American workers rely on their employers’ plans for most of their retirement savings. But among businesses with fewer than 100 employees, only 42% of employees participate in retirement plans.* To help reduce this retirement coverage gap, nearly every state has either begun considering or actually implemented some version of a state-sponsored retirement program.

December 11, 2024

KEY TAKEAWAYS

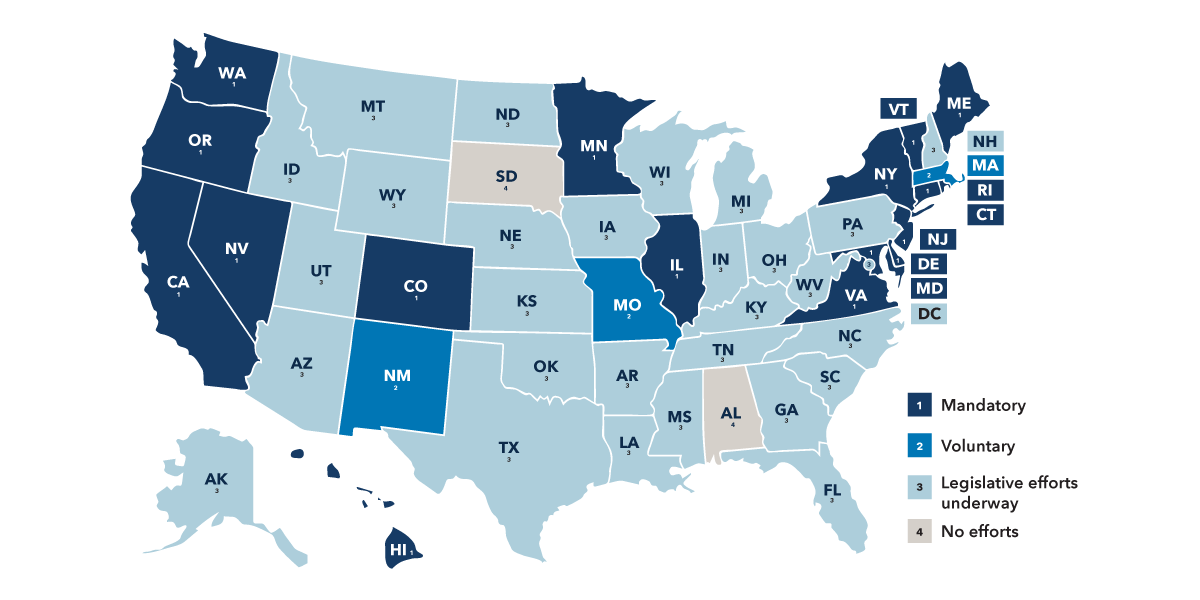

- 20 states have enacted state-sponsored programs, 17 of them mandatory

- Conventional retirement plan solutions may work better than some state programs

- Financial professionals can help employers decide the best option

20 programs and counting

As of June 30, 2024, 20 states have enacted programs. Some are already active; some will take effect at a future date. Every state program is unique, but many share common features:

- Investments through Roth IRAs (individual retirement accounts)

- Automatic payroll deduction

- Investment firms chosen by the state

Is your state plan mandatory or voluntary?

Seventeen state plans, such as those in California and Illinois, are considered mandatory plans. That is, employers with a certain number of employees must make available a state-run auto-IRA plan if they offer no other plan. These plans typically also require a minimum salary deduction, unless the employee opts out, as well as various financial penalties for non-compliance.

Other states, like Massachusetts, use a voluntary model, where employers can shop for a payroll-deduction-only plan – typically with some tax incentives – by using a state-approved menu of IRA and 401(k) providers.

First out of the gate: The Prairie State

To get a feel for the logistics of a state program, let’s look at the example of Illinois’ Secure Choice Program, which was the first state plan to be signed into law. This program requires employers to automatically enroll their employees into the program or select a qualified plan in the private market if the business:

- Has at least 5 employees,

- Has been domiciled in Illinois for two or more years, and

- Does not currently provide an employer-sponsored retirement plan, like a 401(k), SIMPLE or SEP plan.

Employees in Secure Choice begin saving at a default rate of 5% of pay – unless they opt out. For the first 90 days after the initial contribution, the default is to hold the money in a money market fund unless participants elect otherwise. If no election is made, the funds are then defaulted into a target date fund. Non-compliance results in a penalty of $250 per employee the first year the employee is unenrolled and $500 per employee for the second year and beyond.

State officials oversee investments

One of the more concerning aspects of state-sponsored plans is investment oversight. In Illinois, for example, investments are chosen by a board of seven: the state Treasurer, the State Comptroller, the director from the management and budget office of the governor and four additional representatives appointed by the governor. These seven individuals are in essence responsible for the retirement savings of thousands of Illinois businesses.

Typically, sponsors customize their retirement plans depending on their participants’ needs. In a state-sponsored plan, that nuance is lost.

CalSavers in California

Another example of a mandatory plan is California’s CalSavers program, which, like Illinois Secure Choice, requires employers without a retirement plan to join a state-run plan where investments are run by a state board. This includes all employers with at least one employee.

Unless they select their own rate, employees begin saving at a default rate of 5% of pay, with auto-escalation of 1% per year to be capped at 8% of salary. An employee may opt out of auto-escalation and set their own rate. As with the Illinois plan, CalSavers imposes penalties of up to $750 per eligible employee for non-compliance.

Alternatives to state-sponsored retirement plans

Given the restrictions and complexity of many state plans, some business owners may want to take a more active role by considering traditional retirement plan alternatives. Many traditional retirement plans were designed specifically to create a comfortable retirement for employees at a low cost with a minimum amount of employer involvement.

A couple of factors may encourage small employers to take a close look at sponsoring their own retirement plan:

- First, SECURE 2.0 Act of 2022 incentivizes startup plans. Employers starting their first-ever retirement plan may qualify for a federal tax credit up to $5,000 a year to defray startup costs. The credit can be used for up to three years after the plan’s launch. Additionally, employers with up to 100 employees will be eligible for a credit for contributions on behalf of employees, up to a per-employee cap of $1,000.

- Second, plan costs have been steadily declining for more than a decade.

Depending on the state program, the following arrangements might be preferable:

- Simplified employee pension individual retirement account (SEP IRA): With a SEP IRA, only the employer contributes to participant accounts. Contributions are capped at 25% of a participant’s compensation or the annually adjusted IRS limit, whichever is less. Annual filings or disclosures are not required.

- Savings Incentive Match Plan for Employees Individual Retirement Account (SIMPLE IRA): SIMPLE IRAs are available to employers with 100 or fewer employees. Employers are required to make contributions for all eligible employees, either a dollar-for-dollar match of up to 3% of pay or a 2% non-elective contribution. Contributions are subject to IRS limits, which are determined annually. Sponsors are required to provide annual notices to all eligible employees.

- 401(k) plans: Traditional 401(k) plans are available for all private-sector employers, regardless of size. These plans allow for both participant and employer contributions, with annual maximums much higher than IRA maximums. Employers have significant flexibility when they sponsor their own plan. Sponsors are required to provide certain disclosures to their employees. Employers do accept fiduciary liability; however, some aspects of fiduciary liability can be outsourced to specialized service firms.

Small businesses need your help

Because many small employers may have never considered implementing retirement plans prior to the introduction of new state programs, the opportunity to educate and assist these business owners is vast. While some may not be eager to take on this new responsibility, retirement plan professionals have the tools and resources to help make the experience better.

Some questions to ask about the arrangements in your state include:

- Does it include part-time employees?

- Is there investment flexibility beyond the prescribed investments of state boards?

- Is there a provision to stop contributing once one has hit the Roth IRA income limits?

The devil is in the details, which is why the best alternative to state-sponsored plans may be an investment professional. With the advent of state-sponsored plans, you, the financial professional, can help an employer comply with state mandates or create a customized retirement program consistent with the needs of the business and its employees. By guiding employers through the alternatives, you may be able to help them create the best plan for their business.