Defined Contribution

This article is part of the Retirement Plan Trends series, which explores issues affecting the retirement space.

The Hispanic proportion of the U.S. labor force is projected to increase more than any other race or ethnic group by the end of the decade.1 At the same time, research shows that Hispanic employees are less likely to participate in retirement plans2 and lag in financial literacy and savings compared to other groups.3 To better understand and serve the retirement needs of U.S. Hispanic participants, Capital Group conducted interviews and other research, which will inform a future collaboration with Pepperdine University. To date, this has included an online survey and a series of in-depth interviews with Hispanic individuals ranging from first-generation college graduates to immigrants diving into 401(k) investing for the first time.

Below, we outline key themes emerging from this work that suggest ways plan sponsors can seek to improve retirement outcomes for Hispanic participants:

- Although Hispanic communities are very diverse, there are commonalities in saving behavior. Understanding and addressing these issues can help drive participation.

- Hispanic participants’ financial decisions are shaped by culture, financial education, emotions and systemic barriers in areas like education and access to retirement plans.

- Some of their challenges and concerns are specific to this group, while others are common to the broader public.

- Many of the people interviewed come from families that generally did not invest in financial markets. As a result, some struggle to reconcile other investing ideas, such as investing in real estate, against the value of investing in a 401(k) plan.

Providing the right tools can lessen retirement saving uncertainty

Here are a few of the key actionable insights we uncovered:

1. Acknowledge cultural influences.

There is tension between unlearning what was taught at home, societal expectations and their personal financial situation. Ensure messaging addresses cultural influences, inherited saving behavior and family dynamics (e.g., participants potentially working additional hours versus allowing their money to grow through compounding).

2. Make retirement plans less of a “black box.”

Fear of asking the wrong questions and not knowing the details of investing in a retirement plan can prevent individuals from learning about what is available to them. Use real-life scenarios to educate participants on plan features (e.g., loan features, rollovers).

3. Connect with values.

While previous generations may have relied on their children in retirement, parents increasingly want to alleviate future financial burdens for children. Position retirement accounts as an investment that aligns with cultural values such as relieving children of the responsibility of supporting parents in their old age.

4. Turn current contributors into advocates.

Since friends and family may not be using an employer-sponsored plan, there is some lack of familiarity, overall hesitation and uncertainty about contributing. Not knowing other Hispanic people contributing to retirement saving plans can cause hesitation. Amplify current contributors by identifying employee ambassadors to create more familiarity and build trust.

5. Emphasize the added benefits to investing in an employer-sponsored retirement plan.

Employees are more likely to trust that plan sponsors have conducted proper due diligence in choosing the right retirement plan provider. Plan sponsors can leverage this inherent trust to encourage contribution. Highlight matching contributions as an additional benefit, if available.

6. Address risk concerns.

Investing in retirement plans is perceived as riskier than other investment opportunities such as real estate. Explain how options like target date funds can help manage risk on a participant’s behalf. Promote the concept of diversification.

Addressing participant concerns

How can plan sponsors tailor communication methods and education efforts to Hispanic participants given the population’s diversity?

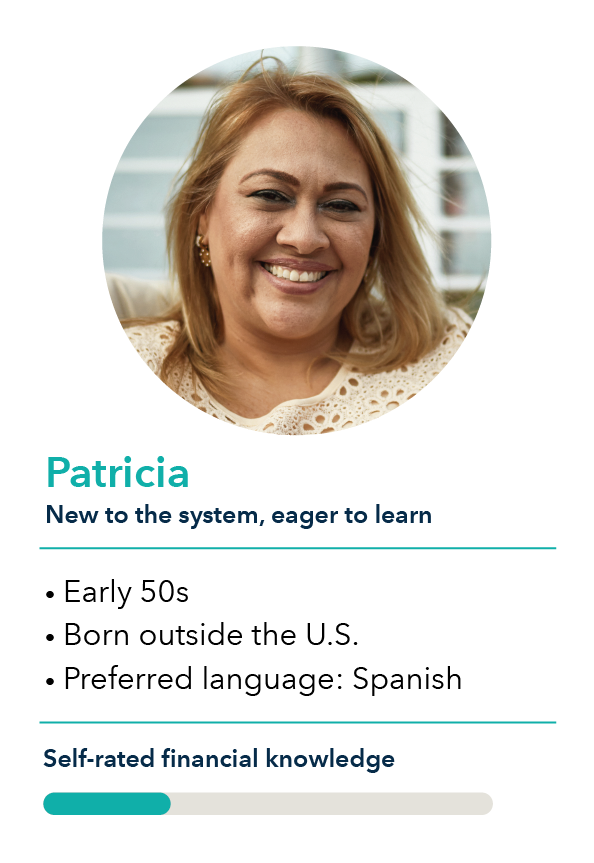

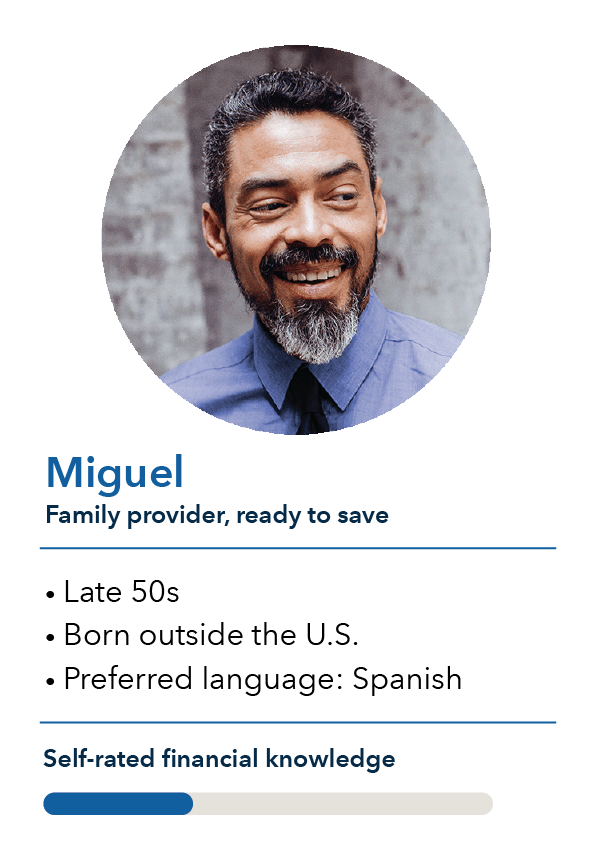

Although it is difficult to cover all the different backgrounds that compose this group, we have segmented the information to create three “personas” representative of significant sections of the respondents in our research. We found the use of personas helpful when enhancing ICanRetire®, Capital Group’s online participant engagement platform. The platform segments participants into various personas to create tailored content and user experiences. Below are details of the three Hispanic personas, which are divided based on factors like background, age, financial literacy, key motivators and preferred language. We also have included each persona’s top concerns, which can help guide plan sponsors when creating their communication and messaging plans.

Saving profile:

*Current contribution rate: 3%

*She is the first in her family to invest and self-taught when it comes to financial literacy

*As a first-gen investor, she is just starting her investing journey and seeking deeper investment knowledge

Top concerns:

- How do I navigate saving for retirement while also saving for my first home?

- How much can I invest when I may have to support my elderly parents?

- How do I balance investing with getting out of debt?

Saving profile:

*Current contribution rate: 1%

* She was familiar with the pension system in her home country, but she is very new to the U.S. retirement system

* Needs guidance in navigating and preparing for retirement

Top concerns:

- How can I balance saving for retirement when my family is relying on me financially?

- Looking at the funds to invest in is overwhelming. I need help.

- How do I know how much I should save for retirement?

Saving profile:

*Current contribution rate: 0%

* This is the first time he has had access to a 401(k)

* Needs help understanding his 401(k)

* Needs guidance in navigating and preparing for retirement

Top concerns:

- Why should I invest in a 401(k) versus continuing to focus on owning real estate?

- How do I handle a downturn in the market and recover from losses?

- My family comes first, and I don’t want to let them down. How do I balance providing for my family and investing in the future?

Conclusion

Hispanic participants come from distinct backgrounds and levels of investment knowledge. However, they share similar ideas and concerns about retirement investment. At the same time, they are willing to expand their knowledge about retirement plans, which plan sponsors can leverage to boost levels of contribution and set them on a successful path for retirement.

Methodology:

Along with robust research and analysis of peer-reviewed articles and government publications, we conducted a series of in-depth interviews and conversations with a representative mix of Hispanic consumers in November 2022. The definition of Hispanic for this research is respondents who see themselves as Hispanic or of Latin American origin (except those from Brazil and Spain) regardless of where they were born and their primary language. We performed online research with 45 people, which was followed by 30-minute in-depth virtual conversations with 10 participants from that group. Eight in-home interviews focusing on diving deeper on the key learnings gleaned from the virtual interviews were also conducted.

Additionally, we are conducting an independent study in partnership with Pepperdine University. The study aims to test ICanRetire’s digital educational program promoting saving and planning for retirement among middle-aged Hispanic adults.

Don't miss our latest insights.

Our latest insights

-

Liability-Driven Investing

-

Defined Contribution

-

Defined Benefit

-

-

Liability-Driven Investing

Capital Group enhances ICanRetire® to meet needs of Hispanic employees

1 Hispanic share of the labor force projected to be 20.9% by 2028: The Economic Daily. U.S. Bureau of Labor Statistics. October 2019.

2 Neil Bhutta et al. “Disparities in Wealth by Race and Ethnicity in the 2019 Survey of Consumer Finances,” FEDS Notes. Washington: Board of Governors of the Federal Reserve System, September 28, 2020.

3 Andrea Hasler et al. “Financial Literacy Among U.S. Hispanics: New Insights From the Personal Finance (P-Fin) Index.” TIAA Institute. October 2017.