In observance of the Christmas Day federal holiday, the New York Stock Exchange and Capital Group’s U.S. offices will close early on Wednesday, December 24 and will be closed on Thursday, December 25. On December 24, the New York Stock Exchange (NYSE) will close at 1 p.m. (ET) and our service centers will close at 2 p.m. (ET)

Sample retirement asset allocations

Use our sample retirement asset allocations to build a retirement investment portfolio based on your time frame.

How do you know which investments to include in your retirement portfolio? Your selections will help determine the health of your finances in retirement.

Ideally, your mix of investments would grow enough to support you in retirement while buffering you from the ups and downs of market fluctuations. But how do you find the right combination of investments?

Your financial professional can work with you to create a customized savings plan. Together, you should assess your overall situation, including your other assets, specific financial needs and risk tolerance.

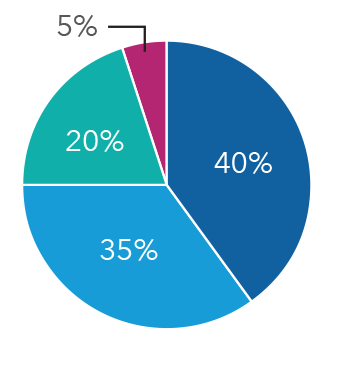

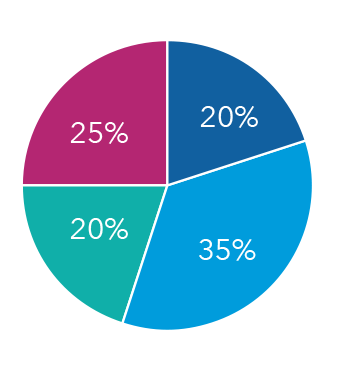

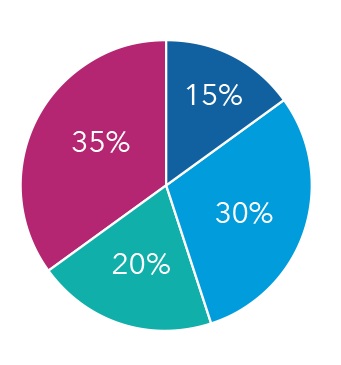

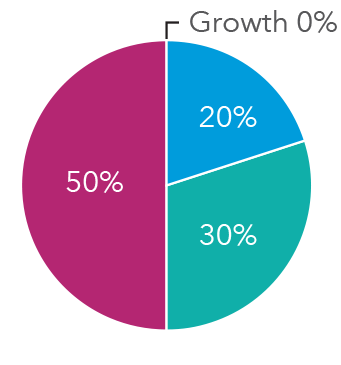

You can also use the American Funds sample asset allocations as a guide when choosing your investments. This collection of sample portfolios was designed for investors based on their retirement time frames. The style categories shown — growth, growth and income, equity income/balanced, and bond — are commonly found in retirement plans. Find the sample designed for your time frame below.

Asset allocation for retirement

Click on any sample for more details and to see how the portfolios compare.

Style categories

Growth funds provide the highest potential risk and reward, followed in order by growth and income, equity income, balanced and bond funds. Your company’s retirement plan may not offer funds in every investment category.

Samples balance risk and returns based on time until retirement

It makes sense for younger investors to invest with the goal of achieving higher returns so that their retirement savings grow and stay ahead of the rate of inflation. As retirement approaches, older investors tend to move into investments with less risk in an effort to protect the money they’ve saved.

That’s how our sample asset allocations were designed. Sample A puts heavy emphasis on growth for younger investors. Samples B, C and D focus more on income and lower volatility than the preceding samples.

If you find yourself more than 10 years into retirement and more dependent on your savings, you may want to consider investing mainly in funds that aim to preserve what you’ve saved.

Reassess your investment mix regularly

Because your needs, goals, portfolio and situation may change over time, be sure to re-evaluate your investment strategy at least once a year. You can always choose a different sample or create your own mix.

Samples are not investment advice

Remember that the samples are intended only as a general guide. Your financial professional can help you decide if the samples make sense for you. Whether you use the samples or not, you’ll need to decide which specific funds to invest in.