In observance of the Christmas Day federal holiday, the New York Stock Exchange and Capital Group’s U.S. offices will close early on Tuesday, December 24 and will be closed on Wednesday, December 25. On December 24, the New York Stock Exchange (NYSE) will close at 1 p.m. (ET) and our service centers will close at 2 p.m. (ET)

RESOURCES / PLAN DESIGN

What’s next for QDIAs?

5-minute read

THE TAKEAWAY

Default investments are becoming more personalized

Overview

Craig Duglin

Product Management Manager Senior

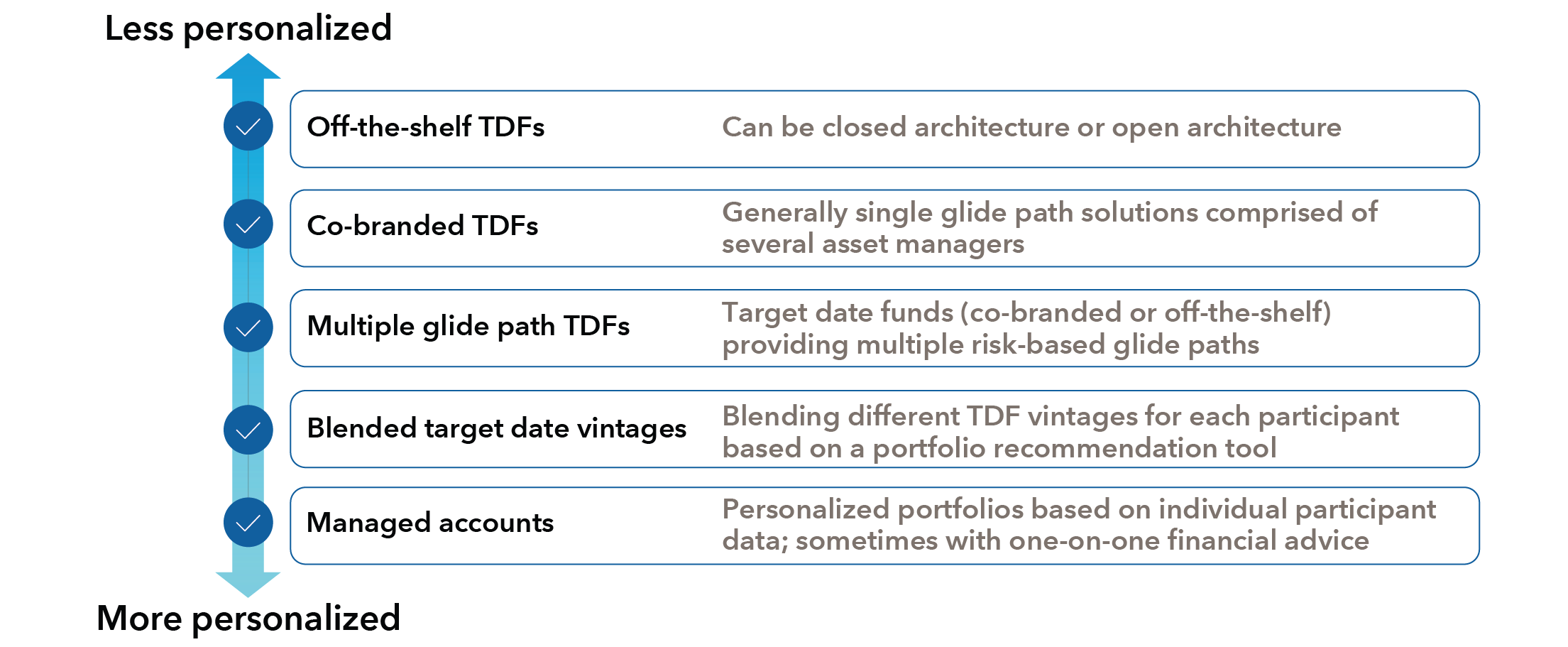

The growth of target date funds (TDFs) has simplified retirement investing for many defined contribution (DC) participants. Most of TDF assets are in “off-the-shelf” funds that offer the same investment strategy (or glide path) for all plans. But some plan sponsors have found that their unique goals for the retirement plan might merit a more personalized approach to their default investment (called a Qualified Default Investment Alternative or QDIA). Recordkeepers and asset managers are responding to this demand with a mix of solutions, ranging from more tailored target date funds to more personalized QDIAs.

Deeper dive

Some plans are exploring more tailored versions of target date funds.

- TDFs with stable value: For example, some TDFs are including a stable value allocation within the series. In many cases, these stable value investments are being offered in co-branded target date funds developed by asset managers and recordkeepers. These recordkeepers hire asset managers to oversee the underlying investments and may engage a third party to design the glide path. For a plan sponsor, a stable value option might be attractive because it can help manage a target date fund's volatility (unlike other fixed income investments, stable value funds are backed by insurance contracts). In addition, the inclusion of a stable value fund might allow the recordkeeper to offer more competitive fees to a plan sponsor.

- Combining different target date vintages: Another next-generation target date option would combine different target date vintages for participants. Target date vintages are each managed toward a planned retirement year. Usually, the vintages are offered in five-year increments (a 2050 vintage, 2055 vintage, etc.) So, a person retiring in the year 2046 would be defaulted into a 2045 target date vintage because it is closest to his/her retirement date. But a purely retirement-year approach may not work for all participants. For example, a participant planning to retire in 2035 might be willing to take on a little more risk in his/her target date fund. In that instance, she/he might want a more aggressive portfolio than a 2035 vintage.

An approach that combines multiple vintages seeks to address this problem. It would combine different target date vintages to match the participant’s risk profile or income needs. Using data provided by the participant and/or recordkeeper, an online tool could recommend that the participant make half of his/her contributions to a 2035 vintage and half to a more aggressive 2050 vintage. Blended vintages could allow plan sponsors to offer more tailored portfolios while still using an off-the-shelf product.

Take note: Although a blended system might be appealing as a default option, it requires personal and financial information provided either by the recordkeeper or the participants themselves. Because of this complexity, it may be unlikely that a plan sponsor would default participants into a blended solution.

Other plans are looking at more personalized QDIA options

- Multiple glide paths: Some target date providers offer employers and their participants a choice of multiple glide paths. Typically, these glide paths vary by risk and are labeled as conservative, moderate or aggressive. Generally, a plan sponsor would choose to default their participants into the moderate glide path but could choose to default all participants into one of the other glide paths based on an analysis of employee demographics. A multiple glide path solution might be appealing to a plan sponsor with different employee demographics. For example, participants might have a mandatory retirement age of 60 or they may have access to a defined benefit plan. Depending on those factors, the plan sponsor might believe that participants would benefit from a more aggressive or conservative glide path. Alternatively, a plan sponsor could default participants into one of multiple glide paths based on their personal and financial data.

Take note: A system that assigns participants to a glide path based on personal and financial data has a potential drawback: The system likely would rely on participants to provide that data, an expectation that might not be realistic.

- Managed accounts: At the full extreme of the personalization spectrum are managed accounts. Managed accounts provide each DC participant with personalized portfolios, possibly with an opportunity for one-on-one interaction with a financial professional. Typically, the managed account provider uses personal and financial data to match the participant with one of its model portfolios. Although managed accounts are offered in many plans, they have rarely been adopted as QDIAs. As a QDIA, managed accounts offer the potential for personalization that could benefit older participants, whose financial situations are more variable than younger employees focused solely on accumulation. That’s why managed accounts are often “bolted onto” target date funds. In some cases, plan sponsors wait until participants are 50 or more years old before switching them from a target date fund into a managed account.

Take note: There are many issues to consider before using managed accounts as QDIAs. For example, managed accounts have overlay fees for portfolio construction, making them more costly than many off-the-shelf target date funds. Second, to be effective, managed account providers need access to participants’ personal and financial data. Ideally, the recordkeeper or plan sponsor would provide this data directly to the managed account provider. If that’s not possible, then the participants likely will have to provide that data themselves. If participants don’t provide the needed data, their portfolios may not look much different than what off-the-shelf TDFs offer – only with higher fees. For participants to fully take advantage of managed accounts, a plan sponsor needs to motivate them to engage with the service – a task that may not be easy.

Next steps

Be ready for personalization

It could gain momentum for several reasons. Technology is making managed accounts and other personalized options more affordable and widespread. Going forward, more participants may be able to enter a few data points about themselves and get a customized asset allocation recommendation.

Remember that plan investment selection is a fiduciary act

Plan sponsors should apply the same due diligence to a tailored target date fund or personalized solutions as they would to any potential plan investment. They should conduct a detailed review of each provider, focusing on their cost and effectiveness. In the case of a QDIA managed account, a plan sponsor should fully consider the investment process, including the portfolio construction methodology.

Explore more plan design resources

-

Plan Design

DC committee paralysis

-

Plan Design

Is your defined contribution plan successful?