retirement Enhancement Act (SECURE Act) of 2019, the legislation includes more than 90 changes affecting qualified retirement plans, IRAs, SIMPLEs, SEPs, ABLEs and 529 plans.

The legislation seeks to help small businesses adopt retirement plans and make it easier for Americans to save. And with several reforms focused on new plans, retirement plan professionals have the opportunity to build or expand on their retirement business.

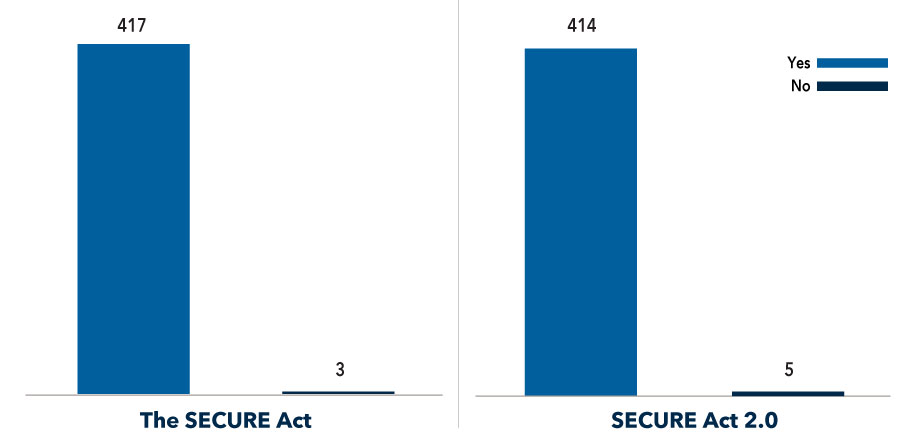

Both versions of the SECURE Act passed in the House by a wide margin

Source: Office of the Clerk, U.S. House of Representatives

Here are summaries of the key provisions related to qualified plans and SIMPLEs. Not every provision is summarized below, such as those regarding the new “starter” 401(k) and long-term part-time employees.

Provisions effective 2023

- ACCESS

- Expanded automatic enrollment: It would require newly established defined contribution (DC) plans to automatically enroll eligible participants with at least a 3% contribution rate and increase the rate through auto-escalation by 1% per year until it reaches 10%. Eligible employees have the option to opt out if they do not want to participate in the plan.

- Expedited access for part-time workers: Beginning in 2023, part-time employees who work at least 500 hours a year will be able to participate in 401(k) plans after two years on the job, a shorter timeframe than the current three years.

- Enhanced incentives for plan sponsors: The startup credit for employers with 100 or fewer employees increases to cover 100% of the cost of initiating a 401(k) plan, up from 50%. An additional credit would be provided equal to the applicable percentage of the amount contributed by the employer on behalf of employees, up to a per-employee cap of $1,000.

- This full additional credit would be limited to employers with 50 or fewer employees and phased out for employers with between 51 and 100 employees.

- The applicable percentage would be 100% in the first and second years, 75% in the third year, 50% in the fourth year, 25% in the fifth year, then reduced to zero thereafter.

2. INCREASED SAVINGS

- Bigger contributions for older workers: The annual catch-up amount increases for participants ages 62 to 64 from $6,500 to $10,000 for 401(k) and 403(b) and up from $3,000 to $5,000 for SIMPLE IRA or SIMPLE 401(k) plan participants.

- Support for employees with student loans: Plan sponsors can match employees’ loan repayments with retirement account contributions beginning on January 1, 2023. This provision is aimed at workers who forgo saving for retirement because of high levels of student debt.

3. INCOME PRESERVATION

- Changes to required minimum distributions (RMDs): The bill raises the RMD age from 72 (set by the original SECURE Act) to 75 in three phases:

- from 72 to 73 beginning in 2023;

- to 74 beginning in 2030;

- to 75 beginning in 2033

Delaying RMDs allows participants’ savings to continue to grow and potentially provide increased income when it comes time to draw down assets. Participants with retirement account balances of less than $100,000 would be exempt from taking RMDs.

4. PLAN SIMPLIFICATION

- Revised disclosure requirements: The bill would eliminate the need for plan sponsors to provide notices to eligible, but non-participating employees beginning in 2023. Plan sponsors would still have to provide an annual reminder notice of eligibility.

- Expanded access to collective investment trusts (CITs): CITs have been available in 401(k) plans for some time, but not in 403(b) plans. SECURE 2.0 includes a provision that allows 403(b) plans to offer CITs as investment options.

Significant expansion of startup tax credits (taxable years beginning after 2022)

The SECURE Act substantially expanded the startup plan tax credit for certain plan costs paid by the employer, such as recordkeeping, TPA and financial professional expenses. SECURE 2.0 strengthened the existing tax credit by removing its percentage limitation for certain smaller employers and, even more significantly, created a new tax credit that reimburses small businesses for a portion of the amount of employer contributions made. The tax credit starts at 100% of employer contributions made for each employee earning less than $100,000 a year up to $1,000 and phases down over 5 years from plan adoption (100%, 100%, 75%, 50%, 25%). Together, these two tax credits could make plan adoption extremely cost-effective.

Relaxed RMD rules (2023)

The age at which required minimum distributions must begin has increased from 72 to 73 and will increase to 75 in 2033. Also, the penalty for not taking an RMD from a qualified plan or IRA has been lowered from 50% of the required amount not taken to 25%. If an untaken RMD from a qualified plan or IRA is corrected in a timely manner, the excise tax has been reduced from 25% to 10%.

Roth option available for employer contributions (2023)

Previously available only as pretax, employers now have the option to allow employees to decide whether to take employer matching and nonelective contributions on a Roth after-tax or pretax basis. The employer may deduct Roth contributions, but employees take Roth contributions as income, and contributions and earnings would be subject to normal Roth rules thereafter.

Roth SIMPLE and SEP IRAs (taxable years beginning after 2022)

Employers are now able to offer Roth SIMPLE and SEP IRAs alongside traditional SIMPLE and SEP IRAs.

Provisions effective 2024

SIMPLE plan enhancements (taxable years beginning after 2023)

The SIMPLE plan contribution and catch-up limits (adjusted for inflation; $15,500 and $3,500 for 2023) are increased 10% for employers with 25 or fewer employees. Employers with 26–100 employees qualify for the higher limits only if they provide a dollar-for-dollar matching contribution up to 4% of compensation or a 3% nonelective employer contribution (up from regular requirements of 3% and 2%, respectively).

Also, employers with SIMPLE plans have the option of making nonelective contributions above the currently required contributions (nonelective or matching) to each employee in a uniform manner, up to the lesser of $5,000 or 10% of compensation.

Required Roth treatment for catch-up contributions (taxable years beginning after 2023)

Catch-up contributions to qualified retirement plans for higher earners are required to be Roth after-tax contributions, even if regular contributions are pretax. Participants with compensation below $145,000 (to be adjusted for inflation) are exempt and can elect pretax or Roth catch-up contributions (if available).

Emergency Roth savings accounts and emergency withdrawals (2024)

Employers have the option to add an emergency savings account to their plan to provide non-highly compensated employees easy, penalty-free* access to emergency funds. Automatic enrollment of up to 3% of salary can be established, and the employee contributions, which are Roth after-tax, are subject to matching. Employers choose the account limit, up to $2,500.

Also, in addition to hardship distribution allowances, one in-service withdrawal per year up to $1,000 is allowed for unforeseen or immediate personal or family emergency expenses without paying an early withdrawal penalty. Once an emergency withdrawal is made, another cannot be made for three years unless the distribution is repaid. Employers are allowed to rely on participant certification that hardship withdrawal requirements are satisfied.

Student loan payment match (plan years beginning after 2023)

Employers with 401(k), 403(b) or SIMPLE plans have the option to make matching contributions on workers’ qualified student loan payments. Matching contributions are also allowed with governmental 457(b) plans.

Tax- and penalty-free rollovers from 529 plans to Roth IRAs (distributions after 2023)

To alleviate fears about having to pay taxes and penalties to access leftover assets in 529 accounts, beneficiaries of 529 college savings accounts can roll up to $35,000 to a Roth IRA tax and penalty-free over their lifetimes. Such rollovers are subject to Roth IRA annual contribution limits, and the 529 account must be at least 15 years old.

Provisions effective 2025 and later

Required automatic enrollment and escalation (plan years beginning after 2024)

Unless employees opt out, new 401(k) and 403(b) plans must automatically enroll participants in the plan with a beginning salary deferral of 3%–10%. Deferrals must increase 1% per year up to 10%–15%. Exemptions apply, including small businesses (10 or fewer employees), new businesses (less than 3 years old), and church and governmental plans. Plans existing before December 30, 2022, are not subject to this provision.

Increased catch-up contributions (taxable years beginning after 2024)

The catch-up contribution maximum for employees age 50+ is $7,500 for 2023 ($3,500 for SIMPLE plans) and adjusted for inflation annually. Beginning in 2025, employees age 60–63 will have a higher catch-up limit — 50% more than the regular catch-up limit or $10,000 more, whichever is greater.

Retirement savings lost and found (2025)

To help individuals find information about previous employers to claim earned benefits, a searchable retirement savings database will be created by the Department of Labor.

Saver’s tax credit becomes a government match (for taxable years beginning after 2026)

The saver’s tax credit (up to $1,000 per individual) for lower income workers changes from a credit paid in cash as part of a tax refund to a federal matching contribution deposited into a retirement plan account or IRA. Also, the credit rate changes from a tiered range of 10%–50% of retirement plan and IRA contributions to an across-the-board 50%.

What’s not changing

CITs not yet available to 403(b) plans

Surprisingly, Congress did not clear the path for 403(b) plans to be able to invest in group trusts such as collective investment trusts (CITs). Until securities laws are amended, 403(b) plan investments will continue to be limited to annuities and mutual funds.

“Backdoor” Roth conversions not addressed

Roth conversion rules were not changed to address the loophole of high earners, who are not eligible to open a Roth IRA but can open a traditional IRA and then convert it to a Roth IRA.

Help clients prepare

Saving for retirement consistently ranks among Americans’ top financial worries. The SECURE 2.0 Act’s provisions provide much-needed opportunities for workers to increase their retirement savings while giving retirees more flexibility to preserve their assets and create income for later in life.

If you have additional questions about any of SECURE 2.0’s provisions, feel free to reach out to your Capital Group representative. In the meantime, you can download a printable PDF of what’s going into effect to share with clients, which also includes key dates for adoption.

Our latest insights

-

Liability-Driven Investing

-

Defined Contribution

-

Defined Benefit

-

-

Liability-Driven Investing

* The first four emergency withdrawals each plan year may not be subject to fees and charges; however, taxes may apply.

This material does not constitute legal or tax advice. Investors should consult with their legal or tax advisors.