Market Volatility

Interest Rates

Is the bull market for bonds over? With the Federal Reserve poised to raise rates in 2017, should one sell their fixed income? Many sophisticated investors believe the answer to these two questions is a firm “No.” In any environment, bonds perform several roles in overall asset allocation. Additionally, not all bonds are hurt as rates rise, especially if rates rise more slowly than usual.

Although the Fed’s campaign to gradually raise interest rates is likely to act as a modest headwind for fixed income securities, investors don’t need to panic.

1. Sharp rate hikes create the risk of negative returns for bonds

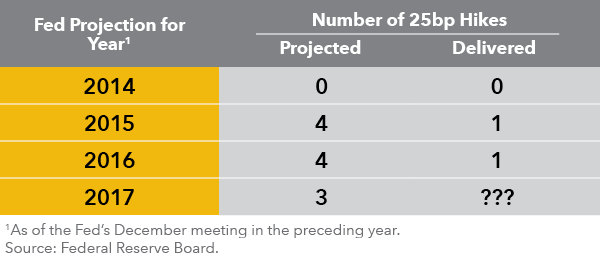

You may have seen headlines or tweets declaring that the bond bubble is about to pop, or that “Bondmageddon” is coming. However, the Fed is projecting a fairly gradual pace of hikes: three 25-basis-point moves this year. But bond investors expect a much more gradual path for rising rates, with only two increases priced into the futures market. In recent years, the Fed has often overestimated just how much it will raise rates, as the table below shows.

“Despite what the Fed projects it will do, I think it is more likely that we will only see one or two rate hikes this year,” says my colleague John Smet, a portfolio manager with The Bond Fund of America®.

Simple bond math implies that many bond funds could see little to no rate-driven losses — as long as hikes occur slowly. Let’s consider the Bloomberg Barclays U.S. Aggregate Index, a common industry benchmark. Given its yield, duration and other characteristics at the end of 2016, and with other factors constant, interest rates would need to rise 1.3% (equivalent to more than five 25-basis-point hikes) over the next two years before investors would experience a loss. That’s an even bigger rate increase than the market anticipates.

2. Higher yields mean . . . higher yields!

Most investors know that when yields rise, bond prices fall. But there’s some good news: “Our opportunity to invest in great credit stories at higher yields creates the opportunity for the shareholders of our funds to receive more income,” explains my colleague Karl Zeile, a portfolio manager with The Tax-Exempt Bond Fund of America®.

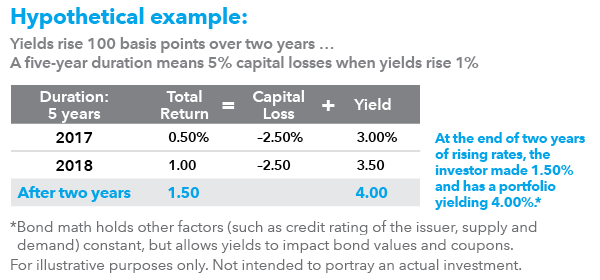

More yield helps to offset falling bond prices. For example, let’s say yields rise 1% over two years — about what the market expects. The table below shows that more yield can actually help to produce a positive total return, despite the bond facing a capital loss:

Another advantage is that higher yields lead to more robust demand for bonds. This in turn helps prevent yields from rising too quickly or too high. Higher yields for U.S. bonds will continue to entice foreign investors who face much lower yields in their local markets. Mutual funds, pension plans and large insurance companies are also likely to increase their fixed income investments as yields rise.

3. Broader market risks persist

The equity bull market has been strong recently, largely based on optimism for U.S. policy changes and potential infrastructure stimulus. But uncertainty — in the form of greater geopolitical risk and the potential for increasing friction regarding global trade and immigration — is clouding the global economic outlook. This creates an obstacle for aggressive Fed tightening and reinforces the need to hold bonds that can protect a portfolio by diversifying equity risk and preserving capital.

The administration’s most bullish policy goals are months or quarters away from being enacted, despite the market’s pricing in positive impacts. Some policies could even create headwinds to growth. Moreover, the geopolitical climate is providing more policy questions than economic answers. In today’s interconnected markets, a disruption or weakness overseas often has the potential to negatively affect U.S. markets and companies.

Investors are prudent to consider the implications of higher rates. However, they are also prudent to consider the risks to global markets. These should not be ignored or underestimated. Thus, I believe owning bond funds that can take advantage of higher yields and provide protection from market shocks by maintaining a low correlation to equity is as important as ever.

Past results are not predictive of results in future periods.

Our latest insights

-

-

Market Volatility

-

Market Volatility

-

-

Artificial Intelligence

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Luke Farrell

Luke Farrell