Investing in developing markets may be subject to additional risks, such as significant currency and price fluctuations, political instability, differing securities regulations and periods of illiquidity, which are detailed in the fund's prospectus. Investments in developing markets have been more volatile than investments in developed markets, reflecting the greater uncertainties of investing in less established economies. Individuals investing in developing markets should have a long-term perspective and be able to tolerate potentially sharp declines in the value of their investments.

The indexes are unmanaged and, therefore, have no expenses. Investors cannot invest directly in an index.

Small-company stocks entail additional risks, and they can fluctuate in price more than larger company stocks.

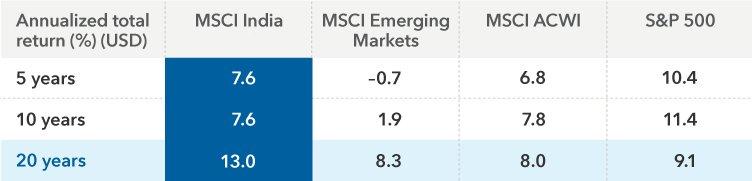

MSCI All Country World Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results in the global developed and emerging markets, consisting of more than 40 developed and emerging market country indexes.

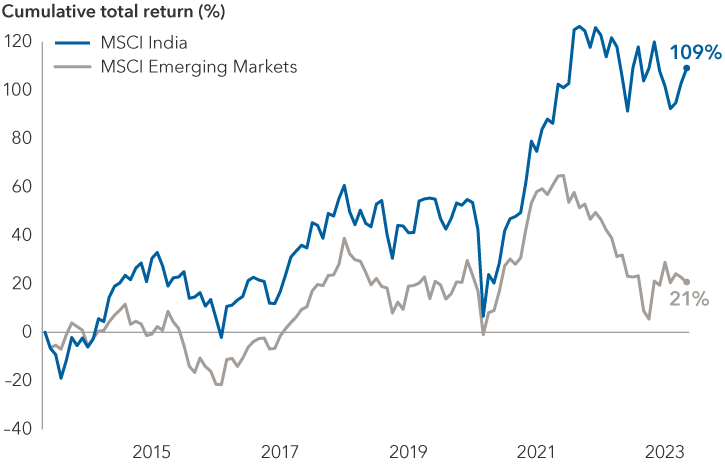

The MSCI India Index is designed to measure the performance of the large and mid-cap segments of the Indian market. With 114 constituents, the index covers approximately 85% of the Indian equity universe.

MSCI Emerging Markets Index is a free float-adjusted market capitalization weighted index that is designed to measure equity market results in the global emerging markets, consisting of more than 20 emerging market country indexes.

S&P 500 Index is a market-capitalization-weighted index based on the results of 500 widely held common stocks.

Each S&P Index ("Index") shown is a product of S&P Dow Jones Indices LLC and/or its affiliates and has been licensed for use by Capital Group. Copyright © 2023 S&P Dow Jones Indices LLC, a division of S&P Global, and/or its affiliates. All rights reserved. Redistribution or reproduction in whole or in part is prohibited without written permission of S&P Dow Jones Indices LLC.

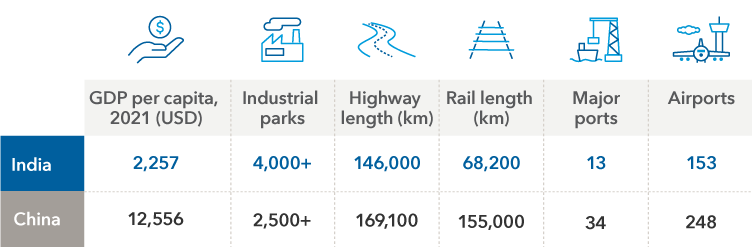

1 All figures as of April 2023. Source: IMF.

2 As of May 31, 2023. Source: MSCI.

3 Net interest margin reveals how much the bank is earning in interest on its loans compared to how much it is paying out in interest on deposits.

4 As of March 31, 2023. Source: Reliance Industries.

5 As of April 2023. Source: IMF.

6 As of May 31, 2023. Sources: MSCI, RIMES.