Fixed Income

Global Equities

Investors searching for reasons to increase their exposure to international markets need look no further than the booming European economy.

Initially slow out of the COVID recovery gate, the major European economies are now expected to post an impressive GDP growth rate of around 5% in 2022, according to Capital Group economist Robert Lind. That’s nearly twice the rate our economists are estimating for the United States.

“Many European economies are firing on all cylinders,” Lind explains, “driven by the release of pent-up demand, improving consumer sentiment and booming industrial activity, particularly in France, Italy and the United Kingdom.”

Moreover, Lind doesn’t see this as a temporary surge, but rather a significant shift in consumer behavior and political climate that could result in stronger European economic growth — as well as higher inflation — over the next few years.

The improving European economy is just one reason investors shouldn’t ignore opportunities in international and emerging markets. Another is the long list of innovative and competitive companies based outside the U.S.

Indeed, international markets are no longer dominated by energy companies and banks as they were 20 years ago. The information technology, health care and consumer-related sectors now account for a larger weighting in the MSCI EAFE Index — reflecting the rapid growth of companies such as semiconductor equipment maker ASML, luxury goods giant LVMH and software provider SAP.

Beyond big tech: The digital revolution spreads overseas

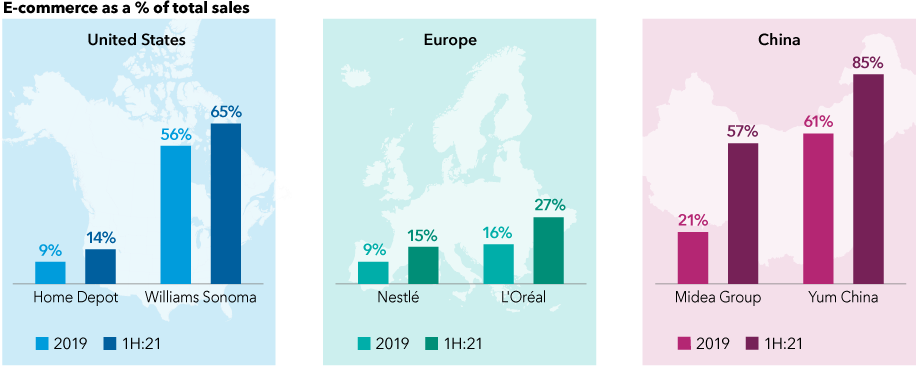

Sources: Capital Group, company filings, company reports, FactSet. For Home Depot and Williams Sonoma, the full-year period refers to the 12 months ending on January 30 to align with the company’s fiscal year (i.e., 1H:21 refers to the period between February 2021–July 2021). All other periods correspond with calendar years. As of July 31, 2021.

Digital dynamism in non-U.S. companies

The digital revolution, initially pioneered by U.S. tech giants, has moved far beyond the turf of Amazon, Google and Microsoft. Across nearly all industries, companies are adopting new technology to improve business and transform the way we live.

“I don’t think these opportunities are yet fully understood by the market,” says equity portfolio manager Greg Wendt. “In addition, there’s no question that valuations are lower for many international and emerging markets companies compared to their U.S. counterparts. That makes non-U.S. markets a very attractive hunting ground.”

Global spending on digital transformation is expected to rise from $1.3 trillion in 2020 to $2.4 trillion by 2024, according to Statista. Even old economy companies are investing heavily in technology to reinvent and revitalize their businesses through automation, cyber sales and machine learning.

In Europe, food giant Nestlé and cosmetics leader L’Oréal have ramped up their digital adoption, nearly doubling e-commerce-related revenues as a percentage of total revenue in recent years. In the case of Nestlé and other consumer staples companies, retailers sought to simplify their shelf space during COVID, resulting in a reduction in the number of items they stocked. Along with a surge in online orders during the lockdowns, this helped larger consumer brands consolidate their market share over more niche product makers for certain food items and everyday household staples.

China is even further ahead in many ways: Companies like appliance maker Midea Group and restaurant firm Yum China have generated significantly stronger growth in e-commerce revenues.

Not every company that embarks on a digital transformation will emerge as a long-term winner. The key, Wendt says, is to fully understand a company’s digital strategy and its prospects for success.

“Some investors may think exclusively about consumer tech giants or cloud-based software providers,” Wendt says, “but we dig deeper across all industries to discover companies with the potential to benefit from a digital transformation.”

From dividend zeros to dividend heroes

An abundance of companies that pay dividends is another important reason for investors to think about venturing overseas.

Simply put, there are greater income-oriented opportunities available outside the U.S., where dividends have historically made up a bigger part of the investment landscape. For example, more than 700 companies headquartered in international and emerging markets offer dividend yields above 3%, compared to only 89 in the U.S., as of October 31, 2021.

It’s true that some dividend-paying companies, especially European banks, came under immense pressure during the worst months of the pandemic in 2020. But that headwind has rapidly changed direction and become a strong tailwind.

In fact, many of those companies are shifting from dividend zeros to dividend heroes, says equity portfolio manager Caroline Randall.

“These were companies that suspended dividends during the pandemic due primarily to political pressure,” Randall explains. “Today, many have surplus capital to be redeployed as regular and catch-up dividends.”

Businesses across sectors and borders are raising their dividends

Sources: Capital Group, Refinitiv Eikon. As of 10/31/21.

Randall is focusing on companies with strong underlying earnings growth that have demonstrated a commitment to raise dividends over time. Dividend growers historically have tended to generate greater returns than other dividend strategies, she notes, while also keeping up relatively well with the broader market.

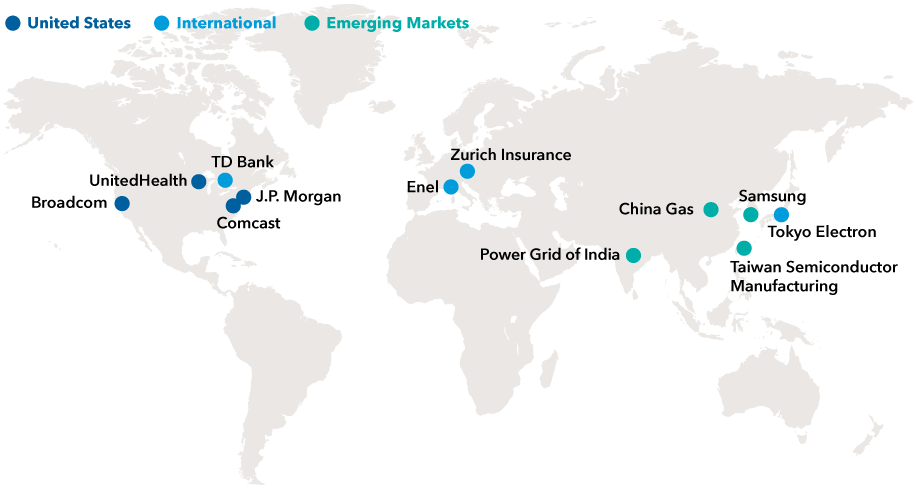

Examples include semiconductor makers Broadcom and TSMC, financials such as Zurich Insurance and TD Bank, utilities such as electricity and gas provider Enel, and telecommunications conglomerate Comcast.

“Because it is reflective of stronger earnings, dividend growth can also offer a measure of resilience against interest rate hikes,” Randall adds.

Facing risks in China

There’s no way to sugarcoat it: Risks to investing in China have risen.

The world’s second largest economy is experiencing a sharp deceleration in growth, weighed down by a credit crunch in the real estate sector, ebbing consumer confidence and stricter regulations.

Heavy government intervention in the country’s internet-related sectors, as well as a crackdown on education companies, has some investors asking: Is China still investable?

Clearly, certain companies and industries face heightened uncertainty in the near term, clouding their investment prospects. But there remain plenty of attractive long-term opportunities on a stock-by-stock basis, especially in business areas more aligned with the government’s strategic priorities.

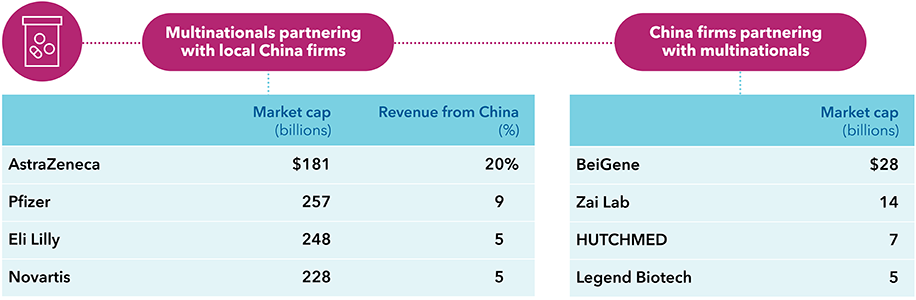

The biopharma sector is one example. Government officials have sought to improve access to quality health care and foster an environment that will allow local firms to flourish. Regulatory reforms have drastically improved the landscape for both foreign and domestic companies and have helped China conform to global standards.

China’s health care sector fosters global collaboration

Sources: Capital Group, company filings, RIMES. Market value as of 8/31/21. Revenue from China are approximations based on most recently available company filings as of 6/30/21.

This hasn’t gone unnoticed by professional investors. The health care sector has attracted a flood of venture capital in recent years. And many Chinese-born scientists have returned to the country after working at U.S. biotech firms and universities.

“Authorities have been pushing policies that encourage and incentivize domestic companies to compete with global companies,” says investment analyst Laura Nelson Carney. “In that sense, biopharma is a little different than other industries in China that have been flagged as the next potential targets in line for heightened regulatory scrutiny.”

Has the U.S. dollar peaked?

Here’s one more potentially compelling reason to look outside the U.S.: At some point, the decade-long dollar bull market will come to an end. Capital Group fixed income portfolio manager Thomas Høgh thinks that point will come in 2022.

The primary reason is the rising “twin deficits,” Høgh says.

The twin deficits are the U.S. budget deficit and the U.S. current account deficit. The budget deficit reached $2.8 trillion this year, the second highest amount on record. The current account deficit — which measures the flow of goods, services and investments into and out of the country — rose to a 14-year high of $190.3 billion in the second quarter of 2021.

These deficits have plagued the U.S. for years and are expected to grow even faster as the U.S. government seeks to ramp up spending on infrastructure, education, health care and climate change initiatives.

With healthy economic growth overseas, Høgh sees the dollar declining modestly against other currencies, particularly the Japanese yen.

“The traditional factors that lead to a weaker dollar are certainly prevalent,” Høgh says. “While dollar weakness may not be dramatic in 2022, I think it could be enough to inject new life into markets that have seriously lagged for many years.”

Bottom line for investors

Even though U.S. markets have led international and emerging markets for the past decade, there are many reasons to be optimistic about investing outside the U.S. in 2022. These include a booming European economy, digital dynamism and dividend opportunities in many companies, as well as the prospect of a declining dollar.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries. Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks.

MSCI EAFE (Europe, Australasia, Far East) Index is a free float-adjusted market capitalization-weighted index that is designed to measure developed equity market results, excluding the United States and Canada.

RELATED INSIGHTS

-

Fixed income outlook: Resilient U.S. provides an anchor

-

Global Equities

Stock market outlook: AI leads a broadening market -

Economic Indicators

Economic outlook: Global growth dependent on a resilient U.S.

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Robert Lind

Robert Lind

Caroline Randall

Caroline Randall