Japan

We expect short-term volatility in Japanese equities, given recent macro events, but we do not expect a longer term downturn because fundamentals remain intact, underpinned by corporate reform and reflation.

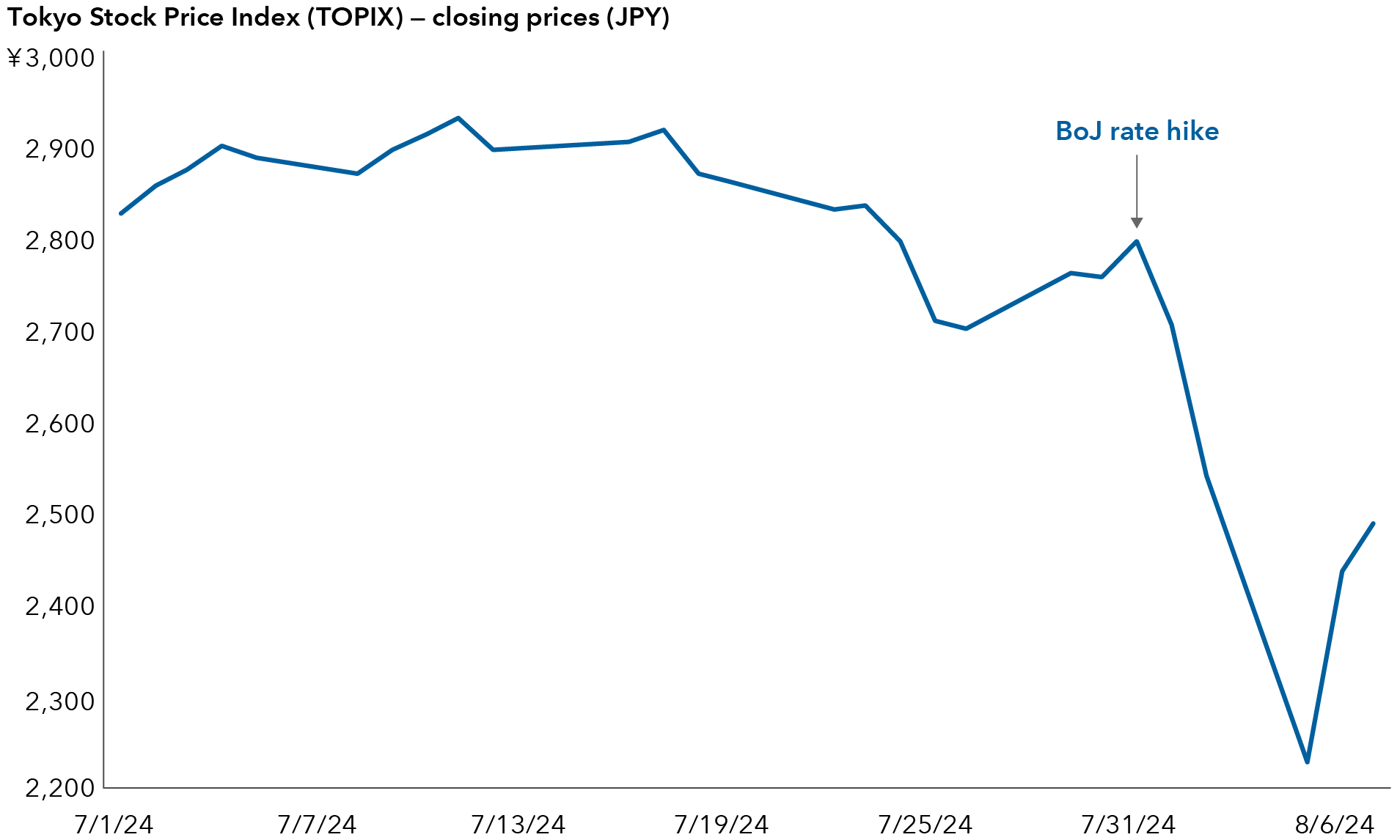

Over recent days, the Nikkei 225 Index suffered its biggest daily loss ever and briefly entered a bear market*, with the broader Tokyo Stock Price Index (TOPIX) similarly battered largely due to a rate hike by the Bank of Japan (BoJ) and a spike in the yen. The BoJ surprised markets by raising its benchmark interest rate to 0.25% — its highest level since the Global Financial Crisis of 2007–2008 — and announced plans to pare back its quantitative easing program. This led the yen to appreciate significantly against the U.S. dollar.

Japanese government bonds and equities initially recoiled on concerns the policy shift may have been too aggressive. Investors added fuel to the fire when they began unwinding popular carry trades, which is when traders borrowed yen to buy higher yielding assets in other currencies. While the carry trades may continue to unwind, some of the market reaction may have been overblown, as the BoJ is likely to proceed gradually. In a global context, our economists believe the U.S. economy will show resilience despite some signs of weakness. Against this mixed backdrop, we have already seen a significant rally, with the Nikkei 225 registering its largest ever single-day gain and the TOPIX close behind on August 6.

A gradual implementation of BoJ policy may be successful at capping yen depreciation, lowering inflation and boosting real domestic demand, all of which would be good for Japanese domestic equities. There is still a risk that wage growth does not materialize, the unwinding of the yen carry trade upsets global markets, or that the U.S. weakens more than expected. While all these concerns are valid and need monitoring, the violent market reaction would suggest investors are too quick to discount Japan’s ongoing reflation. Under a scenario where policy normalizes at a palatable pace, markets can likely absorb any tightening of global liquidity. Gradual policy changes are warranted in these conditions.

The BoJ has relented because inflation remains above target and is threatening to reaccelerate in light of a weak yen (raising import prices) and a tight domestic supply (especially in labor). This could weaken real household income further and create a much bigger macro and political problem in Japan. By raising rates gradually, the bank hopes to keep yen depreciation and imported inflation in check. This would allow nominal wage growth to catch up with inflation, which would strongly support domestic demand over time. We believe the the BoJ may pause in September.

That said, BoJ Deputy Governor Shinichi Uchida has quickly acknowledged the bank will not hike rates when markets are unstable, making another move in September less likely. In contrast, the U.S. Federal Reserve is likely to cut at that stage. In the short term, the performance of the yen and Japanese equities will depend not only on local monetary policy but also what the Fed does and what happens with macro data, especially in the U.S. Capital Group’s U.S. economist Darrell Spence is not anticipating a recession and sees the recent rise in U.S. unemployment as a function of the labor force surge, and not due to a contraction in employment.

Japanese equities look to crawl back after rate hike

Source: Source: Bloomberg. Data from July 1, 2024, to August 7, 2024. Past results are not predictive of results in future periods.

While we expect some volatility, fundamentals for Japanese equities are strong on a multi-year horizon and valuations remain cheap, with recent pullbacks bringing the market in the range of the historically attractive 12 times price-to-earnings (P/E) level. Perhaps the most obvious factor behind Japanese equities’ resurgence has been efforts to modernize the country’s business landscape and eliminate long-running resistance to prioritizing shareholder interests.

Broadly, Japanese companies have a lot of cash on their balance sheets. Unlike in the past, many now want to return cash to shareholders. They have implemented a combination of buybacks, better capital allocation and rationalization. We believe these improvements in corporate governance will stay on track. If anything, recent volatility will put more pressure on companies to protect their share price.

We expect market leadership to rotate, as the investors realize that the extended period of substantial yen weakness may be behind them. Domestically-oriented companies are likely to do better, particularly among food, software, local banks and local consumer brands. Investors are also likely to focus on quality companies with dominant market share and strong balance sheets rather than those with only low valuation and without strong self-help factors.

Until recently, the low price-to-book (P/B) was the predominant factor for the individual stock return. Besides, the large-cap exporters and semiconductor equipment makers benefited from the substantially weaker yen and the AI boom, leading Goldman Sachs to coin the Seven Samurai stocks to include Screen Holdings, Advantest, Disco, Tokyo Electron, Toyota Motor, Subaru and Mitsubishi Corp. We anticipate improved returns across a wider spectrum of stocks, including small- to medium-sized companies, as major changes to market dynamics often come with changes in market leadership.

Exporter stocks may not perform as badly as feared in the stronger yen environment, as the TOPIX earnings-per-share has become less currency sensitive than before, thanks to the substantial production shift overseas that took place before the latest weak yen trend started a few years ago. Finally, semiconductor-related stocks may be weak in the near term amid market volatility but remain good opportunities in the long term, given expectations of the large capital expenditure on artificial intelligence on a multi-year horizon.

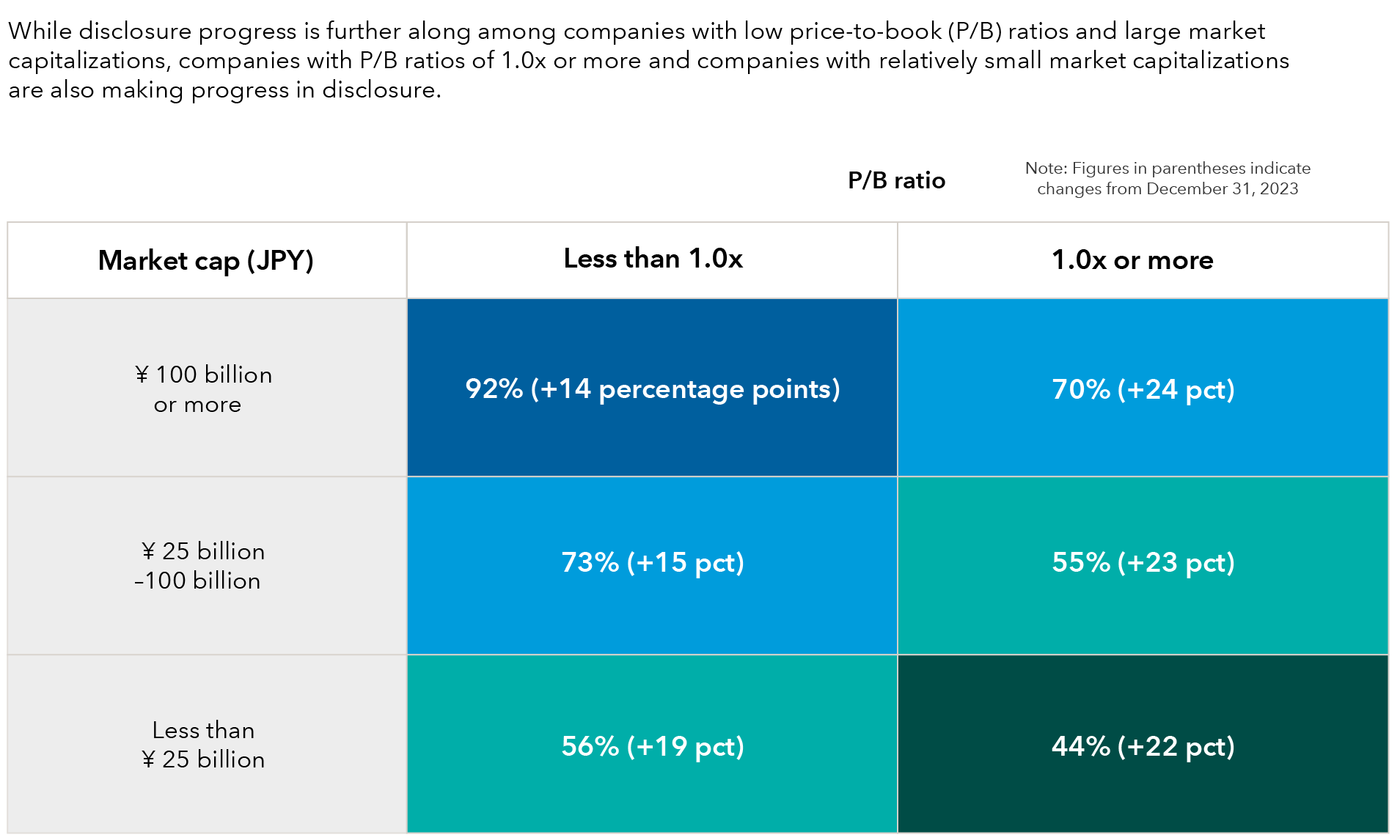

Our experience suggests there is still significant room for improvement among small- and mid-sized companies. Since the start of this year, the Tokyo Stock Exchange has started publishing progress reports on companies adhering to its reform agenda. One of the original initiatives from the exchange included encouraging companies to improve on dialogue with shareholders and disclosure, noting that individuals including senior management should be able to carry out such actions.

Figures from the end of April showed 92% of firms with a market cap of JPY 100 billion (around $630 million) or more and a P/B ratio of less than 1.0 have now disclosed their improvement initiatives. The universe of small- and-mid-cap stocks is also presenting opportunities after the recent market rout, where specific companies are reasonably priced and can withstand a weakening market environment.

Japan company disclosures are improving

Source: Japan Exchange Group. As of April 30, 2024. Figures in parenthesis indicate changes from December 31, 2023. In March 2023, the Tokyo Stock Exchange (TSE) requested that all companies listed on the Prime and Standard Markets take "action to implement management that is conscious of cost of capital and stock price.” https://www.jpx.co.jp/english/equities/follow-up/02.html

While progress is encouraging among smaller businesses, disclosure numbers are much lower, at 44% for companies with a market cap of JPY 25 billion (around $160 million) or less and a P/B ratio above 1.0. The Tokyo Stock Exchange has clarified that its request does not only apply to companies with P/B ratios below 1.0, With this announcement, reforms should spread further among small- and mid-caps with higher P/B ratios during the upcoming earnings season.

* Down 20% or more from a previous market high

TOPIX is a market benchmark with functionality as an investable index, covering an extensive proportion of the Japanese stock market. TOPIX is a free-float adjusted market capitalization-weighted index. TOPIX shows the measure of current market capitalization assuming that market capitalization as of the base date (January 4, 1968) is 100 points. This is a measure of the overall trend in the stock market, and is used as a benchmark for investment in Japan stocks.

Indices including TOPIX (Tokyo Stock Price Index), calculated and published by JPX Market Innovation & Research, Inc. (JPXI), are intellectual properties that belong to JPXI. All rights to calculate, publicize, disseminate, and use the indices are reserved by JPXI.

Seven Samurai is a group of Japanese equities, coined by Goldman Sachs, or Japan’s version of the Magnificent Seven. The Magnificent Seven refers to the seven largest contributors to the S&P 500 in 2023. The companies are Alphabet, Amazon, Apple, Meta Platforms, Microsoft, NVIDIA and Tesla.

S&P 500 Index is a market-capitalization-weighted index based on the results of 500 widely-held common stocks.

The S&P 500 (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2024 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Don't miss our latest insights.

Our latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

-

Global Equities

-

Economic Indicators

-

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Akira Horiguchi

Akira Horiguchi

Anne Vandenabeele

Anne Vandenabeele

Eu-Gene Cheah

Eu-Gene Cheah