Market Volatility

Technology & Innovation

Since long before COVID, leading tech companies have been the primary focus of market attention — for good reason. Market-leading tech giants are transforming the way we live, work and shop.

This well-deserved attention has resulted in lofty valuations for some market leaders, especially the so-called FAANG (Facebook, Amazon, Apple, Netflix and Google) stocks. Their dominance has also drawn the attention of government regulators. Together these conditions may have some investors feeling uneasy and bracing for volatility in tech stocks.

The good news is there are other places to look for technologically savvy companies outside the tech industry.

Across industries as diverse as food service, luxury goods, heating and cooling and farming, companies that have been entrenched for generations are adopting new technology to improve their competitive positions, drive societal change and create opportunity for investors.

“Today all companies are tech companies,” says equity portfolio manager Anne-Marie Peterson. “Established, sleepy industries and companies are using tech to transform their businesses in compelling ways, creating significant investment opportunity. And I don't think these opportunities are fully understood by the market yet.”

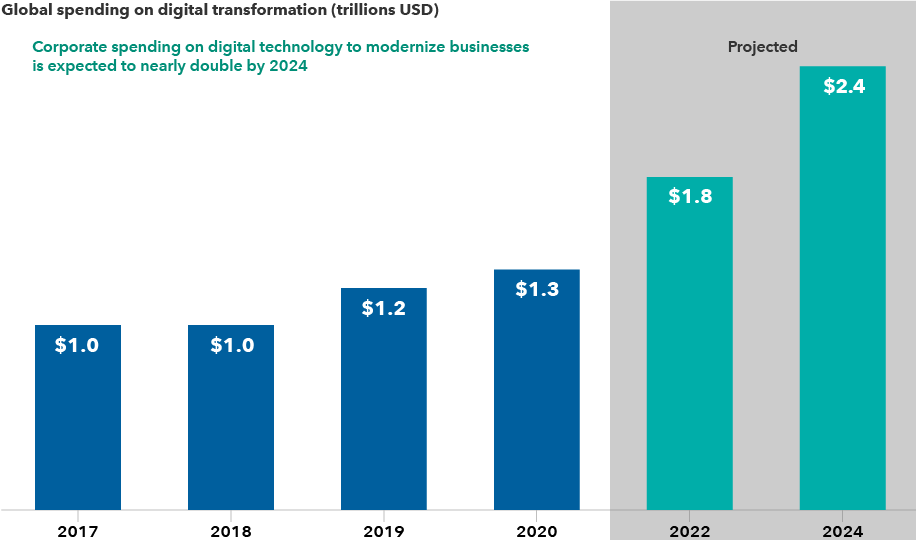

In fact, global spending on digital transformation by companies is expected to rise from $1.3 trillion in 2020 to $2.4 trillion in 2024, according to Statista. Here is a look at some old-economy companies adopting new technology to transform their businesses through automation, online sales, machine learning and other processes.

Companies around the world are investing heavily in a digital future

Source: Statista. Forecasts for 2020–2024 are as of November 2020. Digital transformation refers to the adoption of digital technology to transform business processes and services from non-digital to digital. This encompasses, for example, moving data to the cloud, using technological devices and tools for communication and collaboration, and automating processes.

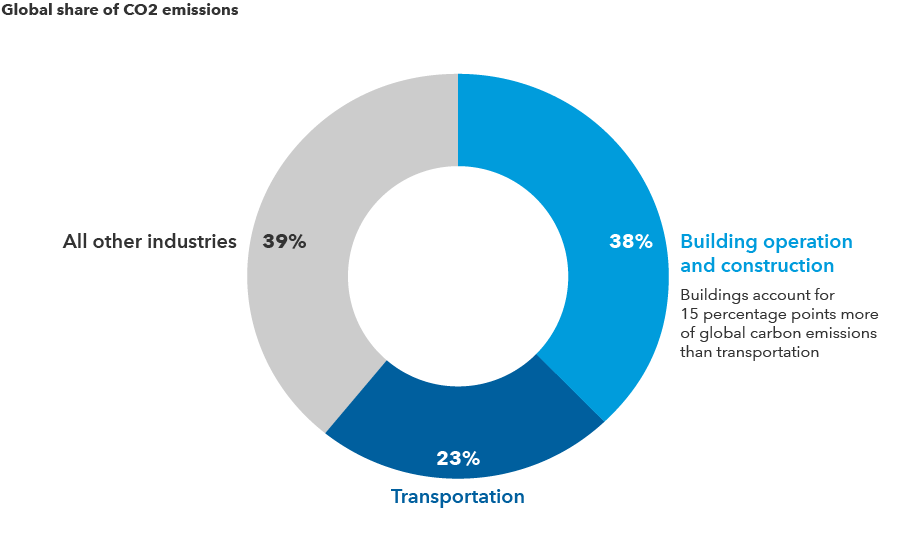

Industrials: Cooling carbon emissions

Mention carbon emissions and the first thing most people think of is cars. But the largest contributor of greenhouse gas emissions is buildings. Building operation and construction worldwide account for more than a third of global carbon output. In part, that is because heating and cooling systems, known as HVAC, are inefficient.

“Shifting energy priorities among governments and the public could provide a faster replacement cycle for heating and cooling systems” explains Peterson, a principal investment officer for The Growth Fund of America®. “This could be a tailwind for HVAC companies that can quickly develop and introduce cleaner systems.”

Buildings, not cars, are the biggest source of carbon emissions

Source: Global Alliance for Buildings and Construction, 2020 Global Status Report. Data includes all CO2 emissions in 2019.

Consider Carrier Global, which was recently spun out of industrial conglomerate United Technologies. Founded in 1915 by Willis Carrier — who is credited with inventing the modern air conditioner — the company might not be top of mind as a leading innovator. But Carrier has introduced a healthy buildings program to improve the efficiency, safety and health of indoor environments. The program includes an air filtration system that reduces the risk of bacteria and pathogens, a feature that has drawn attention during the COVID pandemic.

“The company is developing a system to help optimize a building’s total energy usage,” says Peterson. The system will identify peak times and identify more efficient options.

Heavy equipment manufacturing: Digging in on automation, clean energy

Construction and mining equipment maker Caterpillar is emerging as a potential leader in the global sustainability movement. “Caterpillar recently introduced a dynamic gas blending engine which is capable of mixing natural gas as well as hydrogen with diesel, helping its customers achieve carbon emissions goals more quickly,” says equity analyst Gigi Pardasani.

Caterpillar has also introduced an e-motor for power generation applications, a hybrid land drilling system and software to help mining, construction, energy and transportation companies track their fleet of vehicles to gauge energy usage and identify areas for improvement.

“One doesn’t often hear about Caterpillar being involved in the energy transition,” adds Pardasani, “but I came away from a recent demonstration of their latest technologies thinking that the inverse is true; the company appears to be a key facilitator in the energy transition globally.”

Similarly, Deere & Co., whose iconic green tractors are ubiquitous in America’s heartland, is developing robotics, automation and machine learning to empower farmers to improve their efficiency. Some of Deere’s tractors and combines use advanced automation to prepare soil, plant seeds, care for plants as they grow and harvest crops. In August 2021, Deere said it would acquire a maker of robotics for tractors to accelerate its goal of offering a fully autonomous fleet of farming vehicles.

The company’s machine learning analysis, for example, can help reduce the use of pesticides by identifying whether a growth is a weed or pest and target it with a minimal amount of pesticide. “With further steps into automation, digital solutions and sustainability, Deere is seeking to provide a ‘connected equipment’ approach to give farmers greater incentive to upgrade their machinery,” Pardasani says.

Retail: Targeting an omnichannel future

Remember when Amazon’s rising dominance was universally accepted as the death blow for traditional retail? Well, those reports, to quote Mark Twain, are greatly exaggerated.

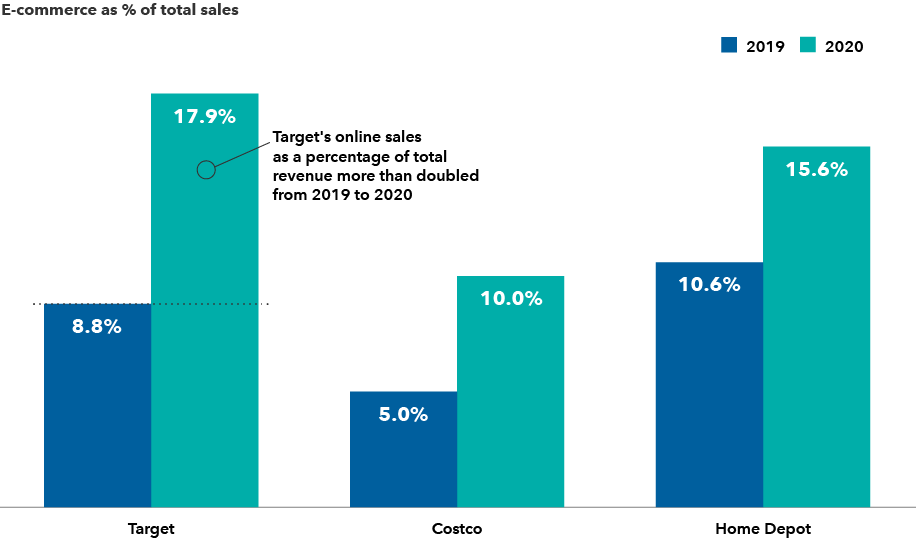

Today leading retailers are recognizing that a key to survival is adopting an omnichannel approach — one that incorporates brick-and-mortar stores with an online presence and “clicks-to-bricks” model where customers buy online and pick up at the store. “The most successful retailers are offering a uniform customer experience across all platforms,” says equity portfolio manager Greg Wendt. “This is a major change in how retailers think, looking at the total customer experience across digital and physical channels.”

Among traditional retailers, Williams-Sonoma, the maker of kitchenware and owner of Pottery Barn and West Elm, has focused on its online business for many years. So it is no surprise that during the pandemic the company has seen strong digital sales. But in March the company disclosed that in areas where it has reopened physical stores, store sales have surged while online sales have remained relatively strong.

“My assumption was that a large portion of online sales gains in 2020 would transfer back to physical stores,” explains Wendt. “It is a big deal if omnichannel retailers can hang on to a large percentage of their online sales gains.”

Omnichannel retailers enjoyed a jump in digital sales in 2020

Sources: Capital Group, company financials. Target and Costco reflect fiscal year 2020 and 2019 sales. Home Depot reflects fourth quarter 2020 and fourth quarter 2019 sales.

Back in 2013 Target was the poster child for tech troubles when it was the subject of a massive data breach of some 110 million customers’ personal and payment information. That was a lifetime ago in digital years.

The company recognized it would have to focus on technology to survive. So it reorganized its software development effort, shifting from a staff primarily of contractors to a team of 4,000 mostly full-time IT employees. The team concentrated on improving Target’s e-commerce offering and developing its customer loyalty program. The company built a robust same-day delivery service for traditional online business as well as its buy online, pick up in store option, which became very popular during the COVID shutdowns.

“The main change over the last few years was the emphasis on in-store pickup and the de-emphasis on home delivery,” says Peterson. “Today Target’s online business is quite profitable.” As business thrived during the pandemic, Target made investments in new technology and sort centers to help keep up with demand and drive down costs.

Luxury goods: Taking online shopping up market

Like many other luxury goods makers, LVMH — whose 75 brands include leather goods maker Louis Vuitton, jeweler Tiffany & Co. and cosmetics maker Sephora — was slow to embrace e-commerce. LVMH executives were concerned that greater access to a broader market, the ability to track customer preferences and other advantages of a digital business could dilute its brands’ image of exclusivity.

For LVMH the additional challenge was to develop a seamless omnichannel experience across brands ranging from fashion to hospitality to wine making, each with their own customs and culture. As a result the company hired its first chief digital officer in 2015, who soon after established the LVMH retail lab to support each brand in its digital transformation.

The company adopted a digital tool to track goods through its supply chain to ensure authenticity and minimize the threat of theft. It also began using order management technology that enables consumers to track available stock in real time and opt for either a white glove same-day delivery or store pickup. Some of LVMH’s brands also adopted artificial intelligence to customize online experiences. For example, Sephora’s smart mirror lets customers try on makeup using augmented reality. “E-commerce was disruptive for a lot of retailers, but it turned out to be a positive for LVMH,” says equity portfolio manager Lara Pellini. “Even as the company has expanded its reach online, their brands have maintained their appeal worldwide.”

Restaurants and food service: Cooking up a killer app

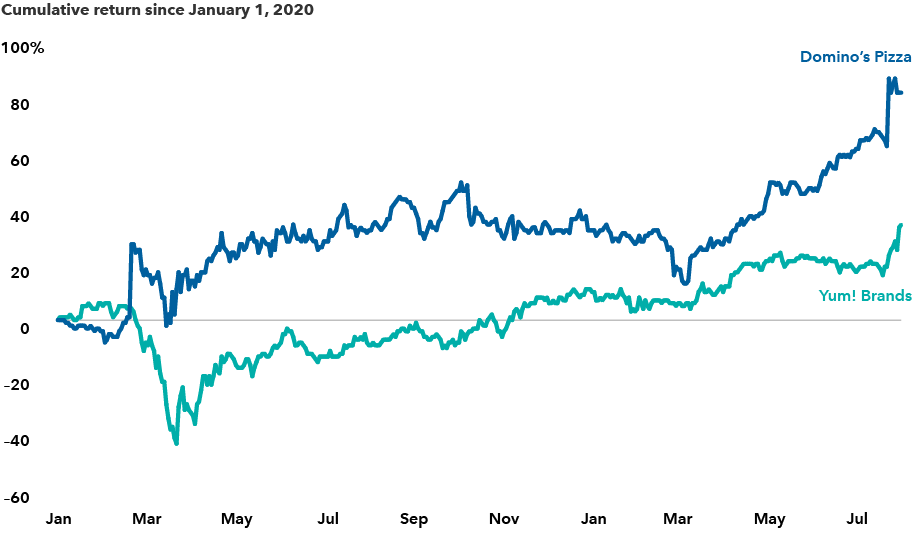

Few industries, if any, suffered more during the pandemic than restaurants. Many failed or filed for bankruptcy protection. It is challenging to provide food service without human contact, and most restaurants took months to adapt to the disrupted environment.

Not pizza delivery giant Domino’s. The company had already begun its contactless delivery and car-side services months before anyone ever heard of COVID. Indeed, Domino’s in a sense had been preparing for years. Through trial and error, the company innovated and improved its delivery approach. Rather than rely on technology from a range of suppliers, Domino’s expanded its technology staff and developed its own online ordering system across all digital platforms.

A digital pioneer in food service has outpaced others

Source: Refinitiv Datastream. As of 7/31/21. Returns are total returns in USD.

The company has an in-house “innovation garage” that has introduced GPS order tracking and, more recently, a “zero click ordering” feature on its app. With the economy reopening and carryout sales picking back up, the company has been maintaining its gains in delivery.

The bottom line for investors

Technological innovation goes far beyond the tech industry, surfacing across industries far afield of the tech sector. Of course, not every company that embarks on a digital transformation will emerge as a long-term winner. The key, says Wendt, is to fully understand a company’s digital strategy and its prospects for success.

“When considering the potential winners in a new digital world, some investors may think exclusively about the consumer tech giants or fintech businesses or cloud-based software providers,” says Wendt, “but at Capital Group, we dig a little deeper across all industries to find companies under the radar with the potential to benefit from a digital transformation.”

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

Our latest insights

-

-

Markets & Economy

-

-

Market Volatility

-

Market Volatility

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Anne-Marie Peterson

Anne-Marie Peterson

Greg Wendt

Greg Wendt

Lara Pellini

Lara Pellini