Economic Indicators

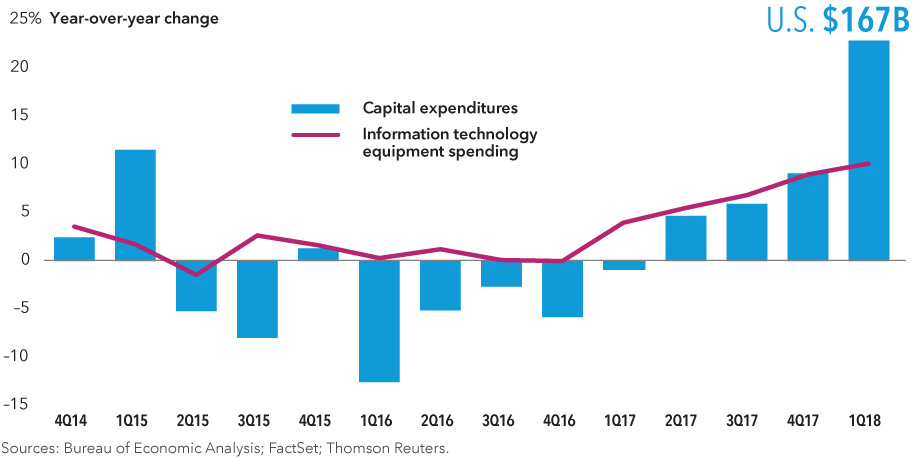

Talk about an inflection point. Passage of the Tax Cuts and Jobs Act of 2017 has put more cash in companies’ coffers, and they have been ramping up spending on their businesses at the fastest pace in years. Capital expenditures — such as spending on factories, equipment and other capital goods — by S&P 500 companies totaled about $167 billion in the first quarter, the fastest pace in seven years and a record for a year’s first quarter.

Higher spending on technology, equipment and facilities could ease worries that S&P 500 companies have reached a peak in their profit growth. The spending could also give the U.S. economy a fresh set of legs, and help extend an expansion now in its ninth year. In addition to capital spending, a solid jobs market, rising corporate profits and healthy industrial production point to the U.S. economy continuing to grow through this year and possibly beyond.

Our latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

-

-

Economic Indicators

-

Demographics & Culture

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.