Embrace auto-escalation and raise the cap

Too many plan sponsors are afraid of auto-escalation and set their contribution caps too low. One objection that frequently arises: “I don’t want to upset employees.” The fear is that an imagined employee will discover that a higher percentage of their paycheck is being channeled into their retirement account than they expected.

Anecdotally, employees are rarely upset about auto-escalation, and they may be surprised when they hit the cap. Of course, most people are pleased when they discover a higher-than-expected balance in their 401(k)s, and the “problem” of an upset employee can be solved with a few clicks of a button. If they want to reduce their contribution, that is an easy fix.

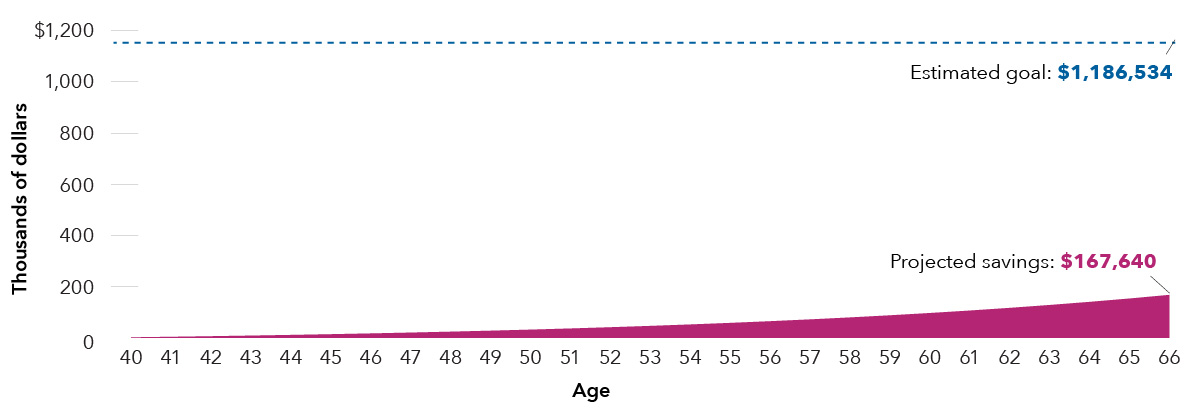

A much greater risk is to your plan participants’ savings goals. People are often inclined toward inertia and underinformed about retirement savings needs. Left to their own devices, they’re likely to assume that their current contribution rate, whether it’s 3%, 6% or something else, will help them reach their goals. Fortunately, you have tools to leverage this inertia and help them overcome their own misinformed confidence. Auto-escalation provides this power, yet some sponsors are reluctant to use it to its full extent. This is particularly true when it comes to capping the escalation rate. I’ve seen sponsors set caps as low as 6%.

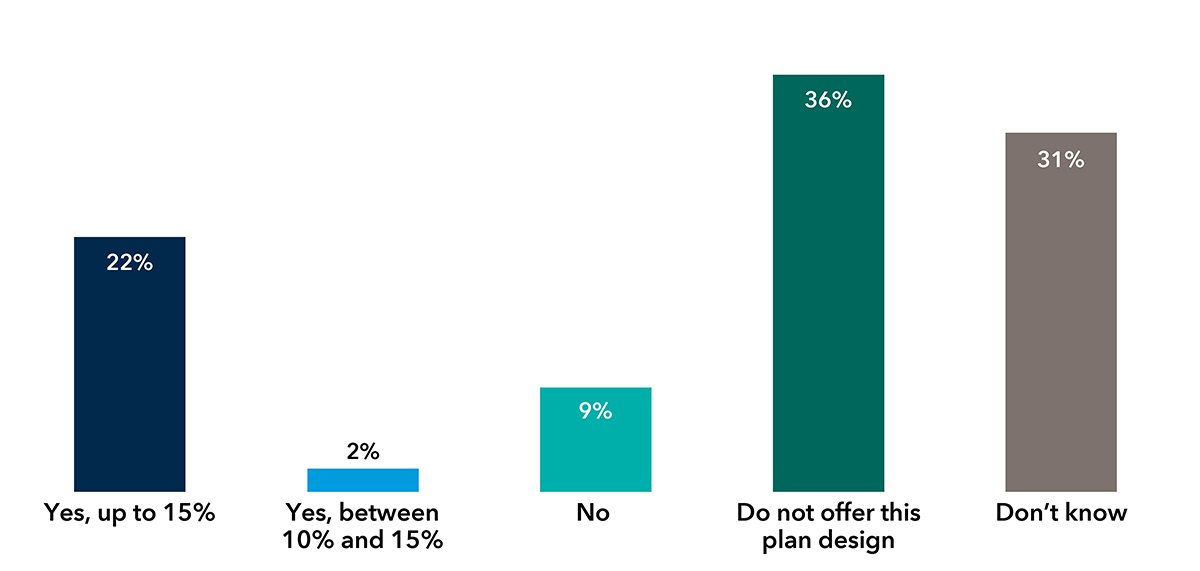

A key provision of the SECURE 2.0 Act of 2022 will require many retirement plans to automatically enroll employees and escalate their contributions annually. New 401(k) and 403(b) plans established on or after December 30, 2022, will need to add automatic enrollment and escalation for plan years beginning in 2025 (unless an exemption applies).‡ Impacted plans will require automatic enrollment starting with at least 3% and increasing by 1% each year until reaching at least 10% but no more than 15%. The increased cap supports ongoing efforts to encourage more employees to save for retirement at an adequate rate.

It’s also promising to see in the Callan Institute’s 2023 Defined Contribution Trends Survey that 22% of plan sponsors with an automatic enrollment safe harbor, called qualified automatic contribution arrangement or QACA plan design, intend to increase their cap to the maximum. Conversely, it is disappointing to see 9% intend to make no increases and 36% don't currently offer this type of plan design.