Market Volatility

Fixed Income

In a world of rapidly escalating prices, Russia’s invasion of Ukraine has exacerbated inflationary pressures. We have seen a direct impact on energy and a broad swath of agricultural commodities, and are likely to see a broadening of price pressures.

Supply chain bottlenecks, another significant source of inflation over the past year, are likely to worsen as a result of sanctions against Russia. And while the world has been focused on the terrible conflict unfolding in Ukraine, another COVID-19 outbreak in several cities in China has stymied economic activity, leading to further disruptions. Meanwhile, house prices continue to rise at a rapid pace. Given these developments, it has become plain to even the most casual observer that monetary policy in most major economies is behind the curve.

The rapid rise in inflation is staggering. In February 2021, headline CPI inflation rate in the U.S. was only 1.7% year-over-year. It rose steadily over the ensuing months to 5.4% in June 2021. As inflation remained stubbornly above target and the unemployment rate continued to fall, the U.S. Federal Reserve made a substantial pivot and began to prioritize fighting inflation over supporting growth. But there was still substantial uncertainty as to how aggressively the Fed would act.

That is no longer the case. As we all know, at the recent Fed meeting on March 16, with inflation at a 40-year high of 7.9%, the Fed hiked interest rates by 25 basis points (bps). Chair Jerome Powell, in subsequent hawkish comments, made it very clear that the Fed was going to do what it takes to try to reduce inflation. The Fed’s latest projections indicate that it may raise rates above its estimated long-term neutral rate of 2.4% by next year. (The neutral rate is a theoretical federal funds rate at which monetary policy is considered neither accommodative nor restrictive.)

Powell appeared to have high confidence that the U.S. economy can not only withstand but flourish under tighter monetary policy. This indicates to us that the Fed does not seem concerned about the potential impact to growth that could come from tightening financial conditions. As such, barring a major fundamental shock, I expect that the Fed will continue on its tightening path for the rest of 2022. Markets are currently pricing in about eight additional 25 bps rate increases over six scheduled Fed meetings in 2022. The market now expects at least two 50 bps hikes in the coming meetings and, if inflationary pressures stay persistent or rise from today’s very high 7.9%, the Fed could easily continue at that pace for longer.

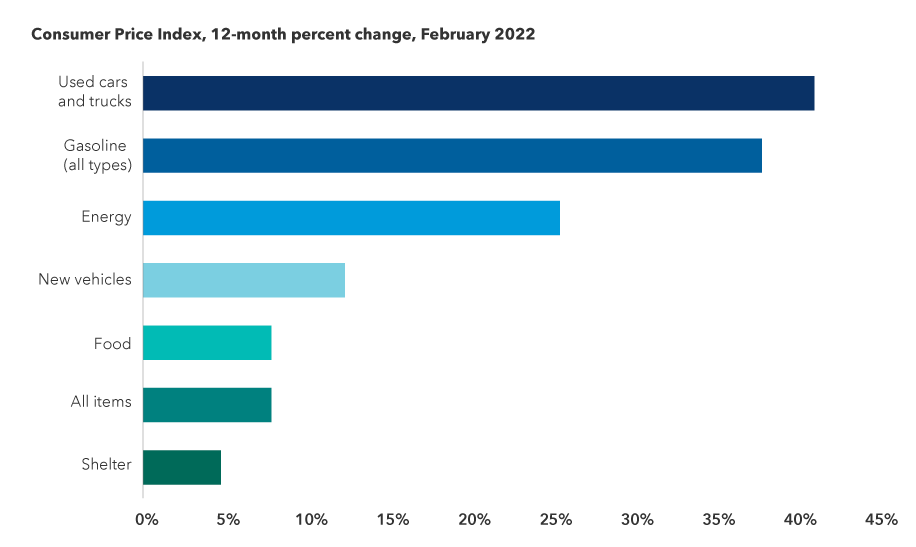

Inflation is being driven higher by several components

Source: U.S. Bureau of Labor Statistics. Data as of March 10, 2022.

With growth already slowing following the 2020 stimulus and economic recovery, I believe that hawkish monetary policy and tighter financial conditions will further reduce growth expectations. We have seen a compressed economic cycle in the COVID/post-COVID period, progressing from recession, to early-, to mid-cycle in less than 12 months. Whether the next economic slowdown turns into a mild or more significant recession will depend to an extent on the pace of Fed tightening.

Over the past six months, valuations have declined from ultra-rich levels across fixed income sectors. I still view them to be a tad expensive given the rise in implied market volatility and the Fed’s determination to bring down inflation. Against this backdrop, we have maintained a defensive posture in core bond portfolios. At the same time, as when prices move to adequately reflect the uncertain environment, we are using bouts of market volatility to selectively add to riskier positions at more attractive levels.

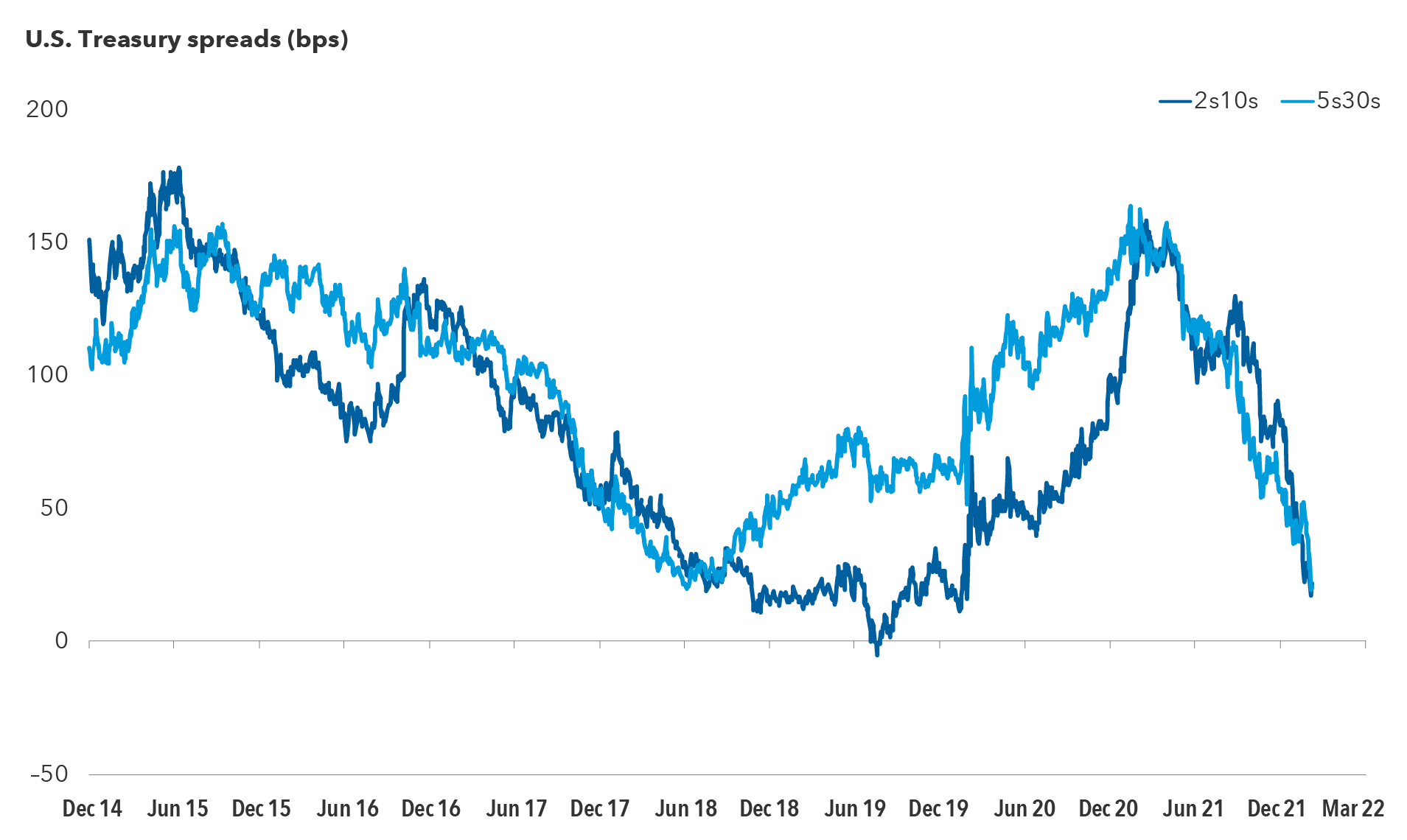

Short duration and a flattening of the yield curve

We maintain a short duration position, mostly at the short- and intermediate end of the yield curve, which is most sensitive to expectations of central bank interest rate hikes. Duration is a measure of a bond’s price to interest rate changes. We on the core bonds team believe that the long end of the Treasury curve is more sensitive to growth expectations, which were already decelerating rapidly before the Fed’s hawkish shift. The combination of these two factors may lead the Treasury yield curve to flatten and perhaps even invert, with short-maturity interest rates rising above long-maturity bonds. Given this dynamic, while front end rates may ultimately move to or through 3%, I believe 30-year interest bonds may remain below 3% over the near term.

Meanwhile, valuations of Treasury Inflation-Protected Securities (TIPS) will also depend to a large extent on the pace of Fed tightening. Market participants are pricing rising inflation risk premia (a measure of the premium investors require for the possibility that inflation may rise or fall more than expected over the period in which a bond is held) into bonds. Breakeven inflation on five-year TIPS has risen from 3.0% to around 3.7% this year, the highest reading since the launch of the asset class in 1997. To the extent that inflation remains persistently high, short-maturity TIPS may benefit. However, long-maturity TIPS anticipate inflation down the line and must consider the Fed’s growing commitment to bring down inflation and the deflationary impact of recessions that may occur in the coming decades.

These risks can often outweigh high short-term inflation readings. We currently favor short-duration TIPS, although we will be opportunistic along the maturity spectrum.

Yield curve will likely flatten further amid Fed tightening

Sources: Bloomberg. Data through March 7, 2022. The 2s10s slope shows the yield gap between 10-year U.S. Treasuries and two-year Treasuries (and, likewise for the 5s30s).

Credit fundamentals remain strong

Although the macroeconomic backdrop is uncertain, the fundamentals of U.S. credit are quite healthy and improving in aggregate. Broadly speaking, as the economy continues to recover from the 2020 COVID-19 shock, corporate leverage is falling, interest coverage is improving, corporate cash balances are high and default rates are near record lows. There are also many credits graduating out of high yield to investment grade (BBB/Baa and above), the so-called “Rising Stars.” So, from a bottom-up perspective, we are broadly positive on the fundamentals for corporate bonds.

The challenge for credit is the broader macro environment. When volatility rises and economic growth slows, the market needs to price in the greater risk of falling equity prices and wider credit spreads as investors become more risk-averse.

In addition, corporate bonds’ longer duration is also an important factor. The duration of the investment-grade credit universe is around nine years, which is very high by historical standards. This compares to a duration of around 6.5 years for the Bloomberg U.S. Aggregate Index, a broad measure of the U.S. investment-grade, fixed-rate bond market, and a close to seven-year duration for the Treasuries component of the index. If investors continue to gravitate toward shorter duration sectors such as bank loans in expectation of rising rates, this may continue to weigh on corporate bond spreads.

Despite these challenges, investment-grade credit provides a lot of opportunity. Inflation readings will be critical in the next few months. Should inflation come down, interest rates may remain in the current range and credit spreads could tighten. On the other hand, if the inflation rate continues to climb and the Fed indicates a more aggressive policy than is currently priced in by the market, I expect credit spreads to widen further. As of this writing, the Bloomberg Corporate Bond Index, a measure of the investment-grade, fixed-rate taxable corporate bond market, has a spread of around 125 bps over Treasuries. I believe these valuations are reasonably attractive if the U.S. economy avoids a recession, but not yet cheap. In a recessionary environment, I would expect spreads to widen further to the range of 150 bps to 200 bps.

As spreads have moved closer to pricing in recessionary levels, we have been adding selectively to high-quality credits and have moved from an underweight to a neutral position in investment-grade corporate bonds. If spreads continue to widen and more fully price in the risk of a recession, I would view it as a buying opportunity. In our portfolios, we will look to build positions in credits where our research analysts believe fundamentals are resilient and improving. Credits emerging from high yield into investment grade are also an attractive hunting ground.

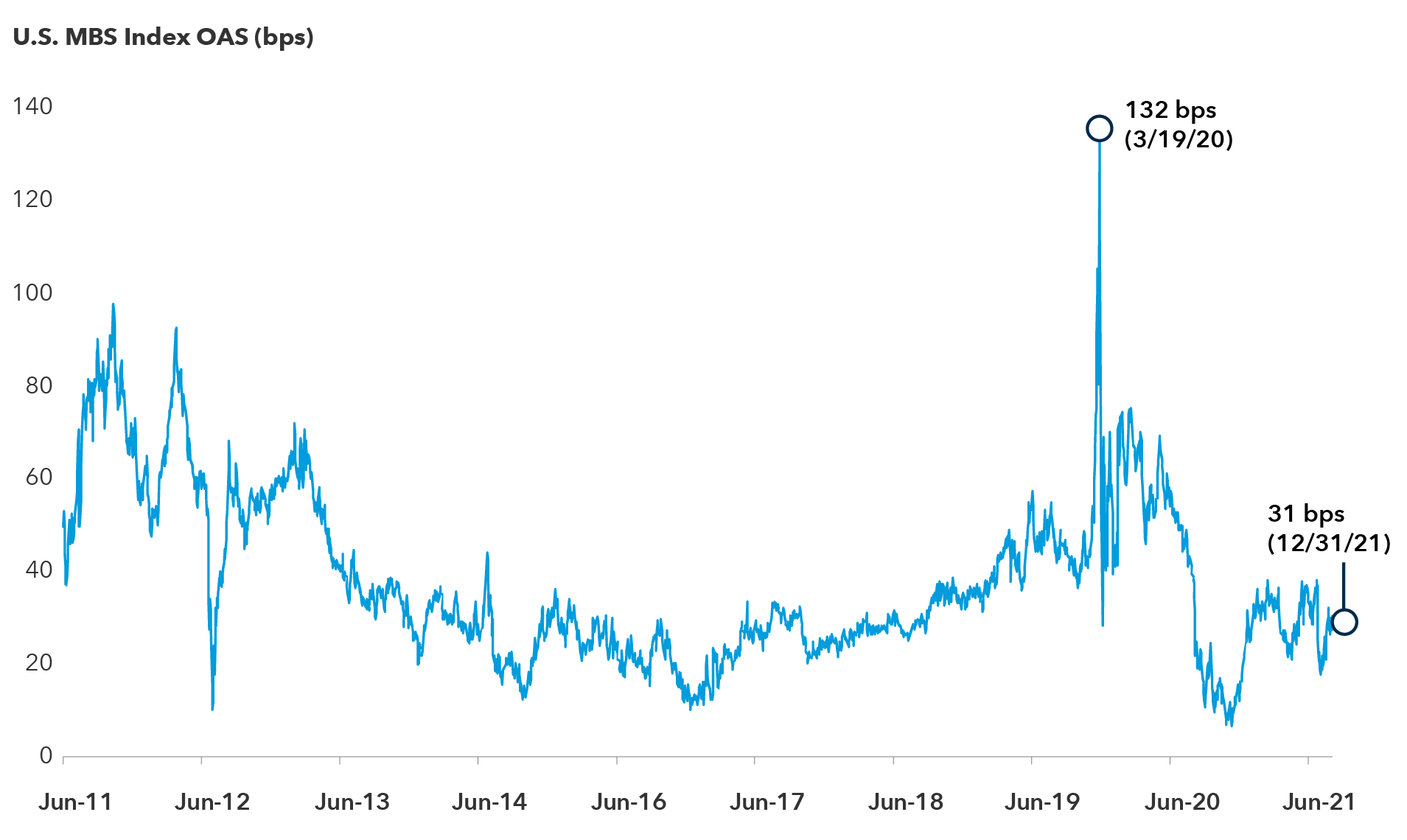

Mortgage securities are weighed down by Fed holdings and volatility

Overall, I think the backdrop for the U.S. housing market remains supportive. Mortgage rates are going higher, but from a low base. An average rate of 4% on 30-year mortgage loans, for example, is still not a high rate, especially in the context of U.S. home prices growing at a double-digit rate. My expectation is that mortgage loan rates would have to go above 5% to have a dampening effect on the current housing market, which is experiencing extremely low supply and very strong demand.

Mortgage-backed securities (MBS) are at an interesting juncture. As mortgage rates rise, the supply of agency MBS securities may fall at the same time as the demand for those securities should rise as they begin to offer higher yields. That said, the $2.7 trillion in agency MBS securities held by the Federal Reserve remains a large overhang on the sector. The Fed has stopped buying additional mortgage-backed securities, but if inflationary pressures force the central bank to become even more hawkish, the market has to price in the risk of the Fed actively selling bonds back to the market. Given the large stock of mortgage bonds in its portfolio, active selling by the Fed could lead to a swift step down in prices. However, that is not my base case, as I expect the central bank to let its balance sheet gradually shrink by letting bonds mature.

At current valuations, we maintain an underweight position in mortgage-backed bonds in core bond portfolios and will look to add to this sector once we believe that prices fully reflect both the risk of asset sales and the higher level of interest rate volatility expected in the coming months and quarters.

Mortgage spreads remain tight

Sources: Bloomberg Index Services Ltd. Daily option-adjusted spreads (OAS) through December 31, 2021. Bloomberg U.S. Mortgage Backed Securities Index is a market-value-weighted index that covers the mortgage-backed pass-through securities of Ginnie Mae, Fannie Mae, and Freddie Mac.

Bottom line

The fixed income team expects the Fed to remain focused on taming inflation from current high levels even at the risk of dampening economic growth. At the March 16 meeting and in subsequent comments, Powell gave clear signals that the central bank is willing to take a more hawkish stance, and that it will remain agile and calibrate its actions based on monthly inflation readings. In core bond portfolios, we maintain a short duration position with our largest underweights in the most Fed-sensitive short and intermediate maturities. We expect the yield curve to flatten further, led by a rise in short-term rates while long-term rates remain better contained. TIPS currently represent greater value in the shorter maturities, although we intend to invest opportunistically along the maturity spectrum. We have been adding to high-quality corporate bonds as valuations have declined, but we remain patient and will look to add select high-quality opportunities should valuations better reflect the current level of risk and volatility in the market.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively "Bloomberg"). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg's licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Institutional investors rely on our newsletter. Have you subscribed?

Our latest insights

-

-

Markets & Economy

-

-

Market Volatility

-

Market Volatility

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Pramod Atluri

Pramod Atluri