FACTORS DRIVING OUR SUCCESS

A sophisticated approach, made simple

The Series holds meaningful amounts of equity near retirement to help build wealth. But it also changes the types of equities and bonds over time to help manage risk in an approach we call our glide path within a glide path.

-

-

Overview

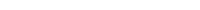

Like other target date providers, our Series rebalances between equities and bonds as a participant ages.

Source: Capital Group. The target allocations shown are as of December 31, 2022, and are subject to the oversight committee’s discretion. The investment adviser anticipates assets will be invested within a range that deviates no more than 10% above or below the allocations shown in the prospectus/characteristics statement. Underlying funds may be added or removed during the year. Visit capitalgroup.com for current allocations.

-

Equity

Our equity holdings evolve over time from an initial focus on growth to a concentration on income and preservation later in life.

Source: Capital Group. The target allocations shown are as of December 31, 2022, and are subject to the oversight committee’s discretion. The investment adviser anticipates assets will be invested within a range that deviates no more than 10% above or below the allocations shown in the prospectus/characteristics statement. Underlying funds may be added or removed during the year. Visit capitalgroup.com for current allocations.

-

Fixed income

Our bond holdings adapt over time to seek the four roles of fixed income: protection against inflation, the preservation of capital, income generation, and diversification from equity-market risk.

Source: Capital Group. The target allocations shown are as of December 31, 2022, and are subject to the oversight committee’s discretion. The investment adviser anticipates assets will be invested within a range that deviates no more than 10% above or below the allocations shown in the prospectus/characteristics statement. Underlying funds may be added or removed during the year. Visit capitalgroup.com for current allocations.

-

Sub-asset class

Our glide path provides well-diversified but age-appropriate exposure to multiple asset classes. Our changing emerging markets equity exposure is an example of this.

Source: Capital Group. The target allocations shown are as of December 31, 2022, and are subject to the oversight committee’s discretion. The investment adviser anticipates assets will be invested within a range that deviates no more than 10% above or below the allocations shown in the prospectus/characteristics statement. Underlying funds may be added or removed during the year. Visit capitalgroup.com for current allocations.

Cash & equivalents include short-term securities, accrued income and other asset less liabilities. It may also include investments in money market or similar funds managed by the investment advisor or its affiliates that are not offered to the public.

-

We believe investors should hold different stocks as they age

Our Series reflects a belief that the types of stocks held, not just the amounts, can help offset age-specific risks participants face.

Top 10 largest equity holdings of the underlying funds in each vintage

Early career (2055 fund)

The vintage emphasizes funds with exposure to high-growth, low-yielding stocks for investors further from retirement.

In retirement (2020 fund)

The vintage emphasizes funds with exposure to dividend-paying stocks for investors in retirement who are more sensitive to market downturns.

Sources: Capital Group, Morningstar. Top 10 largest equity holdings as of December 31, 2022. Weighted-average yields as of September 30, 2022. The weighted-average yield adjusts the yield of each stock by the stock’s weight within the Top 10 portfolio. The adjusted yields are then summed. When multiple share classes of a stock exist, the largest holding’s yield is shown. Holdings of the funds will change over time.

The freedom to adapt

Our Series features multi-asset and global strategies that empower portfolio managers of the underlying funds to use measured flexibility to pursue investment opportunities across geographies and asset classes. The views of these portfolio managers influence the Series’ asset mix.

Equity exposure (%) based on historical asset mix of underlying strategies

Geographic flexibility based on historical asset mix of underlying strategies

Source: Capital Group. As of December 31, 2022. Average and ranges of exposure were calculated using the historical quarterly asset mix of each underlying fund since Series inception, based on the glide path as it existed on December 31, 2022. Although the data are based on the December 31, 2022, glide path, the Series’ glide path changed multiple times prior to that date. Therefore, movements in asset exposure shown in the chart reflect only the changes in the asset mix within the underlying funds from Series inception to December 31, 2022; the movements do not reflect the historical top-down changes to the glide path made over the life of the Series. The maximum and minimum values reflect the highest and lowest asset exposure based on the underlying funds’ historical asset mixes at each point of the December 31, 2022, glide path; the average reflects the average asset class exposure under the same parameters. Current asset mixes reflect underlying fund data and the glide path as of December 31, 2022.

UNDERLYING FUNDS

Solid building blocks

Our funds have delivered peer-beating results and held up well in down markets.

LOW FEES

Delivering value at a low cost

We encourage a focus not just on expenses but on value delivered to participants.

HOMEPAGE

Discover what sets our Series apart

Target date funds have a lot in common. But the American Funds Target Date Series takes a distinctive approach that has delivered uncommon investment outcomes and helped thousands of participants come closer to achieving their financial dreams.

Compare us to the competition

View our funds

Contact us

Our team is ready to help you help participants.