Market Volatility

Dividends

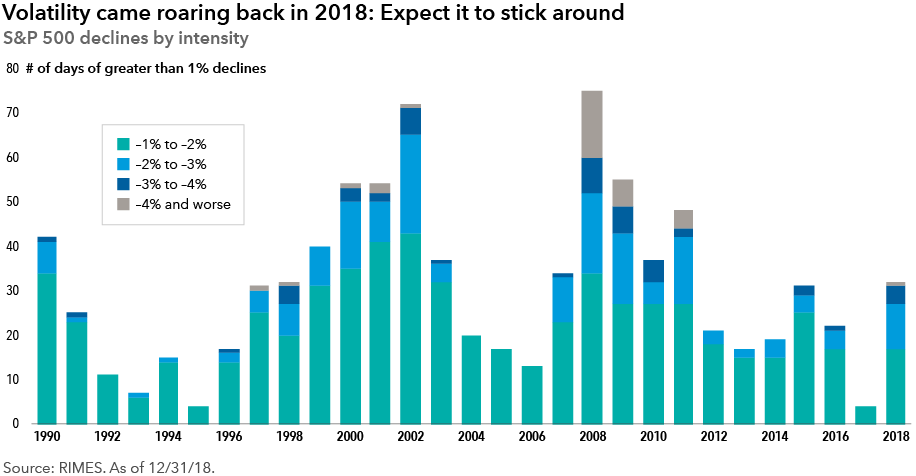

- Market volatility came storming back last year, with so-called FAANG shares leading both the ups and downs.

- Long-term prospects for many tech stocks are bright, but expect more volatility in the near term.

- If you’re looking for a smoother ride, consider the “DANGs” — dividend-focused companies ― for your portfolio.

Nowhere were the market gyrations of 2018 felt more acutely than among shares of leading technology companies ― including the “FAANG” stocks (Facebook, Amazon, Apple, Netflix and Google owner Alphabet). Technology shares led the market both up and down. Thus far in 2019 market-leading tech and consumer companies ― and the broader market ― have recovered meaningfully.

Nevertheless, investors should keep their seat belts fastened, as a late-cycle U.S. economy, unresolved trade tensions and slower earnings growth suggest the bumpy ride may continue.

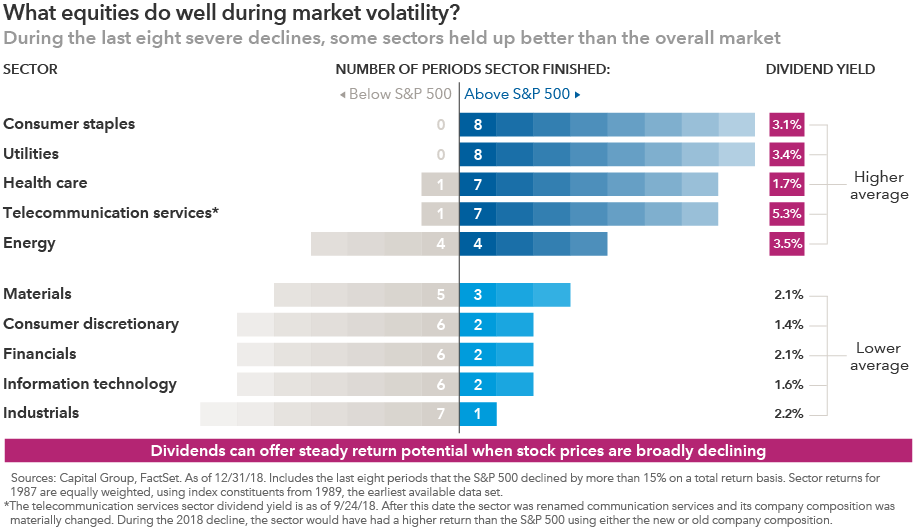

While corrections are a normal feature of healthy markets, it’s understandable that the volatility of 2018 made investors uncomfortable. Those who lost sleep last December may want to reconsider how their equity portfolios are allocated. Investments in established, dividend-paying companies can help smooth out the ride in volatile markets.

“Income-oriented stocks have not fared well over the past several years, as all of the excitement in the U.S. market has been with a very narrow group of innovative tech companies,” says equity portfolio manager Alan Berro. “But I am confident that at some point the market will recognize the value in these income-oriented stocks. And the dividends they pay offer steady return potential when markets are falling.”

The power of diversification

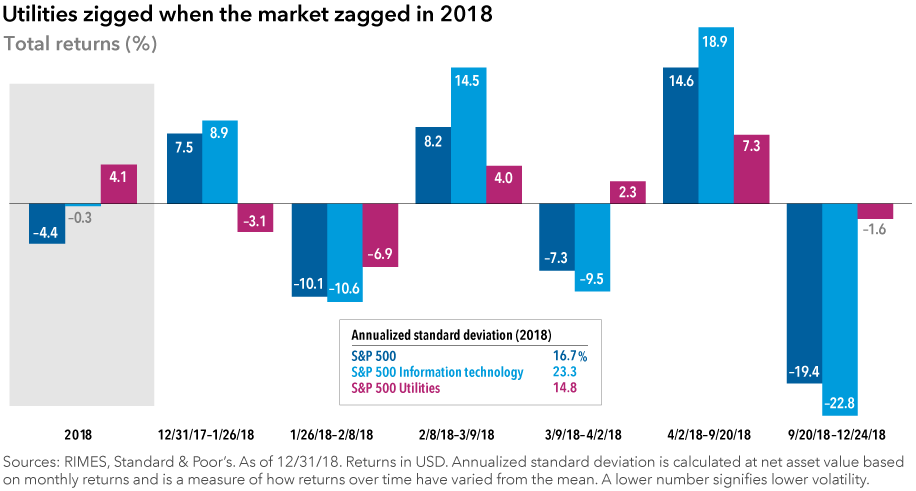

Indeed, some of the more defensive areas of the market that pay substantial dividends held up reasonably well in 2018. For example, the utilities sector outpaced the overall market in each of the three periods of pronounced volatility ― and despite significantly trailing the market when it was rising, utilities ended with a gain for the full year while experiencing relatively low volatility.

Yet companies across a wide range of sectors and industries are creating wealth by offering compelling products and services. A look at eight major declines, dating back to 1987, shows that many of the areas that have held up better than the broader market have paid meaningful dividends.

As an example, here is a brief look at what we’re calling the DANGs: DowDuPont, AbbVie, Nestlé and General Motors. Each from a different market sector, they represent a range of business prospects, earnings potential and challenges, but all are established blue chip companies that have paid meaningful dividends and represent potential value for long-term investors.

DowDuPont: Can 1+1 equal 3?

Chemical giant DowDuPont was formed in August 2017 via the merger of Dow Chemical and DuPont with the notion that combining the two would add up to more than the sum of its parts, thereby unlocking value for investors. Later this year it is scheduled to split into three independent companies: an agricultural business, a commodity chemicals business specializing in plastics for packaging, and a specialty chemicals business that makes Kevlar and automotive parts.

“The company is taking steps to extract cost savings from the merger before separating into three tightly focused businesses,” Berro explains. “This is complicated, but it provides a good example of how in-depth research helps us understand the potential value a company represents. Our investment analysts have really dug into this and have a good understanding of what each of the new companies will look like.”

Since the merger, the company’s shares have been under pressure from a number of external factors, including China’s slowing economy and a softening of demand for materials. “I believe once the new companies are formed, the market will begin to recognize the three represent more value than is obvious today,” Berro says. “In the meantime, the company pays a healthy dividend, so investors are essentially paid to wait.”

AbbVie: An established franchise with innovation potential

Within the health care sector, drugmakers tend to be defensive investments because demand for their therapies typically is not economically sensitive. Some innovative drugmakers also represent significant growth potential thanks to advances in biotechnology that are bringing the world closer to a cure for cancer. One such company is AbbVie, the maker of rheumatoid arthritis drug Humira®, which has invested heavily in the development of potential cancer-fighting therapies.

“The market is very concerned about pending patent expiration for Humira and the risk it presents to future earnings,” says equity portfolio manager Chris Buchbinder. “I believe the franchise is more sustainable than the market anticipates.”

AbbVie has a pipeline of potential cancer treatments. “Not only is the company growing pretty well today, I believe its future growth potential is much stronger than the market anticipates,” Buchbinder adds. “What’s more, if we go into a recession tomorrow, the outlook for AbbVie really won't change very significantly.”

Nestlé: A century old and a history of resilience

Nestlé, the Swiss maker of packaged food products including pet care, coffee and infant formula has been in business for more than 150 years. Always innovating, the company invented — among other things — instant coffee and bouillon cubes, and has been quick to recognize changing consumer tastes.

“Nestlé will never get your heart racing, but that is part of its attraction,” says investment analyst Georgios Damtsas. “The company hasn’t cut its dividend in decades, and it has demonstrated a commitment to growing its dividend over time.”

A change at the top of Nestlé may be the catalyst the company needs to return to growth. CEO Mark Schneider, the first outsider to lead the company since 1922, plans to boost growth in part by exiting less profitable businesses like processed meats, skin care and U.S. chocolate, and focusing to a greater degree on infant formula, pet care, coffee and medical nutrition products.

“The company plans to meet its target of mid-single-digit growth by 2020, regardless of economic conditions,” Damtsas adds.

General Motors: Old-line automaker ramps up innovation.

When you think of autonomous vehicles, the first name “G” that comes to mind is Google, since they are investing heavily in self-driving technology. But General Motors, a traditional, old-line firm, has made strides in self-driving technology through its acquisition of innovator Cruise Automation. As of late 2018, the company had about 180 autonomous cars undergoing testing primarily in San Francisco.

“GM is rapidly accumulating data, and I believe it could become the No. 2 player in the U.S. market for self-driving cars,” Buchbinder says. “The market seems to be pricing in somewhere between nothing and very little for the value of that business, partially because we're in a late-cycle environment and partially because of concerns over global trade. I believe GM may be well positioned to capitalize on a leading technology trend that could transform the industry over the next five to 10 years.”

Although history is not predictive of future returns, maintaining a broadly diversified equity portfolio that includes a mix of dividend-paying stocks can help mitigate volatility and provide access to potential growth across an evolving opportunity set.

“As a value-oriented investor, I look not only for the relative stability that dividends can provide, but also for the flexibility to invest in companies across sectors that offer growth potential or whose value is misperceived by the market,” Berro relates. “Very often that means investing in companies with different drivers than the fast-growing, innovative tech companies.”

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries.

The Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

Standard & Poor’s 500 Composite Index is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2019 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

The S&P 500 Utilities Index comprises those companies included in the S&P 500 that are classified as members of the GICS® utilities sector.

The S&P 500® Information Technology Index comprises those companies included in the S&P 500 that are classified as members of the GICS® information technology sector.

Our latest insights

-

-

Markets & Economy

-

-

Market Volatility

-

Market Volatility

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Alan Berro

Alan Berro

Chris Buchbinder

Chris Buchbinder