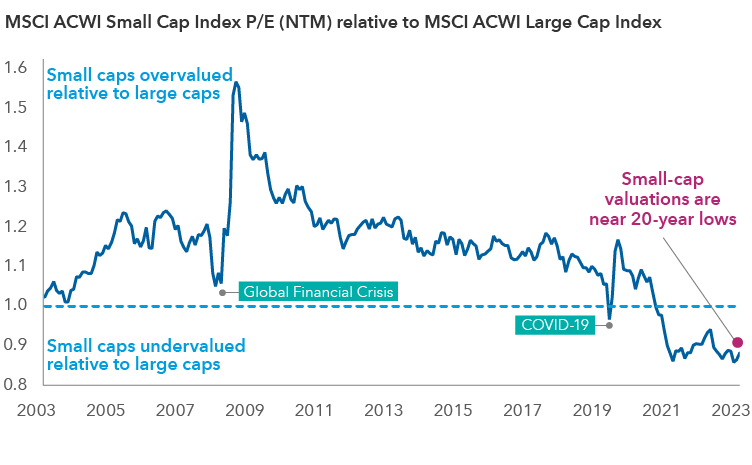

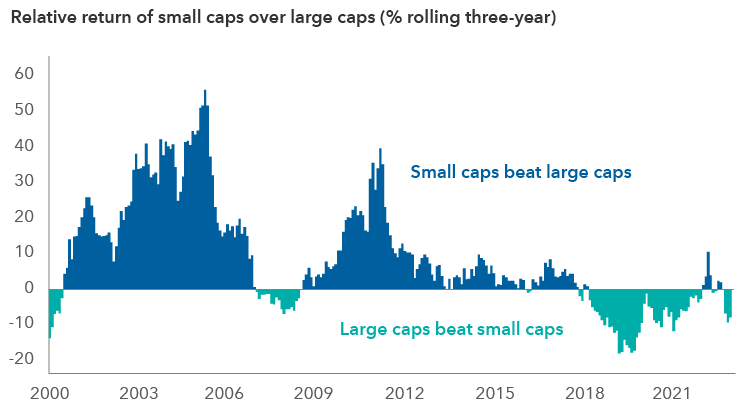

Over the last couple of years, the gap in both returns and valuations between small-cap and large-cap stocks has expanded against the backdrop of tighter monetary policy, higher interest rates and fears of a global economic slowdown. The MSCI ACWI Small Cap Index is trading near a 20-year low on a relative basis versus large caps. Now, as the Federal Reserve appears to be pivoting to a more dovish stance, potentially leading to an easing of financial conditions, the outlook for small-cap stocks is brightening.

The path for small-cap companies — or those with a market value of $6 billion or less — to obtain financing should be easier. And the initial public offering (IPO) pipeline, which had shriveled to a trickle, should start to flow again, providing a fresh set of opportunities.