Why Capital Group for fixed income

Deep experience and a global footprint

52

years of fixed income experience

252

fixed income professionals around the world

17

average years of investment industry experience for fixed income professionals

55

research analysts

Source: Capital Group. Data as of December 31, 2024.

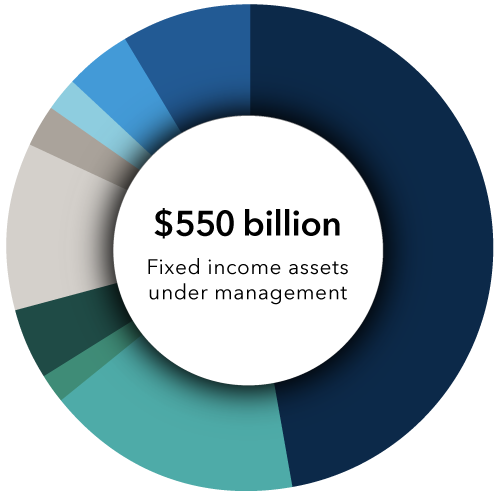

Capabilities spanning the fixed income spectrum

| ⬤ | U.S. core/core plus |

| ⬤ | Mortgage |

| ⬤ | Global |

| ⬤ | Short-term |

| ⬤ | Inflation-linked |

| ⬤ | Emerging markets |

| ⬤ | U.S. government |

| ⬤ | Tax-exempt |

| ⬤ | Credit |

Source: Capital Group. Data as of December 31, 2024. U.S. core/core plus also includes intermediate core. Credit also includes high-yield, credit plus and long duration credit. Global also includes global plus and global flexible.

Assets under management by Capital Fixed Income Investors by strategy mandate. All values are in USD. Totals may not reconcile due to rounding.

FIXED INCOME

Uncovering opportunities in high yield

Distinctive portfolio construction approach

Research is the cornerstone

Equity and fixed income analysts work together to develop differentiated insights

A culture of collaboration

Portfolio managers and analysts collaborate as peers, creating portfolios that reflect multiple perspectives

A focus on consistent outcomes

We strive for strong risk-adjusted results, without style drift

Analysts manage money

Analysts are empowered to invest in their best ideas, alerting portfolio managers to their strongest convictions*

Multilayered risk management

Helps ensure portfolio exposures are intentional and properly scaled

INSIGHTS

Fresh perspectives from our fixed income team

Solutions

Featured fixed income capabilities

Our broad suite of capabilities seek strong long-term risk-adjusted returns through deep fundamental analysis and a distinct investment approach

U.S. Core – A high-quality core approach seeking superior returns throughout market cycles

Core Plus – A total return approach seeking attractive returns while providing a differentiated return pattern during periods of equity market volatility

Investment-Grade Credit – A high-quality credit approach seeking strong returns via fundamental research and active sector positioning

U.S. High Yield – A balanced high-yield approach seeking superior returns via security selection and with a volatility profile in line with or below that of its benchmark and peers

Emerging Markets Debt – A fundamental approach to developing markets that seeks strong returns via deep research and insights across the broad opportunity set

Long Duration Credit – A high-quality credit approach seeking to deliver an attractive and complementary pattern of returns for liability-driven investors

Connect for more information

Interested in learning more about our fixed income solutions? Call us between 8:00 a.m. and 7:00 p.m. ET, Monday through Friday.

*Analysts manage assets in most Capital Group portfolios.