Defined Benefit

This article is part of our Retirement Plan Trends series, which explores issues affecting the retirement space.

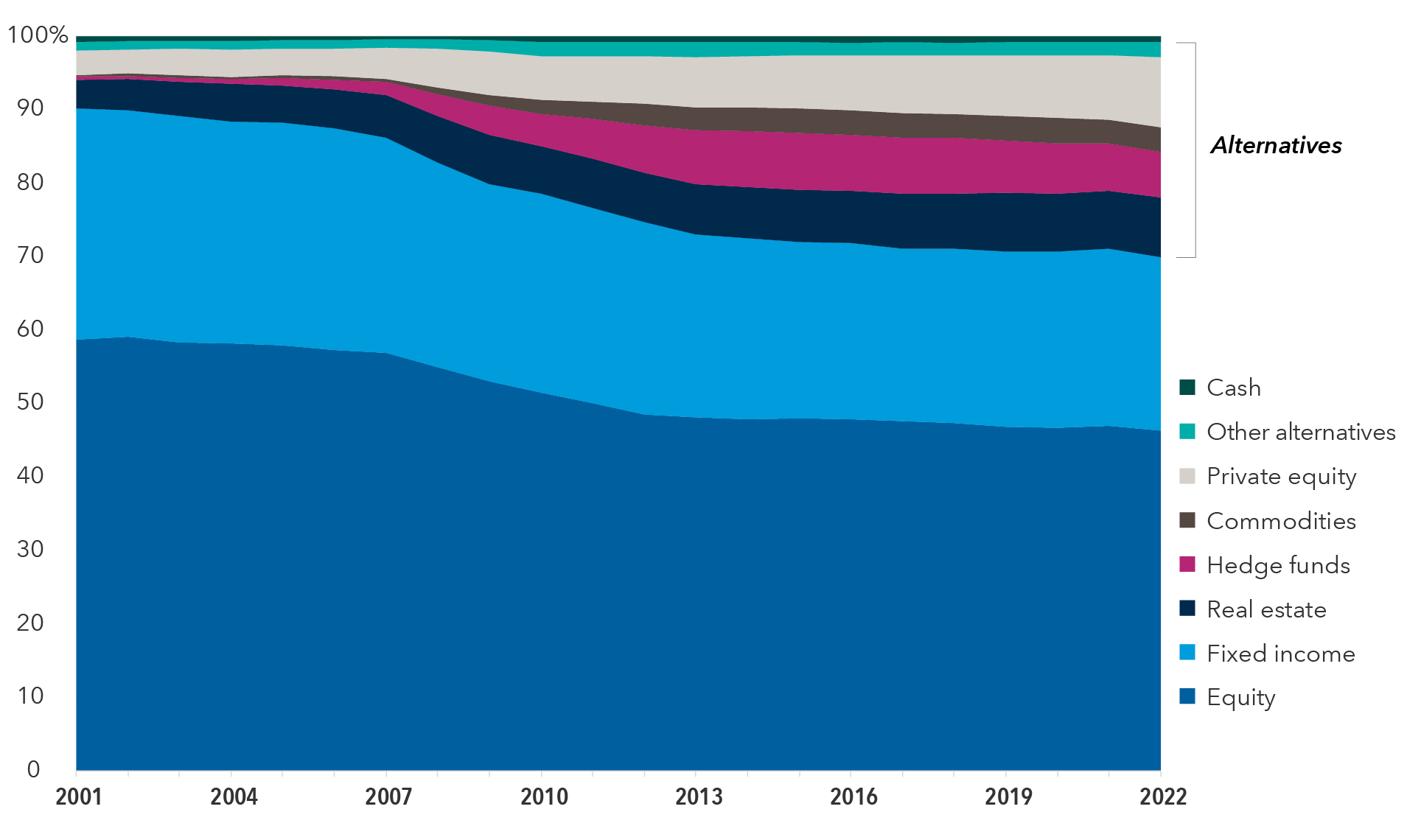

Public pension plans have meaningfully raised their exposure to private equity, real estate, hedge funds and other alternative asset classes over the past two decades. Although public equity and fixed income remain the bedrock for public plans, alternatives accounted for nearly 30% of their holdings in 2022, compared with just 9% in 2001. But with many alternative assets under pressure from high interest rates, and capital markets in flux, public pensions could benefit from shifting some of their alternatives exposure back to more traditional asset classes.

In alts we trust

Source: Public Plans Data. 2001–2022. Center for Retirement Research at Boston College, MissionSquare Research Institute, National Association of State Retirement Administrators, and the Government Finance Officers Association. As of December 31, 2022.

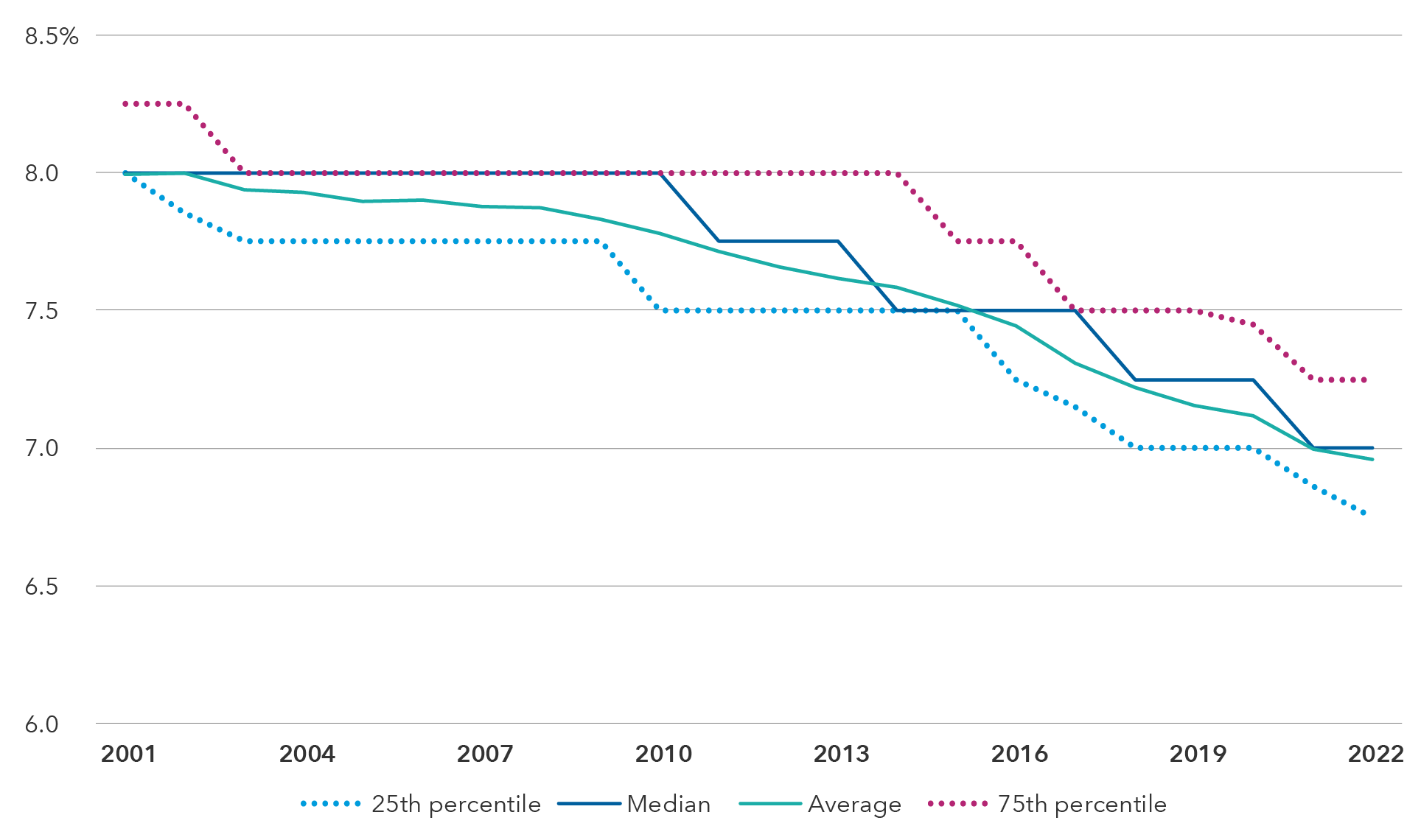

As public plans increased their exposure to alternative vehicles over the past two decades, they also trimmed their expected return targets, driven in part by the historic decline of interest rates and volatility of equities over most of that period. In 2022, public plans’ return targets averaged 7%, down from 8% in 2001.

Now the capital markets dynamic has changed as interest rates have surged over the past two years and major equity indexes have reached record highs. Higher rates tend to weigh on alternative investments by, for example, reducing demand for real estate, limiting the viability of certain private equity transactions, and increasing default risk in private lending. To the extent that public plans respond by taking some alternatives exposure off the table, fixed income and emerging markets (EM) equity and debt could be attractive areas for increased allocations.

In fixed income, higher yields may offer public pensions solid opportunities to revisit the risks they took to achieve their overall return objectives. With even core fixed income yielding more than 4.5%[1], pensions that are targeting a 7% return and set strategic asset allocations based on the aggregate bond yield of around 1.7% at the end of 2021 may have an opportunity to take less risk for a similar level of targeted return. This could take the form of moving higher in credit quality or shortening duration, for example.

Lowered expectations

Source: Public Plans Data. 2001–2022. Center for Retirement Research at Boston College, MissionSquare Research Institute, National Association of State Retirement Administrators, and the Government Finance Officers Association. As of December 31, 2022.

The role of emerging markets

While alternative strategies will most likely continue to play a role in public plans, emerging markets could provide more liquid investment opportunities. The asset class should benefit from improving macroeconomic dynamics, such as declining policy and market interest rates, potential currency tailwinds and relatively low valuations.

The valuation pressures on EM assets largely reflect concerns about China’s economy. The shifting of global supply chains away from China, along with its weak property sector and challenging demographic profile are all weighing on China equities. On the other hand, India is a significant bright spot in emerging markets — with equity valuations soaring — as it benefits from expanding infrastructure investment, pro-business reforms and positive demographic trends.

While the EM backdrop is improving overall, public pensions remain underallocated. Target allocations to emerging markets average just 5%, well below their nearly 10% weight in the MSCI All Country World Index, according to data from eVestment on the public pension funds universe as of December 31, 2023.

Public pensions do appear to be moving more into emerging markets. Of public pensions with exposure to emerging markets, 78% expected to maintain or increase exposure to emerging markets equities and 35% expected to maintain or increase exposure to emerging markets debt, according to Cerulli Associates’ 2022 study of North American institutional markets.

For long-term investors, the current opportunity in emerging markets has the potential to increase expected returns and improve diversification in pension portfolios. To be sure, public plans looking to shift assets from alternatives to emerging markets will have to deal with the relative illiquidity of many alternative assets. This issue is plan-specific, depending largely on the maturity of each sponsor’s alternatives program.

Plan sponsors can access emerging markets through investment strategies that are more narrowly focused on emerging markets or through mandates that have a broader geographic purview that includes developing countries. In such a deep and challenging market, active management can be particularly helpful in navigating geopolitical issues and more idiosyncratic risks, helping investors to benefit from the potential tailwinds and strategic opportunities that this market has to offer.

Don't miss our latest insights.

Our latest insights

-

Portfolio Construction

-

Defined Benefit

-

Liability-Driven Investing

-

Defined Contribution

-

Defined Benefit

[1] Based on the Bloomberg U.S. Aggregate Bond Index yield to worst as of February 29, 2024.

Alternative investments are financial assets such as private equity, venture capital and hedge funds that do not fall into conventional investment categories such as stocks, bonds and cash.

Credit quality refers to the likelihood that the issuer of a fixed income security will be able to meet all principal and interest payment obligations associated with that security.

Duration refers to the sensitivity of a bond’s price to changes in interest rates.

Yield to worst is the lowest yield that can be realized by either calling or putting on one of the available call/put dates or holding a bond to maturity.

Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market.

MSCI All Country World Index is a free-float-adjusted market-capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes.