Markets & Economy

Technology & Innovation

Shares of many technology giants are at record highs, rekindling comparisons to the dot-com bubble. But this boom looks different. The dominant companies have solid profits, enormous cash flows, large market share and high barriers to entry. At current price levels, there is no denying that the valuations are high, but nowhere near the unsustainable levels of the dot-com period.

Here’s what some of Capital Group’s portfolio managers and analysts have to say:

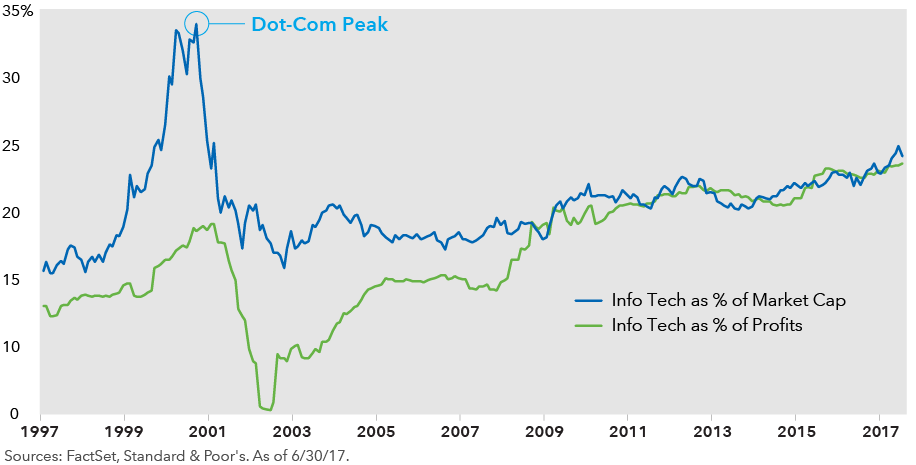

1. Unlike the dot-com bubble, profits are now in sync with prices.

Irfan Furniturewala, investment analyst covering U.S. hardware and semiconductor companies:

This is a new era. During the late 1990s tech boom that peaked in early 2000, share prices of web companies outran their earnings potential, stretching valuations to unsustainable levels. This is not the case currently. Profits for technology companies are more in sync with their share prices.

A big difference from the dot-com period is that, as a group, these stocks don’t all trade at nosebleed valuations. Apple, with the upcoming release of the iPhone 8, is only at 14 times consensus earnings for the next 12 months. In the case of Microsoft and Google, these stocks trade for less than 25 times forward earnings. While those valuations are richer than the broader market, it is easier to make a case that these companies can grow into those multiples.

The five large technology companies (Alphabet, Amazon, Apple, Facebook and Microsoft) have learned from the mistakes that the big companies made in the dot-com era. So today, they are much more obsessed with making sure their technologies — and business models — stay relevant. These companies don’t seem to be running out of steam. If anything, they are doubling down on new technologies such as artificial intelligence and autonomous vehicles, which makes the barriers to entry even more prohibitive for startups and more established companies. Companies like Yelp and TripAdvisor are being sidelined by the power of the Google search engine, as an example. Apple, Microsoft, Alphabet and Amazon are spending more than $10 billion a year on research and development, which substantially raises barriers to entry for newcomers. I truly believe we are undergoing a massive transformation in technology over the next 20 years, and these companies are at the frontier of change.

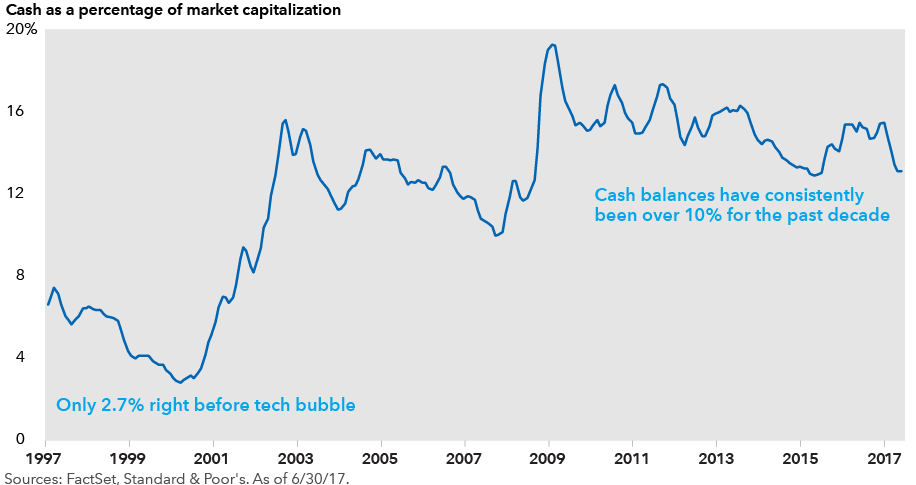

2. Tech balance sheets are cash-heavy.

Jody Jonsson, portfolio manager for New Perspective Fund®:

Unlike the previous bubble, tech companies are flush with cash.

Stronger balance sheets are a testament to the underlying strength of their business models. Cash balances at Apple, Microsoft and Alphabet are the largest among nonfinancial companies in the U.S. Apple and Microsoft even pay quarterly dividends — a big shift from a decade ago, when the thought of a technology company paying a dividend was seen as a sign that growth was slowing.

The biggest tech companies have great topline growth, substantial cash flows and strong earnings. They also have dominant market positions and pricing power. As an investor, it’s hard to dislike companies with these near-monopolistic attributes. On the other hand, they could also be vulnerable as regulators scrutinize them more closely and policymakers become more sensitive to the social impact of the potential disruptions they could cause.

Business models in technology have changed, as have consumption patterns, which make the industry look less cyclical than in prior peaks. The volatility in technology share prices is also lower than it has been historically. Investors are looking to the sector for reliable growth, which is now hard to find in traditional consumer sectors because of the “Amazon effect.” All of these factors have caused investors to gravitate toward tech. That said, given where valuations and sentiment are right now, we could see a pullback that would affect not only this sector, but also other growth stocks that have a high correlation to technology. We are very positive on technology fundamentals, but these positives are also well-known to the market.

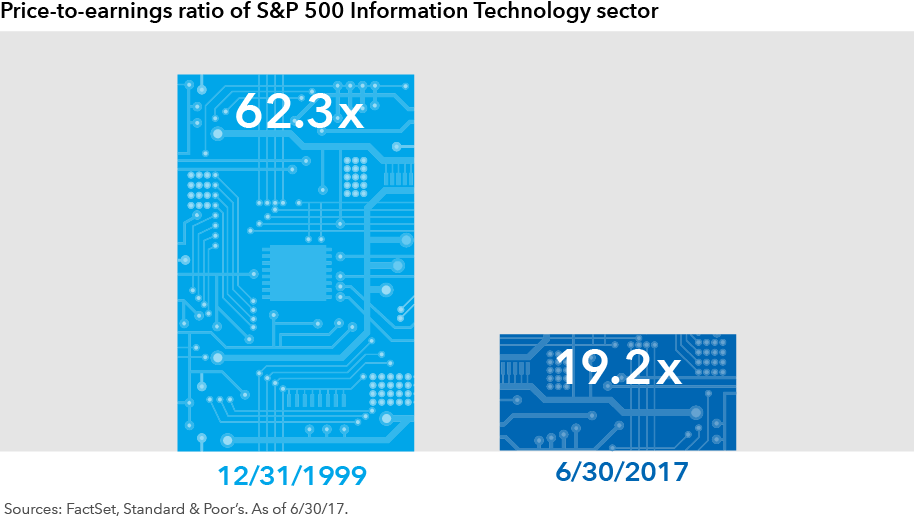

3. Valuations are nowhere near 1999.

Larry Solomon, portfolio manager for The Growth Fund of America®:

The 1999-2000 period was much more speculative than today.

While the leading technology stocks are not cheap today, I don’t think they are nearly as overvalued as the most popular stocks were in 1999. It’s easier to see a scenario in which the current leaders (Apple, Alphabet, Amazon, Microsoft and Facebook) can grow into their earnings. They are well-positioned for increased use of mobile, e-commerce, cloud computing and mobile payments. These are all durable trends; it’s just a matter of what you pay for them.

Historically, companies traded on their overall revenue or earnings. But today, shares of some companies are trading based on small parts of their business, or they are generating modest profits with the hope that they will eventually grow into healthy earnings. The complacency about earnings and valuations is one reason why I am cautious.

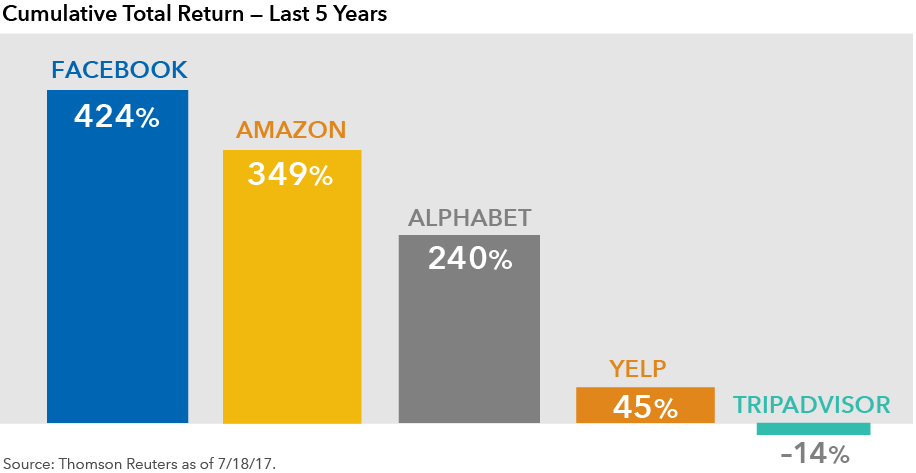

4. “Winner takes most” rules the internet.

Will Craig, investment analyst covering global internet companies:

The dynamics of the internet have created a “winner takes most” environment. The largest companies — such as Facebook, Amazon and Alphabet — are capturing a majority of incremental market growth. In recent years, they’ve actually begun to grow faster as they’ve become bigger. These businesses are becoming incredibly ubiquitous as their services become rooted in people’s everyday lives, similar to daily household items we use. Their platforms are entrenched, revenue is growing, and cash flows are robust.

This is making life difficult for smaller- and medium-sized internet firms, who increasingly can’t compete with the likes of Google, Facebook and Amazon. The smaller internet businesses don’t have significant customer loyalty and brand recognition, and this limits the amount of direct traffic to their websites. They also struggle to hire the same quality of engineering talent and have much less cash on their balance sheets to defend their turf. This hurts their long-term prospects. One could argue that the small-to-mid cap internet space is now in secular decline.

Past results are not predictive of results in future periods.

Our latest insights

-

-

-

Market Volatility

-

Market Volatility

-

World Markets Review

Related Insights

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Irfan Furniturewala

Irfan Furniturewala

Jody Jonsson

Jody Jonsson

Larry Solomon

Larry Solomon