Retirement changes all aspects of life, including investing. As a result, constructing an effective retirement-income portfolio requires a considerable shift in perspective.

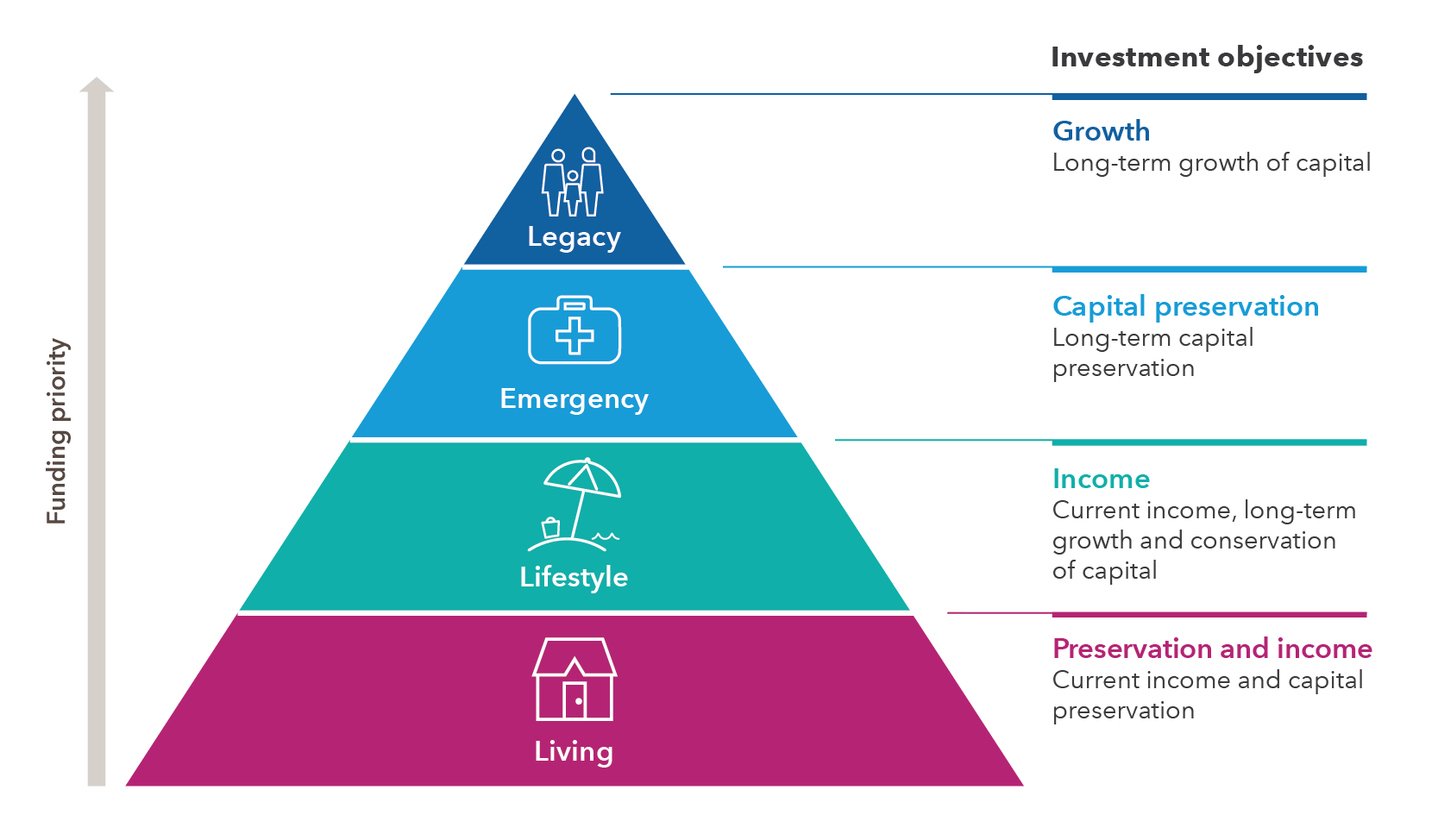

When saving for retirement there is an emphasis on return, usually with defined time horizons, regular salary increases to help counter inflation and regular investing to take advantage of market declines. Living in retirement shifts the emphasis to income and preservation, with an unknown time horizon, and promotes portfolio-construction strategies that guard against inflation, volatility and market declines — the things that can devastate a retiree’s income.

Here are three ideas to consider for retirement-income planning that may help mitigate the effects of volatility.