Election

The rematch is on. With incumbent President Joe Biden and former President Donald Trump set to square off in November, the 2024 election cycle presents the possibility of a significant shift in political leadership — potentially leading to policy changes that could impact portfolios.

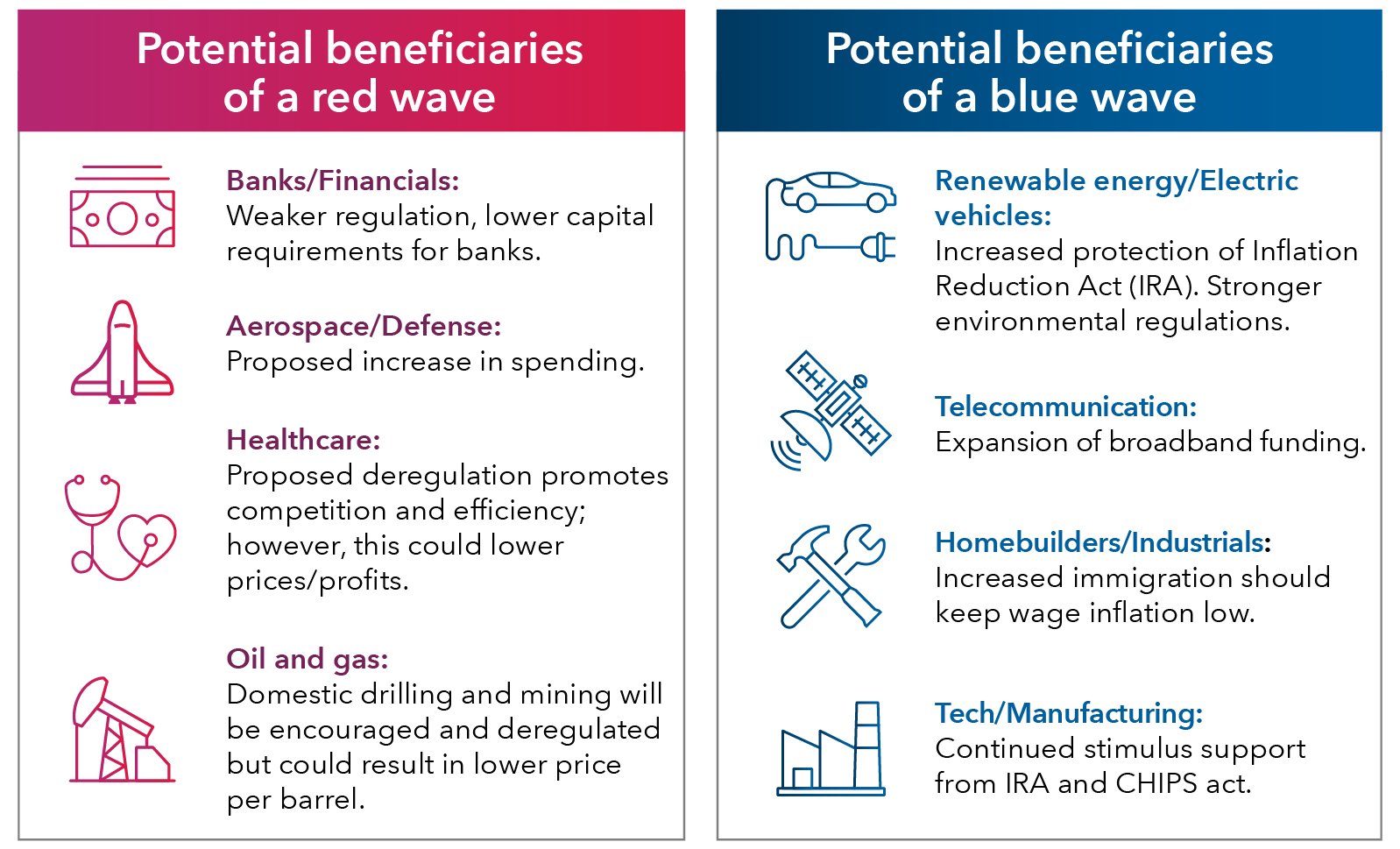

Investors should be prepared for policy shifts across a variety of sectors. Both candidates have outlined a slate of goals that could boost — or hinder — certain industries, such as energy, financials and manufacturing.

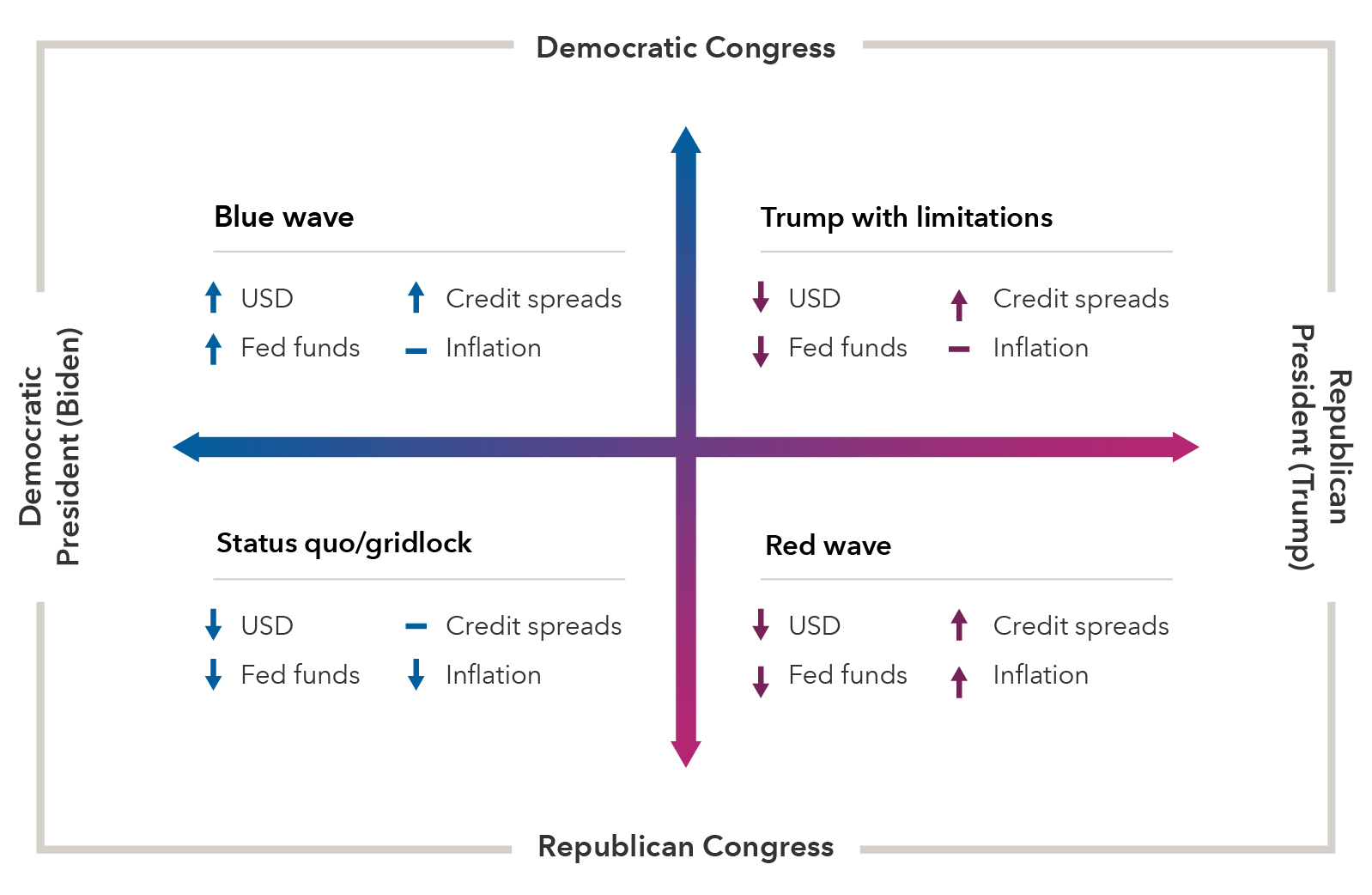

Rather than foretelling the future, this article examines possible outcomes to identify themes and potential risks. Either candidate’s ability to implement policy will be constrained if the opposing party controls Congress. As such, this paper primarily analyzes what would be expected under a red wave or blue wave scenario, where either the Democrats or Republicans control the White House and both legislative chambers.

Source: Capital Group. Note: These scenarios include hypothetical situations in which Congress is either majority Republican or split. Our goal is to offer possibilities, not specify a magnitude of change. Fed Funds = U.S. federal funds rates. USD = U.S. dollar valued against a basket of currencies.

1. Tax implications vary without taming deficits

Tax policy is one of the most important issues to pay attention to this election. Provisions from 2017’s Tax Cuts and Jobs Act (TCJA) are scheduled to sunset in 2025, opening the door for substantial changes. While the two candidates’ tax proposals vastly differ, they both appear unlikely to lower the deficit.

Trump has said he is committed to extending the TCJA, which includes a 21% corporate tax rate and 20% deduction on corporate pass-through income. He could bring corporate and individual tax rates even lower and try to eliminate the estate tax.

In a second Biden term, we could see a substantial change from the status quo. Biden’s plan calls for raising the corporate tax rate to 28% and increasing the tax on corporate buybacks from 1% to 4%. Both of those moves could weigh on corporate profitability.

For individuals, Biden has proposed an increase to capital gains rates on high earners to match income tax rates and a minimum income tax rate for individuals worth at least $100 million. Some of the TCJA tax cuts would be allowed to expire, retaining the current, lower rates for taxpayers earning less than $400,000 per year.

While some reports show Biden’s proposed tax policies could raise revenue, and a divided government could temper spending, our analysis shows the Federal deficit is likely to grow in any scenario.

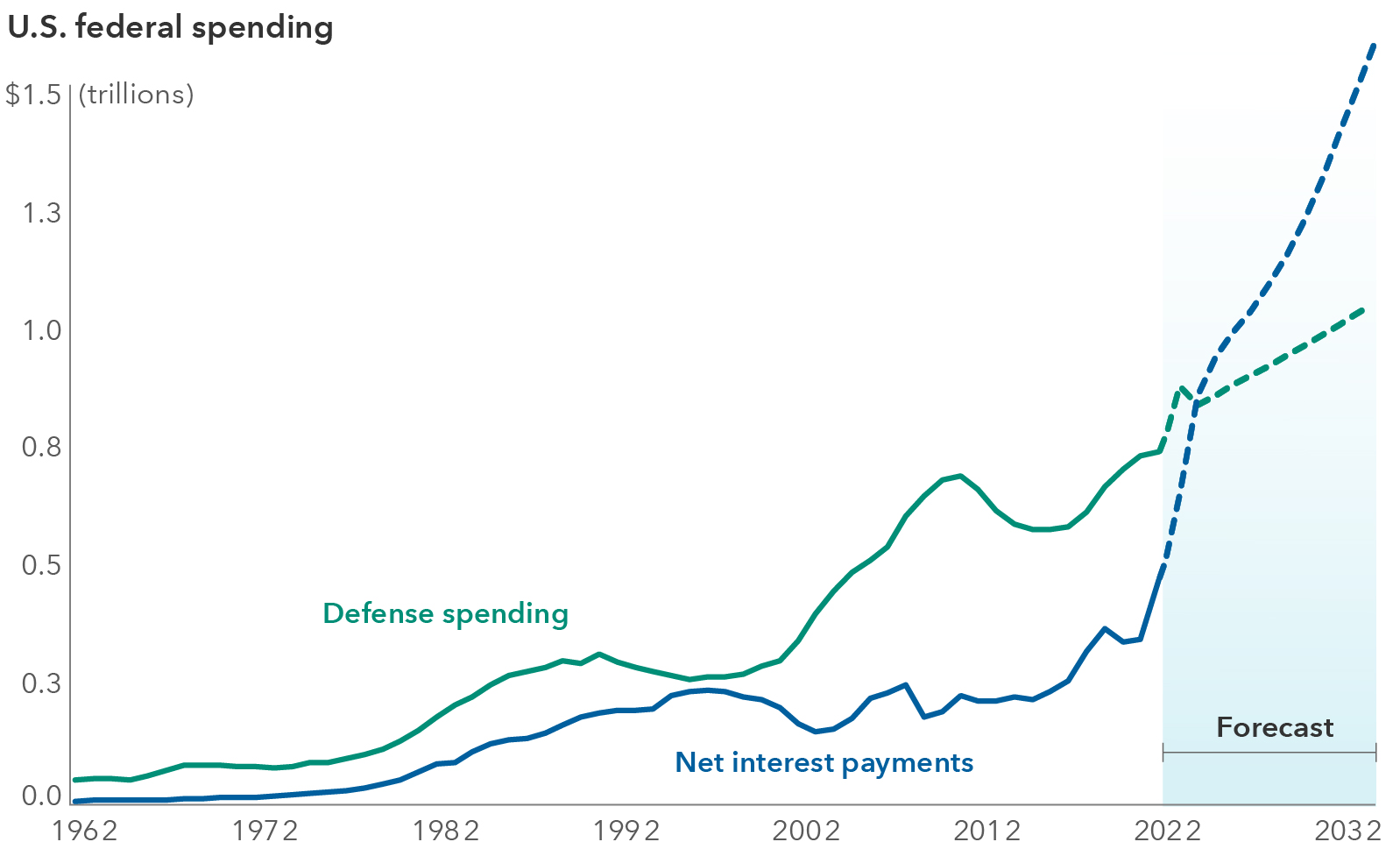

Interest payments on pace to exceed defense spending

Sources: Capital Group, Congressional Budget Office (CBO). Dotted lines indicate forecasted values from the CBO. CBO projections as of February 2024.

The Congressional Budget Office (CBO) estimates that U.S. federal government debt held by the public will exceed 100% of GDP next year and will continue to grow rapidly over the next decade. In particular, interest payments are forecast to surpass defense spending in 2028, ballooning from $660 billion to $1.63 trillion over the next 10 years.

This might force tough policy choices that could impact some companies and industries, but neither party appears inclined to address the issue. Increased deficits could also put pressure on rates, driving up Treasury yields at the long end of the curve, and making it difficult for the government to afford to continue borrowing.

2. Federal Reserve: Status quo or massive overhaul?

The future of the U.S. Federal Reserve could hang in the balance in November. Should Biden win, the most likely outcome would be that the central bank continues the status quo.

If Trump wins, however, we may witness sweeping changes. We believe Trump would replace Federal Reserve chair Jerome Powell with someone more dovish. This would likely mean rate cuts, which would stimulate markets in the near term, but might risk reigniting inflation.

Trump could also try to influence the central bank beyond appointing a new chair. The broader ramifications of these potential changes are unclear, but history warns that countries have not fared well economically when their central banks have lost their independence.

3. Immigration policy could have major implications for labor markets

Another area in which Biden and Trump differ is immigration. During Biden’s first term, higher immigration helped the labor market rebound after the COVID-19 lockdowns eased. This has enhanced productivity and benefitted the U.S. economy. If elected to a second term, Biden has proposed additional funding to help rebuild refugee resettlements to support up to 125,000 refugees in 2025 and to create a smoother, expanded visa process, allowing immigrants who are in the U.S. illegally to apply for legal status.

Trump took a hardline stance on immigration and border security in his first term and has pledged to expand upon those policies should he be reelected. His campaign promises include carrying out one of the largest deportation operations in history, restricting legal immigration, and ending birthright citizenship.

While touted as a benefit to U.S.-born workers, restricting immigration could create labor shortages in certain sectors, hampering productivity and growth. Lower immigration could impede industries reliant on low-cost labor, like homebuilders, and could impact sectors like industrials, by boosting wage inflation and pushing companies toward further automation. Skilled workers and entrepreneurs could also be affected, which could have implications for industries like tech.

4. China: Trade war tensions could re-escalate under Trump

During Biden’s first term, the U.S. kept the tariffs on China enacted in the Trump era intact. To date, the Biden campaign has not provided many details on potential policy changes but has proposed new tariffs on Chinese steel and aluminum and raising existing tariffs on Chinese EVs to protect American companies.

If Trump is elected, we expect him to ramp up pressure on China, boosting tariffs as high as 60% and restricting Chinese ownership of U.S. infrastructure.

Trump’s initial tariffs did not cause much inflation in the U.S., as they were absorbed by shrinking corporate margins rather than passed onto consumers. That might change if the tariffs are larger or more broadly implemented — but the margin impact remains a higher concern than inflation. Trump has also indicated he would try to promote U.S. exports by devaluing the dollar and impose a baseline 10% tariff on most imported goods coming from regions other than China.

Under a Trump presidency, we expect more difficult trade negotiations with Beijing than in his first term. Beijing could retaliate more aggressively, targeting areas such as rare earth minerals and U.S. agricultural exports. We also expect heightened risk Beijing could exert greater influence over Taiwan, increasing the importance of the efforts being made by companies like semiconductor manufacturer TSMC to establish facilities outside of Taiwan.

5. Regulatory action could be tempered regardless of election outcome

In Biden’s first term, regulatory oversight has strengthened across agencies like the Federal Trade Commission, Internal Revenue Service and Securities and Exchange Commission, implementing more restrictive policies and stepping up enforcement actions.

This has created a drag on profits in sectors like financials, where banks suffered a downturn in dealmaking. If reelected, Biden would likely continue his approach, increasing capital requirements for banks and imposing stricter policy in other areas, such as environmental protection. However, his ability to do so could be stymied by the Supreme Court's upcoming ruling on the limits of Federal agencies’ regulatory authority.

Under a second Trump term, we expect to see sweeping changes to the regulatory state and significantly weaker oversight overall. Trump has indicated he could fire thousands of federal employees and potentially eliminate some agencies altogether.

This change could dramatically impact many agencies’ operations. But we do not expect it to add significantly to unemployment, as more than 70% of federal employees work for defense-related agencies that are not likely on the chopping block. Out of the approximately 2.4 million current federal employees (excluding postal workers), we see 700,000 federal jobs outside of defense at risk.

One regulatory area to watch is energy. Both candidates have been vocal on their approaches to energy production. Trump prioritizes fossil fuels. Biden’s administration has focused on renewable energy and electric vehicle manufacturing through legislation such as the Inflation Reduction Act.

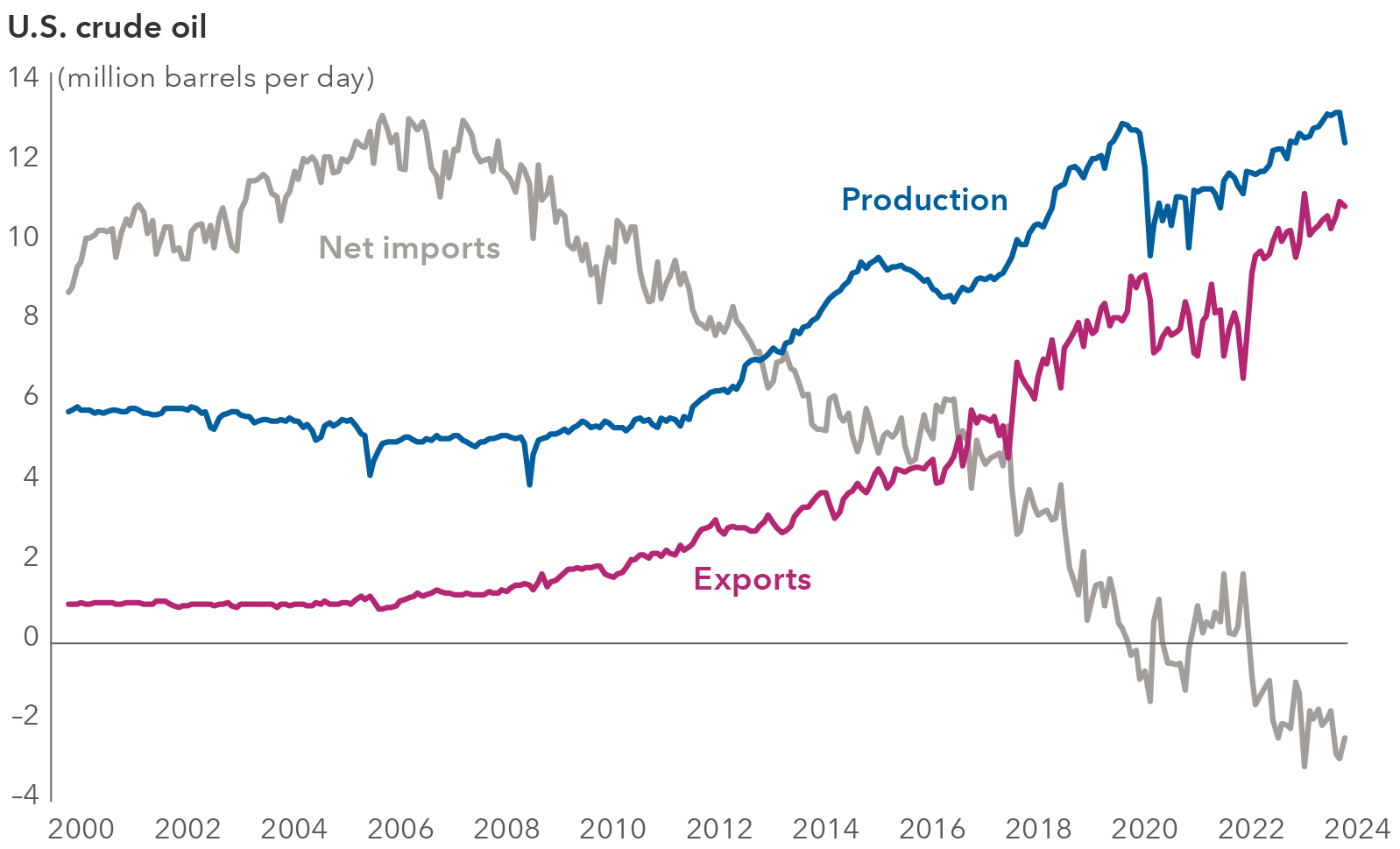

However, U.S. crude oil production and exports have consistently increased in Biden’s first term.

U.S. oil production continues its post-pandemic surge

Source: U.S. Energy Information Administration. As of April 18, 2024. Production = U.S. field production of crude oil. Exports = 4-week average U.S. exports of crude oil and petroleum products. Net imports = 4-week average U.S. net imports of crude oil and petroleum products.

Trump has said he would immediately repeal all green energy mandates instituted by the Biden administration. Instead, he’d seek to open more nuclear plants — an option the U.S. has largely abandoned since the mid-‘90s — and promote oil and gas exploration by issuing more extraction and pipeline permits.

Many of our analysts think this would weigh on the renewable energy industry, but some also foresee mixed prospects for fossil fuel companies. More drilling means more fuel supply, and that implies lower prices. If costs fall, these industries could ultimately have to run faster just to stay in place. From a wider point of view, lower energy prices could help mitigate inflationary pressures, perhaps offsetting the costs of Trump’s proposed tariffs.

Biden, on the other hand, has said he wishes to entrench and potentially expand the renewable energy incentives he’s championed, particularly through the Inflation Reduction Act. A second Biden administration could bolster these tax credits, potentially giving green industries and electric carmakers more confidence for long-term planning. But even in a red wave, it could prove difficult to roll back large portions of these stimulus packages.

Source: Capital Group.

The bottom line

The impact of the presidential election could be tempered if the winning party does not also achieve a majority in Congress. And some issues, like the deficit, appear unlikely to change under either party. But many sectors wait on edge. Capital Group analysts, including the scenario-analysis team known as the Night Watch, are keeping close tabs on each candidate’s rhetoric and policy positions to examine possible outcomes to identify potential risks.

The 2024 election cycle has a long way to go, and it is still far too early to predict a winner, but it is helpful to recognize proposed policies and what they could mean for markets.

Don't miss our latest insights.

Our latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

-

Emerging Markets

-

Economic Indicators

-

Demographics & Culture

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Jared Franz

Jared Franz

Clarke Camper

Clarke Camper

Reagan Anderson

Reagan Anderson