Municipal Bonds

China

- China’s stock market is being rapidly integrated into global financial markets and will present investors with both significant opportunities and challenges.

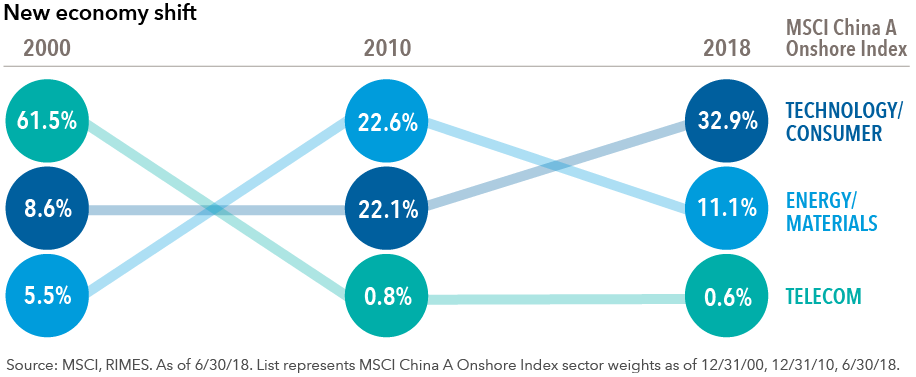

- The depth and breadth of the A-share universe is improving from industrials companies to technology and consumer-oriented firms.

- Stock selection is key since the quality of companies varies significantly and the equity market is less mature.

China’s economy has grown rapidly to become the world’s second-largest after the U.S. And its stock market is not far behind.

The country’s stock market capitalization is a whopping $9 trillion in U.S. dollar terms. But a large part of it is not included in global financial markets. That’s changing, and China could well be on its way to becoming a market that investors may not be able to ignore anymore.

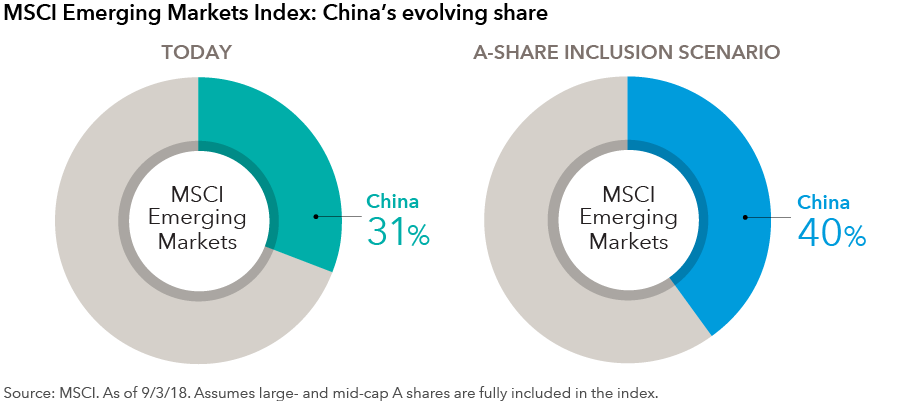

Chinese equities already dominate emerging markets indices and MSCI, which runs the most well-known international and global indices, bolstered their presence by adding more than 230 companies from mainland China, known as A-shares, to its benchmark emerging markets index in June and August of this year.

MSCI and other index providers are likely to continue expanding representation of China’s market in these broader indexes even if the country’s economy slows.

“It’s a large hunting ground, and we’ve devoted considerable resources to understanding it,” says portfolio manager Steve Watson. “Capital Group began studying the A-share market in 2002 and made our first investments in 2009. Our team in Beijing is analyzing these companies in a systematic way that will be of immense value to our decision-making process.”

A stock picker’s paradise

What’s more, the domestic A-share market has many more dynamic companies that are in the technology and consumer spaces. Alibaba and Tencent have already become household names among many U.S. investors who’ve admired the fast growth of these Chinese internet and online shopping giants. Investors hope to find the next set of high-growth companies as they become available to foreign investors by virtue of their inclusion in broader international indexes.

The going won’t be easy, no doubt. The cultural norms of corporate management in China can be different from what western investors are used to.

Imagine meeting with a bank chairman who burns through three cigarettes during the course of a one-hour meeting, leaving the conference room hazy with smoke. And for every question you ask, he launches into a 10-minute monologue.

In the course of her research, that was the experience of Helen Ding, Capital Group’s financials industry specialist in Beijing. But she wasn’t fooled by the appearance of this executive — it was clear that behind the gruff exterior he had complete command of his business and industry.

“I think this is typical of A-share management teams,” says Ding. “They are capable executives who know their business but aren’t experienced in meeting with investors. They don’t know how to walk the walk and talk the talk.

“As investors, we shouldn’t be deterred by the appearance of top management and conclude that these companies are not investable or have corporate governance issues just because they are different from more polished management teams we see in developed markets. Rather, I think it can lead to opportunities for investors who do dig deeper to look through this murky market to find true gems.”

Gauging the A-share universe

The A-share market is a sum of many parts. Its sheer size, regulatory environment and multiple corporate structures adds layers of complexity that can be challenging to navigate. However, such complexities provide opportunities for investors who pick stocks on a company-by-company basis.

Capital Group’s research into the A-share market has shown that what motivates business choices and capital allocation decisions depends on management and whether the company is state-run.

For example, large state-owned conglomerates in banking and energy tend to be more politically driven, while small- and mid-sized companies are more focused on revenue growth and market share gains. Furthermore, the A-share market is dominated by retail investors, who are more momentum-driven and short term in focus.

“I view China as a classic stock picker’s market. It’s a vast universe with a wide disparity in terms of the quality of companies in which to invest,” says equity portfolio manager Winnie Kwan. “For instance, the small- and mid-cap universe is large, with close to 1,000 companies. The challenge is finding companies with the right management team and business models that I would want to invest in long term on behalf of our clients.

“There are a number of stocks that aren’t attractive from a valuation or corporate governance standpoint. But, I do believe there’s potential for some A-share companies to become much larger in market value, especially when I evaluate opportunities in areas of China’s new economy.”

On-the-ground insights

Like Ding, Jerome Lang is among seven Capital Group industry specialists — fluent in Mandarin and based in Beijing — who spend much of their time visiting A-share companies and meeting with a broad network of local industry and government contacts to source differentiated industry research to the investment group analysts.

Their specific areas of focus include health care, technology, finance, commodities and consumer products.

Lang says he is seeing changes in how state-owned enterprises (SOEs) communicate with outside investors.

“I remember 10 years ago how it was really awkward and uncomfortable to communicate with SOE management teams,” he says. “They didn’t answer investor’s question directly and behaved like they were diplomats. In their minds, investors were like journalists, so the less they spoke, the safer it was for their personal reputation.

“Furthermore, access to senior management was practically non-existent, even for large shareholders. That’s changing. Now, I feel some SOEs have become more sensitive to the concerns of foreign investors and are taking meetings and considering their suggestions. Some of these executives are now younger and have studied outside of China. Of course, it’s too early to say all SOEs have evolved in this respect, but I’m witnessing some positive changes.”

Corporate governance improving

Over the years, governance standards and cultural differences have been hurdles to investing in China, but the growing presence of A-shares in major indices may help ease those concerns.

“From my experience in dealing with Chinese companies, the level of corporate governance has come a long way and is improving,” says Watson. “I met with a company in Shanghai in 1995 that eventually went public on the Hong Kong exchange. Management sat stone-faced as their colleague droned out 10 years of financial numbers. When he was done, I asked why revenues had increased every year but profits had declined. No one was able to answer the question — they clearly had not thought about it. Most Chinese companies I meet today are far savvier. Management teams are learning what we consider best governance practices and implementing changes.”

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

MSCI does not approve, review or produce reports published on this site, makes no express or implied warranties or representations and is not liable whatsoever for any data represented. You may not redistribute MSCI data or use it as a basis for other indices or investment products.

Our latest insights

-

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

related insights

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Statements attributed to an individual represent the opinions of that individual as of the date published and do not necessarily reflect the opinions of Capital Group or its affiliates. This information is intended to highlight issues and should not be considered advice, an endorsement or a recommendation.

Winnie Kwan

Winnie Kwan

Steve Watson

Steve Watson