Market Volatility

Technology & Innovation

How persistent will the shortage in semiconductors be, and what does it bode for the future of the industry? In our view, the shortage is more cyclical in nature and more acute in a couple of industries like autos and PCs. If anything, we see semiconductors powering the next decade of global growth in an increasingly data-hungry world, much like oil fueled the rise of industrial economies in the last century.

Importantly, the semiconductor industry has evolved from boom-and-bust cycles marked by excessive capital expenditures, poor inventory management and lack of pricing discipline. It is more disciplined and better positioned today, following years of consolidation that has resulted in a few dominant players along each specialized area of the global supply chain.

On the demand side, as corporations, governments and industries transition to 5G technologies, artificial intelligence (AI) and cloud-based solutions, we believe the industry is prepared to benefit from these powerful tailwinds in the years ahead.

By various estimates, including ours, global semiconductor sales might double from about $450 billion in 2019 to nearly $1 trillion by 2030.

Capacity shortages are more COVID related than structural

A confluence of events has led to this global crunch, none of which we think are structural in nature or affect long-term demand. The automotive industry simply got caught flat-footed after canceling orders with manufacturers during the initial months of the pandemic. At the same time, the world went virtual, accelerating everything digital. This shift increased orders for chips used in personal computers, video game devices, home appliances and cloud-based applications.

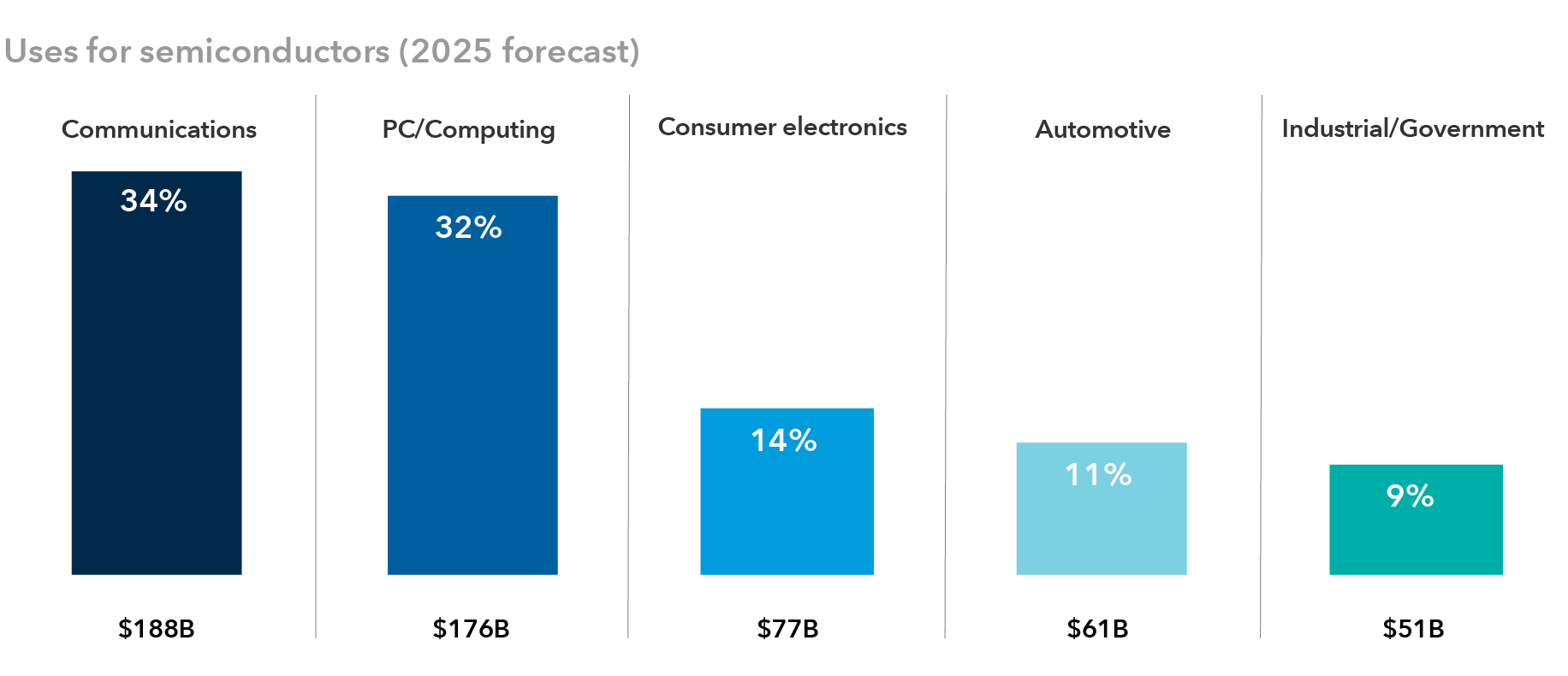

Personal computers are the most prominent example. While PCs still account for about a third of the overall semiconductor market, this had been an industry in slow decline over the past decade. This changed last year when the market grew at its highest rate in 10 years.

So, when automakers replaced their orders with manufacturers last fall, there was no capacity for them. Fortunately, the auto sector is a small percentage of the overall semiconductor market, even though it’s a future area of potential growth with the anticipated rise in electric vehicle production. Since it takes about four months to manufacture auto chips, the situation is likely to correct itself by the end of this year.

Semiconductors play integral role in global economy

Source: Bloomberg. Data represent the share of all semiconductor device applications in 2025, as forecast by Bloomberg.

AI and machine learning are powerful industry growth drivers

An increasing amount of data is being created every day. It started with social media and people posting pictures and videos of their children, food they ate at restaurants and places they visited. Then, in 2018, machines surpassed humans as the largest data creators. We believe this transformative shift will be a significant catalyst for the semiconductor industry.

Going forward, the majority of data will likely be created by machines that require massive amounts of processing power. The challenge will be in increasing processing power and lowering power consumption.

Enormous amounts of data won't reside in our phones, but in data centers. Today, data centers account for roughly 3% of global electricity consumption. If we do nothing to make them more efficient, they might account for 25% of electricity consumption in 10 years. Given this dilemma, the rule of thumb in semiconductor design is to try to reduce power consumption in these components by 30% every two years.

In our view, this is likely to drive growth for more advanced and complex chips used in high-end smartphones and data centers, which will drive up their semiconductor dollar content over the next five years.

You've discovered one of Capital Group's 10 investment themes for 2022

A massive semiconductor spending cycle is coming

The world’s largest semiconductor companies are planning to spend billions of dollars on new manufacturing facilities to meet new demand, as well as to navigate geopolitical tensions with semiconductors being seen as a national security priority. The U.S. and Europe both seek to bring critical supply chains closer to home, given that Taiwan controls a majority of the high-end manufacturing production for semiconductors.

Industry bellwether Taiwan Semiconductor Manufacturing (TSMC) plans to spend $100 billion through 2023 for new chip fabrication facilities, including a large site planned for Arizona. TSMC holds close to 80% market share for leading-edge chip production, and its clients include Apple, Qualcomm and Broadcom.

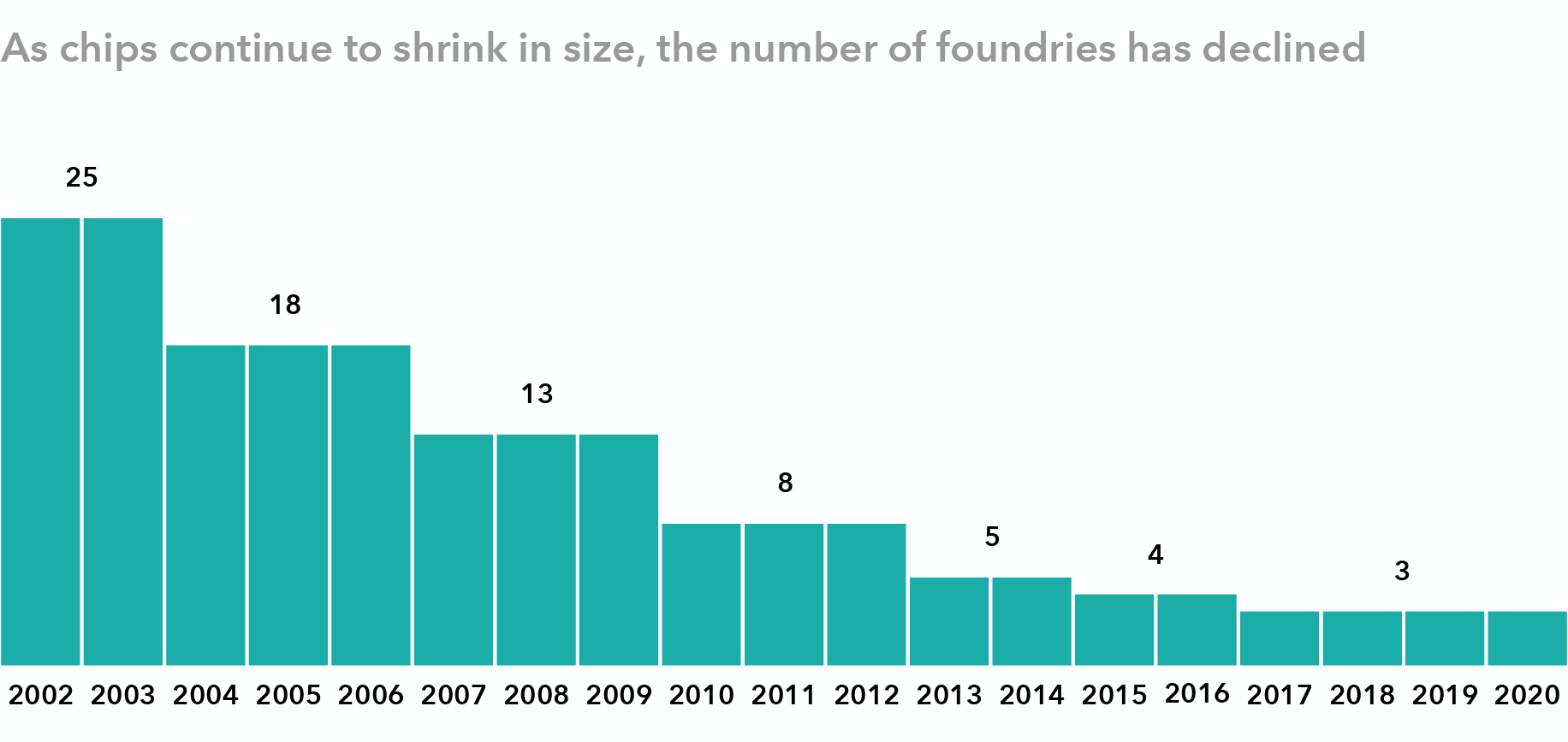

Semiconductor manufacturing has heavily consolidated

Source: Capital Group, Intel. Shows semiconductor companies capable of manufacturing the smallest chips available in each period. Data as of December 2020.

Meanwhile, Intel plans to spend $20 billion on two new plants in Arizona, and Samsung Electronics is eyeing construction of a new manufacturing facility in Texas worth $17 billion. Spending comes after a long period of capital discipline and industry consolidation, which has left the business with two dominant players: TSMC and Samsung, with Intel a distant third.

However, it’s unclear how these new foundries might benefit the industry longer term, and this is something we’ll be watching closely. Manufacturing processors in the U.S. will likely cost more than in Taiwan or Korea, where most of the current capacity lies. This could create market inefficiencies. It’s also unclear if U.S. semiconductor and technology companies, almost all of whom outsource the manufacturing of their chips to Asia, will want to bring it onshore.

Industry has consolidated across segments

Following several rounds of consolidation, each segment along the supply chain — the chip designers, chip equipment manufacturers, the foundries that make the chips and the companies that test the chips — is dominated by a few companies.

With highly specialized expertise in each of these areas, competitive moats have expanded. Many of these companies are well-managed, with a stronger grasp of customer demand patterns. Pricing power remains high and margins are attractive.

Semiconductor equipment makers: This market has heavily consolidated, with the top five companies controlling close to 75% market share, up from roughly 40% 15 years ago. These companies, including ASML in the Netherlands and Applied Materials and Lam Research in the U.S., have developed wide competitive moats, with each company developing its own specific niche within the semiconductor manufacturing and testing process.

As a result, they’ve become difficult to supplant given the complexities of their machines. For example, an extreme ultraviolet lithography (EUV) machine, used to make advanced chips, is made of more than 100,000 parts, costs approximately $120 million and is shipped in 40 freight containers. ASML is essentially the only manufacturer of this equipment.

The equipment makers have further developed a servicing model with recurring revenue from machine maintenance. Operating margins have averaged 25% over the past five years and are on track to expand beyond 30% based on our estimates. In years past, they would dip into the single digits.

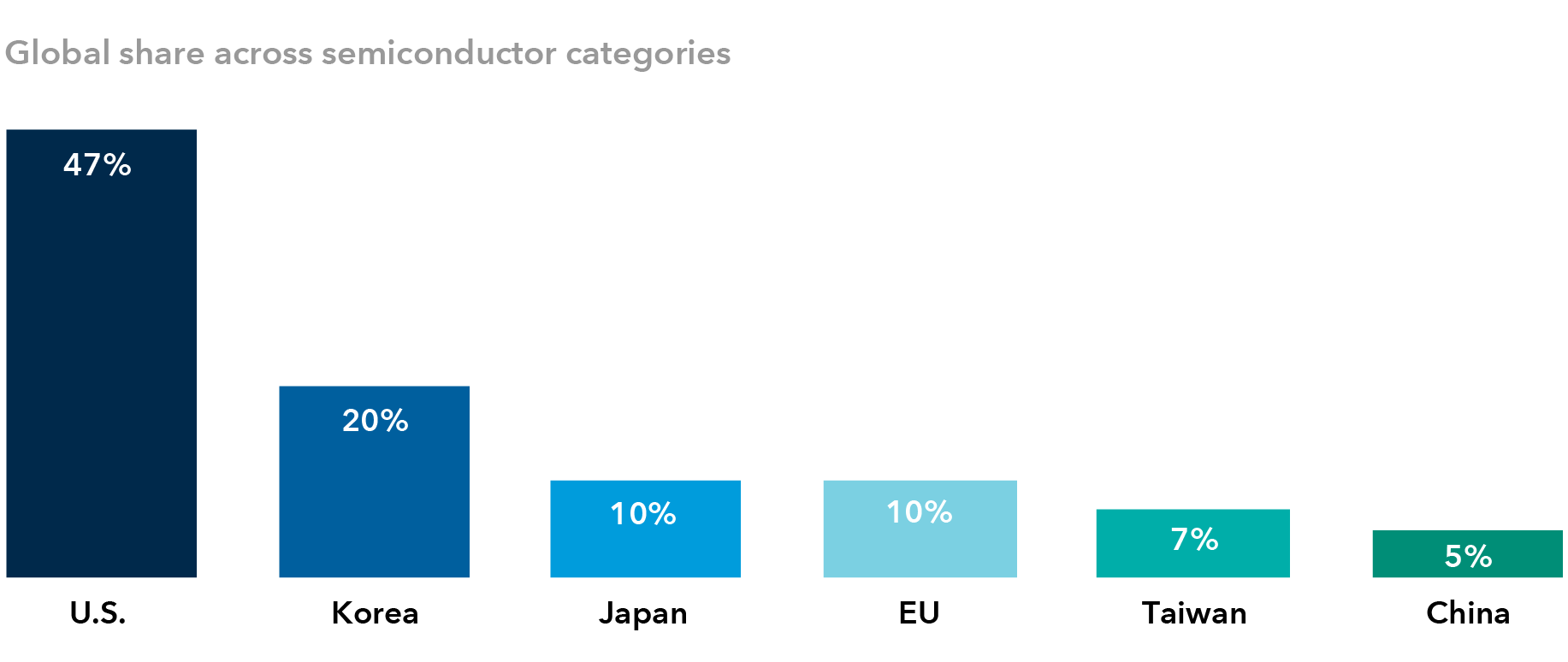

Memory chips: The industry structure has evolved, and it's become more attractive. Memory used to be a cyclical, commodity-like business. It’s shrunk from around 15 companies globally to three, the biggest being Korea’s Samsung Electronics. In turn, the industry has become more disciplined and rational. And memory chips remain a critical component for computing processors used in a wide range of devices. Although Korea accounts for almost three-fourths of global memory chips manufacturing, the U.S. still dominates the global semiconductor market with about 47% share due to its dominance in fabless, equipment and intellectual design segments.

U.S. semiconductor companies hold significant market share

Source: Semiconductor Industry Association, based on 2020 data.

Strategic importance stirs geopolitical frictions

As semiconductors have become strategically imperative, it has raised concerns among government officials in the U.S., China and Europe, who are all driven by their own motives.

The U.S. worries that while its companies are global leaders in chip design, the country ceded leadership in manufacturing years ago to Taiwan, namely TSMC. Currently, U.S. market share for chip manufacturing is 12%, down from 37% in 1990.

Meanwhile, Europe is concerned that it lacks any manufacturing capabilities for cutting-edge semiconductors. This became amplified during the recent chip shortage that hurt big German automakers.

For China, its leaders want to reduce the country’s dependence on U.S. semiconductors. Given current U.S. trade sanctions, China has defined semiconductors as a strategic imperative in its most recent five-year plan. It will take time, but with the money and resources that China is devoting to the effort, it will develop some capabilities, just as it has in other industries.

As semiconductor chips become integral to virtually every industry and are essentially the “brains” for most things we use, their importance will only grow. Whether the strategic imperatives that drive public policy chip away at some of the industry’s efficiency and execution prowess is a trend we will be closely watching.

Bloomberg® is a trademark of Bloomberg Finance L.P. (collectively with its affiliates, “Bloomberg”). Barclays® is a trademark of Barclays Bank Plc (collectively with its affiliates, “Barclays”), used under license. Neither Bloomberg nor Barclays approves or endorses this material, guarantees the accuracy or completeness of any information herein and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Our latest insights

-

-

Market Volatility

-

Market Volatility

-

World Markets Review

-

Chart in Focus

Never miss an insight

The Capital Ideas newsletter delivers weekly insights straight to your inbox.

Mathews Cherian

Mathews Cherian

Shailesh Jaitly

Shailesh Jaitly