Participant Education

Participant Education

Whenever financial markets are volatile, it is natural for people to get nervous and want reassurance about the sustainability and health of their retirement savings.

Many of your plan participants may be unsettled by the market fluctuations accompanying recent dramatic shifts in U.S. trade policy. They may be grappling with financial fallout if they were heavily invested in stocks that were hit particularly hard. Although those stocks may increase in value over time, your participants may hesitate to continue investing, not wanting to expose themselves to more potential volatility.

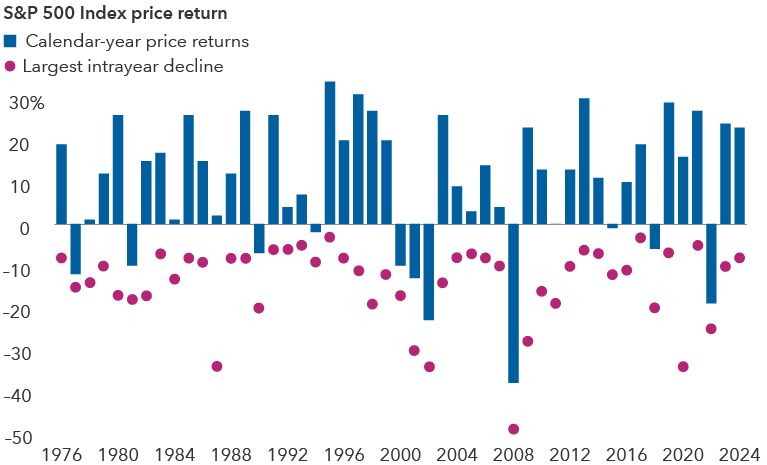

It is important to remind participants that market declines are a normal and expected part of investing. While stocks have moved higher across decades, there were many episodes of sharp declines along the way, including the COVID-19 pandemic in 2020, the global financial crisis in 2008-2009 and the bursting of the technology stock bubble in 2001-2002. Ultimately, the market as represented by the S&P 500 Index recovered from these downturns and eventually reached new highs.

Market declines have occurred every year

Sources: Capital Group, Standard & Poor’s. As of December 31, 2024.

Common questions from participants

Uncertainty isn’t easy for anyone, least of all your plan participants. They may come to you for guidance on how to navigate volatile markets. Here are some common questions they may ask:

The market is so volatile. Should I just cash out? Retirement planning is a long-term endeavor. No matter how bad things may seem, it is important to remember that volatility is a part of investing. Although at times it may be difficult to stomach the market swings, it is often best to stay the course if you can and not pay attention to the short-term noise, especially if your time horizon allows it.

If participants still want to cash out, be sure to discuss the potential impacts. For example, taking money out of the markets might mean missing out on potential market recoveries.

Am I in the right investments? Cash and bonds are generally less volatile than stocks and have their own market cycles. By investing in a mix that includes stocks, bonds, cash and other types of investments, participants can lower their risk by not being overexposed to any one area. Factors such as risk tolerance and time horizon help investors determine how much to allocate to each asset class.

For participants who prefer a more passive approach to retirement savings, investing in a target date fund can be beneficial. A target date fund is a group of investments combined into a single, easy-to-use investment, where the investment mix automatically adjusts over time based on the target retirement date.

Target date funds, which are typically composed of a mix of stock and bond funds, will shift their exposure toward more conservative investments over time, which can help older participants withstand a market decline.

When will the volatility end? What to say: We don’t know. But what we do know is that down markets are part of investing. While stocks have typically risen steadily for most of the last decade, history tells us that stock market declines are inevitable. The good news is that history tells us that market corrections (defined as declines of 10% or more), bear markets (extended declines of 20% or more) and other challenging patches don’t last forever.

Tips for success

- Talk to participants. Don’t wait for them to come to you with questions. Be proactive during times of volatility and send emails reminding them of why it is important to stay the course.

- Acknowledge their feelings of anxiety. Market volatility can be scary, especially for younger participants who haven’t experienced down-market cycles before or those nearing retirement. If they have a long-term investment plan that was put into place during calmer times, refer them back to their initial strategy to help them maintain their focus on their long-term goals and keep their emotions in check. If their goals haven’t changed, in most cases, their plan shouldn’t either.

- Prepare them before volatility occurs. The best way to help participants stay calm is to educate them before the next bear market. Give participants the tools to develop an investment plan that is designed to help them manage risk as your employees work to achieve their investment goals.

Target date portfolios are managed based on a projected retirement date, but the allocation strategy does not guarantee that investors will meet their retirement goals.

Don't miss our latest insights.

Our latest insights

-

-

Investment Menu

-

Participant Education

-

Participant Education

-

Fiduciary Responsibility

-

Plan Design

-

Participant Education

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week