Fixed Income

United States

Every so often a crisis comes along that drives change at such velocity that investors can almost feel the ground shift beneath their feet.

Consider that at the start of World War II an estimated 75% of U.S. artillery was horse drawn. By the end of the war America had entered the atomic age, which precipitated a wave of innovation that helped the U.S. become the world’s dominant economy.

“Think about how dramatic those years were,” notes equity portfolio manager Martin Romo. “The COVID-19 pandemic presents an interesting analog to that. We have suddenly found ourselves spending much of our time online — working, shopping and learning. But what if online learning as it exists today is the horse-drawn equivalent? What might the nuclear equivalent of an online classroom look like?”

Indeed, as striking as behavior shifts were in 2020, we may one day look back at 2021 as a major turning point not only for the economy but for public health, politics and the way we live in the digital age. “The longer we live in an environment where we have to be careful about our health, the more persistent behavior change will be,” Romo says. “We just hit the fast-forward button to the future, and I don’t think we’re going back.”

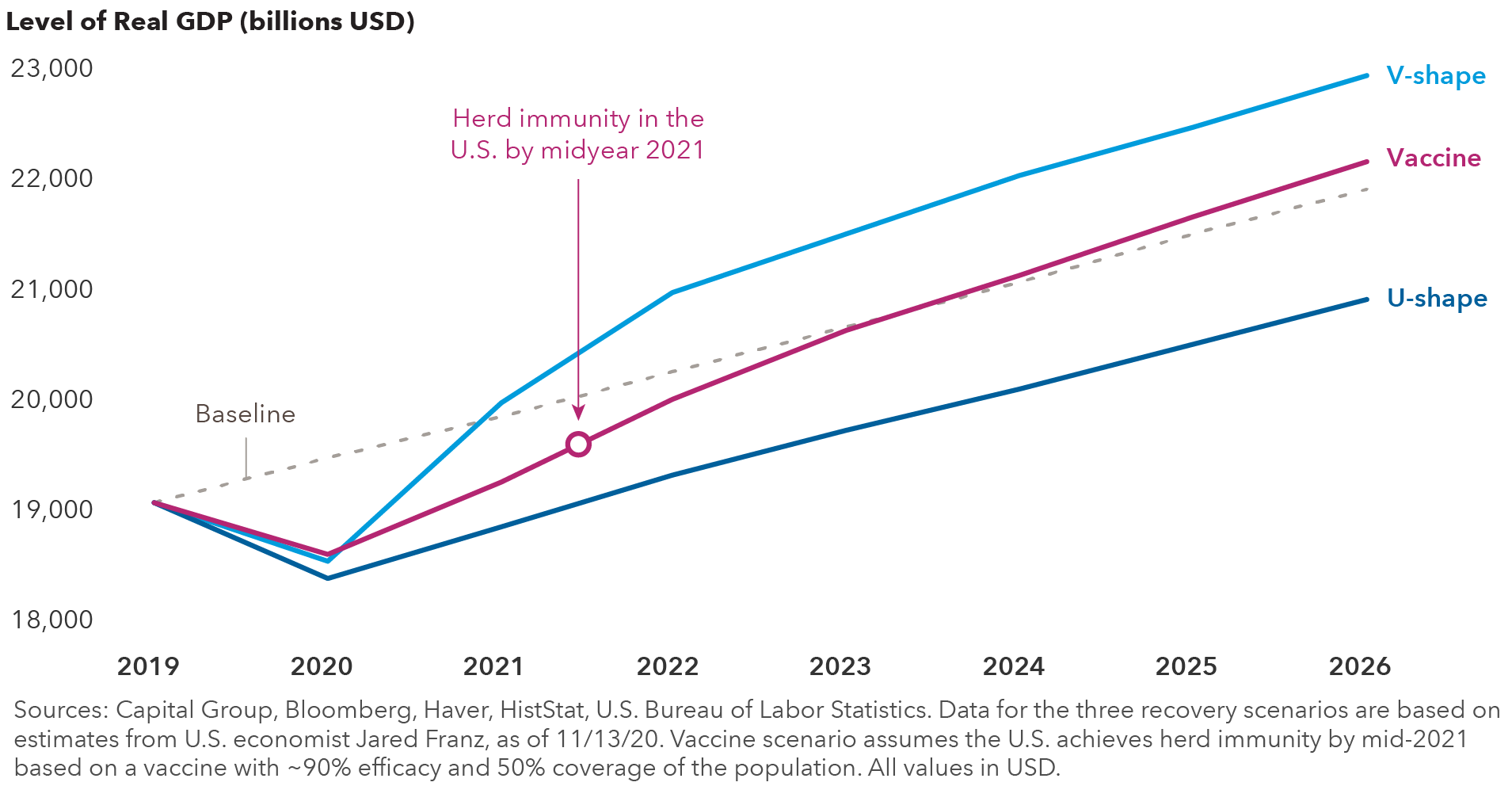

Shape of economic recovery depends on vaccines

Although consumer habits and whole industries may forever be altered by the pandemic, overall economic activity has been staging a remarkable comeback. After experiencing its worst recession since the Great Depression, the U.S. generated a record 33.1% annualized GDP growth in the third quarter of 2020. Can the American economy continue its strong rebound in 2021?

Recent COVID-19 flareups across the country suggest that the virus has yet to be contained and will likely continue to impact near-term growth, says U.S. economist Jared Franz. “All growth forecasts depend on the trajectory of the vaccines,” adds Franz, who conducts scenario analyses of economic growth rather than issue a forecast. A slower rollout of vaccines could result in uneven growth for a few quarters, whereas quicker distribution could drive GDP growth above 3% in 2021.

The strength of the recovery is vaccine dependent

When will vaccines be widely available? “We’ve already seen promising data from Pfizer, Moderna and AstraZeneca trials,” says equity portfolio manager Rich Wolf. “It will take time for a vaccine to be made widely available and to convince people to take it. That said, in late November it appeared we would have two vaccines available for emergency use authorization by the end of 2020. I expect there will be at least four vaccines widely available by midyear 2021.”

2021 Outlook webinar

Get insights for 2021 and beyond

Great acceleration reshapes the economy

A look beneath the surface reveals that major sectors of the economy have moved in sharply different directions, reflecting the disparity between companies that have benefited from the COVID-19 pandemic and those that have been crushed by it.

For restaurants, hotels, retailers, airlines and small businesses, it has literally been the worst of times. At the opposite end of the spectrum, the stay-at-home era has been a boon for e-commerce, cloud computing, video streaming, digital payment processors and home improvement stores.

As the recovery grinds along, separating the long-term winners from the losers will be the No. 1 job for investors.

“The post-pandemic economy is going to look very different than the one we had in February 2020,” Franz says. “It’s going to be more efficient and more dynamic, but there will be winners and losers. Our job as active investors is to identify them — finding the growing companies that have not only benefited from the pandemic but that also have the potential to continue generating solid growth in a post-pandemic world.”

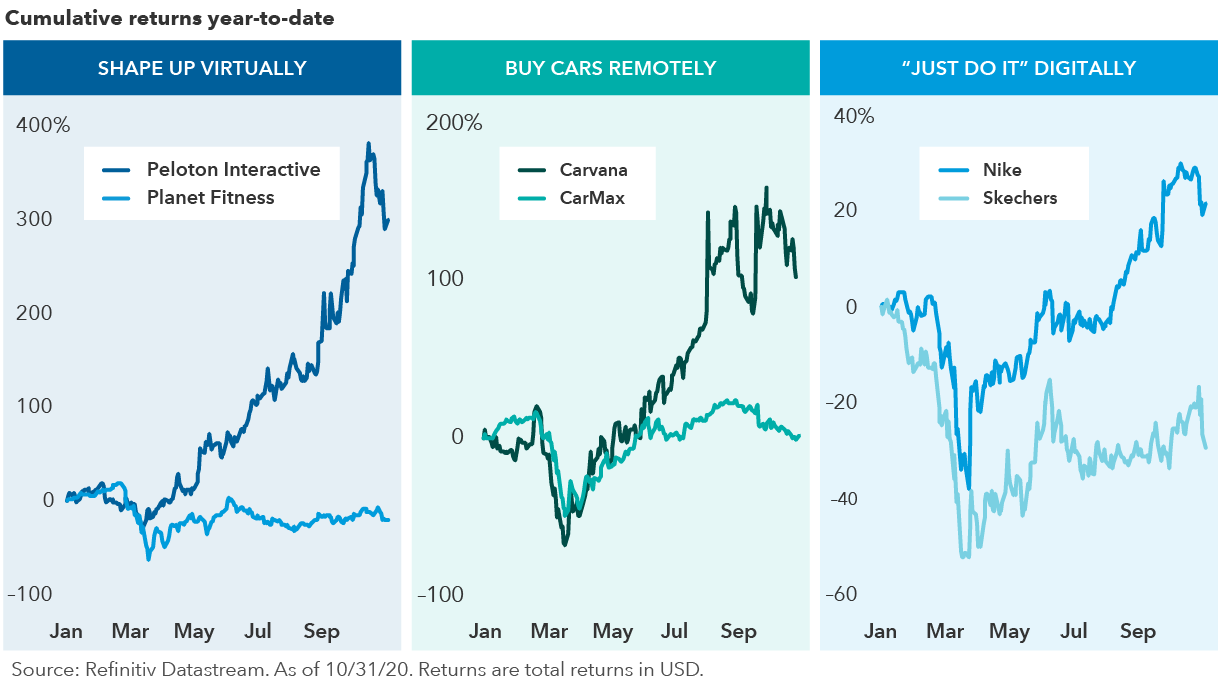

Across industries, digital leaders are leaping ahead

The digital gap that existed long before the coronavirus outbreak has suddenly become a digital Grand Canyon. Black Friday, the traditional start of the holiday shopping season, offered a clear illustration of the divide. About half as many consumers visited stores on Black Friday 2020 as did a year earlier, according to the Wall Street Journal. Meanwhile, online holiday shopping was expected to rise about 22% to $202 billion, according to the National Retail Federation.

Companies with strong online business models have an advantage

Companies with strong online business models have an advantage

Companies with fast and efficient online business models are soaring above the competition, disrupting the status quo and displacing old-economy stalwarts. This broad-based investment theme is not confined to retail but crosses many key sectors of the economy — from entertainment to advertising and payment processing. Even the fitness industry is getting a vigorous digital workout.

“We were already headed in this direction when COVID came along and gave it a huge shove forward,” says portfolio manager Chris Buchbinder. “The growth rates at companies with a digital advantage have been phenomenal. When the pandemic is over we may see slower growth rates, but I don’t think a lot of people will be canceling their Netflix subscriptions or returning their Peloton bikes.”

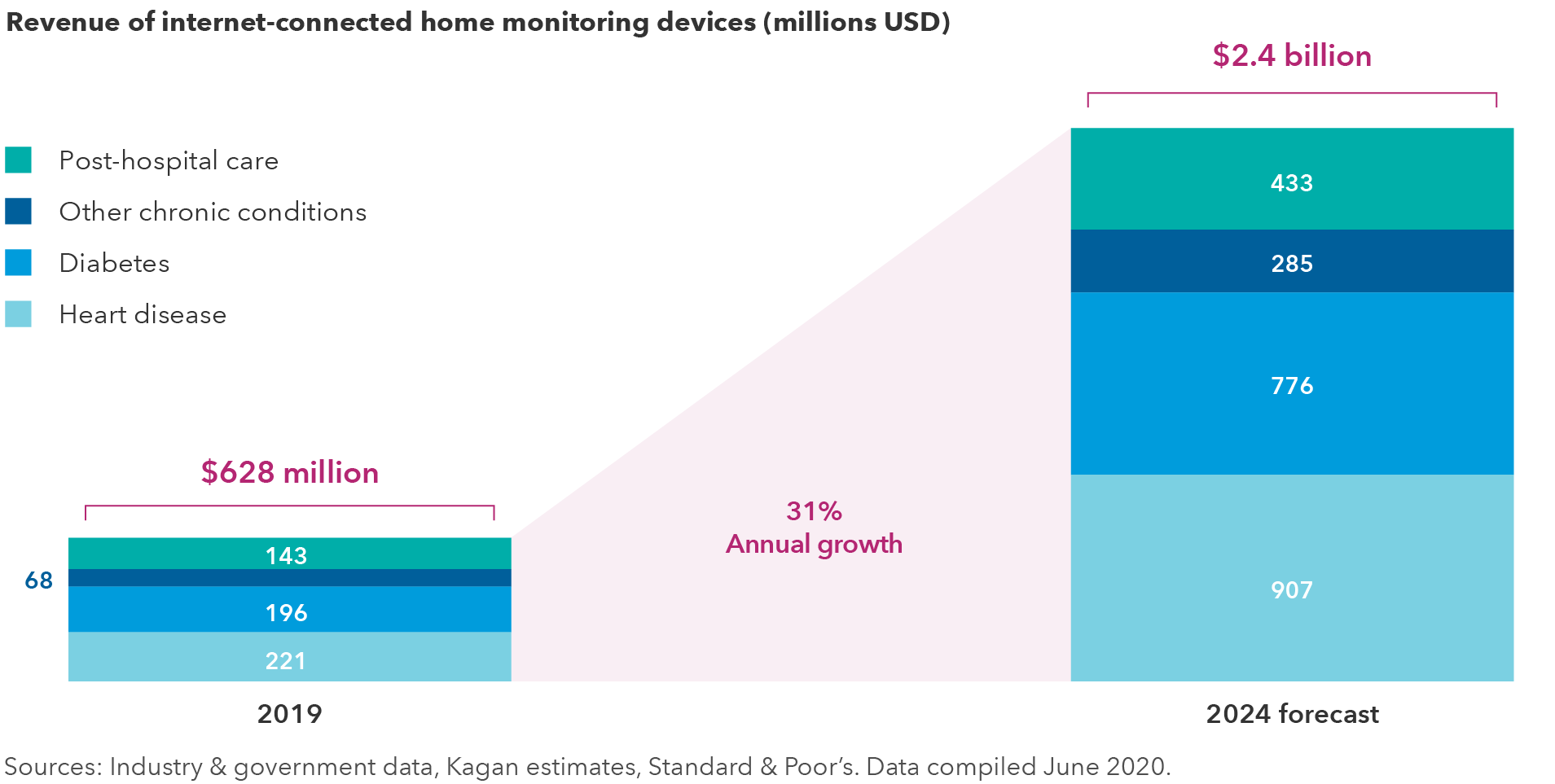

House calls are coming to health care

The world’s attention has been focused on the speed of COVID vaccine development. But advances in medical technology and shifts in consumer behavior are converging to improve outcomes for patients, drive down medical costs and generate opportunity for companies. “There’s never been a more exciting time in health care,” Wolf says.

Consider the recent spike in demand for online doctor visits. The service has been available for a few years, but its adoption was limited prior to the pandemic. “Telemedicine was already a wave, but COVID and relaxed rules by regulators turned it into a tsunami,” Wolf adds.

What’s more, advances in home diagnostics — including continuous glucose monitors and insulin pumps for diabetes, as well as wearable monitors that track irregular heartbeats and other signs of heart disease — are allowing doctors to monitor patients remotely.

Home-monitoring devices are gaining traction with patients

“We’re still in the early stages of cost-efficient devices that can send a variety of health-related metrics to physicians or assist the patient in managing their own care,” Wolf notes.

A range of companies could address the rising demand for remote monitoring, including DexCom, ResMed, Insulet, Tandem, iRhythm and Abbott Laboratories. It also includes telemedicine services like those offered by Teladoc and UnitedHealth.

Some experiences can’t be digitized

However, the advantages of a digital presence only go so far. Some experiences simply can’t be digitized.

Take the so-called “flight to nowhere.” On October 10, 2020, after months at home, 150 restless passengers boarded Qantas flight QF787 for a seven-hour flight from Sydney, Australia to ... Sydney, Australia — just for the sake of traveling. The flight sold out in 10 minutes.

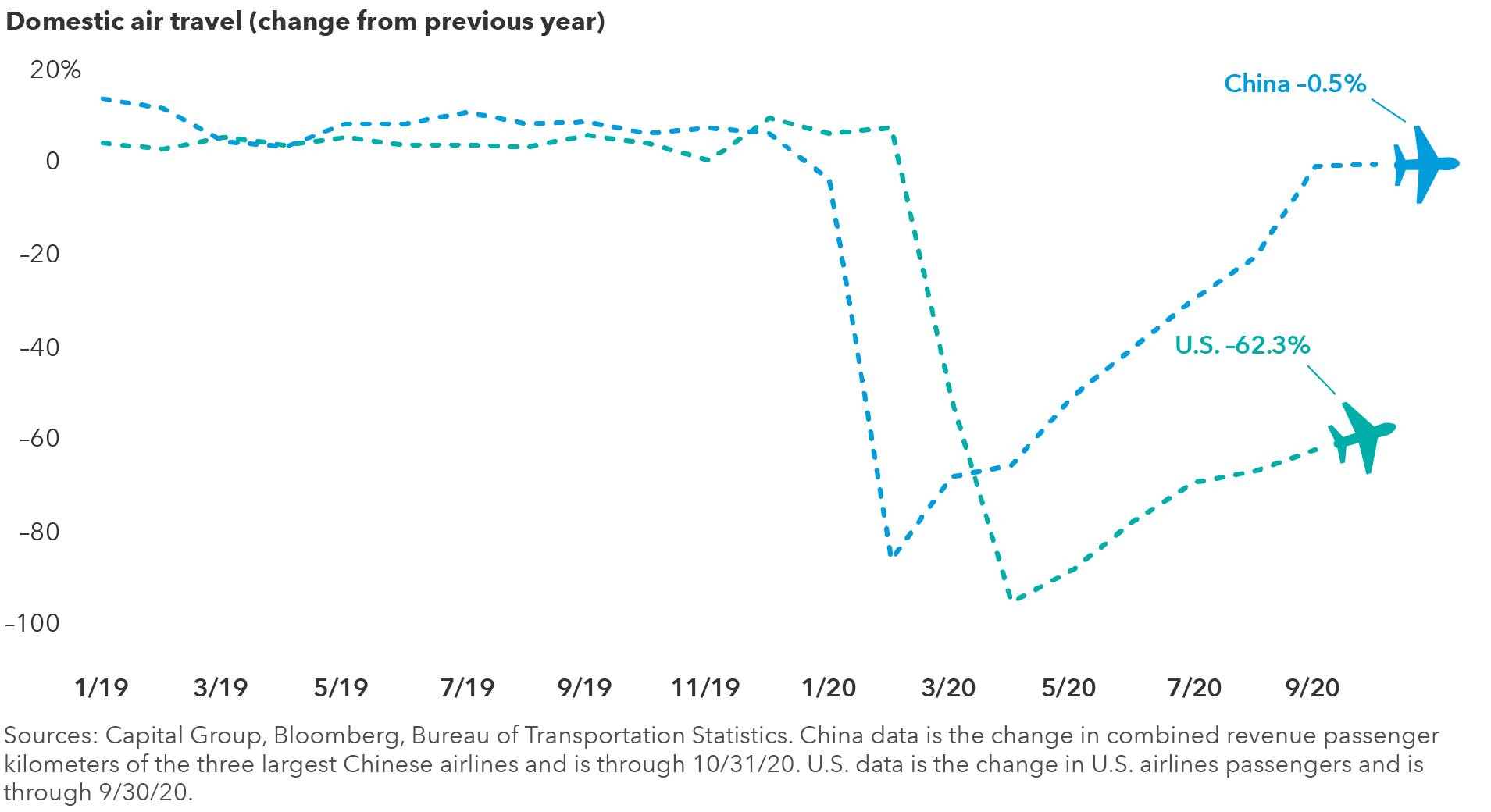

Few experiences animate the human spirit like the desire to travel, which gives equity investment analyst Todd Saligman confidence that demand for airlines and even cruises will bounce back.

“The question is how quickly,” says Saligman, who covers U.S. and European airlines and U.S. cruise lines. “I believe it will happen quickly once we get a vaccine. We also saw this after the September 11 attacks. A lot of people thought consumers would never fly again, and traffic recovered relatively quickly.”

Indeed, in China, where the virus is largely under control and the economy has rebounded, domestic air travel has nearly returned to pre-COVID levels.

Domestic air travel in China is soaring back. Will the U.S. follow?

Cruising has resumed in Europe, and the U.S. has lifted its “no sail” order, provided ships meet strict health and cleanliness standards.

“This industry has gotten so much negative media, yet people are still booking cruises for next year at prices higher than they were in 2019,” Saligman adds. “That’s pretty indicative of the pent-up demand for leisure travel.”

With the election settled, look for cash to come in from the sidelines

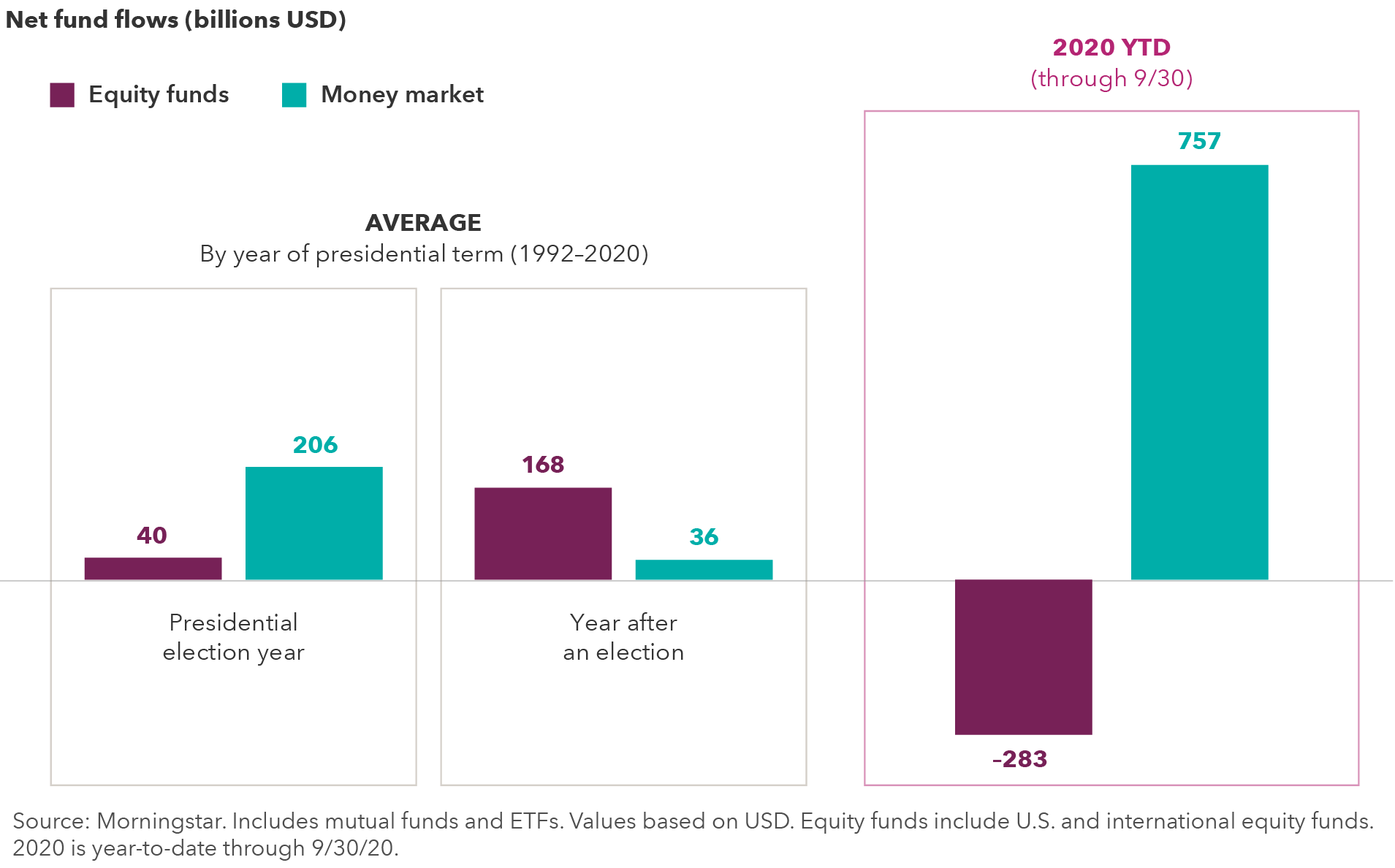

So what does all of this, and the recent presidential election, mean for investors? A tidal wave of fund flows shifted portfolios from equities to cash in the last year, but investors should be prepared for that tide to turn in 2021. Investors sought calmer waters in 2020, pouring a record $757 billion into money market funds — low risk investments that offer essentially no return.

This flight to cash is nothing new in the months preceding U.S. elections, when uncertainty is often at its peak. In the last seven election years, money market inflows have been five times higher than those of equity funds — a trend that typically reverses in the year after an election. But 2020 was yet another example of why market timing is not a winning strategy. Investors who were on the sidelines missed much of the Standard &Poor’s 500 Composite Index’s 50% rally from market bottom in March through Election Day.

In 2021, expect cash to come off the sidelines

Long-term investors may want to consider opportunities to invest in durable growth trends like digitization, global payments and renewable energy. More cautious investors should consider alternatives to cash that may leave them better positioned to reach their goals. Short-term bond funds are one option with their history of greater stability and higher potential returns than cash. Given the turmoil of 2020, now may be a great time to review your overall asset allocations.

Indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

Standard & Poor's 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

©2020 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Standard & Poor's 500 Composite Index ("Index") is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

RELATED INSIGHTS

-

Fixed income outlook: Resilient U.S. provides an anchor

-

Global Equities

Stock market outlook: AI leads a broadening market -

Economic Indicators

Economic outlook: Global growth dependent on a resilient U.S.

Jared Franz

Jared Franz

Martin Romo

Martin Romo

Richmond Wolf

Richmond Wolf