RESOURCES / PLAN DESIGN

Build a retirement tier in your DC plan

8-minute read

THE TAKEAWAY

Restructure DC plans to facilitate retirement income

Overview

Senior Retirement Strategist

Toni Brown

Head of Retirement Strategy

An increasing number of employers are not only allowing, but also encouraging, retirees to stay in the defined contribution (DC) plan instead of rolling into an IRA. As a result, plan sponsors should rethink the plan’s design, investment structure and recordkeeping solutions to help retirees translate their savings into retirement income.

The problem

Retirees staying in the plan need help converting their savings into a “retirement paycheck” for regular, steady withdrawals from their DC accounts.

The solution

To help them, plan sponsors can restructure a DC plan to provide additional options for income in retirement.

Take action

Add a retirement tier to the investment menu

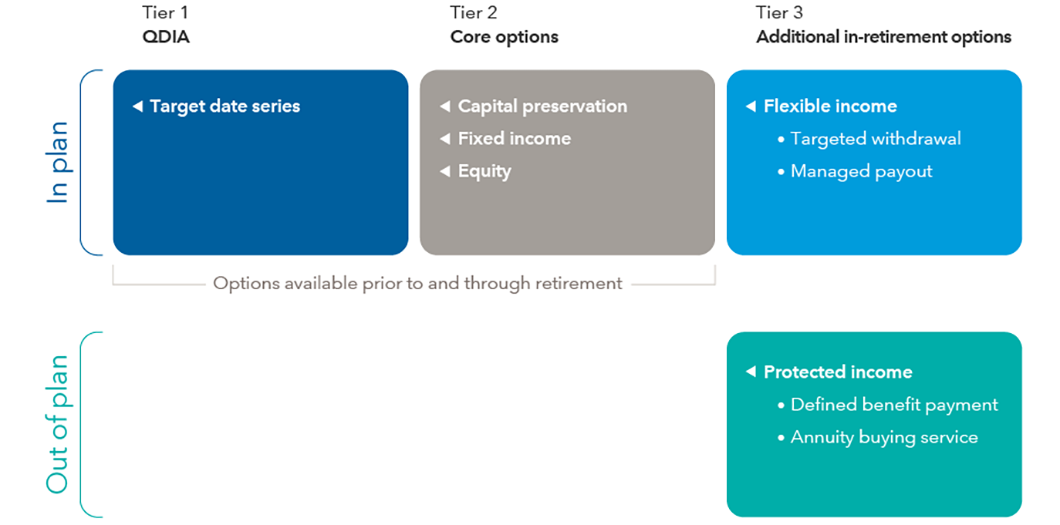

Many DC plans today offer a tiered investment menu, generally consisting of Tier 1 with the qualified default investment alternative (typically a target date series) and Tier 2 with asset class options for participants to create their own portfolio. In Tier 1, a “through” target date fund (managed for a number of years after the retirement date) can help participants retire successfully by gradually reducing risk over time and providing income options in retirement.

To more effectively serve retirees, we suggest considering adding a Tier 3 — an in-retirement tier. This tier would offer additional options to provide retirement income and could consist of options provided within the plan and without. Within the DC plan, an in-retirement tier could offer targeted withdrawal or managed payout funds. Outside of the DC plan, an in-retirement tier could offer protected income sources such as a defined benefit payment or an annuity-buying service.

The graphic below shows an example of how the investment structure prior to retirement, through retirement and in retirement could be organized and communicated.

Source: Capital Group.

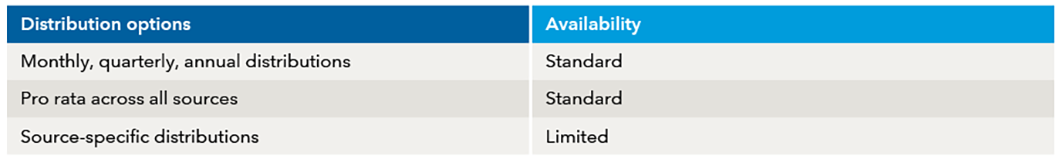

Access to distribution and recordkeeping options gives retirees flexibility

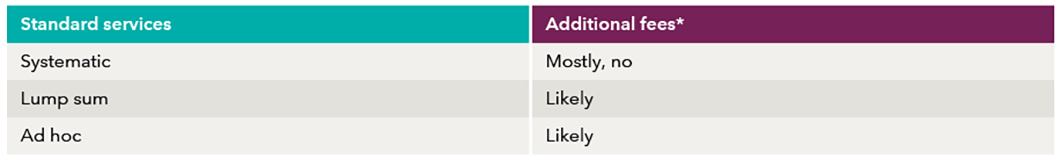

Recordkeeping systems have evolved to accommodate retirees. Instead of offering just a lump-sum withdrawal option at retirement, today’s systems offer multiple options for retirement, including lump-sum, ad hoc or systematic withdrawals. This type of flexibility makes the DC plan work for retirees who may use their savings in different ways at different points in their retirement. Key to this success is ensuring the fees to take withdrawals are reasonable so they don’t deter participants from taking ad hoc or systematic distributions. The tables below review distribution options and pricing based on our survey of the marketplace.

Availability of distribution options

Source: Capital Group.

Fees for typical distribution services

Source: Capital Group.

*Recordkeeping arrangements vary. Examples of additional fees: Plan A: $60 for periodic distribution setup and $15 for each periodic installment. Plan B: $50 for full or partial withdrawals, but no fee on periodic installments.

Case study

CASE STUDY

A materials firm proactively encourages retirees to remain in the plan

Approximately 15% of plan participants are retired, representing 25% of plan assets. By working with the recordkeeper, the plan was able to create total flexibility on distribution options without additional user fees.

INDUSTRY

Materials

PLAN TYPE

Defined contribution

NO. OF EMPLOYEES

150,000+

Explore more plan design resources

-

Plan Design

Is your defined contribution plan successful?

-