Election

Now that the results of last week’s U.S. elections are coming into focus, investor attention is shifting to the policy implications of a Joe Biden presidency. Bottom line: Don’t expect big, sweeping changes in the years ahead.

With a Democrat in the White House and Republicans likely maintaining control of the Senate, consequential changes will be difficult to achieve in a familiar environment of Washington gridlock. That may prove to be the best of both worlds from an investment perspective.

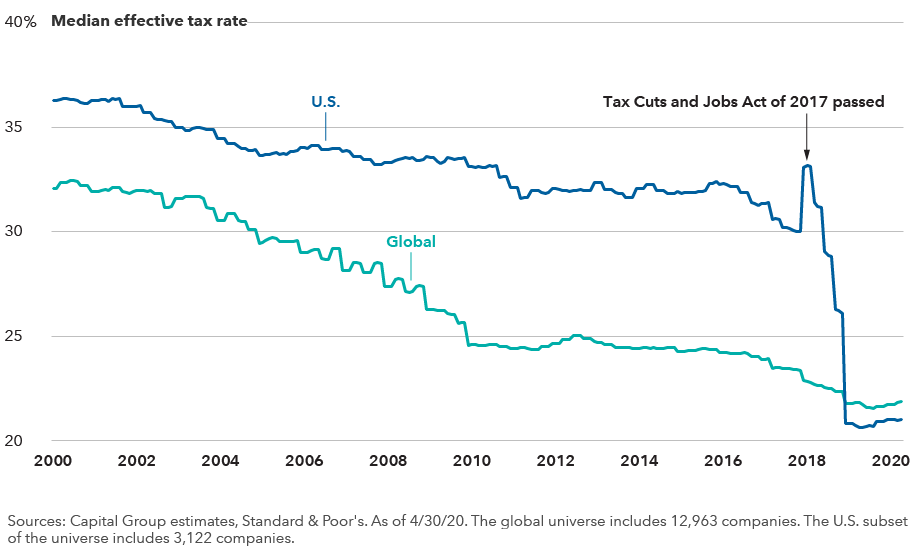

“Assuming the base case of a divided government holds, major tax increases should be off the table at least for the next two years,” says Jason Bortz, senior counsel at Capital Group who specializes in tax and retirement plan issues. “I think the 2017 tax cut bill — President Trump’s signature achievement — will stand.”

Of course, that outcome hinges on the continuation of a Republican majority in the Senate, and not all Senate races have been resolved, Bortz notes. Two Senate races in Georgia are headed for a January 5 runoff election, which could change the equation. However, it’s been 20 years since a Republican lost a Senate race in Georgia, which requires an outright majority to win statewide office.

U.S. corporate taxes are likely to remain low under a split Congress

Political uncertainty persists

In addition to Georgia’s unresolved status, a degree of uncertainty remains around the presidential election results. While Biden has been declared the winner by major news organizations, the Trump campaign has filed a flurry of lawsuits challenging the results — claiming election fraud and other irregularities in several key states. Recounts are also likely in Georgia and potentially other swing states where media outlets have declared Biden the winner.

While those efforts are unlikely to change the outcome, they can’t be completely dismissed either, says Capital Group political economist Matt Miller.

“I think we have to be prepared for a few weeks of litigiousness,” Miller says. “The Trump team will pursue every available legal challenge, and there could be some twists and turns before it’s all over. From an investor’s point of view, all we can do is keep calm and carry on while they work their way through the process.”

Capital Ideas™ webinars

Insights for long-term success

CE credit available

Capital Ideas™ webinars

Insights for long-term success

Policy priorities in motion

So what might change under a Biden administration?

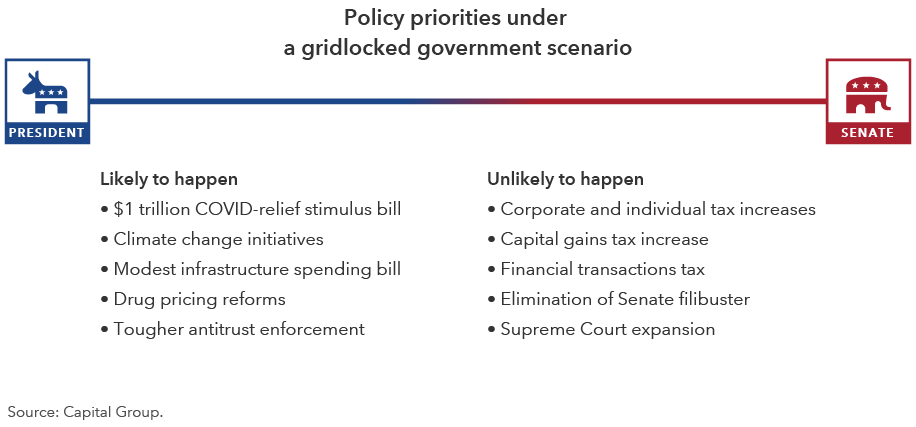

The top priority will be a COVID-relief stimulus bill, which might even happen before Inauguration Day. The idea has bipartisan support; however, Democrats and Republicans have so far not been able to agree on a dollar amount. That could change now that Election Day has passed.

“After the dust settles, I am cautiously optimistic that the Senate can work with the House of Representatives to get something done,” says Reagan Anderson, a senior vice president on Capital Group’s government relations team. “In my estimation, there is bipartisan support for roughly $1 trillion in spending, which is half the size of the previous relief bill, but it’s probably a compromise that Republican and Democratic leaders can live with.”

Other Biden administration priorities may include a modest infrastructure spending bill, immigration reform and drug pricing reform — all of which have some level of Republican support. The environment and climate change probably will move front-and-center, as well, including policies to encourage green investing and more disclosure related to environmental, social and governance (ESG) matters.

On the other hand, as long as Congress remains split, specific tax policy proposals are not likely to see the light of day, including corporate and individual income tax increases, a capital gains tax hike and a financial transactions tax.

“We also expect no change to the Senate filibuster or to the number of justices on the Supreme Court, both of which became hot-button issues during the campaign,” Anderson adds.

The fiduciary rule and Regulation Best Interest (Reg BI)

Other policy priorities may be enacted through executive orders and federal agency regulations. “Changes that can be made without going through the legislative process will be high on the president’s agenda,” Bortz says. “It’s the means to affect change when you have divided government.”

In the retirement industry, Bortz expects fiduciary standards to once again come under the regulatory spotlight. The Trump administration is working to finalize a U.S. Department of Labor (DOL) proposal that would give an exemption allowing investment fiduciaries to receive variable compensation for nondiscretionary investment advice, as long as they acknowledge fiduciary status in writing and adhere to certain conduct standards under current securities law.

Biden’s team may nix that rule, even if it is finalized during the remaining months of the Trump administration. The new administration is also likely to start work on a proposal that is expected to track the controversial Obama-era fiduciary rule, which was struck down by a federal court in the early days of the Trump administration.

Many prominent Democrats, including Vice President-elect Kamala Harris, have been supportive of tougher “standard of care” rules, arguing that current law does not go far enough to protect investors. Democratic leaders have also maintained that Reg BI does not adequately safeguard investors, and it is possible that a new SEC will tighten Reg BI’s requirements and take a firmer enforcement stance.

Recently, the DOL also finalized a regulation that will make it more challenging for plan sponsors to offer ESG funds in defined contribution (DC) plans, particularly within a default investment option like a target date fund. Democratic leaders and a large portion of the asset management industry have sharply criticized the rule. Democratic leaders might seek to water it down via DOL-led amendments or interpretive guidance, Bortz adds.

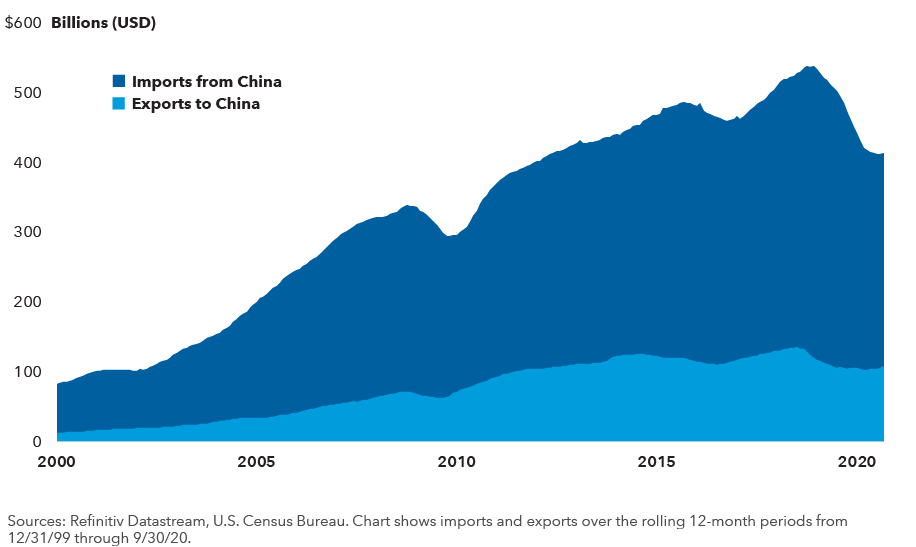

U.S.-China relationship will continue to be a key issue

Foreign policy

On the foreign policy front, U.S.-China relations will almost certainly remain the top priority under a Biden administration, says Michael Thawley, a Capital Group political economist and formerly Australia's ambassador to the United States. While Biden's foreign policy team will approach China in a more strategic and less confrontational fashion than Trump, they probably will take a tougher stance than the previous administration did under Obama.

Biden’s trade policy toward China will likely borrow some tactics from the Trump administration, such as the use of tariffs. Technology and investment restrictions will remain and will almost certainly be tightened, albeit in a more systematic and targeted way, Thawley adds, given the growing support for such measures in Washington.

"Overall, the trajectory of the U.S.-China relationship is becoming clearer, and the fundamentals would not be different under a Biden administration," Thawley says. "The intensity of the strategic competition will not have diminished. In a few years, we could end up with a much more tightly defined but still substantial bilateral economic relationship."

Our latest insights

-

-

-

Market Volatility

-

-

Market Volatility

RELATED INSIGHTS

-

-

Economic Indicators

-

Manufacturing

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Reagan Anderson

Reagan Anderson

Jason Bortz

Jason Bortz

Matt Miller

Matt Miller

Michael Thawley

Michael Thawley