U.S. Equities

U.S. Equities

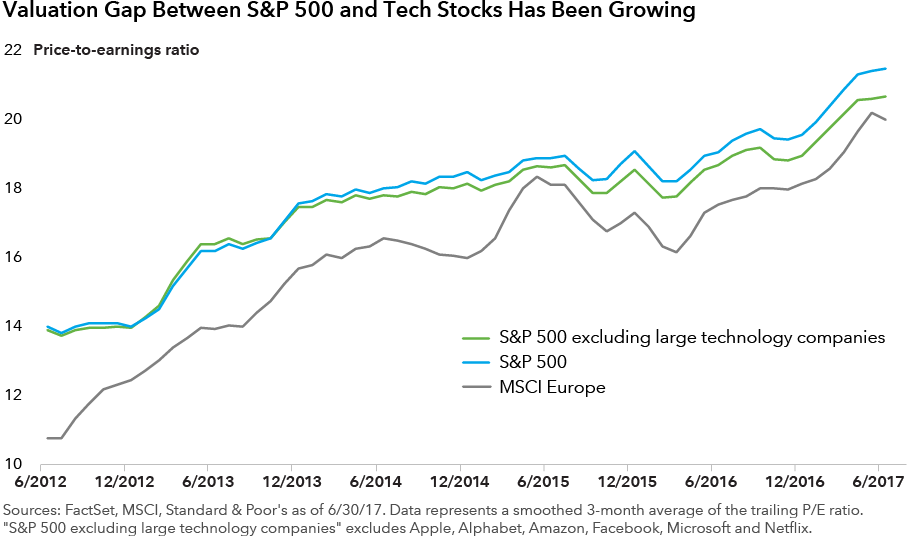

High-flying tech companies have gained attention for their robust returns in recent years, but those strong gains have also pushed market valuations higher. When excluding FANG stocks (Facebook, Amazon, Netflix, and Google parent Alphabet) plus the two largest technology companies (Apple and Microsoft), the U.S. does not look as overvalued as it may first appear. In fact, its price-to-earnings ratio becomes comparable to international markets, which have been touted for having more bargain opportunities during the recent expansion. Tech still maintains strong growth potential, but investors should remember that aggregate numbers don’t tell the entire story, and fundamental research can be used to uncover stocks still under the radar.

The S&P 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2017 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

Past results are not predictive of results in future periods.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Our latest insights

-

-

-

Global Equities

-

Economic Indicators

-

Related Insights

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.