Bonds

The bond market has been on a wild ride so far in 2020. The yield on the 10-year Treasury note started the year just below 2% and recently stood at 0.7%.

The economic data story has been similar — take the unemployment rate, for example. The jobless figure, which showed some recent improvement, went from a 50-year low to an 80-year high in the three months through May.

Alongside job losses, weaker consumer activity, low oil prices and diminished corporate investment suggest near-term disinflationary pressure. Longer term, trillions of dollars of government spending and a return to ultra-easy monetary policy could be inflationary.

What does this all mean for investors? The recent rebound in stocks suggests pessimism may be fading. And yet, the COVID-19 pandemic will cast a long shadow over the medium-term economic outlook. Could there be a second wave of infection as the economy reopens? Will consumers feel comfortable resuming normal life? How quickly will economic growth regain lost ground?

We’ve rarely been in a situation where the path from recession to recovery is so uncertain. Faced with this great unknown, some investors have naturally decided to sit on the sidelines, moving much of their portfolio to cash. But history shows that staying invested can be a more effective approach for long-term investors.

A balanced portfolio is especially important at times like these, when change is rapid and unpredictable. With that in mind, here are four actions to consider for your fixed income portfolio:

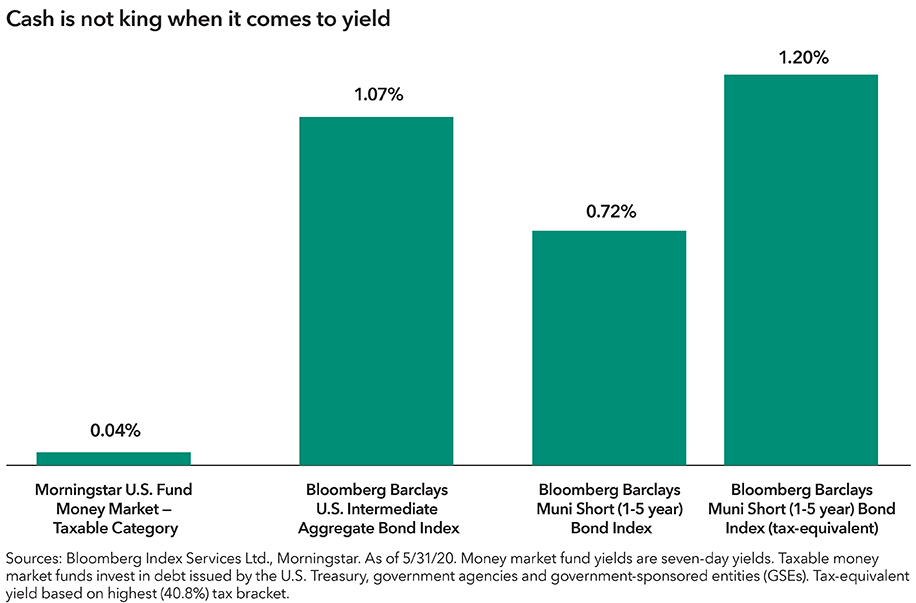

1. Do more with cash

In recent months investor money has flooded into cash equivalents such as money market funds. While perfectly understandable in these unprecedented times, overallocating to cash means that you can miss out on potential investment gains.

For investors who are ready to move off the sidelines, short-term bond funds may be worth a closer look. Those that focus on high-quality and liquid investments have the potential to generate income without assuming significantly higher interest rate or credit risks.

If inflation remains in a 1.5%–2.0% range, investors in cash would see their purchasing power eroded, while moving cash into high-quality short-term bond funds could help preserve purchasing power without taking much risk. While a short-term bond fund can produce a negative return, many are focused on capital preservation and contain only high-quality fixed income assets. Two funds that heavily weigh capital preservation and diversification from equities in their strategies are Short-Term Bond Fund of America® and Intermediate Bond Fund of America®. These funds had three-year correlations to the S&P 500 Index of –0.3 and –0.2, respectively, as of May 31, 2020.

2. Stay strong at the core

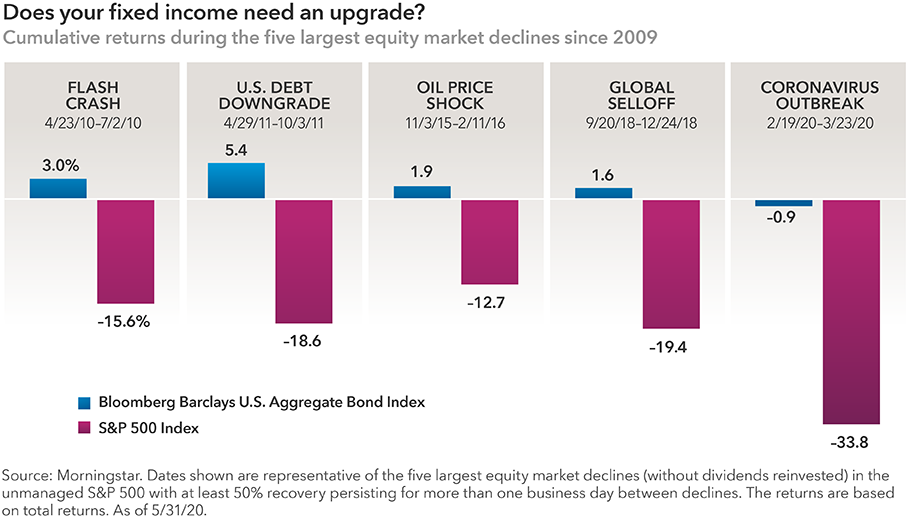

The volatile first quarter of 2020 underscored that, for real balance, portfolios need fixed income that’s primarily core bonds that can hold up when stock markets decline. Here, it’s important for investors to know what they own. Many widely used bond funds come from the Core-Plus or Multisector bond categories. Often funds in these categories have been heavily invested in high yield and, therefore, may not serve as a ballast for equity-heavy portfolios.

In contrast, many high-quality core bond funds provided diversification from equities and capital preservation over the period. The Bloomberg Barclays U.S. Aggregate Bond Index — a typical benchmark for core bond funds — was near flat while equities fell sharply.

How can you find bond funds that can help add resilience to your overall investment mix? Look for ones with a track record of zigging when equities zag. A correlation to equities that is low to somewhat negative has historically been a good indicator of equity diversification. Both The Bond Fund of America® and American Funds Strategic Bond FundSM (our flagship Core and Core-Plus offerings) have delivered in this regard: Their three-year correlations to the Standard & Poor’s 500 Composite Index were 0 and –0.1, respectively (F-2 share class as of April 30).

Investors should also monitor the quality and concentration of credit investments. Too much emphasis on lower rated high-yield bonds is a red flag, as it may mean equity diversification is being sacrificed in pursuit of higher yields.

With rates already close to zero, many investors have asked: “Have I missed my chance to add to investments in core fixed income?”

Our answer is an emphatic no — it’s not too late. Easy monetary policy, modest growth and muted inflation suggest that significantly higher rates aren’t a major risk over the medium term. The bond market does not price in a 25 basis point rate hike until the end of 2023. In fact, the Federal Reserve has even committed to keeping interest rates at their zero bound until at least 2022.

A largely range-bound rates environment can provide decent opportunities for actively managed core fixed income. Additionally, market volatility is likely to persist, and the importance of having a strong core bond portfolio remains front and center.

3. Rethink income

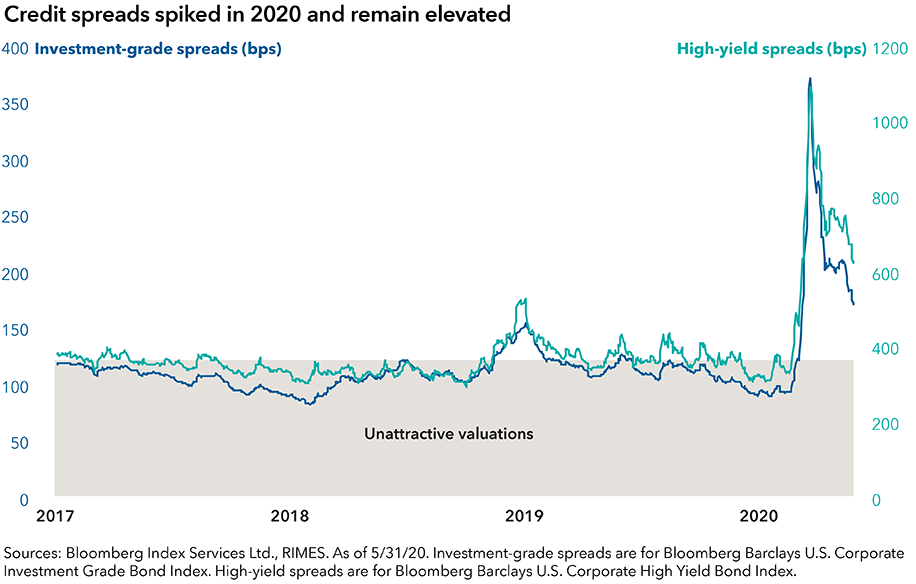

Corporate bond valuations were expensive as we entered 2020 but became decidedly more attractive. Credit spreads — the extra yield that corporate bonds pay in comparison to U.S. Treasuries — had widened sharply, reaching levels not seen since the global financial crisis. As equities recovered, credit spreads tightened again, though they remain wide from where they started the year. Across a wide range of credit sectors, fixed income provided opportunities to investors during the worst days and weeks of the crisis.

Today’s market environment should continue to provide fertile ground for selective investors. The Fed’s support for credit markets combined with the sharpness of the downturn has led to record investment-grade bond issuance. Many companies have the wherewithal to withstand more challenging economic conditions, but some do not.

Arguably, overall prospects for investment-grade issuers could be more of a mixed bag than in recent recessions. The BBB-rated portion of the investment-grade universe — those companies at the low end of the investment-grade spectrum — rose from 35% to 50% in the past decade.

Investors should be prepared for defaults and downgrades that exceed past cycles, according to our colleague Damien McCann — lead portfolio manager of our recently launched American Funds Multi-Sector Income FundSM. He also sees potential for bankruptcies of companies in the U.S. high-yield and loan market to exceed 10% in the next year.

For enhanced income, investors should seek a research-driven, balanced approach to multisector income. The four primary sectors our American Funds Multi-Sector Income Fund allocates to are investment-grade corporates, high-yield corporates, emerging markets debt and securitized credit. As a rough guide, it aims to be 50/50 above and below investment grade, which is designed to give investors a smoother ride than a 100% high-yield portfolio.

4. Revisit municipal bonds

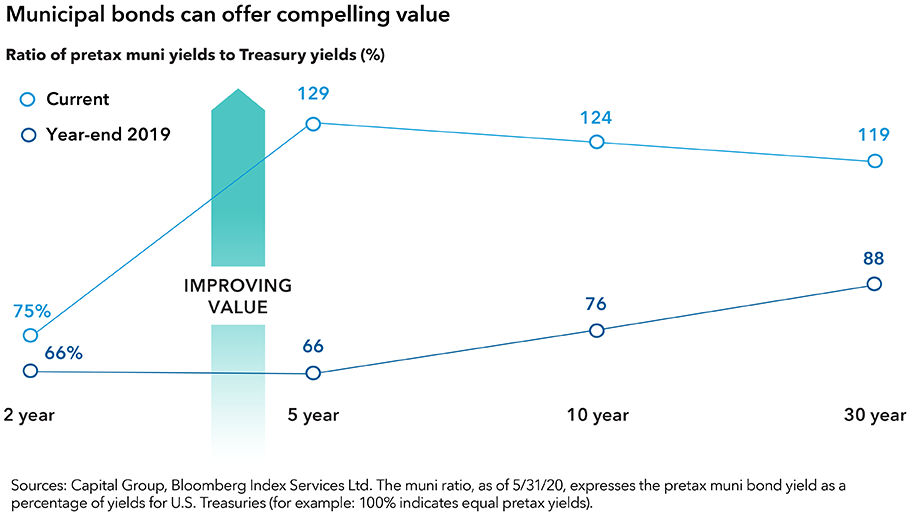

The March selloff in municipal bonds pushed valuations down into uncharted territory — creating unprecedented value. Since then, the gradual reopening of local economies and tentative signs of improving jobless claims have boosted sentiment around the asset class.

Despite recent gains, there are many pockets of compelling value. For example, the yield advantage of BBB-rated over AAA-rated municipal bonds has climbed from below 1% to over 2%. Relative value compared to U.S. Treasuries (measured by the muni to Treasury ratio) has significantly improved. The ratio shows municipal yields as a percentage of yields for U.S. Treasuries.

Owning muni bonds can benefit investor portfolios in other ways: The asset class has offered a source of equity diversification over time and provides income that is exempt from Federal taxation.

Looking forward, recession may expose vulnerable state finances. Use of rainy day funds should help alleviate some of the impact of lost personal income and sales tax revenues. States and local governments also have the flexibility to raise revenues and cut expenses.

That being said, investors should brace themselves for more volatility. Funds such as The Tax-Exempt Bond Fund of America® take a fully active approach, looking to manage risk and add value through selectivity. Using bond-by-bond research to assess the trade-off between risk and return potential is especially important at present.

As of May 31, the taxable equivalent yield for the Bloomberg Barclays Municipal Bond Index stood at 2.7% for anyone in the highest income tax bracket — about double the yield on the Bloomberg Barclays U.S. Aggregate Bond Index. Taxable-equivalent rate assumptions are based on a federal marginal tax rate of 37%, the top 2020 rate. In addition, we have applied the 3.8% Medicare tax. So, with interest rates expected to remain low and the possibility of higher future tax rates, the asset class offers investor portfolios a truly compelling source of tax-advantaged income.

Bloomberg Barclays U.S. Aggregate Bond Index represents the U.S. investment-grade fixed-rate bond market.

Bloomberg Barclays U.S. Intermediate Aggregate Bond Index is an unmanaged index that consists of 1–10 year governments, 1–10 year corporates, all mortgage and all asset-backed securities within the Aggregate Index.

Bloomberg Barclays Municipal Short 1–5 Years Bond Index is a marketvalue-weighted index that includes investment-grade tax-exempt bonds with maturities of one to five years.

Bloomberg Barclays U.S. Corporate Investment Grade Bond Index represents the universe of investment grade, publicly issued U.S. corporate and specified foreign debentures and secured notes that meet the specified maturity, liquidity, and quality requirements.

Bloomberg Barclays U.S. Corporate High Yield Bond Index covers the universe of fixed-rate, non-investment-grade debt.

Standard & Poor’s 500 Composite Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds. Income from municipal bonds may be subject to state or local income taxes and/or the federal alternative minimum tax. Certain other income, as well as capital gain distributions, may be taxable. The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional cash securities, such as stocks and bonds. American Funds Strategic Bond Fund may engage in frequent and active trading of its portfolio securities, which may involve correspondingly greater transaction costs, adversely affecting the fund’s results. Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness. If agency ratings differ, the security will be considered to have received the lowest of those ratings, consistent with the fund's investment policies. Securities in the Unrated category have not been rated by a rating agency; however, the investment adviser performs its own credit analysis and assigns comparable ratings that are used for compliance with fund investment policies.

Methodology for calculation of tax equivalent yield: Based on 2020 federal tax rates. Taxable equivalent rate assumptions are based on a federal marginal tax rate of 37%, the top 2020 rate. In addition, we have applied the 3.8% Medicare tax. Thus taxpayers in the highest tax bracket will face a combined 40.8% marginal tax rate on their investment income. The federal rates do not include an adjustment for the loss of personal exemptions and the phase out of itemized deductions that are applicable to certain taxable income levels.

© 2020 Morningstar, Inc. All rights reserved. The information contained herein: (1) is proprietary to Morningstar and/or its content providers; (2) may not be copied or distributed; and (3) is not warranted to be accurate, complete or timely. Neither Morningstar nor its content providers are responsible for any damages or losses arising from any use of this information. Past performance is no guarantee of future results.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays ® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Standard & Poor’s 500 Composite Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2020 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Mike Gitlin

Mike Gitlin

Pramod Atluri

Pramod Atluri

Karl Zeile

Karl Zeile