In observance of the Christmas Day federal holiday, the New York Stock Exchange and Capital Group’s U.S. offices will close early on Wednesday, December 24 and will be closed on Thursday, December 25. On December 24, the New York Stock Exchange (NYSE) will close at 1 p.m. (ET) and our service centers will close at 2 p.m. (ET)

Target date retirement series — American Funds

A smart choice for investing for retirement

The American Funds Target Date Retirement Series® is a professionally managed collection of mutual funds designed to help you invest for retirement and meet your changing financial needs over time.

One fund. Many benefits.

Each fund is made up of a broad range of investments. That’s important when saving for retirement because spreading your investment dollars among different types of investments can help reduce volatility.

American Funds Target Date Retirement Series

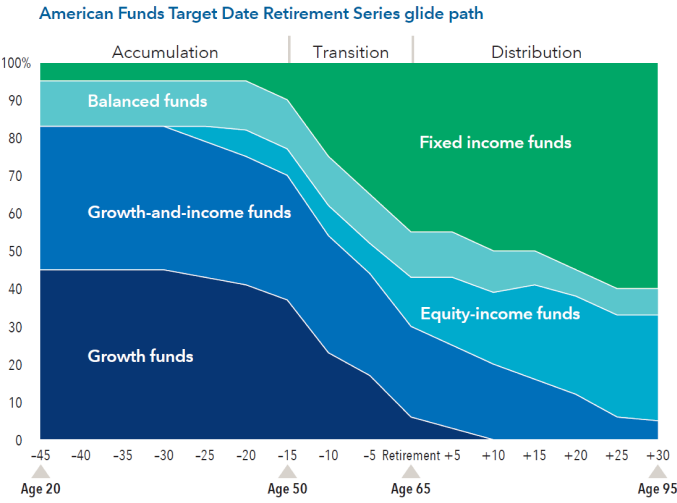

Investments in American Funds target date funds are allocated among a diversified portfolio of stocks and bonds. Investors select a target date fund, typically the one nearest their anticipated retirement date. Over time, that fund's mix of stocks and bonds will shift toward more conservative investments. This gradual shift over time is called a "glide path."

Here’s how it works:

- Significant stock investments throughout the lifetime of your fund can help manage the risk of outliving your savings in retirement.

- An increased emphasis on bonds as you near your retirement date can help manage the risk of market declines.

- The fund is managed beyond retirement, so you could feasibly use a single fund for decades.

Our objective-based glide path

Although the target date portfolios are managed for investors on a projected retirement date time frame, the allocation strategy does not guarantee that investors' retirement goals will be met. Investment professionals manage the portfolio, moving it from a more growth-oriented strategy to a more income-oriented focus as the target date gets closer. The target date is the year that corresponds roughly to the year in which an investor is assumed to retire and begin taking withdrawals. Investment professionals continue to manage each portfolio for approximately 30 years after it reaches its target date.

The target allocations shown are as of March 31, 2024, and are subject to the oversight committee's discretion. The investment adviser anticipates assets will be invested within a range that deviates no more than 10% above or below the allocations shown in the prospectus. Underlying funds may be added or removed during the year. Visit capitalgroup.com for current allocations.

Benefit from professional oversight and a commitment to low fees

Low fees are crucial to positive investor outcomes

There are fees and expenses associated with investing through an employer’s retirement plan. High investment fees and costs can reduce your long-term retirement savings. The lower the costs, the better it is for you.

Experience can make a difference

Our Target Date Solutions Committee brings a diversity of experience and draws on the fundamental research and quantitative resources of the global Capital Group team.

An emphasis on stocks

Our approach to allocating between stocks and bonds puts more emphasis on stocks than some other target date funds. This helps manage the risk of investors outliving their savings. We also place a greater emphasis on dividend-paying stocks in an effort to provide more equity exposure while managing volatility.

Investment professionals invest alongside you

In addition to managing the funds, our investment professionals invest their own money in the funds.

Find your target date fund

The target date is the year closest to the year you plan to retire. To find your target date fund, add your birth year to the year you plan to retire and begin taking retirement withdrawals. The retirement age is 65 for many investors but may be different for you.

To determine your retirement year:

|

Birth year |

|---|---|

+ |

Retirement age |

|

Retirement year |

Select the fund that is closest to your retirement year

The Target Date Solutions Committee is responsible for overseeing the target date series. Committee members average 29 years of investment industry experience as of January 1, 2024.