Chart in Focus

With optimism building around a Federal Reserve interest rate cut, small-cap equities are finally grabbing investor attention after years of being overshadowed by megacap technology stocks. Month-to-date through July 19, the Russell 2000 Index surged back 6.7%, and the MSCI World Small Cap Index rose 4.3% versus the S&P 500 at 0.8%, placing emphasis on this ignored segment of the market.

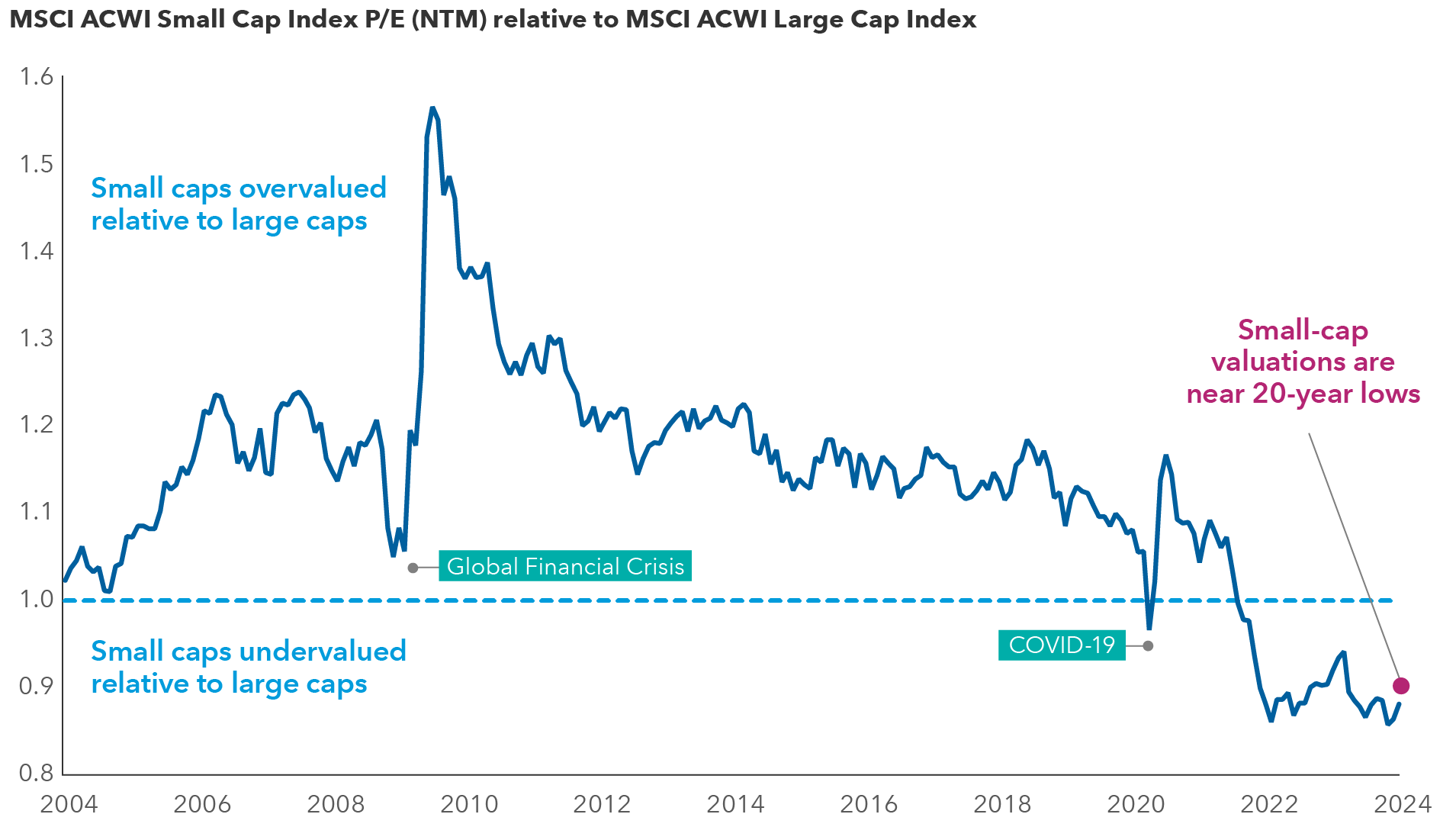

Small caps seek to close valuation gap

Source line: Capital Group, FactSet, MSCI. Data as of May 31, 2024. P/E = price-to-earnings. NTM = next twelve months. The y-axis represents the ratio between the P/E of MSCI ACWI Small Cap Index and the P/E of the MSCI ACWI Large Cap Index.

Small caps have emerged from the shadows after an extended period when investors favored large caps in a high interest rate environment. Many smaller businesses are sensitive to shifts in interest rates, which raise their cost of capital and debt refinancing costs. However, with a potential rate cut in sight and relative valuations for small caps at 20-year lows versus large caps, a long-term opportunity may be presenting itself.

It’s important to note that quality varies among small caps, hence stock selection will be key. Despite a historic bias for U.S.-based small caps, opportunities have arisen globally. Japan and India are two notable markets.

For small caps to sustain and achieve further gains, the economy needs to operate moderately well and not fall into a recession. Additionally, those anticipating interest rate cuts should see funding costs come down this year and in 2025. But I think the recent gains are more than a cyclical rebound. Many companies have used this time to optimize their capital structures for a higher interest rate environment. Some firms stand to benefit from the broader ecosystem focused on artificial intelligence, serving as suppliers and vendors to the big firms that have ramped up their capital expenditures. Potential beneficiaries include software-as-a-service and industrial firms. Finally, investors are also looking to diversify away from the large-cap tech stocks, which have market caps that expanded rapidly and now dominate the major indexes.

The MSCI All Country World Small Cap Index captures small cap representation across 23 developed markets and 24 emerging markets countries.

The MSCI All Country World Large Cap Index captures large cap representation across 23 developed markets and 24 emerging markets countries.

MSCI is a registered trademark owned by Morgan Stanley Capital International, Inc.

The Russell 2000® Index measures the performance of the small-cap segment of the US equity universe. The Russell 2000 Index is a subset of the Russell 3000® Index representing approximately 7% of the total market capitalization of that index, as of the most recent reconstitution. It includes approximately 2,000 of the smallest securities based on a combination of their market cap and current index membership.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies. FTSE® and Russell® indexes are trademarks of the relevant LSE Group companies and are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

The S&P 500 Index is a market-capitalization-weighted index based on the results of approximately 500 widely held common stocks.

The S&P 500 Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks.

Don't miss our latest insights.

Our latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

-

Global Equities

-

Economic Indicators

-

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Kent Chan

Kent Chan