Fixed Income

Markets are on edge over soaring consumer prices, the war in Ukraine and recession fears in the U.S., Europe and China.

The Bloomberg U.S. Aggregate Index, a broad representation of the U.S. bond market, declined 5.9% in the first quarter, the worst quarterly loss since 1980. In April, it was down another 3.8%. With bond returns battered, investors may be wondering if there are any bargains in fixed income markets. Given the low prices, is now a good time to buy?

The risks are real. The U.S. Federal Reserve’s efforts to contain inflation are likely to pressure growth and employment. This week, the Fed raised its key policy rate 50 basis points to 0.75%–1.00%, the largest increase since May 2000.

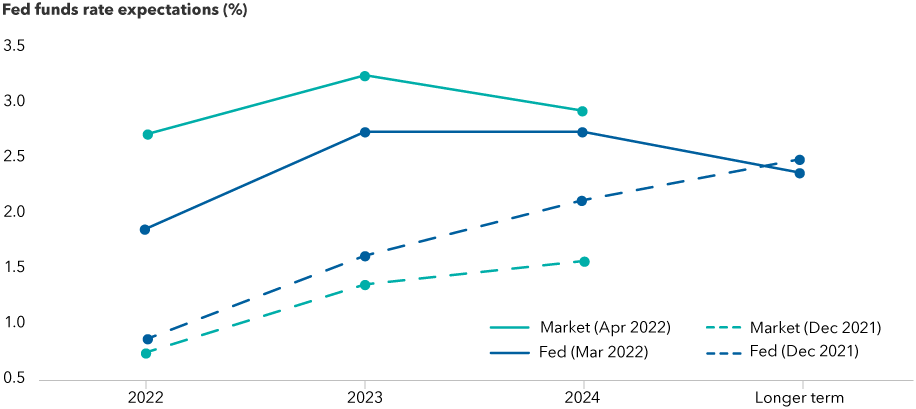

Rate hike expectations have jumped

Sources: Bloomberg, Federal Open Market Committee. Projections assume rate at year-end.

And as Europe seeks to wean itself from Russian oil and gas, energy prices — up 38% year-to-date — may remain elevated.

Against this challenging backdrop, portfolio managers with American Funds Multi-Sector Income FundSM offer their views about what’s ahead for some of the riskier bond market sectors.

Companies are benefiting from consumer demand, but expect a more volatile environment for credit

Damien McCann, fixed income portfolio manager

The Fed seems intent on trying to slow economic activity. Rate hikes tend to impact economic activity with a lag of at least two quarters. Right now, corporate fundamentals are fairly strong, and companies are benefiting from a consumer that is able to withstand price increases. I am seeing early indications that lower income consumers are spending less, but overall, there is no significant pullback.

Inflation is a major concern, and Russia’s invasion of Ukraine has only added fuel to the fire. The economic toll of the invasion has far-reaching effects that are not yet fully visible. Obviously there has been an impact on the energy and grain sectors, but it has also spilled into certain parts of auto manufacturing and industrial gasses the semiconductor industry relies on.

Food and autos are more exposed to higher input costs and shortages compared to telecom and cable, or health care companies.

Spreads have widened over the past year, and it is a more volatile environment for credit. The issuance of high-yield bonds has dropped dramatically as companies wait for things to settle down.

Corporate bond spreads have widened ahead of slower economic growth

Sources: Bloomberg Index Services Ltd., RIMES. As of 4/30/22. Chart reflects option-adjusted spreads. Bond ratings, which typically range from AAA/Aaa (highest) to D (lowest), are assigned by credit rating agencies such as Standard & Poor's, Moody's and/or Fitch, as an indication of an issuer's creditworthiness. If agency ratings differ, the security will be considered to have received the highest of those ratings, consistent with the fund's investment policies.

As an active manager, I have the flexibility to react to these ongoing shifts.

The returns across investment grade, high yield, emerging markets and securitized debt are not the same over time. Being flexible and adjusting your portfolio can help buffer some of the current headwinds. There have been more opportunities in investment-grade bonds over the past few months, but I still think high-yield bonds offer better value.

Within investment-grade corporates, certain California-based utilities seem attractive. In high yield, energy companies have some upside. In my view, oil prices will stay fairly high as supply is likely to remain tight. Beyond Russia, U.S. energy companies have a labor shortage problem which will limit increases in drilling activity. People in West Texas can work remotely and earn the same wage as if they were working on an oil rig.

Among high-yield credits, I also see value in insurance brokerage and financial advisory issuers. These are resilient business models that can withstand high leverage.

Valuations and fundamentals suggest cautious optimism for emerging markets

Kirstie Spence, fixed income portfolio manager

What’s happening in Ukraine is heartbreaking. I’ve dealt with many crises in my 25-plus years of investing in emerging markets, and this one is uncharted territory on so many levels.

I think it’s prudent to stay cautious given the heightened volatility from war, inflation and the slowdown in China. However, there are idiosyncratic opportunities in emerging markets debt that an active manager can pursue.

Bonds across many emerging markets have traded lower, but some of that trading has been related to risks tied to inflation and what central banks are doing. The asset class has matured significantly over the past decade. I think valuations generally reflect some downside risks.

Overall, fundamentals are fairly decent. Several emerging markets banks have raised rates dramatically to combat inflation. And in some markets like Brazil, investors are being fairly compensated for elevated inflation. I also think certain currencies may even be cheap by historical standards.

There are bright spots. Commodity exporters such as certain Latin American-based countries have traded higher, as surging prices could help them withstand a slowdown in global growth.

Proactive rate hikes could provide attractive entry points for some emerging markets

Source: Bloomberg. Data shown as of 4/30/2022.

Securitized assets may be more resilient compared to other bond sectors as inflation and rates rise

Xavier Goss, fixed income portfolio manager

Securitized assets cover a wide gamut of sectors such as residential mortgages, auto loans, commercial real estate and student loans. Broadly speaking, asset-backed securities and commercial mortgaged-back securities have some upside even with higher inflation. Select areas appear attractive compared to corporate credit, particularly at current spread levels.

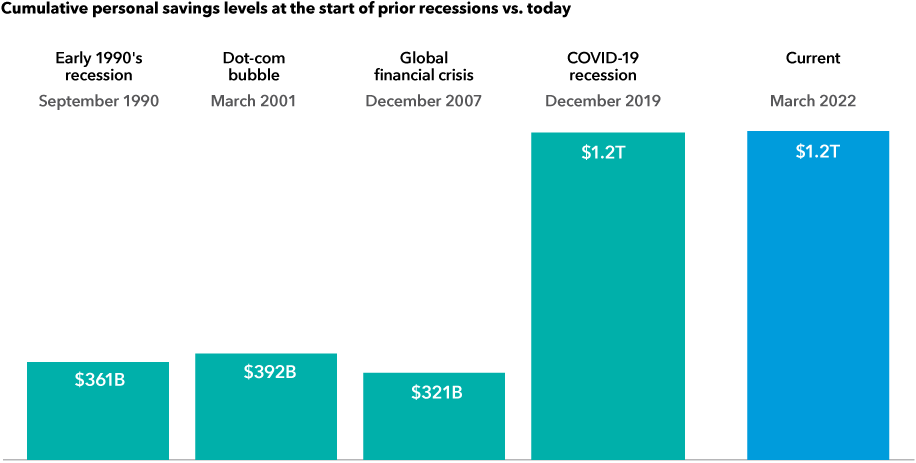

I remain a bit cautious as tighter monetary policy will slow growth and loan demand. That will flow through and impact consumer spending. I expect an uptick in delinquencies and defaults as eviction moratoriums and other pandemic-era programs roll off. While the increase could be higher than pre-pandemic levels, it shouldn’t be exceptionally so because consumers are in a better financial position today as compared to past financial crises.

Consumers may be better prepared to weather an economic slowdown

Sources: Capital Group, Federal Reserve Bank of St. Louis, National Bureau of Economic Analysis, Refinitiv Datastream. Personal savings figures are seasonally adjusted and released quarterly. All prices shown in USD.

I have been spending more time meeting with loan originators to better understand their specific underwriting standards. As financial conditions tighten, there may be a bifurcation in deal performance as weaker originators loosen their underwriting standards to maintain current loan volume.

In the current environment, I foresee more bespoke and privately negotiated transactions across the securitized space, particularly as security selection becomes a more prominent driver of returns. This is especially relevant in the consumer asset-backed securities market where there are more niche issuers.

The return of principal for bond funds and for funds with significant underlying bond holdings is not guaranteed. Fund shares are subject to the same interest rate, inflation and credit risks associated with the underlying bond holdings.

Lower rated bonds are subject to greater fluctuations in value and risk of loss of income and principal than higher rated bonds.

The use of derivatives involves a variety of risks, which may be different from, or greater than, the risks associated with investing in traditional securities, such as stocks and bonds.

Investing outside the United States involves risks, such as currency fluctuations, periods of illiquidity and price volatility. These risks may be heightened in connection with investments in developing countries.

Bloomberg U.S. Aggregate Index represents the U.S. investment-grade fixed-rate bond market. The index is unmanaged and, therefore, has no expenses. Investors cannot invest directly in an index.

BLOOMBERG® is a trademark and service mark of Bloomberg Finance L.P. and its affiliates (collectively "Bloomberg"). Bloomberg or Bloomberg's licensors own all proprietary rights in the Bloomberg Indices. Neither Bloomberg nor Bloomberg's licensors approves or endorses this material, or guarantees the accuracy or completeness of any information herein, or makes any warranty, express or implied, as to the results to be obtained therefrom and, to the maximum extent allowed by law, neither shall have any liability or responsibility for injury or damages arising in connection therewith.

Stay informed with our latest insights.

Latest insights

-

-

Emerging Markets

-

Global Equities

-

Economic Indicators

-

RELATED INSIGHTS

Don’t miss out

Get the Capital Ideas newsletter in your inbox every other week

Damien McCann

Damien McCann

Kirstie Spence

Kirstie Spence

Xavier Goss

Xavier Goss