Market Volatility

Bonds

- Modest growth is supportive for municipal bonds, as are the U.S. Federal Reserve and fiscal policy

- Investor appetite for the asset class seems robust

- The constructive post-tax reform environment remains intact

- With valuations near record highs, emphasize higher quality municipal bonds and use election-year setbacks as entry points for longer term investments

Decent prospects in 2020

Election years and municipal bonds. It’s a combination that has sometimes struck fear in the hearts of investors. The reason? Uncertainty around how tax and other fiscal policies may evolve.

This time around, the election also comes on the heels of six consecutive years of positive returns for municipal bonds. In 2019 alone, investment-grade municipal bonds climbed 7.5%.

Among market watchers, some observers think similar gains are in the cards for 2020. In the opposing camp, others worry the market is overdue for a “bad” year given the extended rally.

2020 will, in the view of portfolio manager Mark Marinella, likely play out somewhere in the middle. “After such healthy returns, and with valuations now so stretched, it’s only sensible to moderate return expectations for muni bonds in 2020,” says Marinella, a portfolio manager for Limited Term Tax-Exempt Bond Fund of America® and The Tax-Exempt Fund of California®, as well as several separately managed accounts.

Three reasons for investors to be constructive on municipal bonds

Marinella sees three key reasons to be constructive: the first applies to fixed income broadly, while aspects of the other two have the potential to shape near-term prospects for municipal bonds in particular:

1. Modest growth and inflation are positives

Many investors intuitively equate strong economic growth with outsized investment returns, especially in equities. For bonds, however, moderate growth and inflation can actually be positive.

Upward pressure on the price of goods and services is often muted in an economy that is merely ticking along. This can help put a lid on inflation, preserving the value of the income that investors earn from bonds.

With little indication that growth in America will race ahead (or indeed, lurch lower), economic conditions in 2020 should, therefore, be supportive of municipal bonds.

2. Unchanged Fed and fiscal policies should also be supportive

Unless some unexpected severe economic challenge necessitates a rate cut, the U.S. Federal Reserve is now on pause.

Interest rates that are low (or merely unchanged) can make for a benign environment for bond yields. That’s because yields and bond prices move inversely: When the Fed hikes rates, yields rise, and the value of bonds falls.

A healthy labor market and consumer spending suggest growth should keep chugging along in 2020. And, even if the economy were to be derailed by trade or geopolitical tensions, the Fed still has room to cut rates — a move that would likely lift municipals and other bonds.

On the fiscal side, it seems almost inconceivable that there is a major shift in taxation or federal spending in an election year. Putting political partisanship to one side, Capitol Hill has shown little appetite for adding to the deficit, now on track to hit $1 trillion by September.

Tax policy changes hold the potential to sway both the supply of new bonds as well as demand from investors. “Whatever the 2020 election result, it’s reasonable to assume that major upheaval in tax policies are off the table until well into the next administration. Near term, that removes a major risk for muni investors,” adds Marinella.

3. Investor appetite for tax-advantaged income is robust

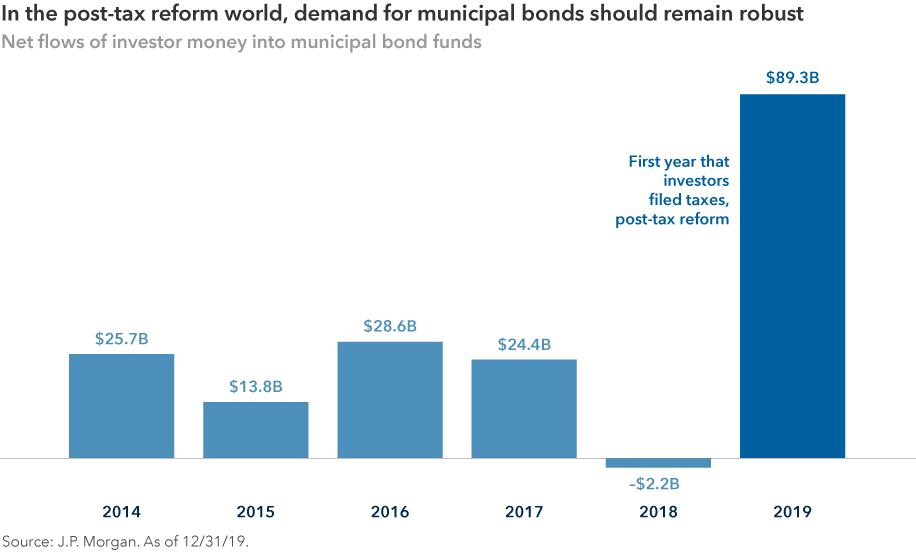

By some measures, 2019 was a record-breaking year for the popularity of municipal bonds. The asset class attracted an unprecedented amount of investor money amid the broader hunt for yield.

Over $89 billion flowed into municipal bond funds in 2019 — about the same as the net amount received in the previous five years combined.

The virtuous circle so often observed in this market was plain to see: Favorable returns acted as a magnet for investor money. Also, many individuals may have become aware of the potential tax benefits of income from municipal bonds for the first time. Following tax reform, last year’s filing season resulted in lots of wealthier taxpayers discovering their overall tax burden had risen.

So, while demand from investors for tax-advantaged income may not set new records in 2020, it does appear entrenched. But how will the supply of new municipal bonds develop?

More than $400 billion of municipal bonds were issued last year — above average for the past decade. Forecasts from market observers suggest that funding needs could result in similar levels of tax-exempt issuance in 2020.

“Assuming investor appetite for tax-advantaged income remains, the balance of supply and demand should still be supportive of municipal bond valuations,” says fixed income investment director Greg Ortman.

2020 vision: Keep an eye on valuations and volatility

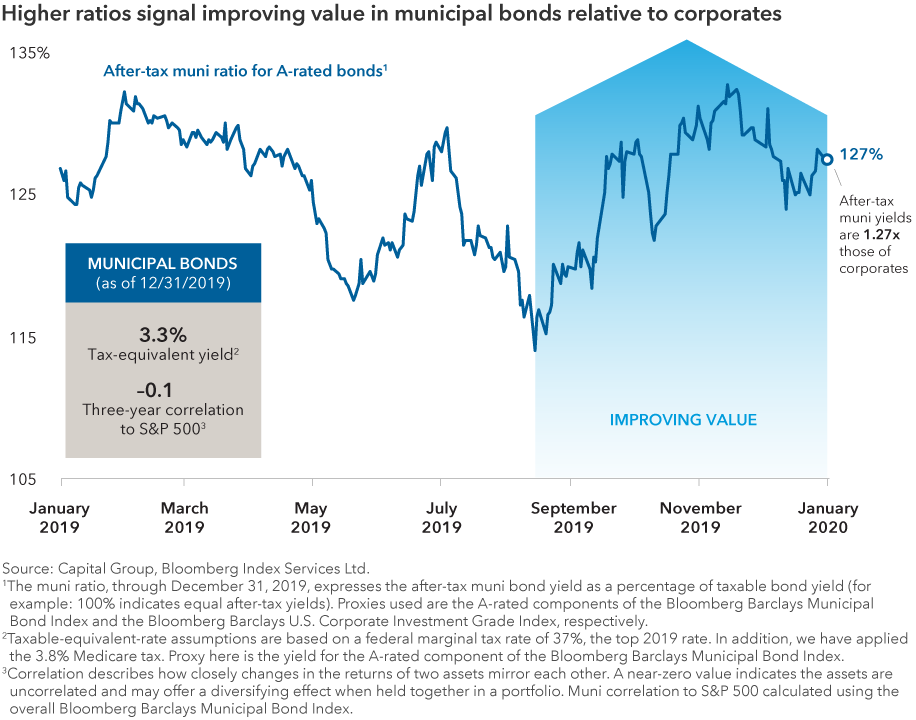

The new year has begun with a decent supply of new bonds, but no letup in investors’ fervor for tax-advantaged income. Already, valuations relative to U.S. Treasuries have moved close to their most expensive levels on record.

Similarly, relative value compared to taxable bonds (measured by the so-called muni ratio) has retreated from its recent peak, having mostly trended higher since August 2019. The ratio shows after-tax muni yields as a percentage of taxable bond yields.

Put simply, higher ratios indicate that the after-tax income potential of municipals meaningfully surpassed that of corporate bonds for taxpayers in higher (and, to a lesser extent, middle income) tax brackets.

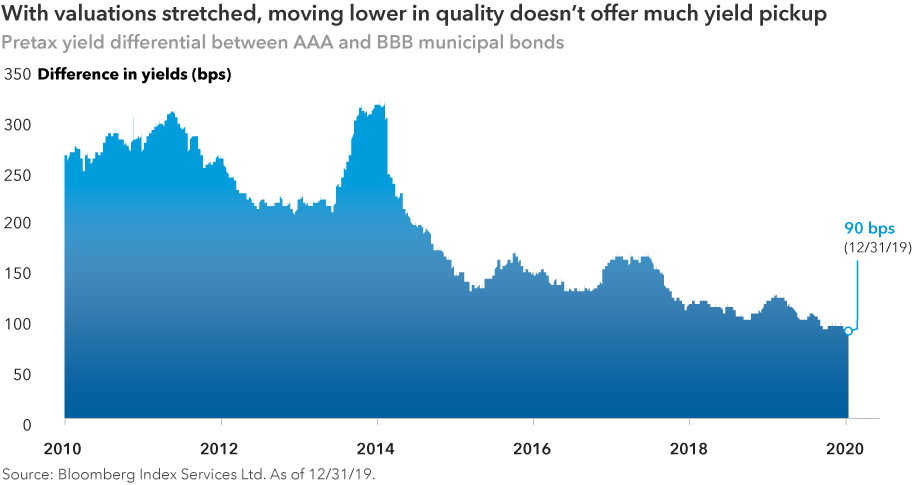

Within the asset class, investors aren’t being very well compensated for stepping down in credit quality. The yield differential (or spread) between triple-A and triple-B municipal bonds was about 90 bps (0.9%) at the end of 2019 — close to its lowest level for more than a decade.

“Amid such stretched valuations, it’s prudent to emphasize higher quality in municipal bond allocations,” says fixed income portfolio manager Karl Zeile. “All our investment decisions at Capital center on individual bonds. Bond-by-bond credit research is central to how we invest,” adds Zeile, a portfolio manager for several funds including The Tax-Exempt Bond Fund of America® and American High-Income Municipal Bond Fund®.

Sector positioning in Capital portfolios therefore naturally emerges from investment decisions with regard to specific bonds. That said, Capital’s team of municipal bond investment analysts do see solid fundamentals across most sectors from the nearly $4 trillion market, with tobacco settlement bonds a notable exception.

In a market of this size, there are likely to be pockets that are not as closely researched by investors. Single-family housing bonds are a case in point. These bonds are issued by various state and local housing authorities, with bond proceeds used to help low-income and first-time buyers purchase their homes.

In some cases, the credit story around these bonds has improved: The underlying mortgage pools are either federally insured or are structured in ways that can reduce the risk of default.

From a valuation standpoint, these bonds look attractive. “For very high-quality credits, it’s not uncommon to see housing municipals offer around 0.60% additional yield over similarly rated munis from some other sectors. Typical pre-tax yields on investment-grade municipals are around 1.5% to 2.0% lately.

Marinella says that recent moves lower in yields across fixed income have him worried that some investors may consider giving up on bonds. “We all want a 10% coupon. I would take it if I could get it. But high-quality bonds, including municipals, are meant to be an anchor for investors, providing three of the key roles of fixed income: equity diversification and capital preservation, as well as income,” he adds.

And, if history’s any guide, this election year is likely to include some bouts of volatility. “Decades of investing have taught me that when valuations are this elevated, it’s important to view market setbacks as possible investment entry points and focus on longer term value.”

Bloomberg Barclays Municipal Bond Index is a market value-weighted index designed to represent the long-term investment-grade tax-exempt bond market.

Bloomberg Barclays U.S. Corporate Investment Grade Index represents the universe of investment grade, publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements.

Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

The indexes are unmanaged, and their results include reinvested dividends and/or distributions but do not reflect the effect of sales charges, commissions, account fees, expenses or U.S. federal income taxes. Investors cannot invest directly in an index.

The return of principal for bond funds and funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds.

State-specific tax-exempt funds are more susceptible to factors adversely affecting issuers of their states' tax-exempt securities than more widely diversified municipal bond funds. Income from municipal bonds may be subject to state or local income taxes and/or the federal alternative minimum tax. Certain other income, as well as capital gain distributions, may be taxable.

The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional cash securities, such as stocks and bonds.

Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund's investment policies. Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Standard & Poor’s 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Our latest insights

-

-

Market Volatility

-

-

Artificial Intelligence

-

Interest Rates

Related Insights

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Mark Marinella

Mark Marinella

Greg Ortman

Greg Ortman

Karl Zeile

Karl Zeile