Markets & Economy

U.S. Equities

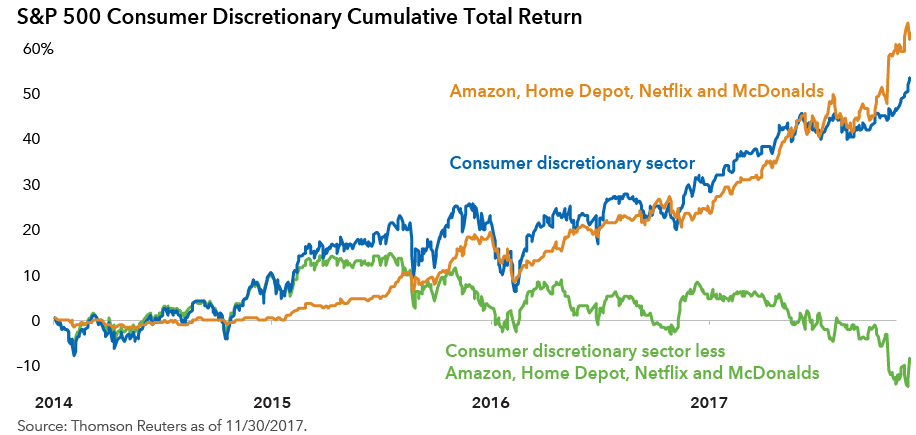

Not all stocks will be rewarded for higher spending

As the current consumer-driven economic expansion heads into its eighth year, investing in the U.S. consumer seems like a logical strategy. Higher consumer spending should theoretically boost a wide range of stocks in the consumer discretionary sector. In reality, the gains in that sector have been concentrated in just a few names — like Amazon, Home Depot, Netflix and McDonalds. The consumer discretionary sector has climbed 46% since the beginning of 2014. Without those four companies, however, the sector has actually declined more than 10%. These four firms are among the new breed of consumer-facing companies that are taking increasing market share partially due to disruptive trends and technological advances. Amazon’s growing influence in the retail industry through its expanding online consumer marketplace is just one example of a disruption that sets the company apart from others. The outsized returns of these four companies provide an example of how important fundamental investment research is in helping to identify companies that could benefit from higher consumer confidence and spending.

Our latest insights

-

-

-

Market Volatility

-

Market Volatility

-

World Markets Review

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.