Market Volatility

Emerging Markets

- Higher U.S. bond yields, a stronger dollar and country-specific risks have fueled volatility in emerging markets bonds.

- Fundamentals for emerging markets remain favorable overall.

- Global growth, firmer commodity prices and deeper local bond markets should help provide resilience.

- The selloff has created potentially attractive entry points for selective investors.

Is a crisis brewing, or is this an overdue market correction? That’s the big question confronting investors in emerging markets debt in mid-2018. For me, what we’re experiencing feels more like a rough patch.

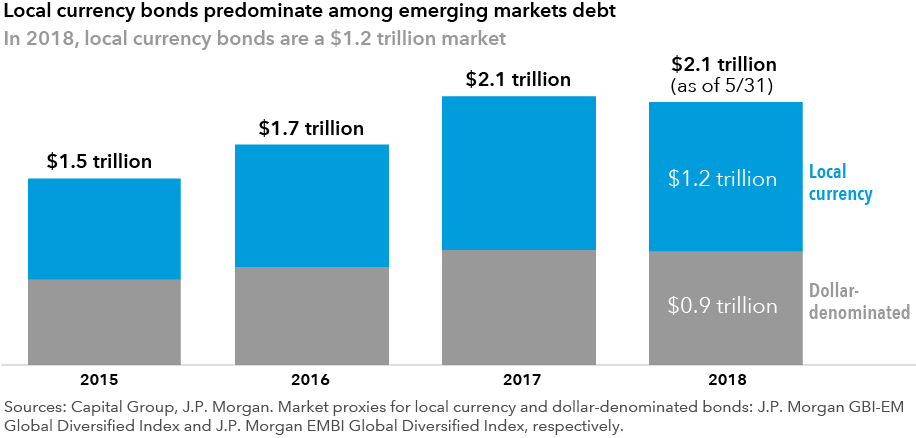

Dollar-denominated bonds, as measured by the J.P. Morgan EMBI Global Index, are down approximately 5% year to date; local currency debt, as measured by the J.P. Morgan GBI-EM Diversified Index, is off 4% in dollar terms through June 11. But these market moves are on the heels of double-digit gains in 2017.

What’s behind the selloff?

The selloff seemed to be sparked by a couple of related developments. U.S. Treasury yields climbing to 3% and a bout of dollar strength dimmed the appeal of certain emerging markets currencies and bonds.

Confidence in the asset class may have taken a hit lately, but the market has actually done a good job of pinpointing country-specific vulnerabilities. In the cases of Argentina and Turkey, for example, higher bond yields seem justified. Both countries face elevated levels of short-term debt, inflationary pressures and expensive currencies relative to the dollar, as well as governments who are unwilling to take measures to address these issues in the longer term.

Why I remain cautiously optimistic

So far, Argentina, Turkey and Brazil have been among the hardest hit. The possibility that negative sentiment may spread to other emerging markets can’t be ignored. With that in mind, a degree of caution is warranted in the near term.

Escalating trade tensions, U.S. midterms, dollar strength and presidential elections in Mexico and Brazil, are among the possible sources of volatility that I’m keeping an eye on. The European Central Bank is likely to soon announce the end of its bond-buying program, and that could also be impactful. And yet, as a selective investor, I continue to find plenty of reasons to remain constructive:

- Fundamentals for a number of developing economies remain favorable.

- Vulnerabilities to political risks or higher U.S. interest rates may not be as widespread as is sometimes assumed; better debt structures should allow them to withstand higher yields.

- Synchronized global growth, albeit at a more moderate pace than last year, should be broadly supportive.

- Commodities prices are stable and appear reasonably valued.

- Policymaking by central banks in many developing nations is closely tied to growth and inflation in those respective domestic economies.

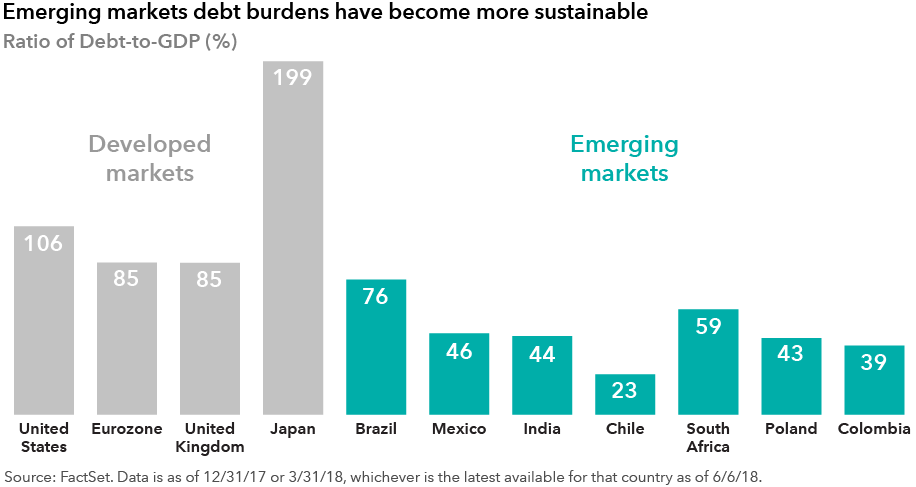

- Debt levels generally aren’t alarming and, in some cases, debt burdens are substantially lower than in major developed nations.

What’s more, rising rates in the U.S. don’t necessarily have to result in a selloff in emerging markets debt. The key thing is that as long as they rise with what the market is expecting and what the U.S. Federal Reserve is communicating, I don’t think there will be an issue for emerging markets debt. Balanced growth in emerging markets is a much more supportive phenomenon.

In the past, emerging markets debt was primarily dollar-denominated; so when U.S. rates rose there was often a rush for the exits in emerging markets bonds. But since local currency markets have grown in recent years, that pattern may not repeat.

Modest preference for local currency bonds

As a portfolio manager for American Funds Emerging Markets Bond Fund®, I remain diversified across the entire emerging markets bond universe.

Modestly greater emphasis on local currency bonds seems appropriate to me in the current environment. In terms of the yield curve, I’m balancing exposure to higher yielding local sovereign bonds with maturities of less than five years with investments in longer maturity bonds from investment-grade countries.

I’m mostly favoring government bonds issued by countries offering a combination of positive growth prospects and political stability (or diminishing political risks). I also prefer to be invested in markets where central bank policy is clear and more driven by domestic economic factors rather than external forces.

India, South Africa, Mexico and several African nations are among the markets offering attractive opportunities at present. Recent volatility has, in some instances, had a silver lining: lifting return potential in a number of markets where fundamentals remain just as solid as they were before the market jitters began.

With U.S. high-yield markets at their tightest spreads in more than a decade, emerging markets debt could be an attractive alternative for investors to consider: The asset class has offered comparable income with modestly better equity diversification potential.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings.

The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional cash securities, such as stocks and bonds.

Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

Our latest insights

-

-

Market Volatility

-

Market Volatility

-

-

Artificial Intelligence

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Kirstie Spence

Kirstie Spence