U.S. Equities

August and September are historically tough months

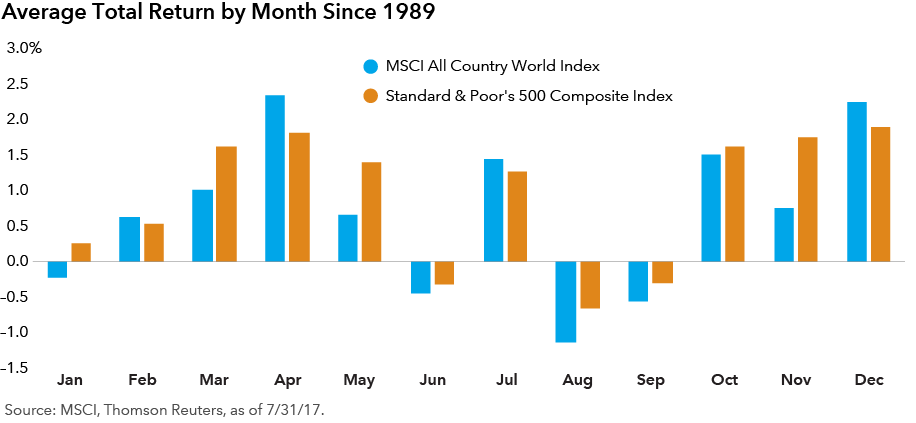

Equity markets are on an impressive run this year with the MSCI All Country World Index (ACWI) returning 15% and the Standard & Poor’s 500 Composite Index returning approximately 12% through July 31. However, as the calendar moves through August and into September, equity markets may lose some momentum. The MSCI ACWI and S&P 500 have posted negative returns in August and September on average since 1989, and tend to be two of the weakest months of the year for equities. For investors with a longer time horizon, staying invested in equity markets during a seasonal period of short-term weakness may be rewarded, as the last three months of the calendar year have historically had better returns.

Our latest insights

-

-

U.S. Equities

-

Artificial Intelligence

-

Interest Rates

-

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.