Markets & Economy

Asset Allocation

Interest rates are rising. Many corporate bonds look expensive. Stock markets are more unsettled. And, as explained in our Outlook, there’s good reason to expect more volatility.

In some ways, the current backdrop appears quite daunting. Bond market returns so far in 2018 have been mixed. Naturally, many investors are wondering how to position their bond portfolios for more challenging market conditions.

At times like these, it’s important to pause and recall why you invest in fixed income. At Capital Group, we believe that bond portfolios should play four roles for investors: diversification from equities, income, capital preservation and inflation protection.

With that guiding philosophy in mind, consider that we are late in a market cycle, when many asset managers have been buying riskier bonds at expensive prices to seek more yield. In this climate, I think there are three simple actions investors should take to upgrade their bond portfolios. They should favor "True Core" strategies, rethink high yield without giving up income and consider adding inflation protection.

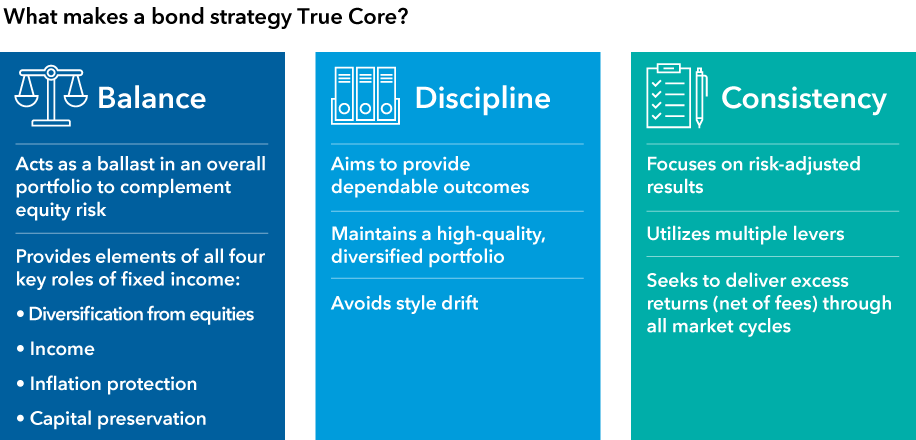

1. Favor true core strategies.

When market volatility is rising, it’s important to emphasize equity diversification and capital preservation in your bond portfolio. In technical terms, you want your fixed income allocation to have a low correlation to equities. In plain English, that means you want your bonds to hold up when stocks go down. To help ensure that your portfolio is prepared for more volatility, consider upgrading the foundation of its fixed income allocation – also known as its “core bond” allocation – to True Core.

Unfortunately, some popular bond strategies that investors are using as their core fixed income allocations have shifted their focus well beyond a True Core positioning. In the recent low-yield environment, many such funds loaded up on high-yield or other types of risky bonds to boost income potential. I call this “scope creep.” It leaves investors vulnerable to fixed income losses at the worst possible time – when stocks hit a rough patch.

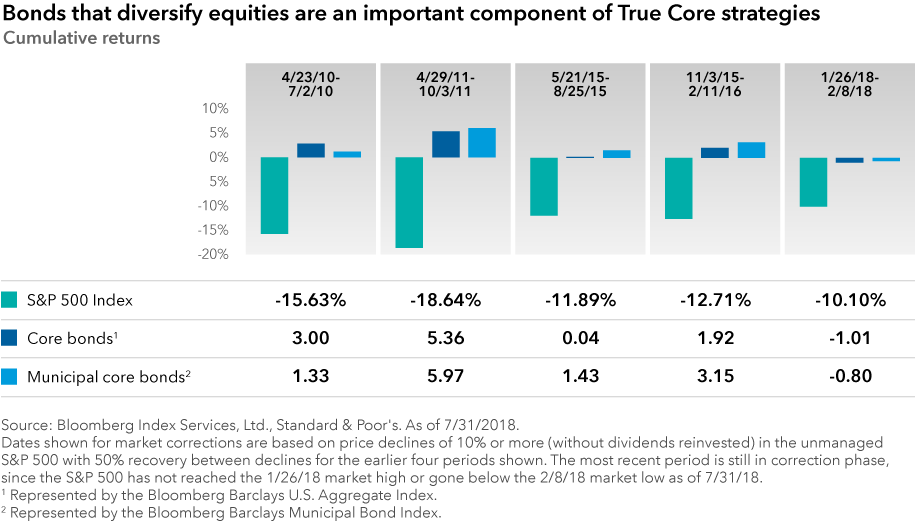

Below, you can see how taxable and tax-exempt core fixed income fared in the five most recent U.S. stock market corrections by considering major core bond benchmarks.

Investors should consider upgrading the foundation of their fixed income allocation to True Core, adding balance to portfolios that have material equity exposure.

Reflecting our belief in the four roles of fixed income, funds such as The Bond Fund of America® and its municipal bond counterpart, the Tax-Exempt Bond Fund of America® are True Core funds that seek to provide the kind of diversification and capital preservation that investors should expect from their core fixed income, while also offering a reasonable level of income.

And for investors who prefer to take relatively less interest-rate risk, rising yields have had a silver lining: higher income potential. Shorter term bond yields have moved more than one percentage point higher over the past 12 months.

Intermediate Bond Fund of America® and Limited Term Tax-Exempt Bond Fund of America® are shorter term bond funds that could be considered as part of a True Core allocation.

2. Rethink high yield without giving up income.

While seven Fed Fund hikes since 2015 have improved income potential of core bond funds through higher yields, some investors also want part of their fixed income portfolio allocated to significantly higher yielding bond strategies.

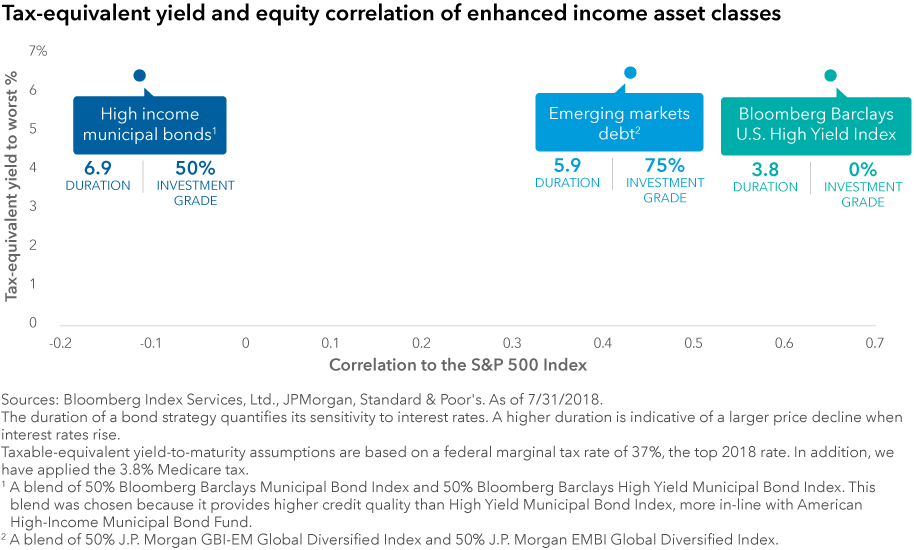

U.S. corporate high yield bonds are a popular choice for this type of enhanced income. Through a full cycle, high yield returns historically have been strong. At this stage of the cycle, however, high yield valuations are expensive compared with what we’ve seen over the past 15 years. Corporate high yield also has a relatively high correlation to the equity market, which means it likely will decline in tandem with the stock market.

There are two higher credit quality options for enhanced income that could complement or replace corporate high yield exposure. Both emerging markets debt and high-income municipal bonds can offer similar after-tax income potential — but with lower historical correlation to the S&P 500 Index and a greater portion of investment-grade bonds. Note, these higher income strategies are part of your “enhanced income” bucket, which should be a limited part of a portfolio.

American Funds Emerging Markets Bond Fund® and American High-Income Municipal Bond Fund® are examples of strategies that seek to provide comparable after-tax income potential to corporate high-yield funds — and with a lower correlation to equities.

3. Consider adding inflation protection.

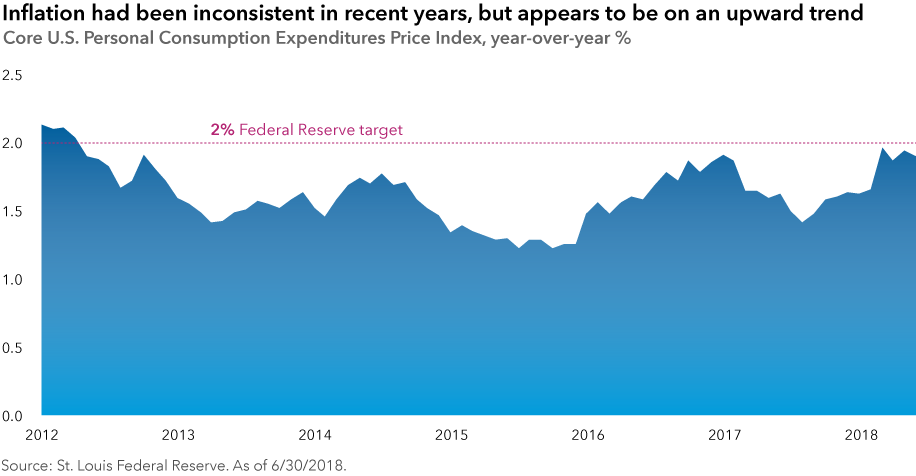

Along with rising rates, inflation has been moving higher and is something that investors should watch closely. Earlier in the year, we outlined why we thought weaker inflation was in the rearview mirror, in part due to stronger economic growth, higher wage growth and low unemployment.

After some ups and downs over the past several years, prices appear to be on an upward trend. July’s core Consumer Price Index, which removes volatile food and energy prices, was the highest since 2008. Similarly, the core Personal Consumption Expenditures Price Index, the metric the Federal Reserve uses to assess inflation, has been nearing the central bank’s 2% target and is hovering at the highest levels since 2012.

Over time, even modest inflation can erode wealth and purchasing power. Rising inflation also can have a negative impact on returns for many parts of the bond market.

Strategies that mostly invest in Treasury Inflation-Protected Securities (TIPS) — such as American Funds Inflation Linked Bond Fund® — can help provide investors with a source of explicit inflation protection for their portfolio. In simple terms, higher actual or expected inflation can have a positive impact on potential returns for TIPS. Protecting purchasing power by owning TIPS when inflation is higher should play a modest, yet important role in your overall portfolio.

How could these three actions be implemented?

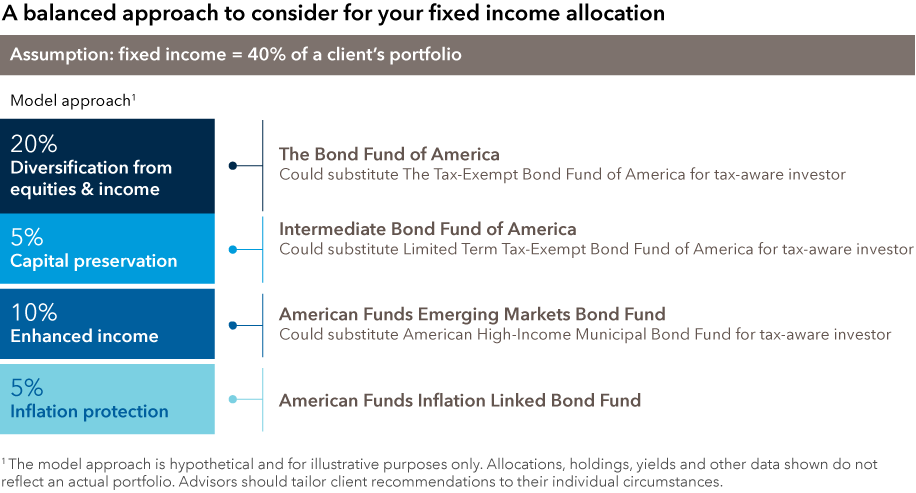

I am not advocating an overall asset allocation change to your current equity and fixed income mix. My view is that investors should maintain a balanced portfolio, such as a typical 60/40 or 70/30 equity-bond mix. I suggest that your bond allocation primarily should focus on diversifying from equities, preserving capital and protecting against inflation. I also recognize the need for higher income and suggest two strategies to achieve that goal.

The hypothetical allocation below offers an example of how the four roles of fixed income could be achieved in a bond portfolio. It assumes 40% invested in fixed income, leaving the 60% allocated to equity untouched. (Of course, the appropriate implementation will depend on individual circumstances.)

This hypothetical portfolio has had reasonable yield, moderate interest rate risk and no correlation to equities. A tax-exempt version has exhibited comparable after-tax yield, correlation and interest rate risk.

The takeaway here is clear: Aligning your bond allocation with the four roles of fixed income helps to ensure a more balanced and resilient portfolio.

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness. If agency ratings differ, the security will be considered to have received the lowest of those ratings, consistent with the fund's investment policies. Securities in the Unrated category have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with fund investment policies.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Bloomberg Barclays U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. Bloomberg Barclays Municipal Bond Index is a market-value-weighted index designed to represent the long-term investment-grade tax-exempt bond market. Bloomberg Barclays U.S. Corporate High Yield Index covers the universe of fixed-rate, non-investment-grade debt. Bloomberg Barclays U.S. Government/Credit 1-5 Years Index is a market-value weighted index that tracks the total return results of fixed-rate, publicly placed, dollar-denominated obligations issued by the U.S. Treasury, U.S. government agencies, quasi-federal corporations, corporate or foreign debt guaranteed by the U.S. government, and U.S. corporate and foreign debentures and secured notes that meet specified maturity, liquidity and quality requirements, with maturities of one to five years. Bloomberg Barclays Municipal Bond 3 Year Index is a market-value-weighted index that includes investment-grade tax-exempt bonds with maturities of four to six years. Bloomberg Barclays U.S. Treasury Inflation-Protected Securities (TIPS) Index is an index that consists of Inflation-Protection securities issued by the U.S. Treasury. Bloomberg Barclays High Yield Municipal Bond Index is a market-value-weighted index that includes below investment-grade tax-exempt bonds.

The Standard & Poor’s 500 Composite Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2018 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings.

The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional cash securities, such as stocks and bonds.

Higher yielding, higher risk bonds can fluctuate in price more than investment-grade bonds, so investors should maintain a long-term perspective.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

Income from municipal bonds may be subject to state or local income taxes and/or the federal alternative minimum tax. Certain other income, as well as capital gain distributions, may be taxable.

Our latest insights

-

-

-

Market Volatility

-

Market Volatility

-

World Markets Review

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Mike Gitlin

Mike Gitlin