Plan Design

This article is part of our Retirement Plan Trends series, which explores issues affecting the retirement space.

Defined contribution (DC) plans are not uncommon in the public sector. In fact, about a third of state and local government workers have access to both a DC and a defined benefit (DB) plan.1

Compared to the lifetime income guarantee of DB plans, a public-sector DC plan could be seen by some participants as simply a “nice-to-have.” But this overlooks three key points:

- In the public sector, DB and DC provide distinct opportunities for retirement savings.

- Each can be used to help insulate against different risks and, in this sense, are complementary.

- The DC option can play different roles in a portfolio depending on whether a participant is a public safety worker (e.g., police and fire) or a general worker (e.g., clerical).

This article explores these issues and gives some tips on how plan sponsors can help workers get the most out of the DC option.

DC and DB benefits are complementary

Even with the stability of a generous DB plan, a DC option can provide key benefits to public employees. These include:

- Diversification: The DC option can diversify sources of income and reduce the reliance on DB income.

- Inflation hedge: DC assets can provide an additional tool to hedge unexpected inflation if there are caps on DB cost-of-living adjustments.

- A source of liquidity: During retirement, a DC account can increase liquid assets that can be used for emergencies, travel and bequests, or to help younger relatives with a home down payment and educational expenses.

- Growth potential: The DC account allows participants to potentially maintain or grow wealth by investing in capital markets.

DC plans can be especially valuable for safety workers

Unlike general workers, safety workers in many cases are ineligible to receive Social Security in retirement. Because of this, DC assets can be an important risk diversifier and income source for safety personnel such as police and firefighters. This point was evident in research we conducted in partnership with a large DB-plus-DC plan run by a county government located in a high cost-of-living area.

The plan asked us to analyze which worker types were most likely to meet an 85% income replacement target in retirement. This target is especially ambitious, considering that the average pension replacement rate in developed countries is 62%, according to 2021 data from the Organisation for Economic Co-operation and Development (OECD). However, the plan wanted to “stress test” the higher 85% target given that retirees might need to replace a greater share of their income to afford the higher cost of living. We found that high living expenses can greatly affect the retirement adequacy of workers in the lower and middle-income tiers of employee compensation.

Our research demonstrated three broadly applicable insights on the role and potential value of a DC plan for public workers’ portfolios and retirement readiness.

First, a DC plan can be a key source of retirement income for lower and middle-income safety workers. In many cases, safety workers get higher income replacement rates from the DB plan than general workers because they contribute a larger percentage of income to the DB plan and receive higher benefit multipliers.2 However, they may get less from the DC plan because they retire earlier. Also, they generally don’t get Social Security income.3

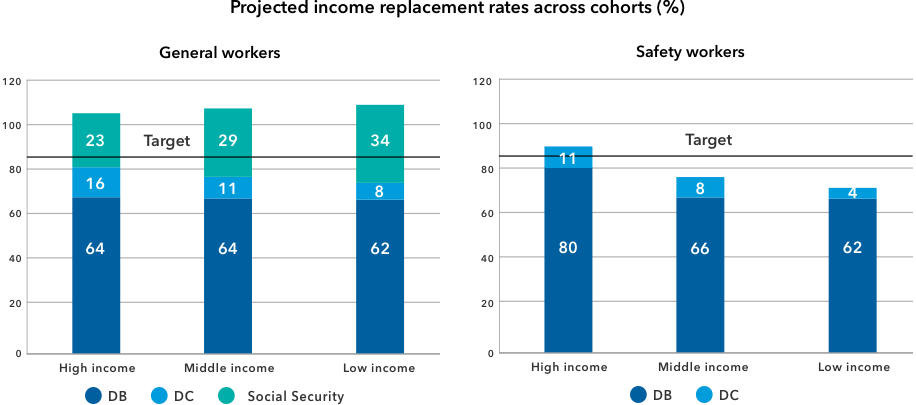

As part of our research, we used participant data to create two archetypes: general workers and safety workers. We then split those two groups into three income levels (low, middle and high), for a total of six types of workers. Based on discussions with the plan, we assumed general workers retire at 65 and safety workers retire at 55, and we made assumptions about inflation rates, investment returns, asset allocation, mortality, DC plan withdrawal rates and other key variables.

Here’s what we found: Social Security made a big difference in plan participants’ ability to meet the 85% target. Every income level of general workers had replacement rates topping 100% (combining DB, DC and Social Security). Again, however, safety workers in this plan (and many in general) are ineligible for Social Security. High-income safety workers were able to achieve a 92% replacement rate with DB and DC alone. But middle- and low-income safety workers fell short: achieving a 74% and 66% rate, respectively. Stripping out the DC contribution, these rates would have fallen to 66% and 62%, respectively.

Most safety workers fell short of the 85% target

Source: Capital Group. Data as of 2021. The horizontal black line indicates the 85% target. Based on an analysis of the plan's population, the income ranges (annual compensation) were defined as: Lower income (up to $86,448), middle income ($86,449 up to $127,052) and high income ($127,053 and higher). Approximately 40% of the plan population were classified as lower income, 40% were middle income and 20% were high income.

For middle- and low-income safety workers, those replacement rates are still a good outcome for the plan we analyzed. Still, relative to general workers and high-income safety workers, those rates may translate to a lower standard of living.

Second, workers with shorter tenure may be more reliant on DC assets for income replacement. Workers with fewer years of service will have built up less of a DB payment and may have to rely more on other assets, including the DC plan.

Third, our research has implications for participants’ decisions on how much risk they should assume in their DC portfolios. Participants are unique, especially in their level of DB benefits and eligibility for Social Security. Given this diversity, plan sponsors should determine whether the level of risk exposure within asset allocation solutions is appropriate for a broad spectrum of participants.

What does this mean for public plan sponsors?

Our research suggests some potential action steps for plan sponsors to help workers build up and extend their retirement savings.

Savings: Public plans should consider steps to help workers get the most out of their DC option.

- Inform workers that a DC option isn’t just a “nice-to-have.” It can be a key part of a retirement income strategy. Consider highlighting the ways in which DC can complement a DB plan.

- Educate workers on the benefit of starting to contribute to DC plans earlier in their careers or increasing their existing contributions, perhaps through hypothetical examples or illustrations.

- If legally permitted, consider instituting auto-savings features. This could include automatically enrolling employees into the plan at a default savings rate unless they opt out. The plan could either automatically enroll all employees (full auto-enrollment) or enroll a particular group, such as new hires, from a certain date forward (partial auto-enrollment).

Plan design: Another way to help boost savings is by increasing the period during which participants are making contributions.

- Particularly for safety employees who have the option to retire earlier, extending their working years can potentially lead to a meaningful increase in account balances.

- While simply allowing participants to work longer can help, additional plan design features such as deferred retirement option plans (DROPs) can help to build assets. DROPs are programs that typically allow employees to freeze pension benefits while continuing employment for a specified period of time. Pension benefits do not accrue additional years of service but can earn interest over the additional employment time frame.

Investing: Workers have different investment objectives, spending patterns, risk tolerances and Social Security eligibility, all of which can be relevant for DC asset allocation.

- Specific cohorts (such as low- to middle-income safety workers) may be best served by a combination of guidance and investment solutions.

- Giving participants the ability to set up flexible withdrawals (both in amount and timing) may also help them extend the life of their DC assets in retirement.

- In sum, investment solutions may work best not in isolation but as part of a broader program of engagement, education and guidance.

Steps to consider to improve a public-sector DC option

Source: Capital Group. DROPs = Deferred retirement option plans.

Don't miss our latest insights.

Our latest insights

-

Portfolio Construction

-

Defined Benefit

-

Liability-Driven Investing

-

Defined Contribution

-

Defined Benefit

1Based on 2020 data from the U.S. Bureau of Labor Statistics.

2Source: National Association of State Retirement Administrators. "NASRA Issue Brief: Employee Contributions to Public Pension Plans," September 2022.

3Source: NCSL (National Conference of State Legislatures). “State and Local Government Workers Without Social Security Coverage," September 22, 2022.

An income replacement rate is the percentage of a person’s annual employment income that is replaced by retirement income after the person retires. A level below 100% indicates the person’s retirement income is less than the employment income. A level above 100% indicates the opposite.

A defined contribution plan, such as a 401(k), is a retirement account funded by contributions, but whose value can fluctuate based on the return of the investments. A defined benefit (or pension) plan promises to pay a specific amount to participants over a certain number of years of retirement.