Market Volatility

Market Volatility

As stocks and bonds continue to tumble a week after the Federal Reserve’s latest rate hike, investors are understandably asking how long this painful bear market will persist.

“It’s been a difficult year, and the pain may continue,” says Capital Group economist Darrell Spence. “But it’s important to keep in mind: One of the things that all past bear markets have had in common is that they eventually ended. Ultimately, the economy and the markets righted themselves.”

While past market results are not predictive of future results, it can be constructive to look at history. Based on the trajectory of past downturns, bear markets that were associated with a recession tended to last, on average, about 18 months, Spence notes. So it wouldn’t be unusual for this one to continue well into 2023.

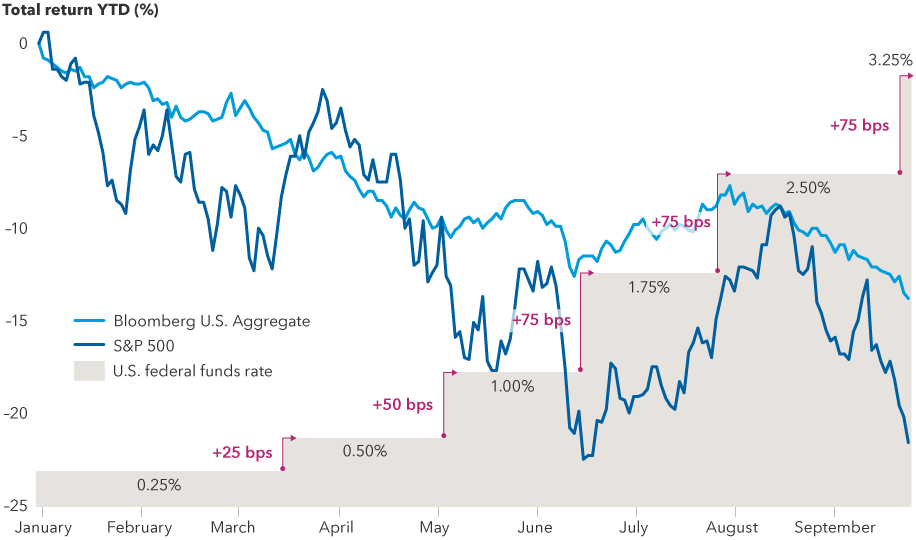

With a recession looming in the U.S. — and probably already underway in Europe — it’s tough to see a catalyst for a near-term rebound, Spence says. Stocks and bonds are likely to come under further pressure as long as the Fed continues to aggressively tighten monetary policy in an attempt to curb inflation, which is hovering around 8%.

Stocks and bonds have tumbled this year as the Fed fights inflation

Sources: Capital Group, Bloomberg Index Services Ltd., Refinitiv Datastream, Standard & Poor’s. As of September 23, 2022.

Fed rate hikes shift into overdrive

Last week, the Fed raised its benchmark interest rate by 75 basis points for the third time since June. That hike brought the federal funds rate to a target range of 3.00% to 3.25%, the highest level since 2008. Based on the latest Fed projections, the central bank intends to take that rate above 4.50% in the months ahead.

Confirming the central bank’s hawkish stance, Fed Chair Jerome Powell said tighter financial conditions are necessary to achieve the goal of restoring price stability. That means bringing the inflation rate closer to the Fed’s 2% target.

“We have got to get inflation behind us,” Powell said during the Fed’s September 21 policy announcement. “I wish there were a painless way to do that. There isn't.”

Financial assets have declined sharply since then, weighed down by the realization that the Fed and other central banks around the world may have to raise interest rates more than previously expected. The S&P 500 Index, the Dow Jones Industrial Average and the tech-heavy Nasdaq Composite are all in bear market territory, defined as a decline of 20% or more from a recent high. The U.S. bond market, as represented by the Bloomberg U.S. Aggregate Index, is down about 14% on a year-to-date basis, as of September 23.

Mounting troubles in Europe

Markets have also come under pressure due to events outside the U.S., including Russia’s escalation of the war in Ukraine, an economic downturn in Europe and a controversial U.K. tax-cut proposal that has triggered fears of a fiscal crisis. U.K. bonds and the pound have plummeted since the plan’s unveiling on Friday.

A European recession may already be underway due to the impact of higher energy prices, which have been exacerbated by the war, according to Capital Group European economist Robert Lind. A harsh winter could make matters worse, sending energy prices even higher.

“The depth and duration of the recession will depend largely on two factors: the war and the weather,” Lind says. “Both of which are impossible to predict.”

At the same time, Lind adds, the European Central Bank and the Bank of England have no choice but to continue raising interest rates since they face the same elevated inflation levels as the United States. He expects the ECB and the BoE to raise rates through the fall and winter months.

The Fed pivot

Looking ahead to 2023, investors will turn their focus to another key question: When will the Fed stop raising rates or even start cutting again?

At the moment, there is little pressure for the Fed to change course, says Capital Group economist Jared Franz. Consumer spending is relatively healthy. The U.S. job market is extremely strong. And the unemployment rate remains near a record low of 3.7%.

But when the unemployment number starts moving higher — as it typically would during a recession — Fed officials will be forced to choose between fighting inflation and pushing millions of Americans out of work, Franz explains.

“It’s easy to talk tough on inflation when your unemployment rate is under 4%,” Franz says. “But what happens when it climbs to 6% or 7%? In my view, that’s about as much pain as the Fed is willing to accept. At the current pace of rate hikes, we’re on course to hit 7% unemployment in the second half of next year. I think it would be very tough to keep monetary policy tight in that environment.”

The S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

The Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market.

The NASDAQ Composite Index tracks the performance of more than 3,000 stocks listed on the NASDAQ and is often viewed as an indicator for the newer sectors of the economy.

The Dow Jones Industrial Average is an index of 30 of the largest blue-chip stocks in the market. The DJIA is a price-weighted index, as opposed to one that is market-cap weighted, such as the S&P 500.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

S&P 500 (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2022 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Our latest insights

-

-

Market Volatility

-

Market Volatility

-

-

Artificial Intelligence

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Darrell Spence

Darrell Spence

Robert Lind

Robert Lind

Jared Franz

Jared Franz