Market Volatility

Bonds

Imagine an economy plagued by persistent inflation and a Federal Reserve determined to fight it with aggressive, equally persistent interest rate hikes. While this might sound similar to what investors have recently been experiencing, it also describes 1973.

That year, which marked one of the most turbulent economic environments since the Great Depression, Capital Group began actively managing fixed income portfolios. Over the past 50 years, our portfolio managers have navigated a multitude of market ups and downs, booms and bubbles, crashes and crises. We asked four of our most tenured fixed income portfolio managers — two retired and two current — to provide insights and lessons learned over their long careers.

1. Don’t forget the simple power of bond coupons

Kirstie Spence, portfolio manager, American Funds Emerging Markets Bond Fund®

I joined Capital Group through our undergraduate program, where a rotation brought me to fixed income. I was intimidated initially, but lessons I learned in that initial rotation have stayed with me throughout my career. At the time a seasoned portfolio manager told me, "Your most important job in fixed income is not to lose money.” From there it became clear that, in many ways, the concept of fixed income is simpler than people think.

One of the things that gets forgotten with bonds is simply the power of a coupon. In most bond structures, you earn an interest rate that is paid out over a specified period. That payment is very important in contributing to the total return you're going to make on the investments. And certainly, in emerging markets debt, the capital appreciation or the value of the bond can move a lot over its life.

Some things at the macro level are out of your control, but that coupon is a powerful cushion in terms of protecting that investment. And in the emerging markets bond sector where I specialize, it has always been the heart of the annual return and is often underestimated. People forget about that a bit when the headlines focus on interest rate changes, and they start worrying about technical terms like duration. But the coupon is a very powerful thing.

Historically, income has dominated long-term total return

Source: Bloomberg Index Services Ltd. As of 12/30/2022. Past results are not predictive of results in future periods.

2. Know when to surrender

Mark Brett, retired portfolio manager, Intermediate Bond Fund of America®

Some important lessons come from mistakes. I remember early in my career before coming to Capital Group I came up with what I thought was a brilliant currency trade. Let’s just say it wasn’t going well. So I approached my supervisor at the time. He asked me, “Do you know the first rule of trading? Surrender.”

As humans, we often cling to bad ideas that we know should be dismissed, but it’s difficult to do so psychologically. Part of being a good investor is knowing when to surrender a bad idea and move on.

One example of a bad idea is to continue fueling an asset bubble. And that leads to another important lesson: Don't ignore the obvious. Consider the tech bubble in the late 90s. A lot of investors looking at it thought it was a bubble, but they didn't know how it would turn out or think through the consequences.

The same is true of the 2007 housing bubble. It was obvious that there was a bubble in residential real estate. But how would it end? That one turned out to be a huge deal, as we all now know, due to the implications for money and credit. Some of the most brilliant investors on Wall Street lost enormous amounts of money.

Pointing out the obvious and surrendering a bad idea might seem like basic concepts, but you would be amazed at how tricky they can be for some investors.

Some notable asset bubbles over the last 40 years

Sources: Capital Group, ICE Benchmark Administration Ltd., London Bullion Market Association (LBMA), NASDAQ, Nikkei, NYSE Arca, NYSE, Refinitiv Datastream, Standard & Poor's, Stock Exchange of Thailand (SET). Figures reflect cumulative price changes over eight-year periods in which the asset's price increased at least 250% before falling at least 50 percentage points. Benchmarks used: gold bullion price per troy ounce as quoted by the LBMA (gold); Nikkei 225 Index (Japan); Bangkok SET Index (Thailand); NASDAQ Composite Index (U.S. tech); S&P Homebuilders Select Industry Index (U.S. housing); NYSE Arca Biotech Index (biotech); NYSE FANG+ Index (U.S. large–cap internet). As of December 31, 2022.

Hear lessons from 50 years of bond investing

3. Company relationships are key in credit markets

David Daigle, portfolio manager, American High-Income Trust®

A skill that I did not have when I started at Capital but worked to develop was building relationships. In active management, cultivating strong connections with the C-suite of the companies we invest in is essential. And I've always felt that if I can build a mutually symbiotic relationship with a management team, I'm providing value to them and they're providing value to me. Those are the relationships that will endure over many years.

Our relationship can benefit a company’s management team by sharing our insights with them about how we think as investors. Our discussions help them to understand what the investment community is looking for and sometimes what the rating agencies are looking for.

What we get as investors is a better understanding of their strategy and whether they are good candidates for our portfolios. They can share how they see their competitive positioning and what they think of their competitors. They may explain how they think about the regulatory structure in which they operate or what their aspirations are over different time horizons. We're sharing information with them and they're sharing information with us. That's where I think you build really lasting, tight relationships.

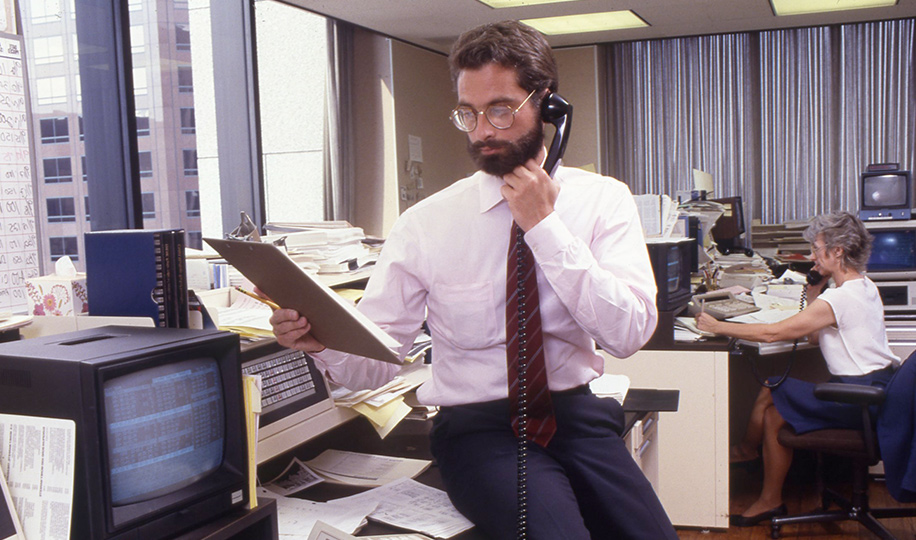

John Smet in the trading room, 1986.

4. Collaborative research is crucial

John Smet, retired portfolio manager, The Bond Fund of America®

There were many lessons I learned during my years as a professional investor, but I’m struck by what I’ve experienced since retiring. Now I am a fund shareholder instead of a fund manager. The contrast is remarkable when I try to assess investment opportunities on my own.

Just think about where we are today with markets and fixed income. There are questions in many investors’ minds: Has the Fed stopped raising rates? Is inflation here to stay? What about a recession? Is the dollar going to strengthen?

These questions are difficult to answer for professional investors with vast resources. But they’re near impossible to answer as a shareholder in my kitchen, reading the newspaper or listening to the news trying to figure all this out.

By contrast, at Capital Group, I had hundreds of analysts that I was able to interact with, along with other colleagues and outside specialists. It was really a stunning amount of information. The thing that strikes me, as I look at the world and the markets, is how blessed I was to have all those resources as a fund manager and the value of collaboration.

Coupon rate is the rate of interest paid by bond issuers on the bond's face value. It is the periodic rate of interest paid by bond issuers to its purchasers. The coupon rate is calculated on the bond’s face value (or par value), not on the issue price or market value.

Duration is a measure of the sensitivity of the price of a fixed income investment to a change in interest rates.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings. The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional cash securities, such as stocks and bonds. Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility, as more fully described in the prospectus. These risks may be heightened in connection with investments in developing countries.

As a nondiversified fund, American Funds Emerging Markets Bond Fund has the ability to invest a larger percentage of assets in securities of individual issuers than a diversified fund. As a result, a single issuer could adversely affect a fund’s results more than if the fund invested a smaller percentage of assets in securities of that issuer. See the applicable prospectus for details.

The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

The Bangkok SET Index is a capitalization-weighted index of stocks traded on the Stock Exchange of Thailand.

Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market.

The London Bullion Market Association (LBMA) Gold Price benchmarks are the global benchmark prices for unallocated gold delivered in London, stated as the price per troy ounce in U.S. dollars and administered by ICE Benchmark Administration Limited.

The NASDAQ Composite Index tracks the performance of more than 3,000 stocks listed on the NASDAQ and is often viewed as an indicator for the technology-related sectors of the economy.

The Nikkei 225 Index, also referred to as the Nikkei Stock Average, is a price-weighted equity index, which consists of 225 stocks in the Prime Market of the Tokyo Stock Exchange.

The NYSE Arca Biotech Index is a capitalization-weighted index consisting of roughly 30 companies that are primarily involved in the biotechnology industry and the use of biological processes to develop products or provide services.

The NYSE FANG+ Index is an equal-weighted equity benchmark designed to track the performance of 10 highly traded growth stocks of technology and tech-enabled companies in the technology, media & communications and consumer discretionary sectors.

S&P 500 Index is a market capitalization-weighted index based on the results of approximately 500 widely held common stocks.

The S&P Homebuilders Select Industry Index is an equal-weighted index that comprises stocks from the S&P Total Market Index that are classified in the GICS Homebuilding sub-industry.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively “Bloomberg”). Bloomberg or Bloomberg’s licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg’s licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

© 2023 NYSE Euronext. All Rights Reserved.

The S&P 500 Index (“Index”) is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. © 2023 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

Our latest insights

-

-

Market Volatility

-

Market Volatility

-

-

Artificial Intelligence

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Kirstie Spence

Kirstie Spence

David Daigle

David Daigle

Mark Brett

Mark Brett

John Smet

John Smet