In observance of the Christmas Day federal holiday, the New York Stock Exchange and Capital Group’s U.S. offices will close early on Wednesday, December 24 and will be closed on Thursday, December 25. On December 24, the New York Stock Exchange (NYSE) will close at 1 p.m. (ET) and our service centers will close at 2 p.m. (ET)

CASE STUDY

Getting DC participants back on track

Client profile

- Large county pension plan in the mid Atlantic region

- Offers a defined contribution (DC) plan

- Sponsor encourages participation in the DC plan

The sponsor wanted to know

- Were the DC plan’s customized models working for participants?

- Were participants selecting an age-appropriate asset allocation?

- Would participants be better off in target date (TD) funds that automatically adjust the asset allocation over time?

Objective

Was the plan serving employees well?

The sponsor of a public DC plan asked us to help evaluate its investment offering. The plan offered five customized asset allocation models ranging from “Ultra Aggressive” with an 85% equity allocation to “Conservative” with 20% equity. Participants chose which risk model to follow at each stage of their retirement journey.

The sponsor wondered if the plan was serving participants well, or whether workers would be better served by target date funds, which automatically adjust the asset allocation from a more aggressive to a more conservative orientation as participants approach retirement.

Research

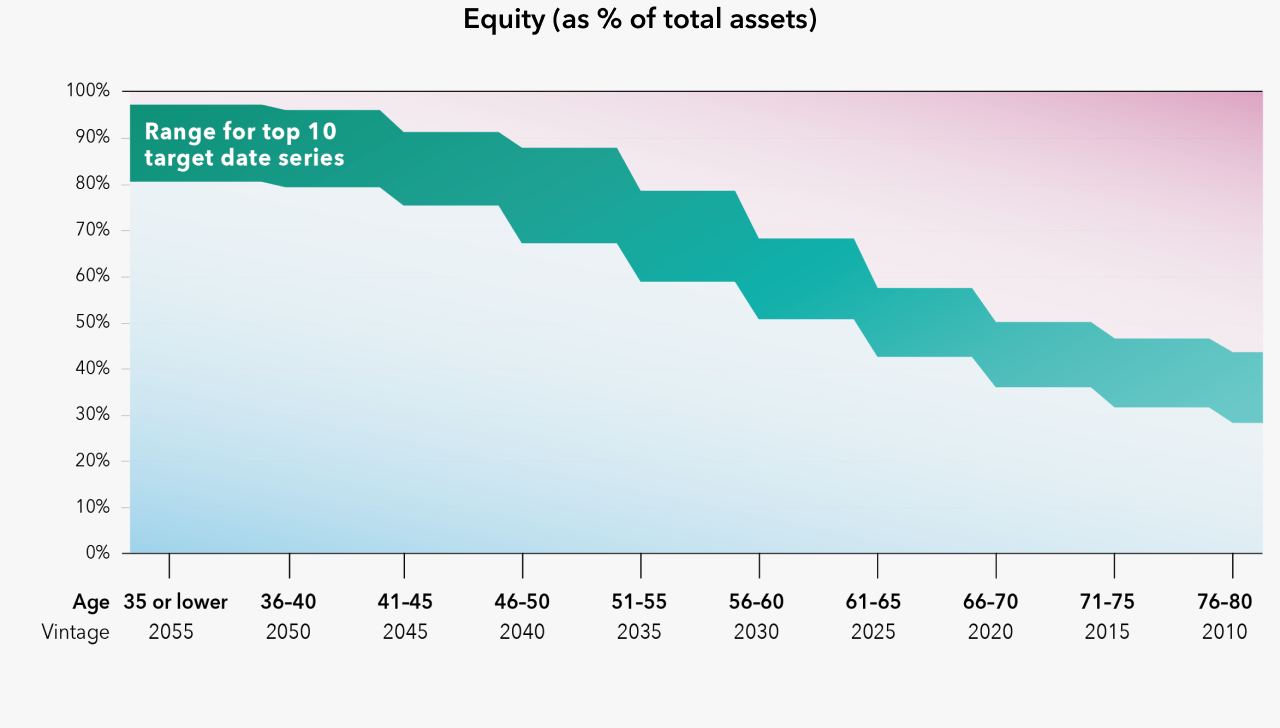

Within this sample, the most conservative funds were the 2010 funds (10-15 years past the target retirement year), in which equity allocations ranged from 28% to 44%. The least conservative were the 2055 funds (30+ years to retirement), in which the equity allocation range was 81% to 97% at the time of the analysis (as of 6/30/2022).

We grouped each of the plan’s participants into a target retirement year based on their current age. In this way, we created 10 participant cohorts ranging from 2055 to 2010 target retirement dates. We then compared the participant equity allocations to ranges for the corresponding TD funds. We denoted these ranges as the “TD benchmarks.”

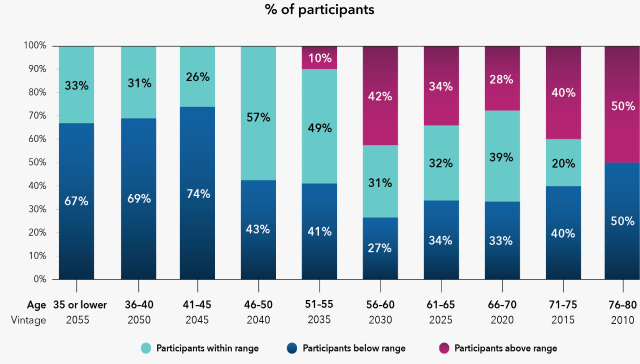

The line chart below shows the range of equity exposure of the top-10 largest TD series. The bar chart below shows the percentage of participants in each age group whose equity exposure was above, below or within that range. Participant equity allocations deviated widely, and tended to fall outside these bounds.

Participant equity allocations versus largest target date funds

Range of equity exposure in 10 largest target date series

Participant equity allocations

Sources: Morningstar and Capital Group (based on plan demographic data). The sample size for participants older than 65 was small (25 in total).

Findings

- Participant asset allocations diverged significantly from their TD benchmarks. Up to two-thirds of participants may have had inappropriate equity exposure (meaning their equity allocations were above or below the corresponding TD benchmark).

- Younger participants tended to hold less equity than the TD benchmarks, likely putting them at greater risk for a retirement savings shortfall. For example, three-quarters of participants with a 2045 target retirement date (41-45 years old) had equity allocations below their TD benchmark’s lower bound of 76%. Some participants in this group had merely 20% in equities.

- Some older participants held more equity than the TD benchmarks, leaving them more exposed to damage from stock market downturns in retirement. For example, one-third of the 2025 group (61-65 years old) had equity allocations above their TD benchmark’s upper bound of 58%.

- The plan’s custom risk models incurred higher costs than TD funds yet underperformed. The model expense ratios ranged from 29 basis points (bps) to 78 bps, while most TD funds in the sample had expense ratios under 50 bps (and some as low as 8 bps). Most of these TD funds had outperformed the custom models on a risk-adjusted basis, using a 10-year lookback period.

Key takeaways

Risk exposures for most self-directed participants fell outside industry standards.

Younger participants tended to invest too conservatively, while many older participants assumed too much equity risk.

Participants often struggle to maintain an appropriate asset allocation.

TD funds have proliferated because they empower individuals to delegate asset allocation decisions to professional managers.

We suggested a move to target date funds.

We suggested that the plan sponsor shift participants out of the customized risk models and into age-appropriate TD funds. We also suggested that new employees be automatically enrolled into those funds.

Discover our institutional capabilities

We work with defined contribution plans, defined benefit plans and nonprofits to seek better outcomes.

Let us help your plan

We can partner with you to analyze your plan’s challenges and explore solutions.

Contact us

institutional@capgroup.com

* The top 10 series at the time of the analysis were the same as those as of 12/31/23.