Market Volatility

Market Volatility

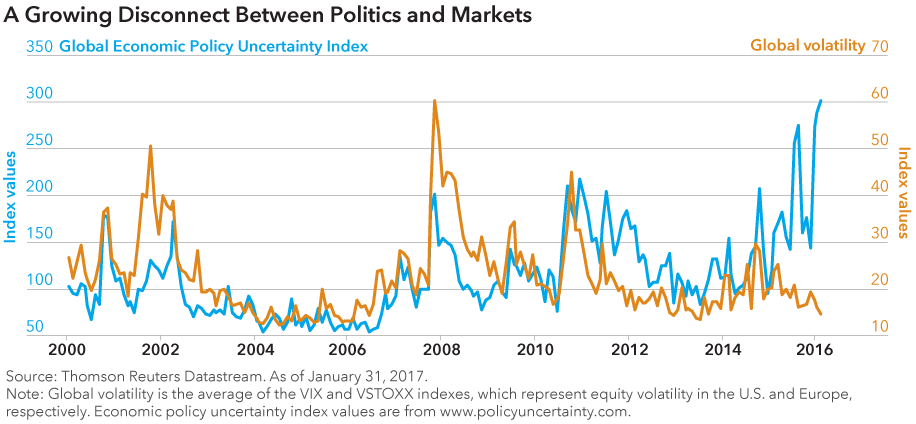

- There is an interesting disconnect these days between political uncertainty and market volatility.

- When history seems to offer little guidance, financial markets take time to adjust and have a bias toward not changing.

- The key to successful investing in these times is for active managers to maintain enough portfolio flexibility to respond rapidly when the uncertainty starts to resolve.

In the short time since the new U.S. presidential administration was installed, there has been a flurry of policy announcements, and even more policy speculation, spanning a multitude of areas. In the process, an interesting disconnect has emerged between the political and financial worlds.

Much of the political news gives an impression of chaos and uncertainty, whereas financial markets have remained liquid and orderly, risky asset prices have remained well supported — and in most cases have actually strengthened — and market-based measures of uncertainty, such as the VIX, have remained low. (The Chicago Board Options Exchange Volatility Index, or VIX, measures the implied volatility of the Standard & Poor’s 500.)

This disconnect exists at a more granular level, as well. For example, the so-called “border adjustment tax,” which in effect subsidizes exports and penalizes imports, should play a central role in a revenue-neutral corporate tax reform package, and would in theory have a significant impact. It should lead to a substantial appreciation of the U.S. dollar, it should be detrimental to low-end retailers who rely heavily on global supply chains, and so on.

The role of active management

But financial markets do not incorporate these expectations. Equity prices reflect a high probability of corporate tax reform, yet forward exchange rates have not adjusted much, and retail stocks have not underperformed a great deal either. There are several other examples of the market’s underreaction to policy announcements that should in theory have a significant impact on specific groups of companies.

It would not be quite right to conclude that markets are not efficient. Rather, in periods of high policy uncertainty, and when history seems to offer little guidance, markets take time to adjust. In the meantime, they have a bias toward not changing until uncertainty is resolved – either because policy is clarified, or because an adverse shock materializes.

This tendency toward inertia is exacerbated by the inclination of many active managers to focus on peer risk rather than absolute risk. There is little incentive to take large portfolio positions with limited information, which may be hard to justify to clients, when the costs of being wrong are potentially high.

In other words, especially in an environment of regime change and high policy uncertainty, market efficiency is not instantaneous, but a process. This creates room for active management to add value. However, that should not imply that all active managers will succeed. In fact, there has been a gradual rise in the dispersion between active managers since mid-2015.

Investment implications

The key to successful active management in periods of elevated uncertainty is not to stake everything on single-point forecasts. Rather, it is the ability to apply detailed policy analysis to a range of scenarios, and to maintain enough portfolio flexibility to respond rapidly and with high conviction as soon as uncertainty starts to resolve itself toward a specific outcome. Furthermore, the ability to populate the portfolio with diversified investment ideas, rather than a few macro positions, is essential if managers hope to generate alpha while keeping active risk under control.

Market liquidity has been good. Investor flows can be invested rapidly and efficiently. But can they be invested wisely when we know so little about the future? They can – but only through an investment process that is solidly grounded in fundamentals, granular enough to generate diversified ideas, forward- rather than backward-looking, and not too strongly anchored to preconceptions about how economic policy and financial markets must function. Advisors should ensure that their clients have exposure to a broadly diversified set of investment themes and can benefit from active management that can respond with agility and flexibility to a rapidly changing policy environment.

Past results are not predictive of results in future periods.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

Our latest insights

-

-

Market Volatility

-

-

Artificial Intelligence

-

Interest Rates

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Wesley Phoa

Wesley Phoa