Market Volatility

Equity

Nearly a decade ago, Greg Wendt recalls, Netflix had reached an early crossroads. The company, which began its life renting DVDs through the mail, decided to split its video streaming business from its DVD rental business, a decision that was panned by the market.

The company’s shares plummeted, reducing its market capitalization to the point that it became a small-cap company. “CEO Reed Hastings had a vision he was driving for,” recalls Wendt, an equity portfolio manager with 32 years of investment industry experience. “The way he put it, ‘The name of the company is Netflix, not Discs in the Mail.’” The company ultimately canceled the split, recovered and grew into a streaming media giant with more than 182 million subscribers worldwide. No longer a small company, as of July 30, Netflix had a market capitalization of more than $200 billion.

“Smaller companies are often willed to life by dreamers,” says Wendt, a co-president of SMALLCAP World Fund®.

“And a key to successful investing in small companies is understanding their dreams, what their potential might be and maintaining patience as the business hits bumps along the road.”

Kids in the candy shop

Since he began his career as a retailing analyst, Greg has naturally gravitated toward small-cap companies, defined at Capital Group as businesses with market capitalizations of $6 billion or less. “I felt that following small companies gave me an opportunity to really add value by pulling apart the mouse trap and truly getting to understand a business, its leaders and their vision,” he says.

“Many people understand the investment case for the largest companies with household names, like Amazon or Microsoft,” says equity portfolio Brad Freer, a likeminded investor who has been following small companies for 27 years. “But with small companies I feel like a kid in a candy shop looking for new ideas.”

Growth and risk potential

Some small companies are among the world’s most innovative and fastest-growing businesses, many of which can be found among the technology, health care and consumer sectors. But they also tend to involve more risk than their large-company counterparts. While many small companies have evolved into household names, like Netflix, Tesla or biotech company Gilead Sciences, many more stagnate or fail.

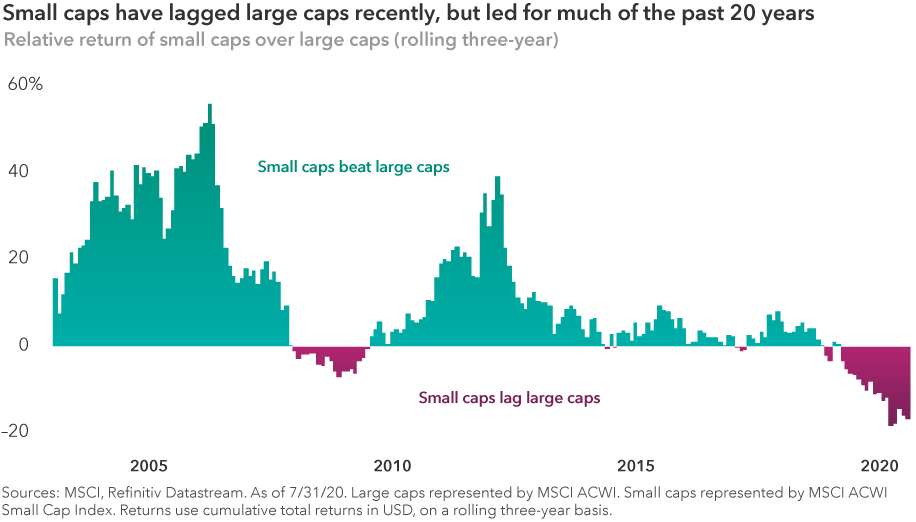

As a result, small caps tend to be more volatile than their larger counterparts. During the first quarter of 2020, for example, the MSCI ACWI Small Cap Index, a broad measure of the global universe of small companies, slid more than 30%, compared with a decline of about 21.4% for the MSCI ACWI Index, a broad measure of the global large-cap universe. But in the second quarter, small caps rebounded strongly, soaring 24.8% compared with a gain of 19.2% for large companies.

It’s the digital divide, not growth versus value

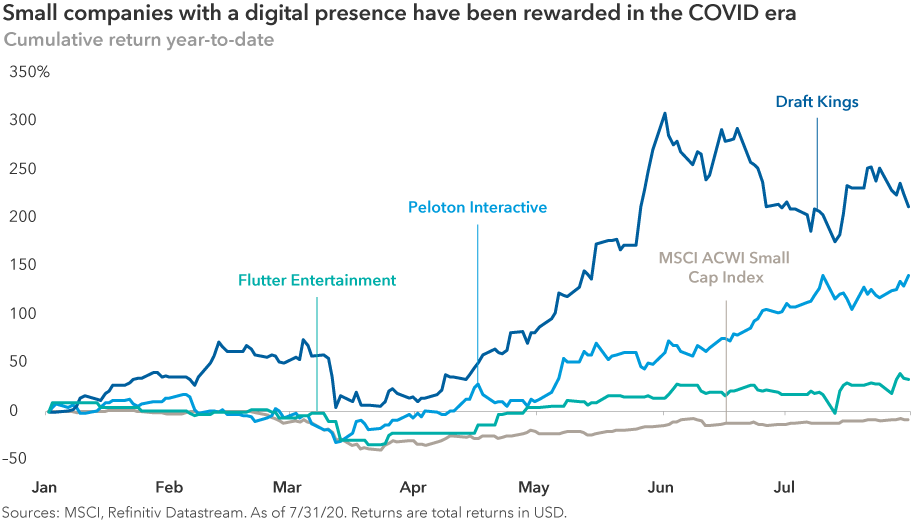

With the coronavirus pandemic and government stay-at-home orders accelerating demand for certain e-commerce, video content, social media and cloud businesses, many of the disruptive growth companies that led the market in the last expansion have continued to lead. “I think it is a bit artificial to describe what we have seen as growth vs. value,” notes Wendt. “We have seen business accelerate for companies on the right side of the digital divide, and those on the wrong side have largely fallen behind. Today, it’s a stock picker’s market.”

The most successful companies anticipate such shifts, says Wendt. “In many respects small companies are better able to do so because their size can allow them to be nimble and quickly adapt to changing circumstances and consumer preferences.”

Thinking outside the digital box

Consider, for example, Peloton, the digital exercise equipment company launched in 2012. Peloton’s stationary bike allows users to participate remotely in spin classes streamed from its studio. “This company is providing a service few even dreamed about 10 years ago, and today its business model is widely regarded as the fitness company of the future and a threat to the gym industry,” explains Wendt. Not even a public company a year ago, Peloton has become relatively large. “The company has been thinking digitally since day one,” says Wendt.

Indeed, the digital divide has stretched across industries, impacting business models far afield of the tech sector. “Some investors naturally think of cloud-based software providers, fintech businesses or e-retailers as the primary beneficiaries in a post-COVID world,” says Freer, “but at Capital we try to go a little deeper and seek to identify a broad range of companies with the potential to benefit from a digital-first approach.”

Consider the global gaming industry, which Wendt continues to cover as an investment analyst. “In my view, the companies with the potential to transform the global gaming industry are not the big casino businesses but online gaming platforms like Draft Kings in the U.S. and Flutter in the U.K., which had a huge head start on the digital side of gaming,” says Wendt.

Of course, not all fast-growing small companies have a digital focus. “Consider German battery maker Varta,” suggests Freer. “This company makes micro batteries, and the quality threshold for such batteries is high because they are used in hearing aids and other audio equipment.” As Varta’s hearing aid business grew, its technology became increasingly differentiated, explains Freer. More recently, the popularity of digital music players like the iPhone created a demand for earbuds, which also need these micro batteries. As demand grew, Varta’s business expanded rapidly. “Today it dominates the market for earbuds,” adds Freer.

Tracking a world of opportunity

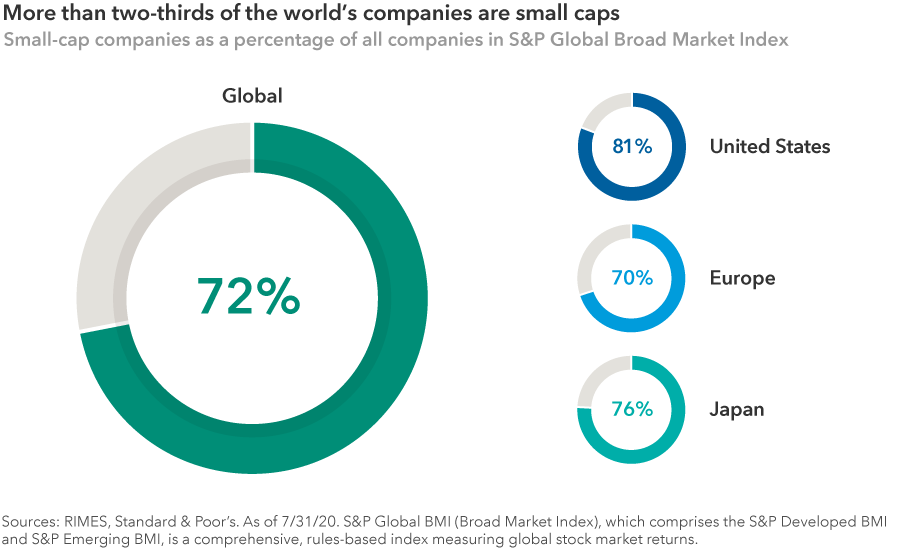

Wendt, Freer and the other managers of SMALLCAP World Fund invest selectively, basing decisions on deep fundamental research. This is no small undertaking, given that the small-cap universe is vast and diverse, accounting for about two-thirds of companies worldwide.

Serving this effort is a network of about 130 investment analysts and 20 portfolio managers. This research team strives to stay at the forefront of innovation and change, following thousands of small-cap companies across dozens of industries and geographies.

“Our effort starts with a big funnel at the top, then we narrow our search so that we might discuss five or 10 new investment ideas in a given week,” says Freer. “We then narrow that universe by meeting with company managements, interviewing competitors and suppliers, and building financial models until we gain conviction to invest.”

Sometimes Capital’s analysts and managers will meet with companies when they're still private and track their progress, checking in on management teams to evaluate how they are executing on their plan as they grow. “It's one thing to have a great idea, but quite another to execute on it,” Freer adds.

From acorns to oaks

Wendt, Freer and their fellow portfolio managers, of course, invest in smaller companies with the hope that they may one day grow into large companies.

“We recently went back and looked at every investment made in SMALLCAP World Fund over a 16-year period to try to identify common trends among successful investments and learn from our mistakes,” says Freer. “Some of the most successful investments achieved what legendary investor Peter Lynch referred to as multi-baggers. This is an investment that grows two, three, or more times than the original investment. Of the 3,900 investments made by the fund over the 16 years, 172 achieved triple-bagger status, or a 300% profit over our cost base.”

Not all investments have worked out

Most investments never achieve that level of success of course, and in some cases they fail. “One thing that makes this asset class so complicated and difficult is that you need to recognize that you're going to make mistakes,” says Freer.

Wendt recalls investing in American Classic Voyages, a venture seeking to disrupt the maritime industry, which was protected by federal regulations. The company planned to build cruise ships in the United States and seek to capitalize on demand for cruises to Hawaii. “They raised the capital, hired a dream management team, but the shipyard was unable to successfully build the cruise ship,” says Wendt. Ultimately the company failed. The lesson? “If something's never been done before, don't assume it can be done.”

More recently, the fund invested in Luckin Coffee, a coffeehouse chain seeking to be the Starbucks of China that purported to use a digital approach to deliver coffee inexpensively. The business proved to be engaging in apparent accounting fraud and was ultimately delisted.

Patience has been a virtue

With regard to the fund’s successes, they’ve had one thing in common. All were held for more than a year. “Whenever I make an investment, step one is to make sure I understand why I'm buying a stock and how I think it will be successful,” says Wendt. “And as long as that thesis doesn't change, I will tend to stick with the investment for years. If the thesis changes, or if a stock goes up too fast, I'll sell it. But otherwise I'm pretty stubborn. I try to be patient with growth companies.

“At Capital Group, we have the luxury of truly thinking long term,” says Wendt. “Portfolio manager compensation is largely based on an eight-year time frame, which is unique in our industry and allows us to be patient investors. This long-term perspective enables us to look ahead to 2030 and invest in some of these small-cap dreamers that could eventually lead the next wave of global innovation.”

Indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing companies.

Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks.

S&P Global BMI (Broad Market Index), which comprises the S&P Developed BMI and S&P Emerging BMI, is a comprehensive, rules-based index measuring global stock market returns.

MSCI ACWI is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes.

MSCI ACWI Small Cap Index is a free float-adjusted market capitalization-weighted index that is designed to measure equity market results of smaller capitalization companies in both developed and emerging markets.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

S&P Global BMI is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part are prohibited without written permission of S&P Dow Jones Indices LLC.

Our latest insights

-

-

Market Volatility

-

-

Artificial Intelligence

-

Interest Rates

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Greg Wendt

Greg Wendt

Brad Freer

Brad Freer