Market Volatility

Global Equities

As a portfolio manager with New Perspective Fund®, I invest in many large, multinational companies. The most common question I get these days is whether I am worried about the impact of de-globalization. The risks are clear: rising U.S.-China tensions, the war in Ukraine, increasing trade barriers, broken supply chains, a painful bear market and a slowing global economy.

Given the turbulence, aren’t multinational companies the most vulnerable of all?

I believe the opposite is true. Simply put, multinationals are in many ways best positioned to navigate an uncertain environment and develop effective solutions to disruptions. That includes an increasingly “multi-local” approach to business, putting them closer to consumers around the world.

Here are four reasons I remain optimistic that multinationals can thrive in tough times:

1. Multinationals can adapt to U.S.-China tensions

When I first discussed this subject a few years ago, the U.S.-China trade war was just beginning to command headlines. Since then, we’ve seen many twists and turns.

The two biggest economies in the world have hit each other with onerous tariffs and other trade restrictions. China has initiated more trade with Russia, despite international sanctions imposed by the U.S. and European Union following the invasion of Ukraine last year. And just a few weeks ago, the U.S. military shot down what it believed to be a spy balloon sent by China to get a glimpse of U.S. defense installations — further stressing U.S.-China relations.

Beyond those immediate issues, we still have a long way to go before the U.S. and China can resolve more entrenched disputes over intellectual property theft and heavy subsidies for China’s state-owned enterprises. Those prickly issues may take years or even decades to resolve — if they get resolved at all.

In the meantime, companies that conduct business all over the world are doing what they do best: finding ways to adapt and succeed regardless of growing headwinds.

For example, in the computer chip industry, Taiwan Semiconductor Manufacturing Company (TSMC) and chip equipment maker ASML are both expanding their operations around the world. TSMC is, rather remarkably, building new manufacturing plants in Arizona and Japan, while Netherlands-based ASML is more quietly investing to bolster its operations in Germany, Connecticut and California. As new facilities are built, Caterpillar, the world’s largest manufacturer of construction equipment, could see increased demand for its heavy duty products.

These are examples of the types of companies I like to call “global champions.” As a group, they often do well in almost any environment. They can certainly weather tough times, but then they can also reposition themselves to succeed when things begin to turn around.

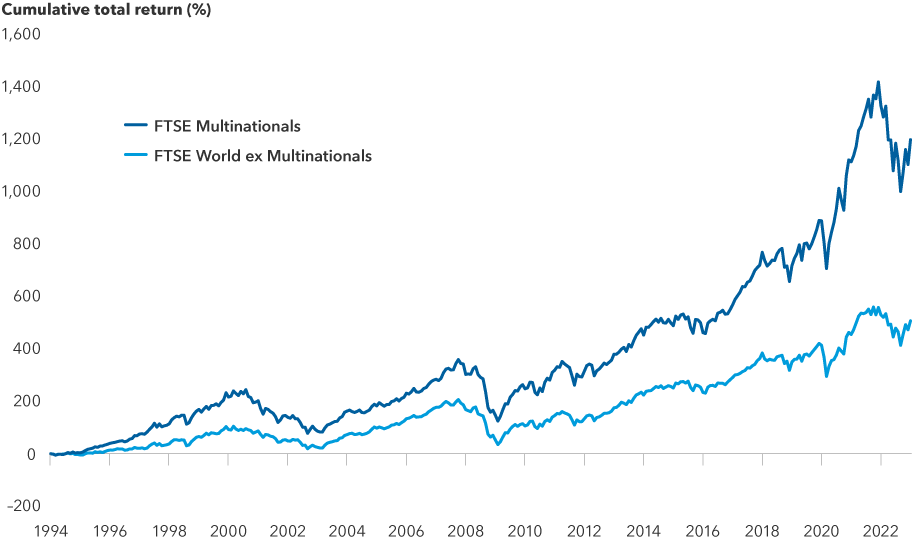

Multinational companies have outpaced the market

Sources: Capital Group, Refinitiv Datastream. The FTSE Multinationals Index comprises companies which derive more than 30% of their revenue from outside their domestic region. Data as of 1/31/23. Past results are not predictive of results in future periods.

2. Experienced management teams can handle challenges

What’s the rationale for my high level of confidence? There is a reason multinational companies have come to dominate the global economy and financial markets. For the most part, they are run by managers who are smart, tough and experienced. This isn’t their first rodeo. They have seen all types of trade environments, favorable and unfavorable. In my view, these battle-tested companies are favorably positioned to survive and even thrive in a hostile landscape.

Nestlé provides a good example of how a multinational can tap into high-tech solutions to streamline its supply chain operations. In recent years, the food giant has increasingly used the blockchain — best known as the foundation of bitcoin-related technology — to enable faster, transparent and more cost-effective delivery of products. The publicly available blockchain data not only allows the company to track its supply chain sourcing in a more efficient way, it also shares the exact origin of the products customers are looking to purchase. If you want to know where those coffee beans are from, just scan a barcode and you’ll have the answer.

For investors, it’s important to avoid focusing too much on the noise surrounding trade, protectionism and geopolitical conflict. It’s easy to get lost in the political rhetoric over steel or semiconductors or whatever product is targeted next. There are conflicting data points released nearly every day, and many of them are inconsequential. To the extent that these types of conflicts cause investors to shy away from multinational companies, paying too much attention to the rhetoric is detrimental to successful long-term investing.

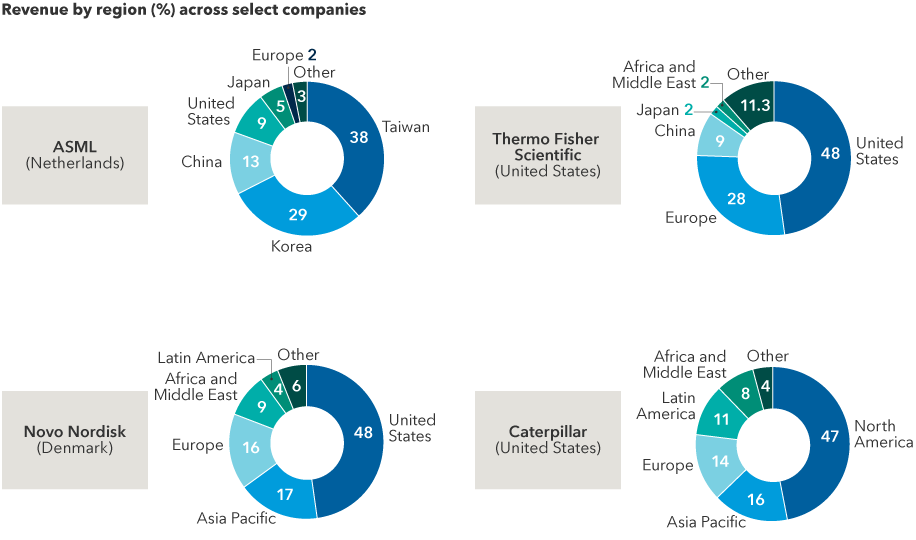

Global companies scour the world for customers

Sources: Capital Group, FactSet. Revenue by region is estimated by FactSet based on most recently reported figures. As of 2/24/22.

3. Reshoring supply chains is likely to benefit some companies

Many global companies are establishing successful operations in local markets, rather than retreating in the face of trade barriers. More and more it is becoming crucial for multinationals to produce where they sell. To succeed, they must be able to move swiftly and respond efficiently to local competition.

Most important, many global companies are moving away from single-source supply chains. Reliability and robustness are of greater importance than cost and efficiency. That means bringing some manufacturing back home, or “reshoring,” and moving some to other countries, such as India, Vietnam and Mexico.

Sports apparel giant Nike optimizes this approach with its hyper-local sales initiatives. For instance, Nike has launched data-driven retail stores that stock shoes according to online buying trends in surrounding ZIP codes. It doesn’t get much more local than that. In Europe, Nike has established a speedy supply chain initiative that allows it to tailor colors and materials based on individual customer preferences in each city it operates.

Visa and Mastercard are following much the same approach when it comes to electronic payment processing, which must be tailored not just to the preferences of local customers but to the strict financial regulations of governments around the world. As a result, both have grown at a healthy pace while evolving and adapting to a changing set of competitors in the fintech industry.

The companies that successfully navigated the COVID crisis were able to quickly expand their online offerings, localize their supply sourcing, produce closer to where they sell and tap into multiple suppliers all over the world. This unpredictable environment played to the strength of multinational companies with the expertise, the resources and the money to adapt at a moment’s notice.

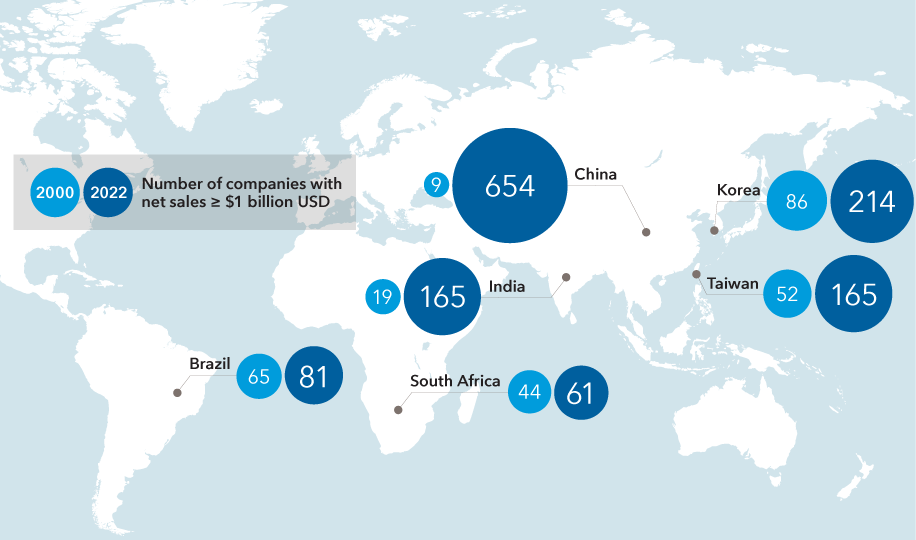

A new breed of multinational companies has arrived

Sources: Capital Group, FactSet, RIMES. Includes all companies within the MSCI Emerging Markets Investable Markets Index (IMI) as of 12/31/00 and 12/31/22.

4. Global champions thrive in emerging markets

In many ways, a multi-local strategy is crucial for companies based in the U.S., Europe and Japan that are looking to stay relevant or expand into faster growing emerging markets. Many of those countries — China, India, Brazil, etc. — are nurturing their own multinational giants, as well as smaller, single-country-focused competitors and not waiting for the traditional global players to catch up.

For example, Mercado Libre — often referred to as “the Amazon.com of Latin America” — has done a remarkable job of defending its territory from the exact company it is so often compared to. One of Mercado Libre’s chief advantages is a more aggressive use of third-party sellers, many of which are based in Latin America, giving local customers greater access to locally sourced goods though a fast, efficient online platform.

A significant risk for some large multinationals is that they could be “leapfrogged” by smaller competitors who are more in touch with local markets. In my view, that dynamic is a bigger threat than any geopolitical or trade-related issue.

Emerging markets consumers are looking for brands they can trust and companies that know the local marketplace. Large multinationals that can break themselves down, think locally, act nimbly and launch products quickly are more likely to succeed in the long run.

In the meantime, this shifting global landscape is good news for stock pickers with a penchant for fundamental research. Not every company will get it right, and it’s our job to separate the ones that can from those that cannot.

If you are willing to embrace short-term discomfort for long-term benefit, it’s a great time to be an active investor.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility.

The market indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

The FTSE Multinationals Index comprises companies which derive more than 30% of their revenue from outside their domestic region.

The FTSE World ex Multinationals Index comprises companies which derive 70% or more of their revenue from inside their domestic region.

MSCI Emerging Markets Investable Markets Index (IMI) is a free float-adjusted market capitalization-weighted index designed to measure results of the large-, mid- and small-capitalization segments of more than 20 emerging equity markets.

London Stock Exchange Group plc and its group undertakings (collectively, the “LSE Group”). © LSE Group 2023. FTSE Russell is a trading name of certain of the LSE Group companies. FTSE® and Russell® indexes are trademarks of the relevant LSE Group companies and are used by any other LSE Group company under license. All rights in the FTSE Russell indexes or data vest in the relevant LSE Group company which owns the index or the data. Neither LSE Group nor its licensors accept any liability for any errors or omissions in the indexes or data and no party may rely on any indexes or data contained in this communication. No further distribution of data from the LSE Group is permitted without the relevant LSE Group company’s express written consent. The LSE Group does not promote, sponsor or endorse the content of this communication.

MSCI has not approved, reviewed or produced this report, makes no express or implied warranties or representations and is not liable whatsoever for any data in the report. You may not redistribute the MSCI data or use it as a basis for other indices or investment products.

Our latest insights

-

-

Market Volatility

-

Market Volatility

-

-

Artificial Intelligence

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Jody Jonsson

Jody Jonsson