Bonds

Amid low interest rates, investors continue to look for sources of yield, and corporate bonds have garnered substantial interest. But in the late stages of an economic cycle and with very tight credit spreads over U.S. Treasuries, how should investors approach credit markets? We spoke with Damien McCann, a portfolio manager with American Funds Strategic Bond Fund to get his take.

1. Given the current macroeconomic backdrop, how are you positioned in credit portfolios?

Economic data will remain a bit soft in the U.S. I don’t expect economic growth to accelerate to the levels that we were experiencing a year ago. That said, the recent softening seems more indicative of a leg down in the current cycle rather than the start of a recession. The Federal Reserve also maintains an accommodative stance, as we have seen with three interest rate cuts this year. Against this backdrop, I am not in a bunker in terms of how I’m building credit portfolios. Rather, it’s a modestly defensive positioning.

2. How do you plan to add value in these portfolios?

I may be oversimplifying this, but in a credit portfolio, one way to generate excess returns, or alpha, is to take a view on the direction of corporate bond spreads and be a lot more or a lot less aggressive than the market benchmark. That is one lever available to investors, but it tends to result in periods of significant underperformance whenever aggregate credit spreads move against your view.

But there’s another, what we think is a more reliable approach, which is generating returns through security selection. That means picking the right corporate bonds that have their own idiosyncratic drivers, which means they move in price based on factors that are specific to those companies and not just the macro environment. My aim is to more consistently add alpha in most market environments by identifying companies where, working with our equity analyst counterparts, we see improving fundamentals or other catalysts for gains.

3. There is a lot of focus and market attention on corporate leverage. How does that factor into your thinking and approach?

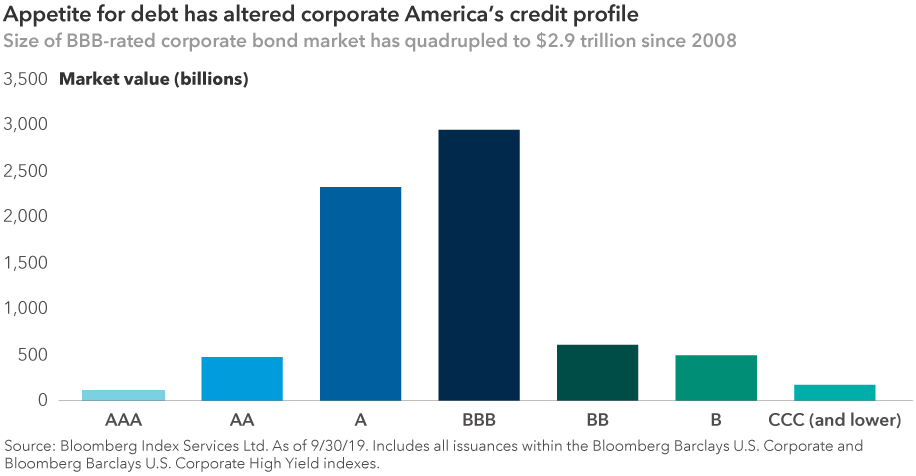

There is no doubt that corporate debt and leverage have steadily increased since 2008. Loan covenants are less stringent in many cases, and there are signs of stress in some areas of the market. There’s also considerable concern about the growth of BBB bonds to $2.9 trillion, roughly quadruple the levels of 2008. That said, it’s important to not paint the entire market with one brush. As active managers, it’s our job to identify areas of opportunity. Our credit investment analysts talk to corporate executives regularly to identify companies with credible deleveraging plans and solid long-term strategies.

Some of the increase in leverage has come from companies with noncyclical cash flows borrowing to fund acquisitions made for — what are in my view — strategically sound reasons. For example, in pharmaceuticals, Japan-based Takeda largely debt financed its acquisition of U.K.-based Shire. In health care, Cigna borrowed in the capital markets to acquire Express Scripts. And in the food industry, Conagra issued bonds to purchase Pinnacle Foods. All three acquisitions resulted in economies of scale as well as complementary businesses or products. And all three acquirers are now actively reducing leverage with free cash flow and asset sales.

Also, we are now seeing a tapering off in the pace of leverage increases among corporations, and this should continue as M&A activity has slowed down. While varying by industry, proposed acquisitions have faced more resistance to regulatory approval, giving acquirers pause. Trade uncertainty has also led companies to push out their capital expenditure plans.

4. If we do see an economic downturn or a shock to markets, what options do companies have to avoid a credit event?

Big picture, I’d say many companies can avoid a downgrade by selling assets, slashing capital expenditures, reducing dividends and/or issuing equity. These steps may not be good for stock investors, but they would be beneficial to bondholders. While none of these options are easy, it’s often preferable to a downgrade to high-yield status, which often results in higher borrowing costs and less access to financing at what may be precisely the wrong time.

While we are likely to see downgrades from investment grade to high yield during the next downturn, as we do in each down cycle, I think the level of downgrades is more likely to resemble past cycles, rather than something extraordinary.

5. Where are you finding value in corporate bonds?

I tend to buy bonds of companies that I think are cheap based on fundamental credit theses that may take years to play out and require that we take a long-term approach.

Within investment-grade corporates, I’m positive on select large pharmaceutical companies. They may have leveraged up to do an acquisition, but there’s high visibility of free cash flow, so they can deleverage quickly. And the business models tend to be very resilient in economic slowdowns.

Meanwhile, in the energy sector, many issuers remain cautious with their balance sheets after the sharp oil price decline we saw several years ago. At the same time, new project investments will likely lead to higher earnings, and planned asset sales should result in some deleveraging of balance sheets.

In high yield, we also see opportunities in pharmaceuticals, especially in companies that are deleveraging and selling assets. Another set of companies that interests me are the fee-based data-centric technology companies that enjoy very sticky demand and generate free cash flow capable of servicing elevated debt loads even in periods of economic downturn.

On the rating spectrum, BB-rated corporates look overvalued on average, while CCC-rated corporate bond spreads have drifted wider and now offer value in select pockets. Companies are rated CCC because they have issues, so one must be very careful and the credit selection has to be backed by very intensive analysis, but there are investment opportunities to be found.

All in all, my current focus is on companies that are less sensitive to the economic cycle or have clearly laid out deleveraging plans. And being selective is key — not by sector, but a company-by-company, credit-by-credit selection.

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund's investment policies. Securities in the unrated category have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with fund investment policies.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds.

Our latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

Related Insights

-

-

Webinar

-

Webinar

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Damien McCann

Damien McCann