In observance of the Christmas Day federal holiday, the New York Stock Exchange and Capital Group’s U.S. offices will close early on Wednesday, December 24 and will be closed on Thursday, December 25. On December 24, the New York Stock Exchange (NYSE) will close at 1 p.m. (ET) and our service centers will close at 2 p.m. (ET)

We make funds for a variety of investing styles

Available through your financial professional or online broker.

Mutual funds

Find mutual funds that can strengthen your investment mix by spreading your money across hundreds of carefully chosen stocks and bonds.

All-in-one strategies

Choose a one-fund solution that aligns with your investment goals.

Target Date Funds

Portfolio Funds

Here's what to consider when investing

All-in-one strategies

Choose from collections of funds that auto-adjust to keep up with your goals.

Target Date Funds

Target Date Retirement Series

College Target Date Series

Portfolio Funds

Portfolio Series

Retirement Income Portfolio Series

Mutual Funds

Find mutual funds that strengthen your investment mix by spreading your money across hundreds of carefully chosen stocks and bonds.

Exchange-traded funds

Strengthen the core of your portfolio with our active, transparent ETFs. They combine our proven approach to active management with the benefits of the ETF vehicle.

Discover how we’re bringing our time-tested active management to ETFs by downloading our ETF brochure.

Public-Private+ Funds

Combine the value of actively managed public market investments with the attractive return potential and diversification benefits of private markets. In partnership with KKR, our Public-Private+ Funds aim to unlock private market investments and pursue differentiated outcomes for investors.

Retirement accounts

A tax-advantaged way to invest for retirement. We offer accounts for both individuals and businesses that want to offer their employees a qualified plan.

PERSONAL

BUSINESS

Variable annuity/ insurance solutions

Variable insurance funds may complement your retirement strategy.

Other account types

Plan ahead for a child's future college and other expenses with these tax-advantaged accounts.

Education

Disability Expenses

WHY ACTIVELY MANAGED?

Professional managers provide knowledge and experience

Our funds are actively managed, meaning each investment in the fund is carefully chosen and monitored by professional managers whose careers are devoted to researching investments and market trends. They buy or sell investments depending on market conditions and the overall objective of the fund.

-

-

Pursuing better returns

American Funds vs. the index*

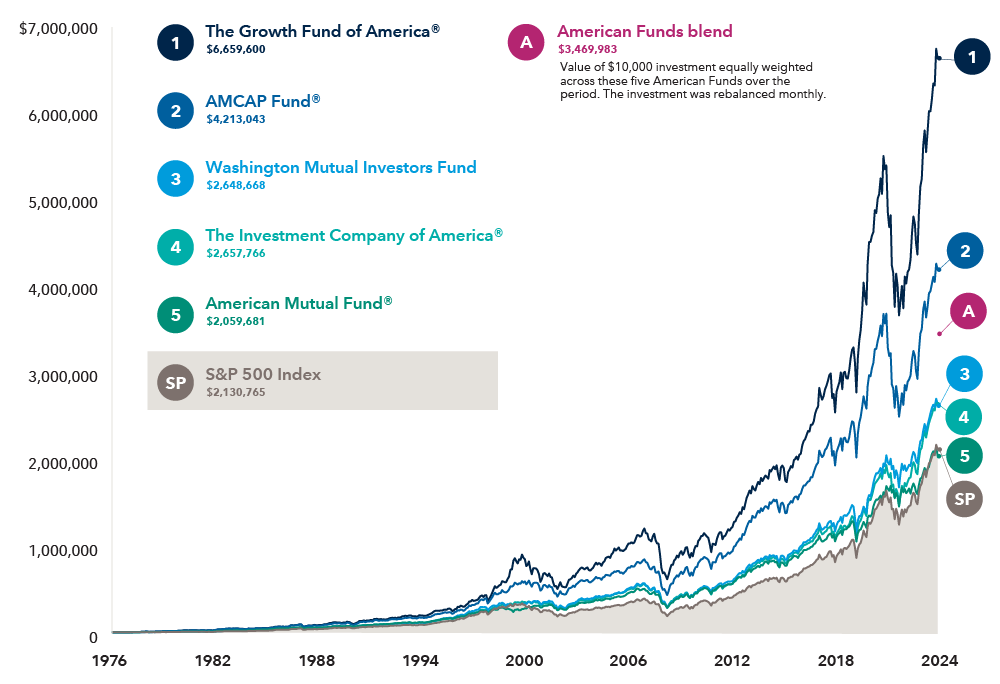

The first retail S&P 500 Index-tracking fund was founded in 1976. The chart shows how much a hypothetical $10,000 investment in the five equity-focused American Funds available that year would be worth compared to the index more than 40 years later.

Index funds are not striving to outpace their benchmarks; rather, they seek to replicate the benchmark's return pattern.

*$10,000 hypothetical investment in American Funds and the S&P 500 from August 31, 1976, through December 31, 2024.

Class F-2, net of all expenses.

Includes all five of the U.S. equity-focused American Funds available for investment when the first S&P 500 Index-tracking fund was launched on August 31, 1976.

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. This index is unmanaged, and its results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. Investors cannot invest directly in an index. There have been periods when the funds have lagged the index.

Source: Capital Group, using data obtained from Morningstar.

Investment assumes $10,000 equally weighted ($2,000 per fund) among the five U.S. equity-focused American Funds available for investment at the inception of the original S&P 500 Index fund.

The Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks. The market index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index. There have been periods when the funds have lagged the index.

Source: Capital Group, using data obtained from Morningstar.

-

Team-led approach

-

How to invest with us

You can invest in American Funds through online brokers or by working with your financial professional.

Talk to your financial professional

We can help you find a financial professional if you do not have one.

Popular online brokers

- Class F-2 shares were first offered on 8/1/2008.